In a prior post we described our analytical approach to deciding the appropriate level of upfront share delivery, incorporating volatility, the duration of an accelerated share repurchase (ASR), and a company’s tolerance of risk of owing cash or shares to their bank counterparty. This post provides a mark-to-market snapshot of what ASR users are doing in practice, as well as an update on accounting development that may make the risk of owing value more tolerable.

As a quick refresher, an issuer who executes a $500mm ASR generally receives less than $500mm of stock at inception. This is because the final number of shares retired is determined over the full life of the ASR based on the average volume-weighted average price (VWAP) of the stock; the upfront share delivery is simply an estimate based on the stock price at the time of signing. If the stock price goes up and the average VWAP is high enough, the total number of shares retired under the ASR can be less than the upfront number of shares, and the company then owes shares (or cash of equivalent value) back to the bank. While receiving fewer shares upfront reduces the near-term share count reduction benefit of the ASR, it is primarily done to reduce the probability of the company owing value at the end of the program.

What are Others Doing?

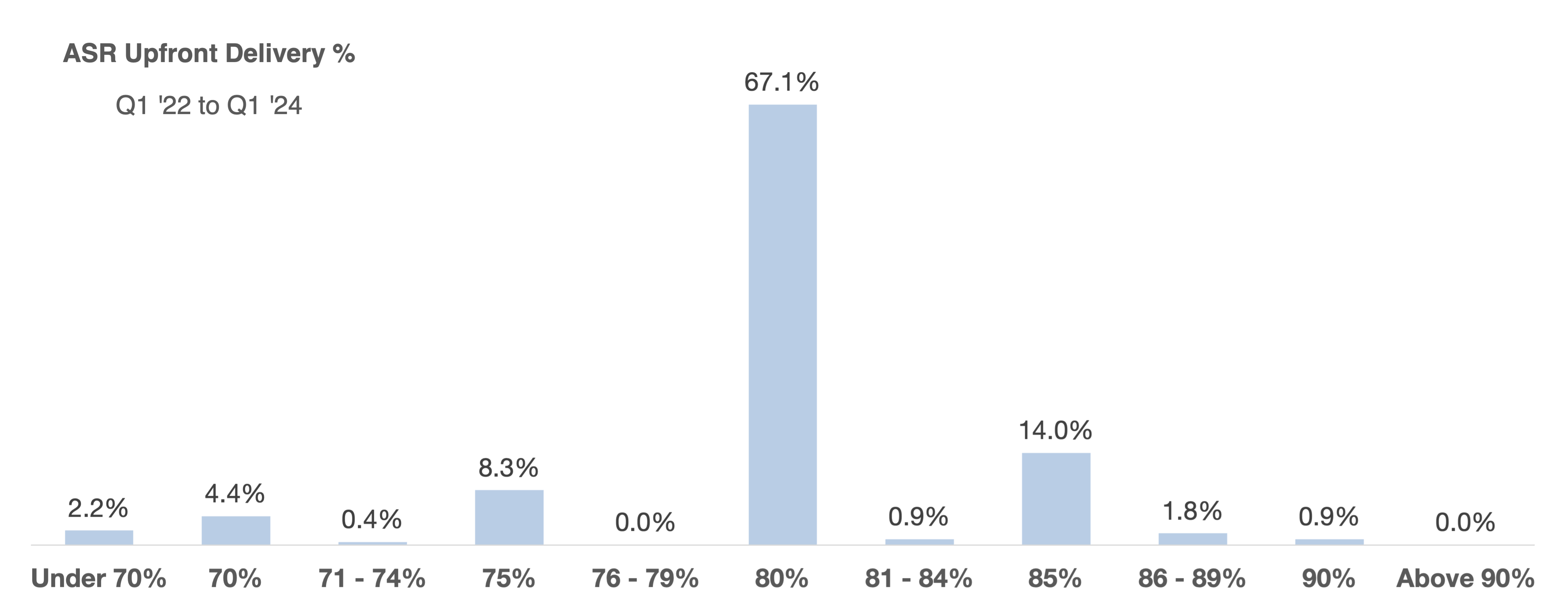

We examined the universe of ASRs executed from 2022 through Q1 2024 that had enough disclosure to indicate the level of upfront share delivery (228 transactions in all).

67% of ASRs use what many market participants regard as standard 80% upfront delivery. Including the frequent 75% and 85% levels brings the total to 90% of all ASRs.

- A meaningful handful of issuers use 70% as a method of being additionally conservative around the risk of owing value. General Motors can fairly be characterized as in this bucket, using 68% upfront share delivery on a $10 billion ASR that can last more than a year.

- At the other end of the spectrum were ASRs at 87.5 – 90% where the ASR was short dated enough and the risk of owing value was low enough to merit additional upfront share delivery.

- A handful of ASRs had delivery levels below 70% (and one at 73%) because they were “variable notional” ASRs such as grid-based ASRs, making a reduced upfront share delivery more appropriate given the potential that the program downsized.

- Several ASRs had low upfront share delivery but a schedule of interim deliveries over the course of the ASR.

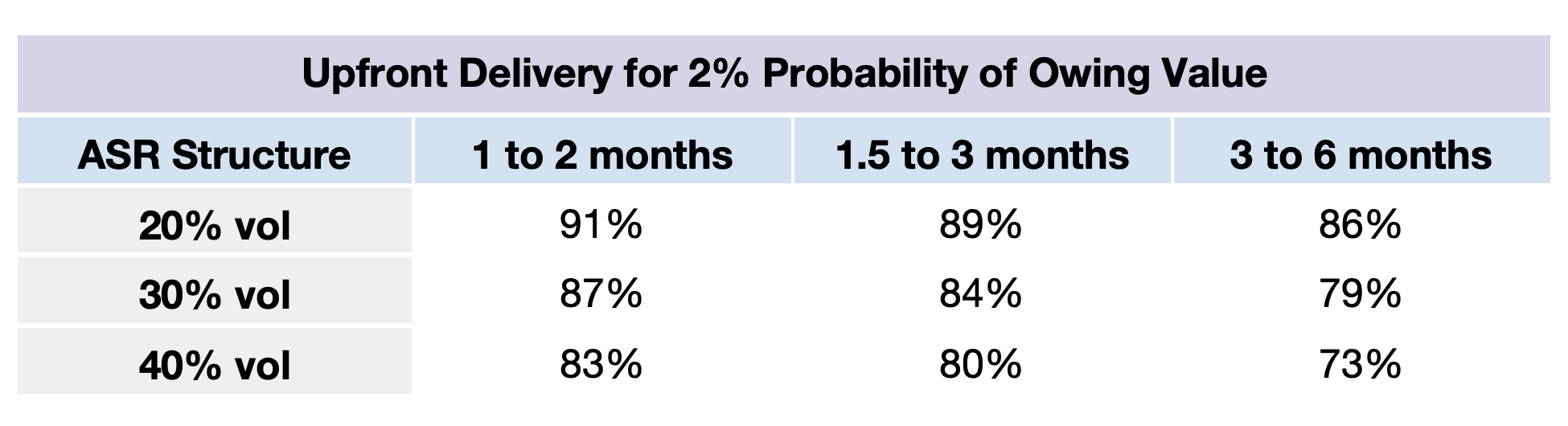

Further refinement is also appropriate if an issuer has valuation-driven views on where its stock price will trade over time.

So What if the Company Owes Value?

Historically, many issuers have targeted a conservative level of upfront share delivery, because of the unpleasantness of delivering cash or shares back to banks.

Delivering shares raises optical and procedural challenges: there may be messaging awkwardness about issuing shares during the course of a stock buyback program (especially if the shares are placed on a registered basis with a prospectus rather than in a private placement to avoid an illiquidity discount).

Delivering cash to the banks was also very challenging: first, a company may not have the excess capital to pay cash and effectively upsize its share repurchase program. Second, the accounting literature had stated that if a company established a practice or history of settling derivative contracts in cash, then EPS should be computed as assuming cash settlement. This could require, in effect, a mark-to-market computation for ASRs.

This Accounting Change May Make a Difference 1

ASU 2020-06 (mostly known for changes to accounting for convertible bonds) amended the EPS guidance in ASC 260-10-45-45 to state that a contract with an issuer choice of cash or share settlement should be treated as a share-settled instrument, irrespective of any history or policy of cash settlement.

We believe this update may reduce the need to be as conservative on upfront share delivery as market practice has been. For many companies, it may make sense to revisit whether 80% is in fact the right level of initial shares.

As always, each ASR is different and all structural decisions, including levels of upfront share delivery, merit a thoughtful and analytical approach.

Please reach out to Matthews South for any questions involving share repurchase planning or the capital markets more generally.

1 Matthews South does not provide accounting advice. Please consult with your own accounting experts or advisors.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.