As part of our market update series, please see the summary below of what we saw in the convertible market in Q4 2021. New Issuance. Q4 2021 saw 27 new issue convertible deals (all debt) with a total volume of $18.1bn, which brought total 2021 issuance to $92.8bn across 155 deals. 2021 was the ... >>>Read More

Q3 2021 Convertible Market Review

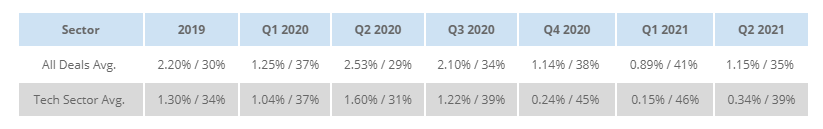

As part of our market update series, please see the summary below of what we saw in the convertible market in Q3 2021. New Issuance. Q3 2021 saw 23 new issue convertible deals (22 debt & 1 mandatory) with dollar volumes of $15.0bn, compared to $17.0bn across 30 deals from Q2 2021 and $19.9bn ... >>>Read More

Q2 2021 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q2 2021. Related Articles Q1 2021 Convertible Market Review Q3 2021 Convertible Market Review Q4 2021 Convertible Market Review ... >>>Read More

Q1 2021 Convertible Market Review

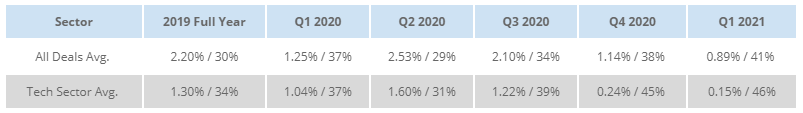

As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2021. Pricing Results: Theoretical Value. The first graph below shows trends in theoretical model valuation throughout the quarter — i.e., showing how much the typical ... >>>Read More

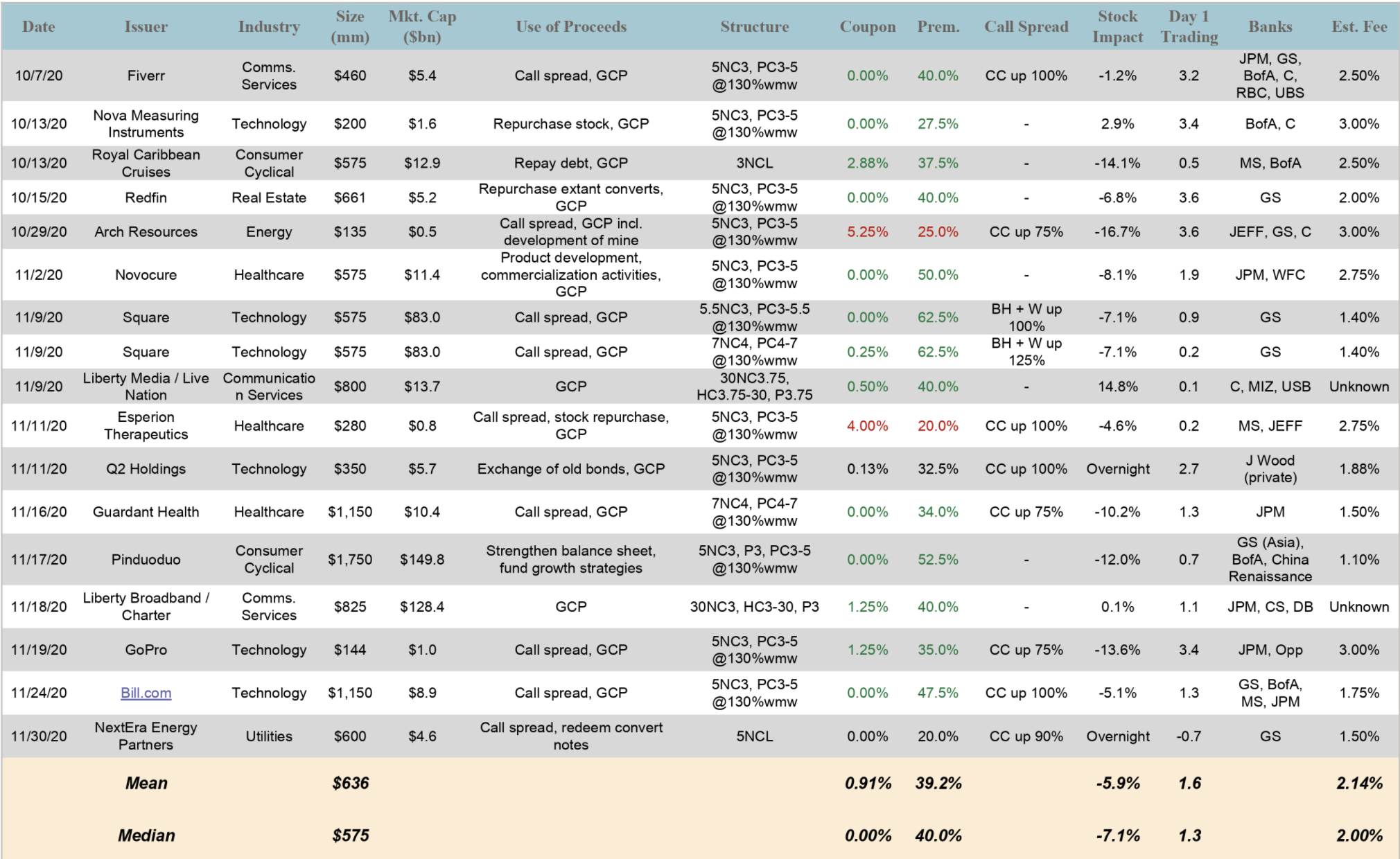

October/November Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in October and November 2020. New Issuance. October and November 2020 saw 5 and 12 new issue convertible deals, with dollar volumes of $2.0 billion and $8.7 billion, respectively. The ... >>>Read More

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 10

- Next Page »