At Matthews South, we continue to see a meaningful increase in Enhanced Open Market Repurchase (eOMR) interest and usage from our clients. Open Market Repurchase (OMR) users are progressively considering eOMR because of the large expected discount beat that eOMR provides. Additionally, it is an ... >>>Read More

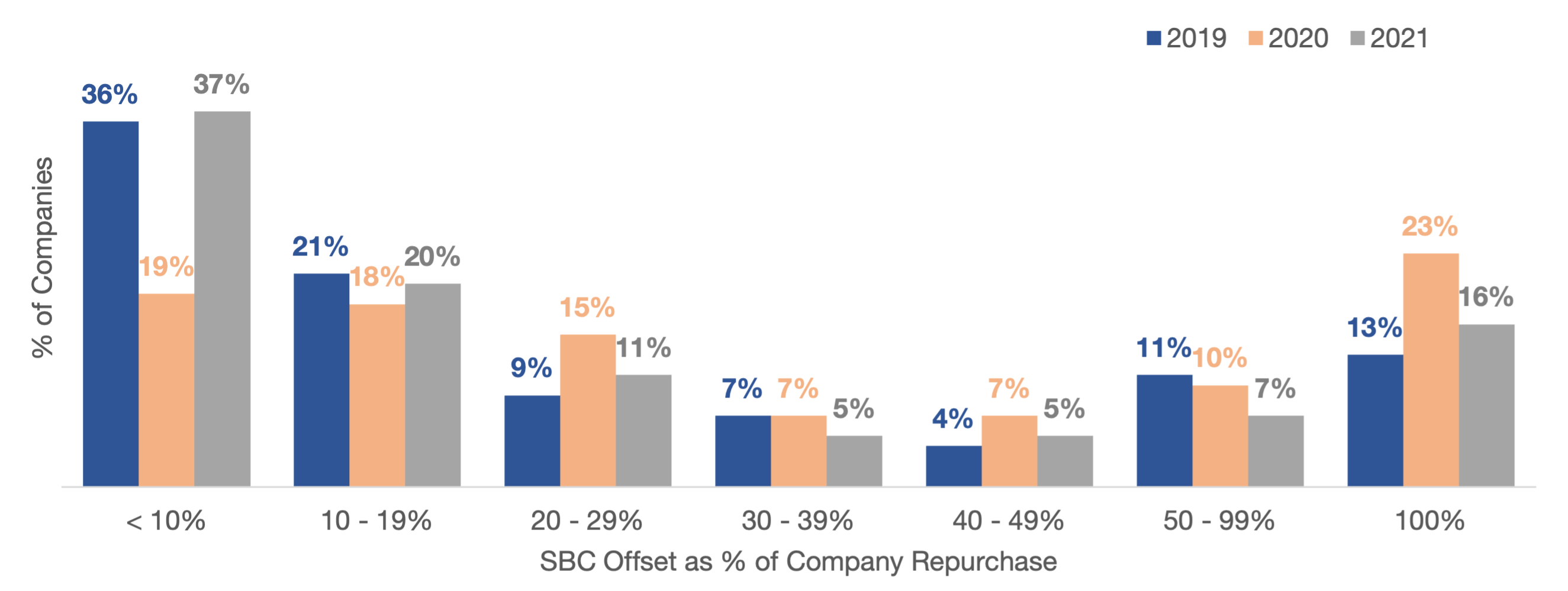

Impact of Stock Based Compensation on the 1% Buyback Tax

On August 16, the Inflation Reduction Act of 2022 was signed into law, including a tax on corporations equal to 1% of “the fair market value of any stock of the corporation which is repurchased by such corporation during the taxable year.” Details (including the treatment of Accelerated Share ... >>>Read More

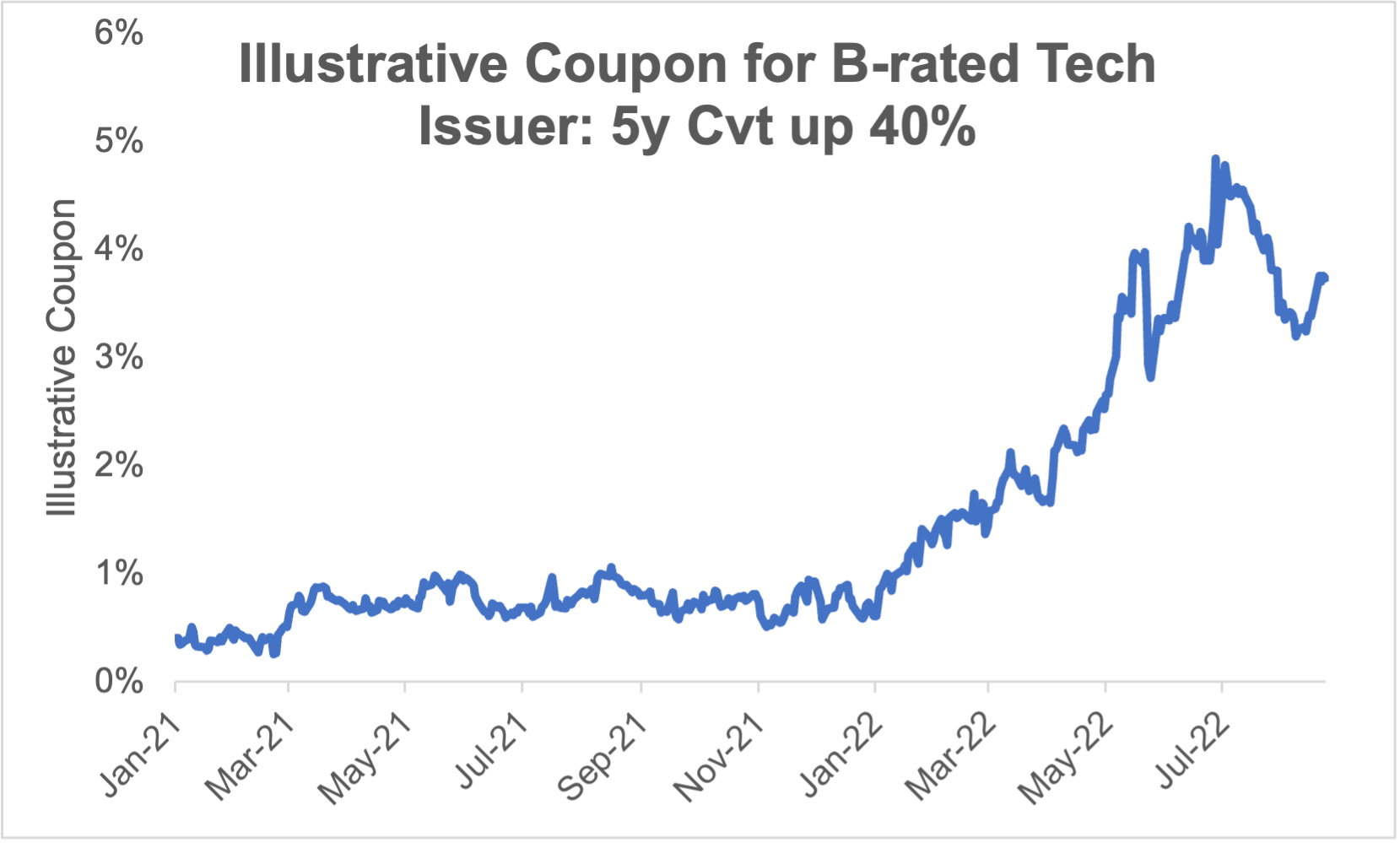

Are the Financing Markets Still Open? – An Update as We Head into Fall

As part of our ongoing market update series, we wanted to take a look at the current state of the convertible markets as we approach the end of summer. In this blog post, we review the recent trading and issuance dynamics of the convertible market and what that means for issuers contemplating ... >>>Read More

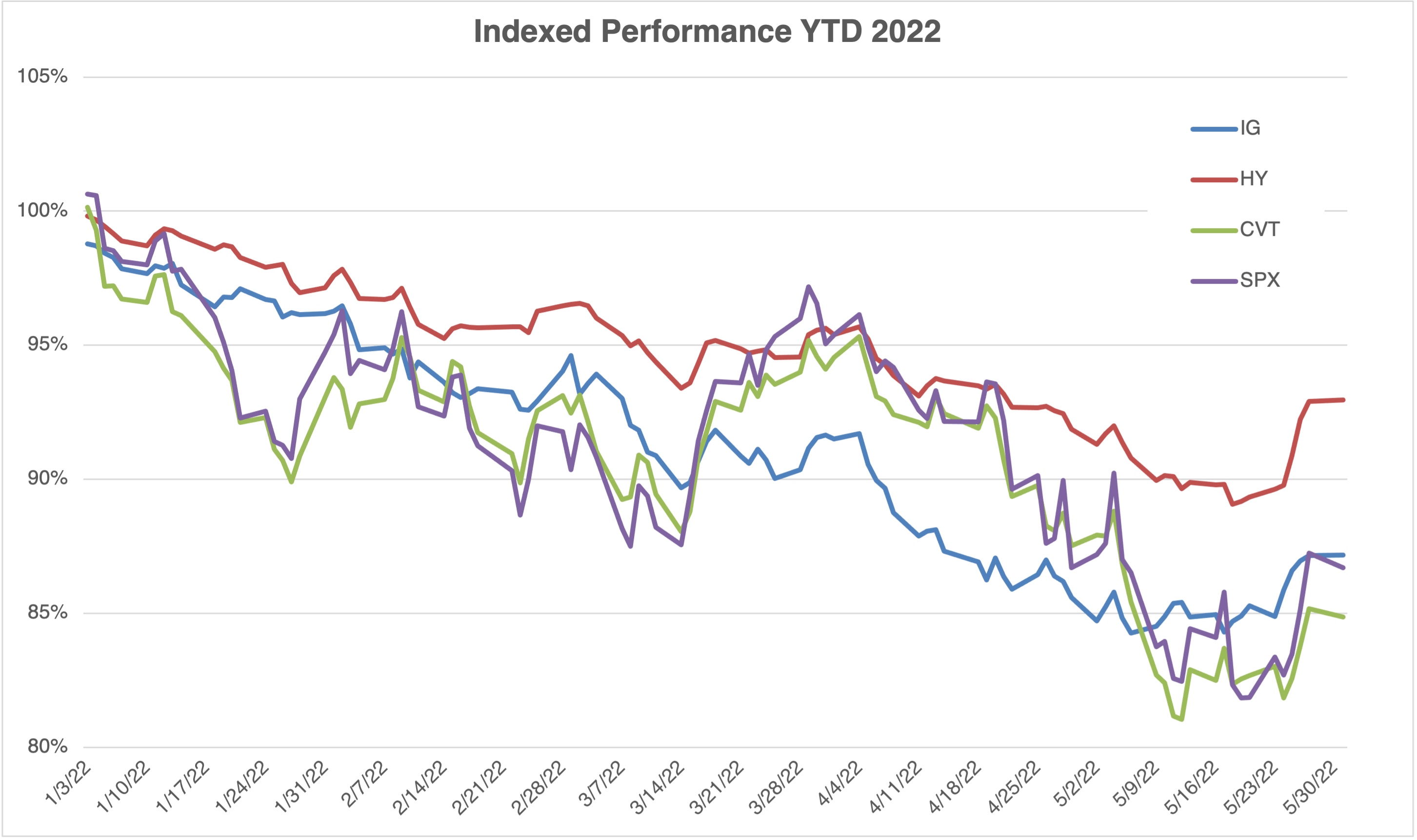

Are the Financing Markets Really Open? – An Examination of the US Equity, Convertible, High Yield, and Investment Grade Markets in Spring 2022

With Federal Reserve tightening and geopolitical uncertainty rising in the last few months, we have seen gains accumulated during COVID dissipate since the start of the year. Consequently, US secondary markets have caused drastic shifts in primary issuance behavior in each of the major financing ... >>>Read More

Share Buyback 101 for Beginners

As a service for those who may not have prior experience with stock repurchase strategies, we provide background information on some general questions. Why do companies do share buybacks? A share buyback is a method of capital return to shareholders. Companies may choose to repurchase ... >>>Read More