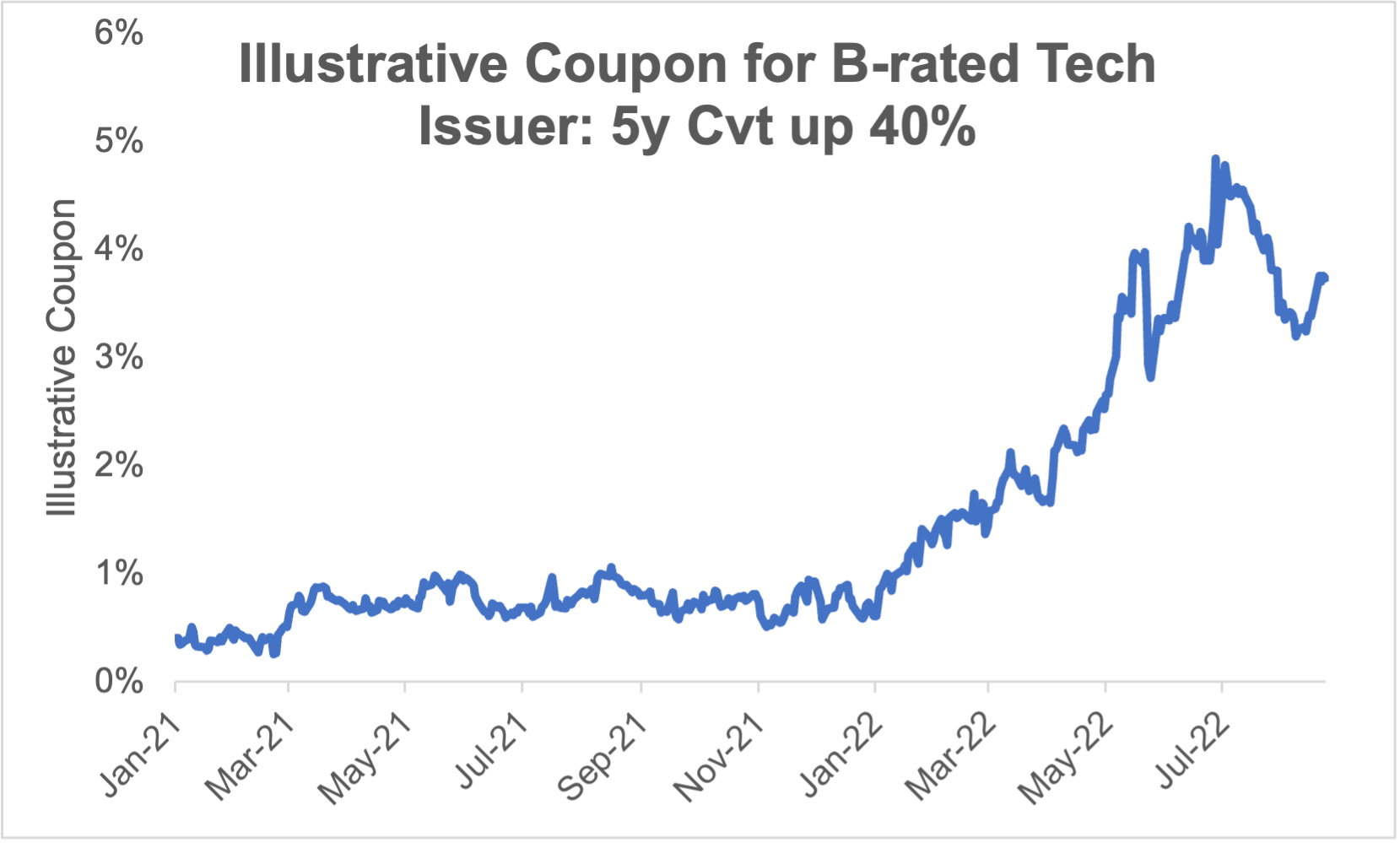

As part of our ongoing market update series, we wanted to take a look at the current state of the convertible markets as we approach the end of summer. In this blog post, we review the recent trading and issuance dynamics of the convertible market and what that means for issuers contemplating ... >>>Read More

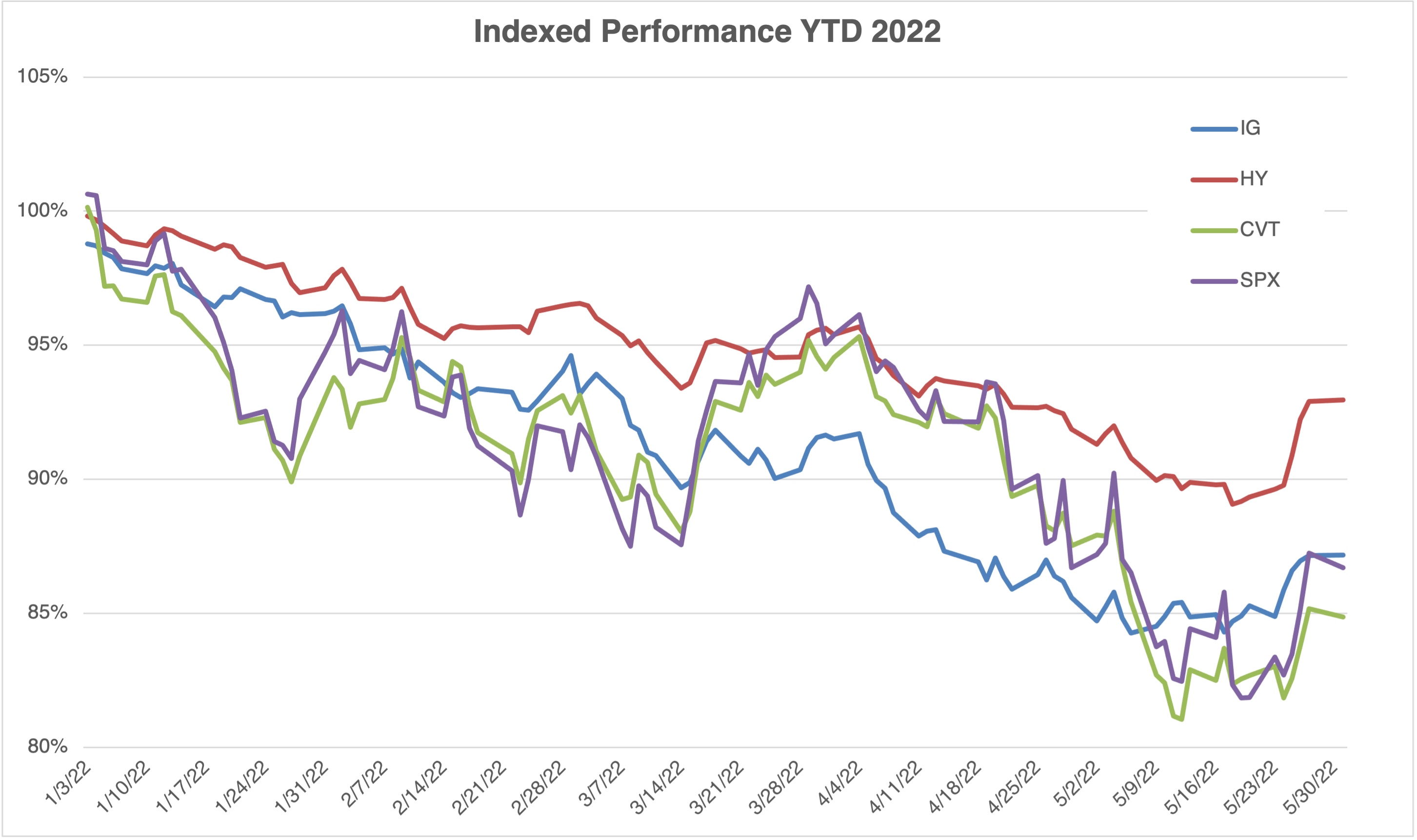

Are the Financing Markets Really Open? – An Examination of the US Equity, Convertible, High Yield, and Investment Grade Markets in Spring 2022

With Federal Reserve tightening and geopolitical uncertainty rising in the last few months, we have seen gains accumulated during COVID dissipate since the start of the year. Consequently, US secondary markets have caused drastic shifts in primary issuance behavior in each of the major financing ... >>>Read More

Share Buyback 101 for Beginners

As a service for those who may not have prior experience with stock repurchase strategies, we provide background information on some general questions. Why do companies do share buybacks? A share buyback is a method of capital return to shareholders. Companies may choose to repurchase ... >>>Read More

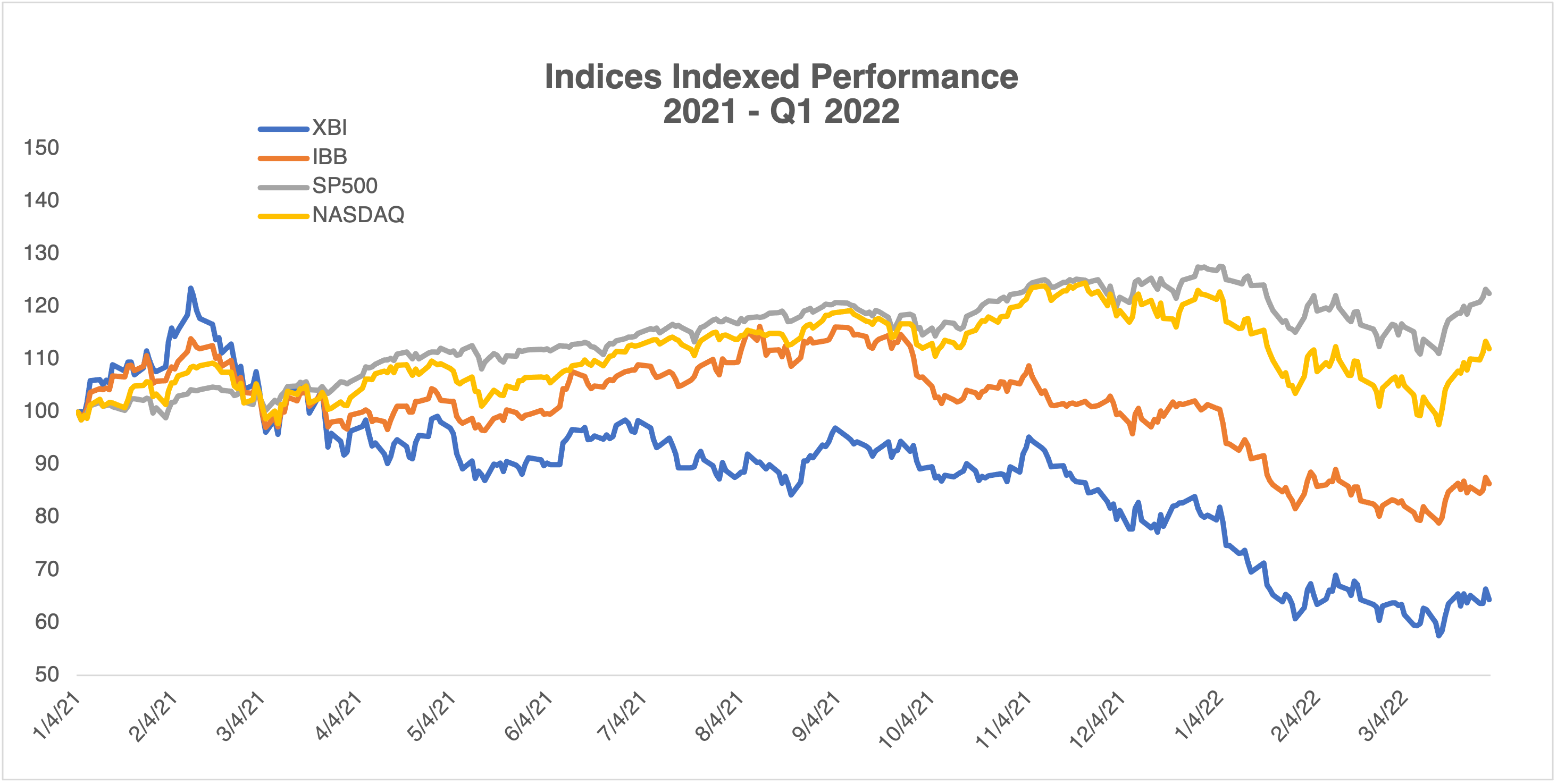

Post-IPO Financing Dynamics: How to Lay the Foundation for Successful Capital Raises

In the first installment of our three-part series on the financing landscape for life sciences issuers, we covered the evolution of the typical life sciences IPO. In this second installment, we will cover post-IPO financing dynamics and the importance of laying the foundation for successful capital ... >>>Read More

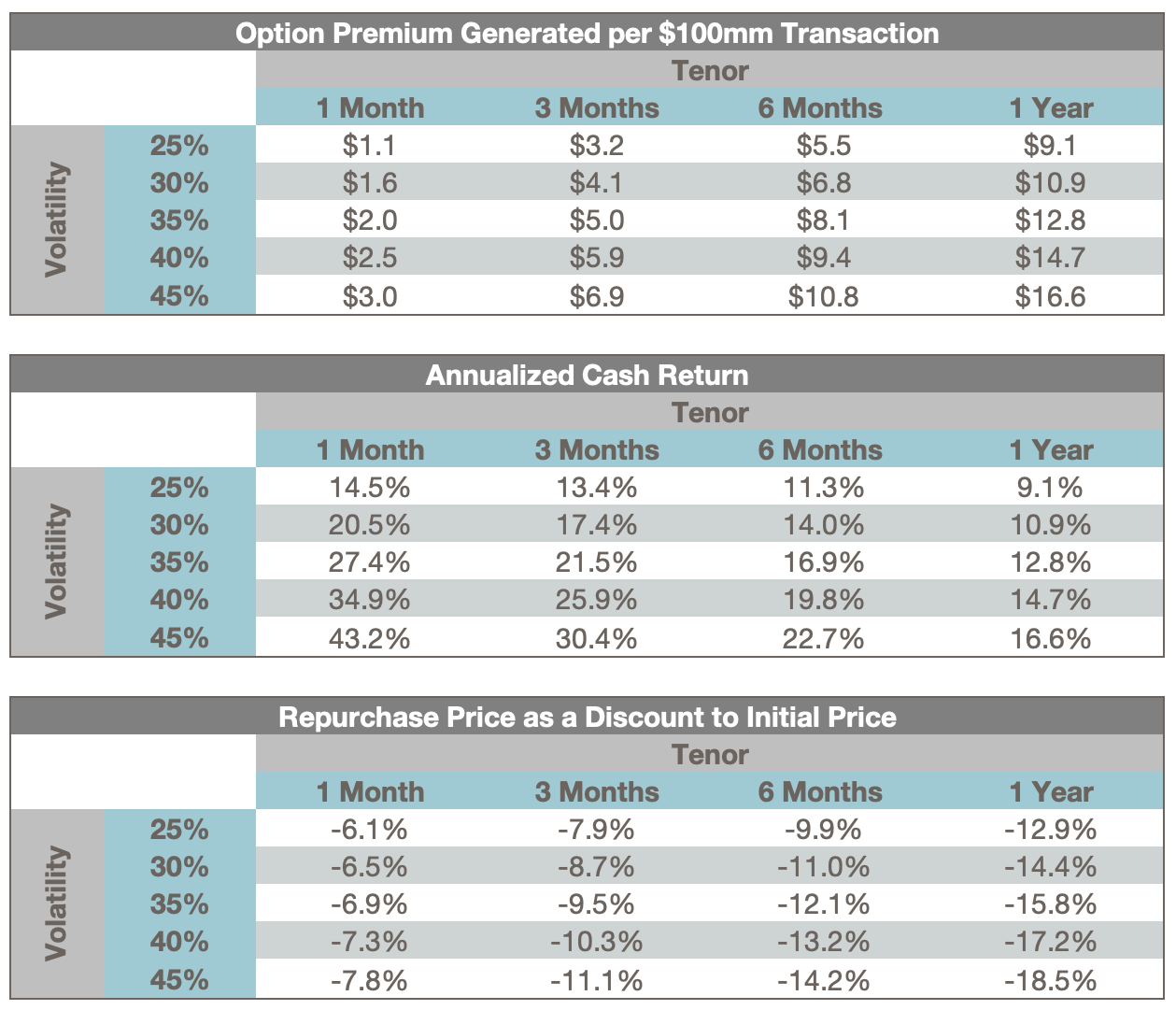

Share Repurchase Strategy: Are Pre-paid Puts Attractive in the Current Market?

CAESARS. Dragons. ZcallS. YEPS. Give derivative marketers a simple product and they will come up with a million names and a lot of dressing up. This blog post explores a simple put option sale (a.k.a. CAESARs, Dragons, ZcallS, and YEPS) and its role in a corporate share buyback plan, especially ... >>>Read More