Policy-driven macroeconomic volatility has triggered U.S. corporate commentary about business and financial uncertainty, especially since the “Liberation Day” tariff announcements on April 2. A number of companies, especially those in sectors with high tariff exposure (e.g., auto manufacturing) and ... >>>Read More

Unscheduled Market Closure – Will ASRs Be Adjusted Fairly?

Background The New York Stock Exchange and Nasdaq announced today that Thursday, January 9, 2025 will be an exchange holiday as a day of mourning in recognition of President Jimmy Carter’s passing. The occurrence of an unscheduled exchange holiday has consequences for outstanding equity derivatives ... >>>Read More

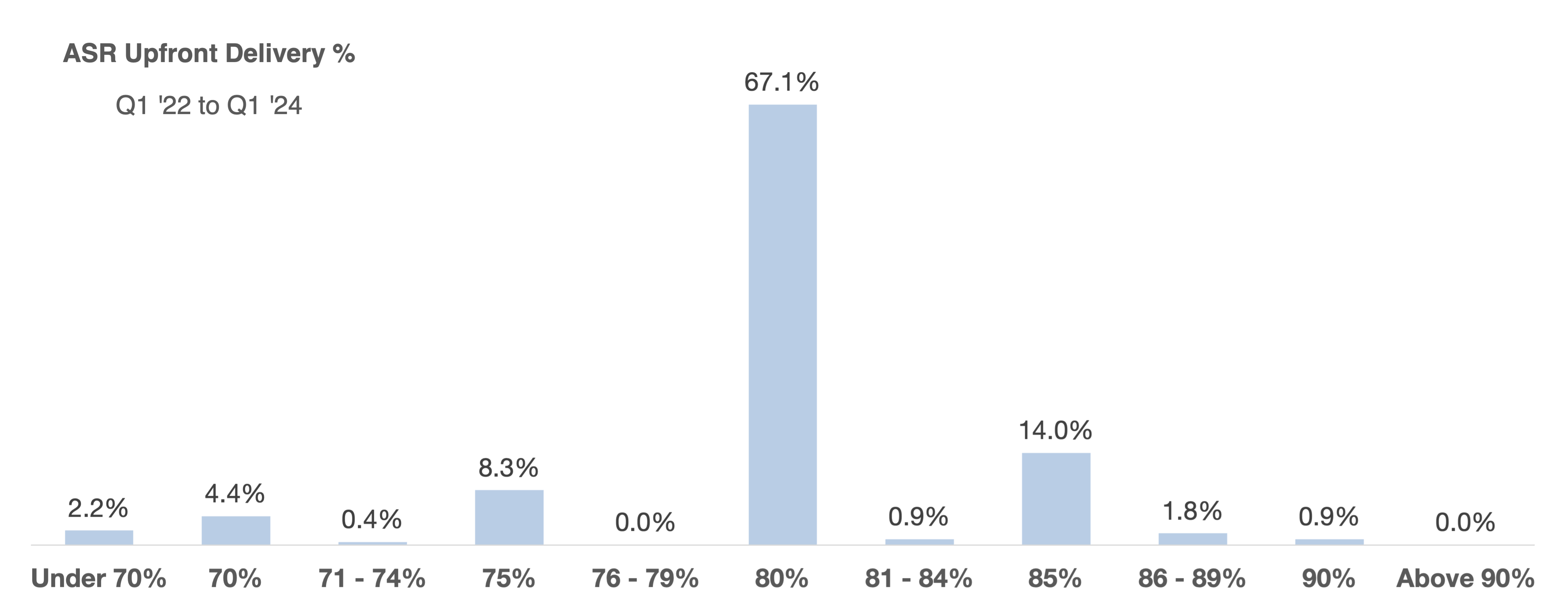

Update: ASR Upfront Share Delivery — Market Practice and Accounting Update

In a prior post we described our analytical approach to deciding the appropriate level of upfront share delivery, incorporating volatility, the duration of an accelerated share repurchase (ASR), and a company’s tolerance of risk of owing cash or shares to their bank counterparty. This post provides ... >>>Read More

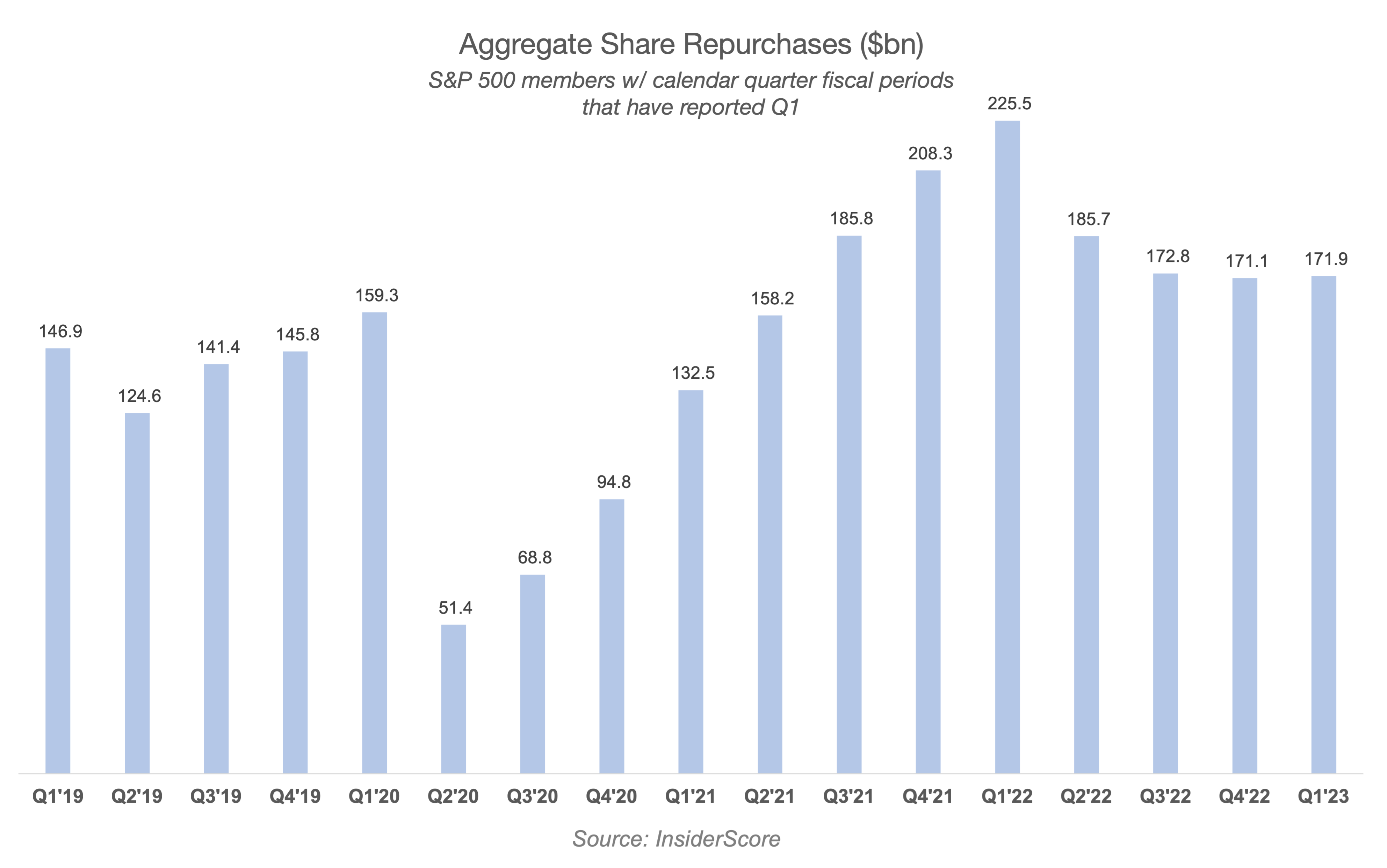

Early Read: No Meaningful Impact in Q1 from 1% Tax on Stock Buybacks

The Inflation Reduction Act of 2022 implemented an excise tax on corporations equal to 1% of the fair market value of stock repurchased during each taxable year, netted against the value of shares issued (including for stock-based compensation). The IRS followed up with more detailed guidance. The ... >>>Read More

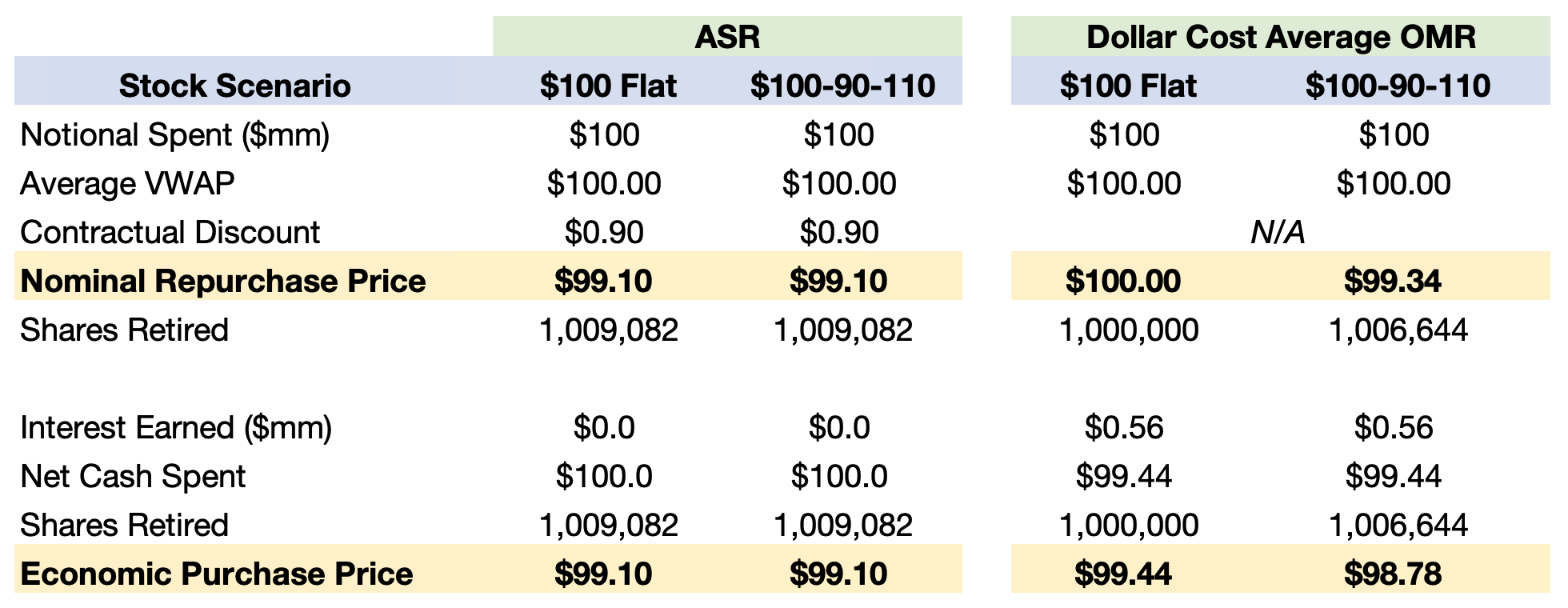

Apples and Oranges: Calculating and Comparing Repurchase Prices Is More Interesting than You Think

It is easy to compute a number for repurchase price per share: cash spent on buybacks divided by number of shares retired. For better informed decision-making, a more complete economic analysis of share repurchase programs that take place over time should reflect both (1) interest income, which has ... >>>Read More

- 1

- 2

- 3

- 4

- Next Page »