In the first installment of our three-part series on the financing landscape for life sciences issuers, we covered the evolution of the typical life sciences IPO. In the second installment, we covered post-IPO financing dynamics and the importance of laying the foundation for successful capital ... >>>Read More

Post-IPO Financing Dynamics: How to Lay the Foundation for Successful Capital Raises

In the first installment of our three-part series on the financing landscape for life sciences issuers, we covered the evolution of the typical life sciences IPO. In this second installment, we will cover post-IPO financing dynamics and the importance of laying the foundation for successful capital ... >>>Read More

What You Need to Know as You Navigate the Market and an Ever-Evolving Life Sciences Financing Landscape

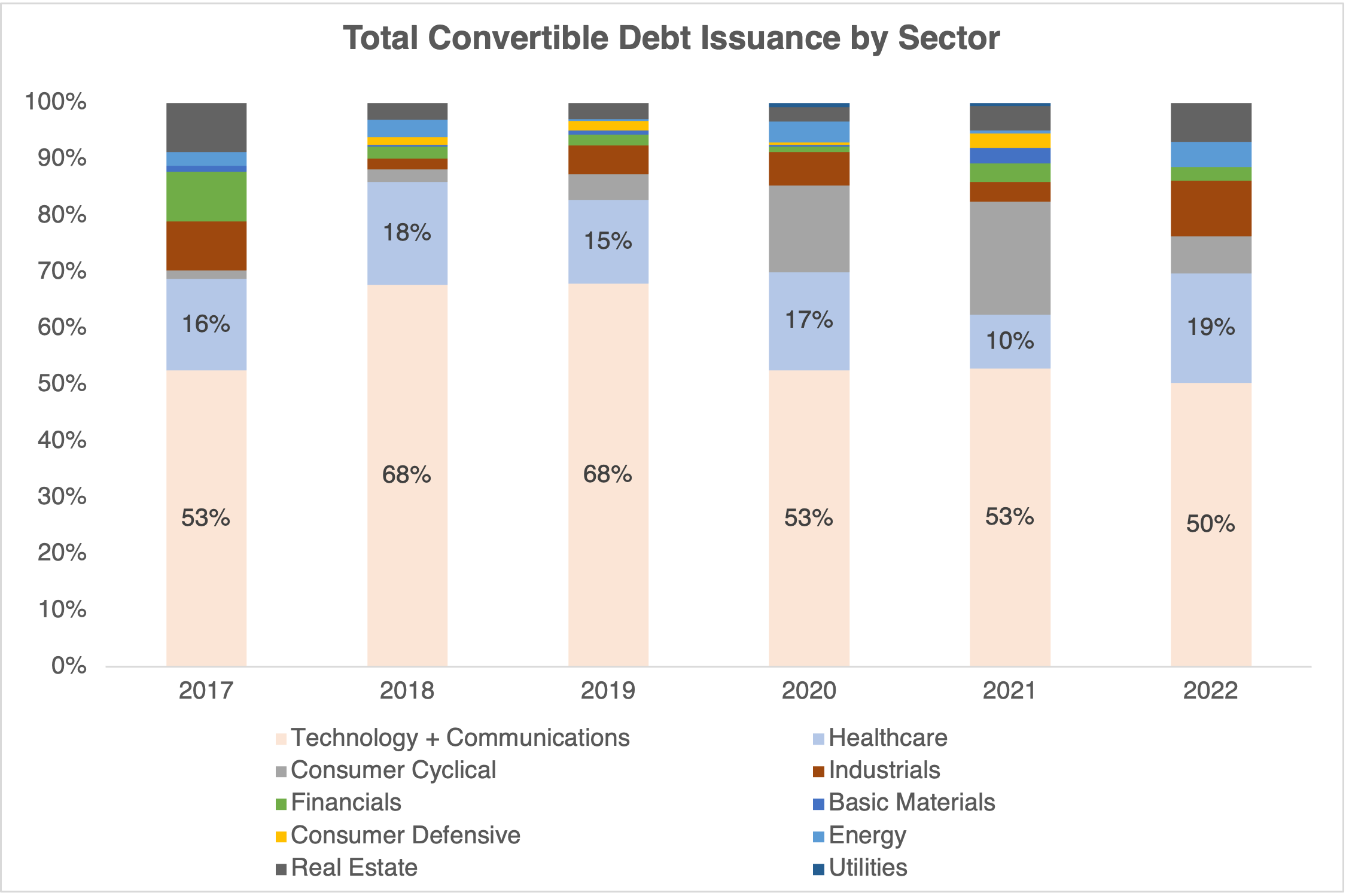

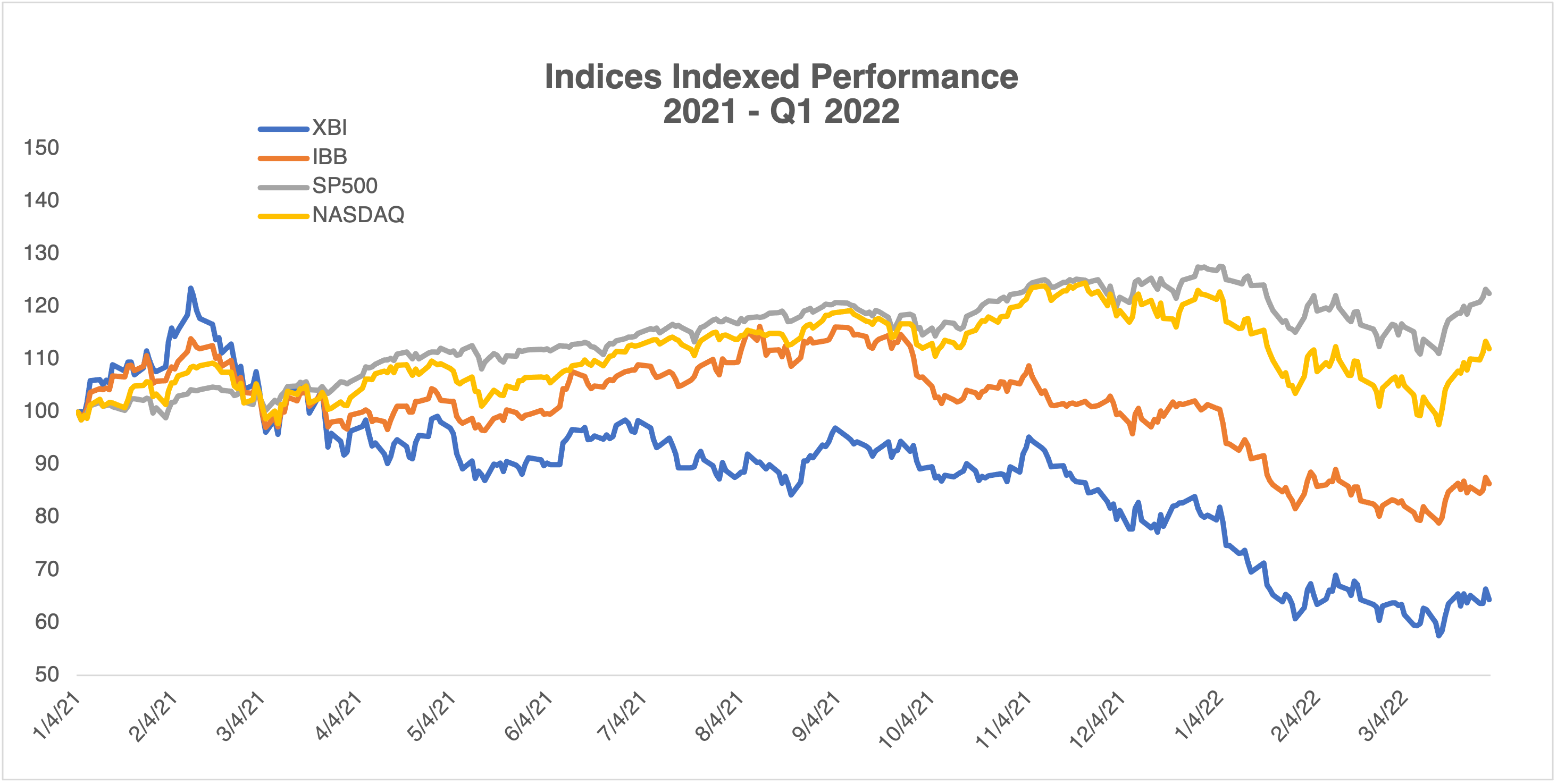

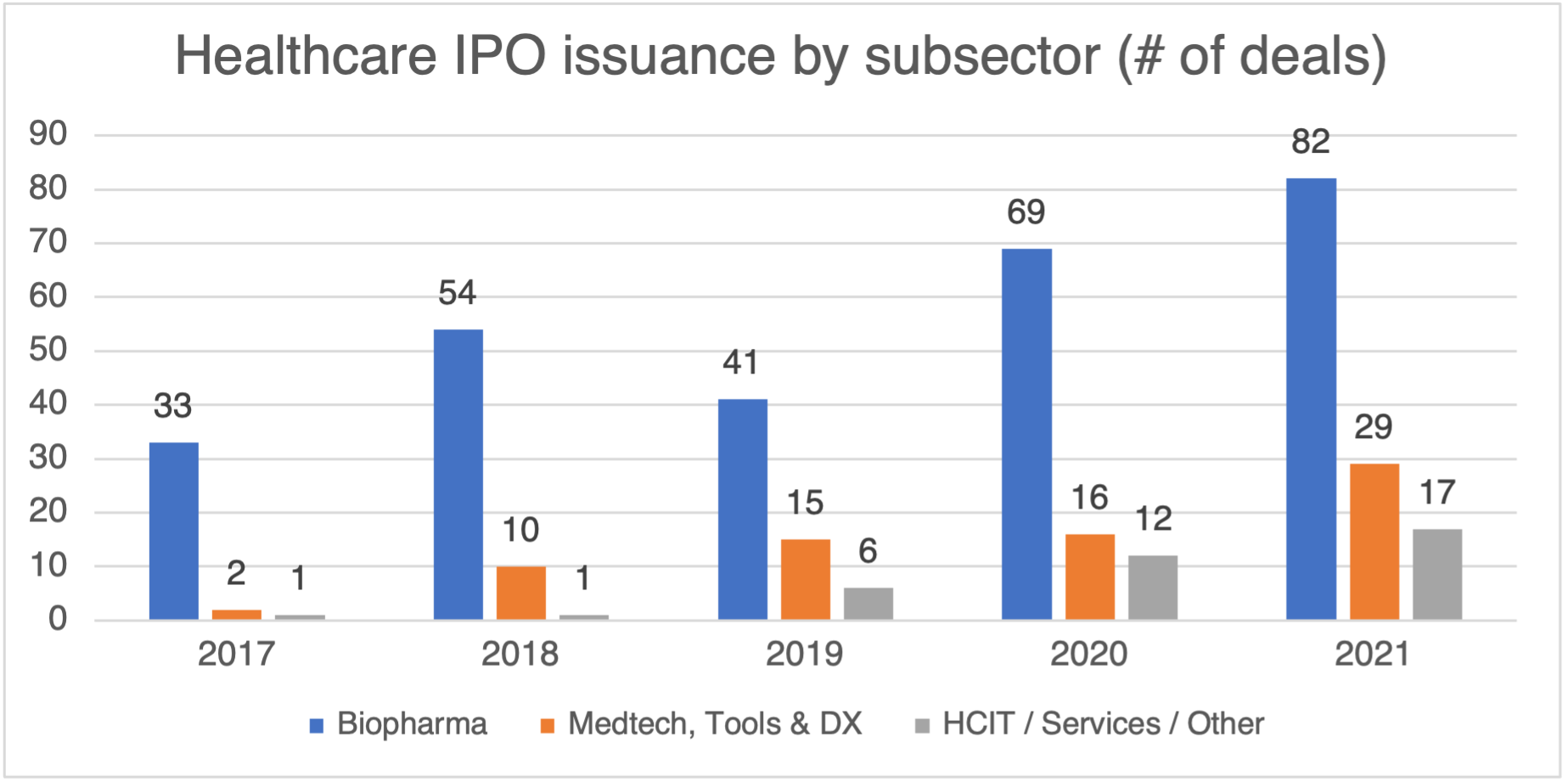

The financing landscape for life sciences issuers has transformed over the last 5 years. In this three-part series, we will cover 1) the evolution of the typical life sciences IPO, 2) post-IPO financing dynamics and the importance of laying the foundation for successful capital raises, and 3) later ... >>>Read More

Post-SPAC Warrant Redemption Features (Part 3)

This is the third of a series of posts examining the redemption features of warrants in post-SPAC public companies. In the first post, we described typical redemption features in warrants. The second post discussed how issuers might economically analyze whether and when to redeem the warrants. ... >>>Read More

Post-SPAC Warrant Redemption Features (Part 2)

This is the second of a three-part series of posts examining the redemption features of warrants in post-SPAC public companies. In the first post, we described typical redemption features in warrants. Here we introduce economic frameworks for how issuers can approach the decision whether and when ... >>>Read More