As part of our market update series, here are our key takeaways from the convertible market in the second quarter of 2024.There was $27 billion of new issuance in the quarter, putting 2024 on pace for ~$97 billion of total volume. The second quarter was the most active in the convertible market ... >>>Read More

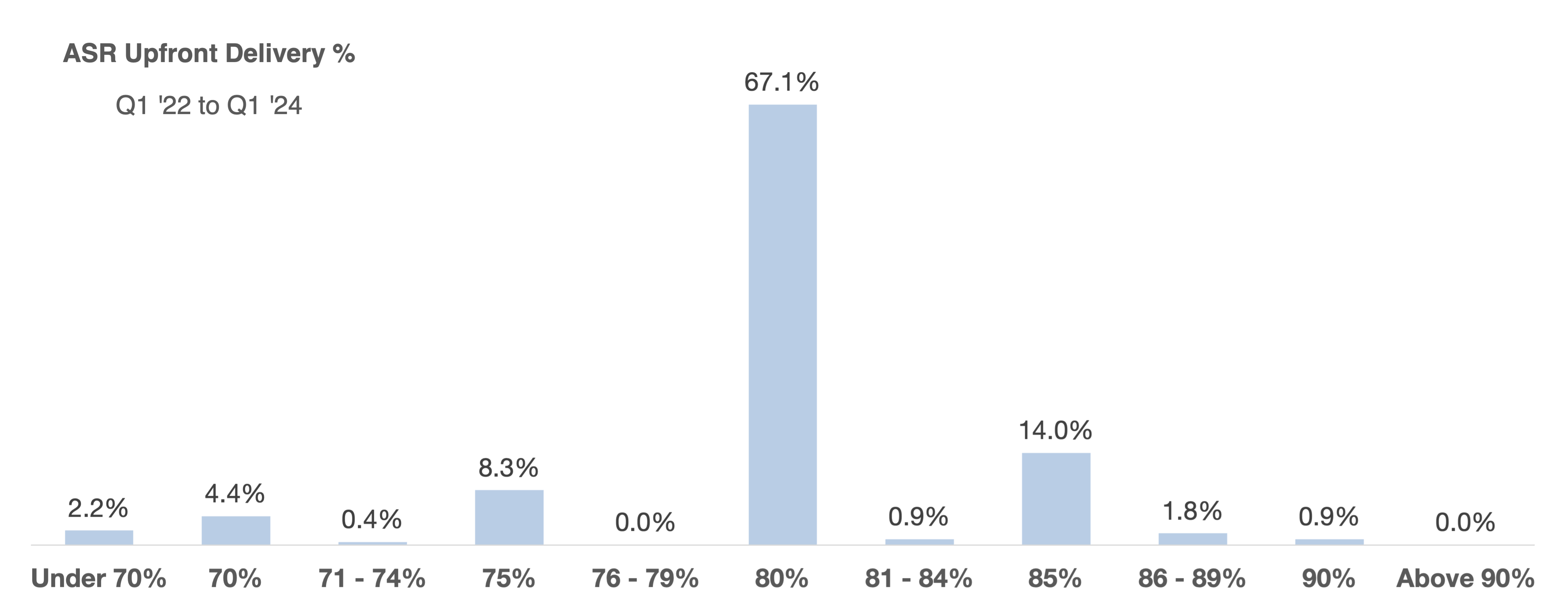

Update: ASR Upfront Share Delivery — Market Practice and Accounting Update

In a prior post we described our analytical approach to deciding the appropriate level of upfront share delivery, incorporating volatility, the duration of an accelerated share repurchase (ASR), and a company’s tolerance of risk of owing cash or shares to their bank counterparty. This post provides ... >>>Read More

Q1 2024 Convertible Market Review

As part of our market update series, here are our key takeaways from the convertible market in the first quarter of 2024. The convertible market started 2024 with a very active quarter yielding ~$20 billion of new issuance. The past quarter was the busiest quarter since the “covid wave” in Q1 ... >>>Read More

Q4 2023 Convertible Market Review

As part of our market update series, here are our takeaways in the convertible market in Q4 2023 and looking across the year. Convertible market ended 2023 with another active quarter with ~$13 billion of new issuance activity. 2023 new issuance volume finished at ~$55 billion, which is a strong ... >>>Read More

Q3 2023 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in the third quarter of 2023 along with some key takeaways. Q3 volume of $14.7 billion slightly surpassed Q2 volume of $14.3 billion, and now puts 2023 on pace for ~$56 billion of issuance ... >>>Read More

- 1

- 2

- 3

- …

- 18

- Next Page »