Background The New York Stock Exchange and Nasdaq announced today that Thursday, January 9, 2025 will be an exchange holiday as a day of mourning in recognition of President Jimmy Carter’s passing. The occurrence of an unscheduled exchange holiday has consequences for outstanding equity derivatives ... >>>Read More

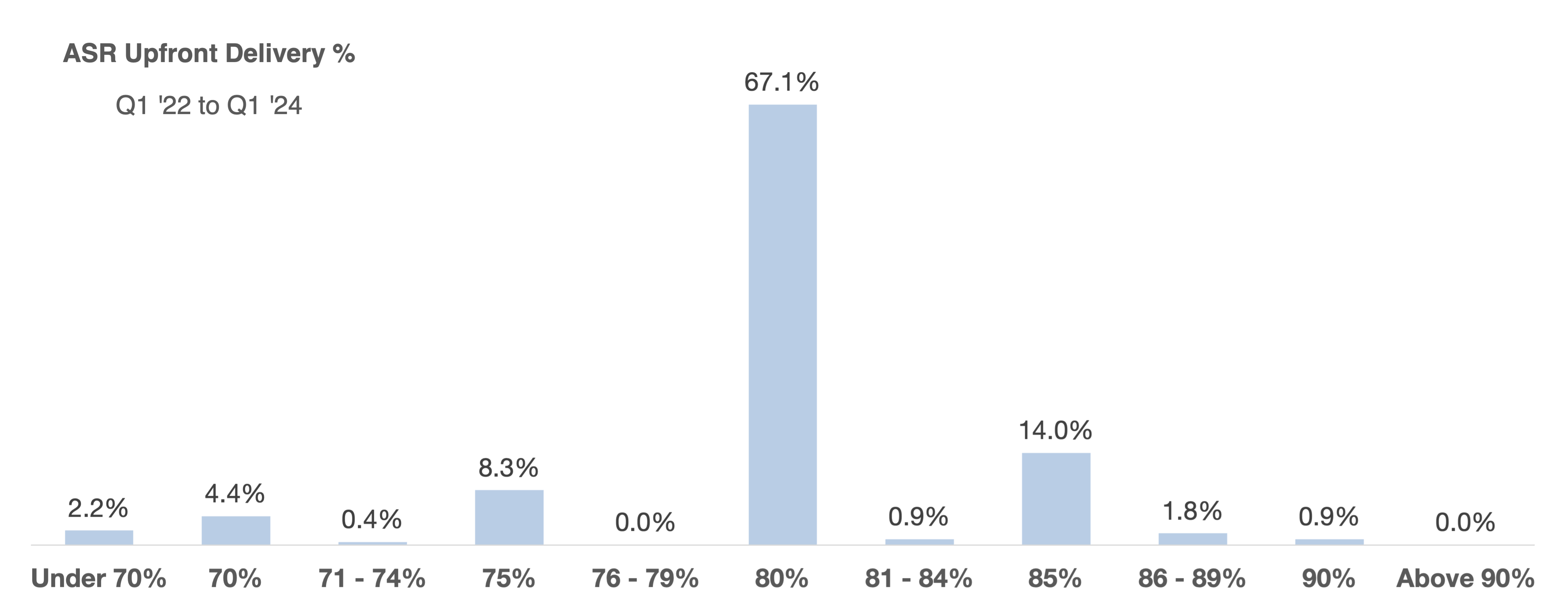

Update: ASR Upfront Share Delivery — Market Practice and Accounting Update

In a prior post we described our analytical approach to deciding the appropriate level of upfront share delivery, incorporating volatility, the duration of an accelerated share repurchase (ASR), and a company’s tolerance of risk of owing cash or shares to their bank counterparty. This post provides ... >>>Read More

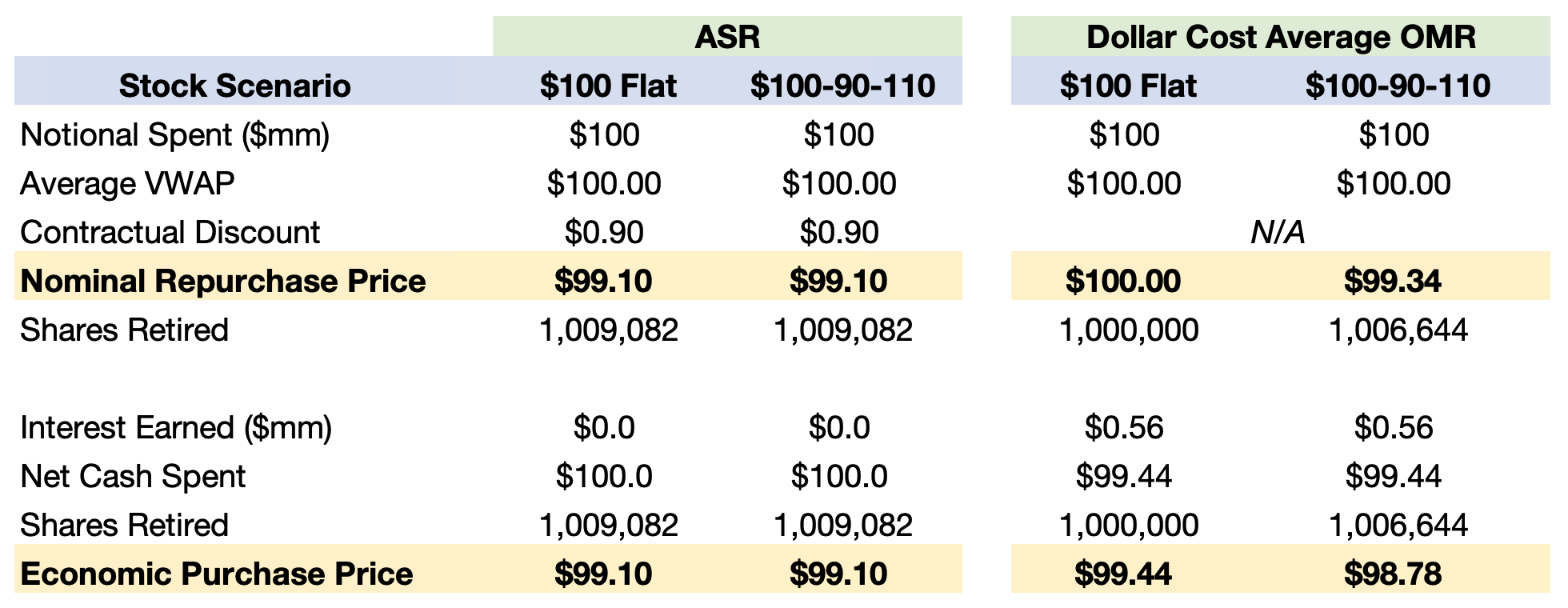

Apples and Oranges: Calculating and Comparing Repurchase Prices Is More Interesting than You Think

It is easy to compute a number for repurchase price per share: cash spent on buybacks divided by number of shares retired. For better informed decision-making, a more complete economic analysis of share repurchase programs that take place over time should reflect both (1) interest income, which has ... >>>Read More

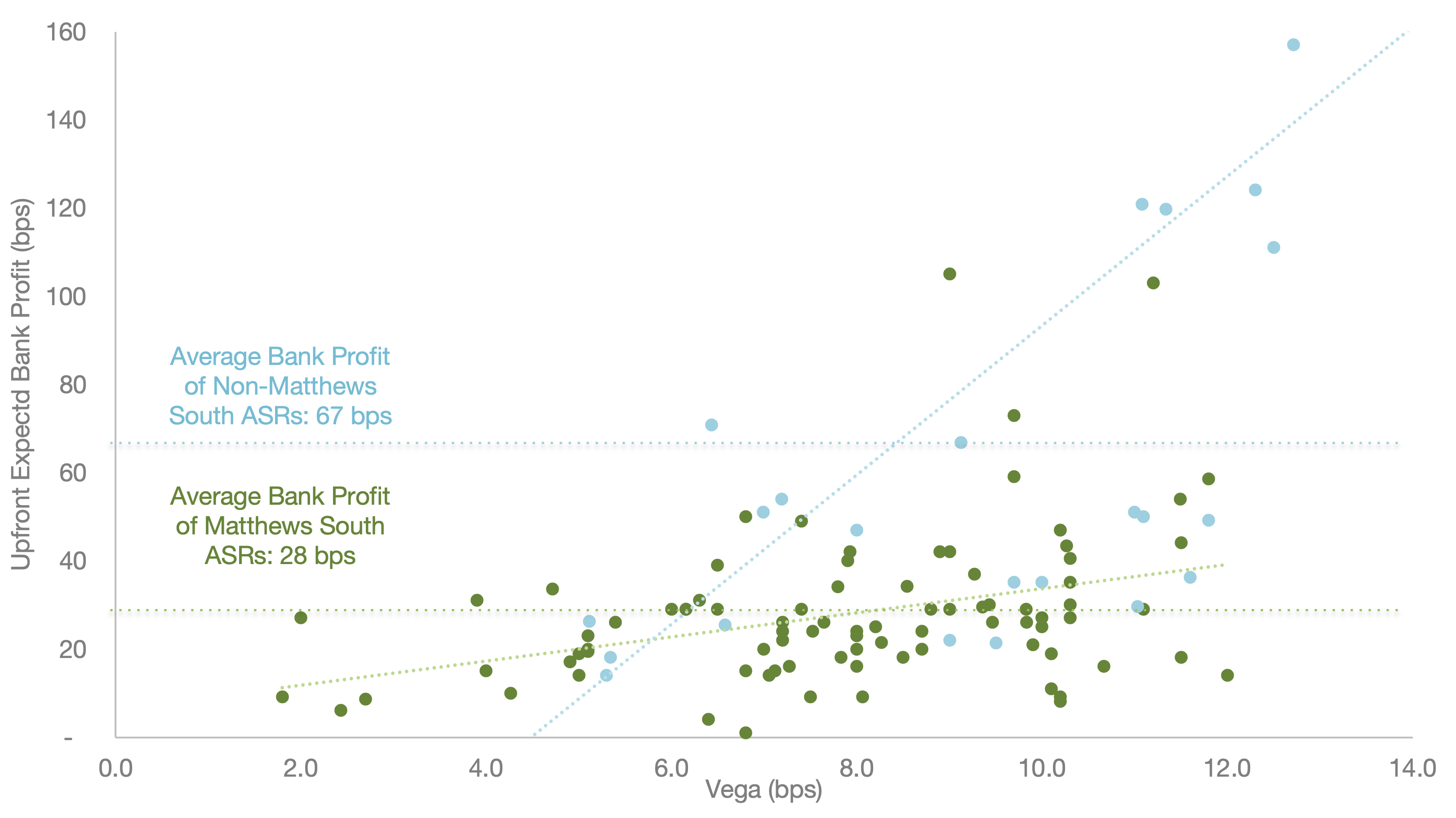

ASR VWAP Discount: Are You Receiving The Best Price?

Matthews South has advised clients on $80bn of share repurchase to date and ~30% of ASRs in 2022. This experience, coupled with our proprietary software, gives us an unrivaled ability to help our clients achieve the best ASR pricing. In this blog, we present updated statistics on the pricing of ... >>>Read More

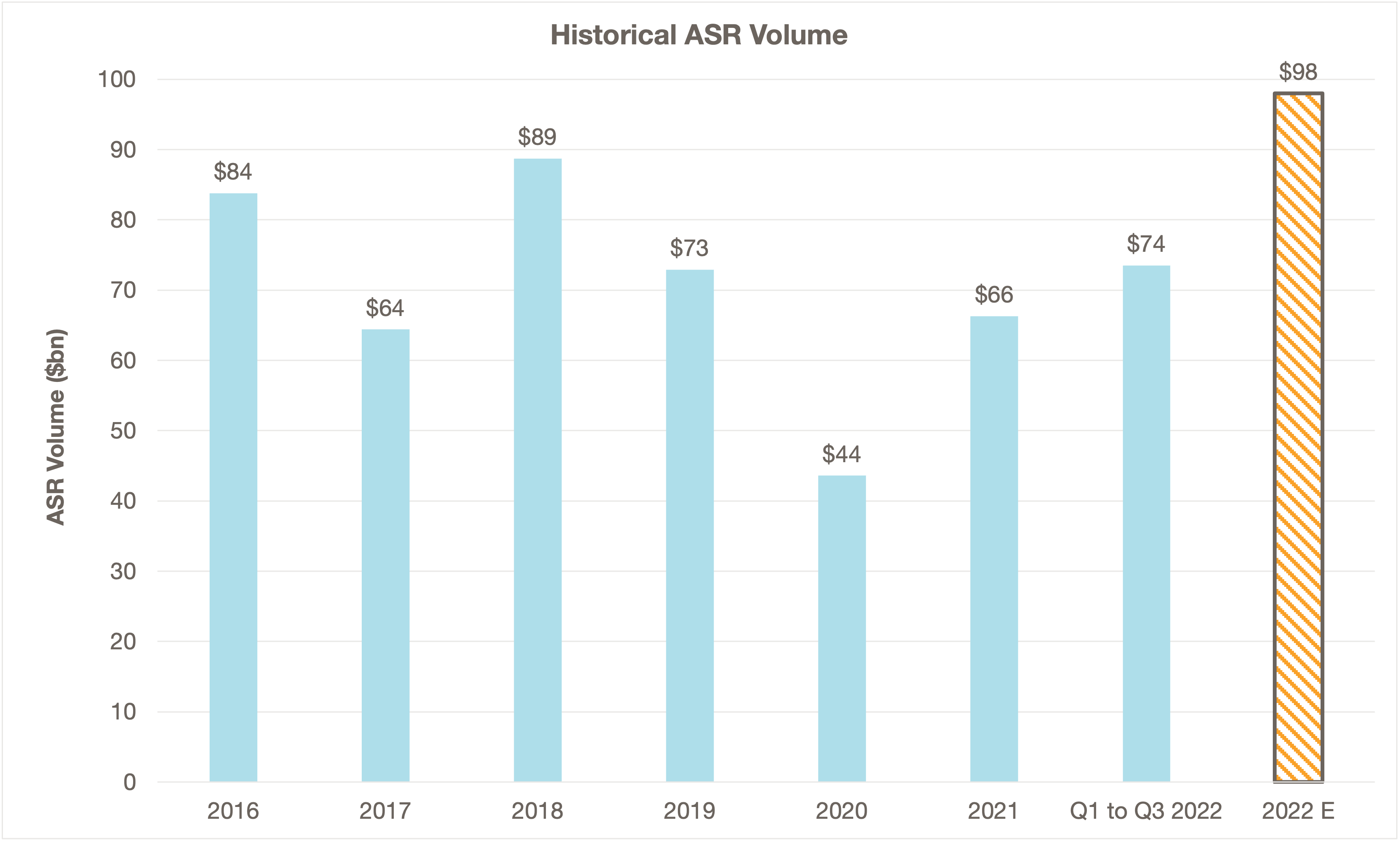

Resurgence of Accelerated Share Repurchase (ASRs)

2022 has been a banner year for ASRs with greater volume through the first three quarters than the corresponding period in any year in recent history. There have been 77 ASRs for a total of $73.5bn during this period. ASR terms for companies have never been better given high volatility and rising ... >>>Read More