Matthews South has advised clients on $80bn of share repurchase to date and ~30% of ASRs in 2022. This experience, coupled with our proprietary software, gives us an unrivaled ability to help our clients achieve the best ASR pricing.

In this blog, we present updated statistics on the pricing of Matthews South advised ASRs and the rest of the market. On average, Matthews South has achieved ~40 bps higher discount for its clients.

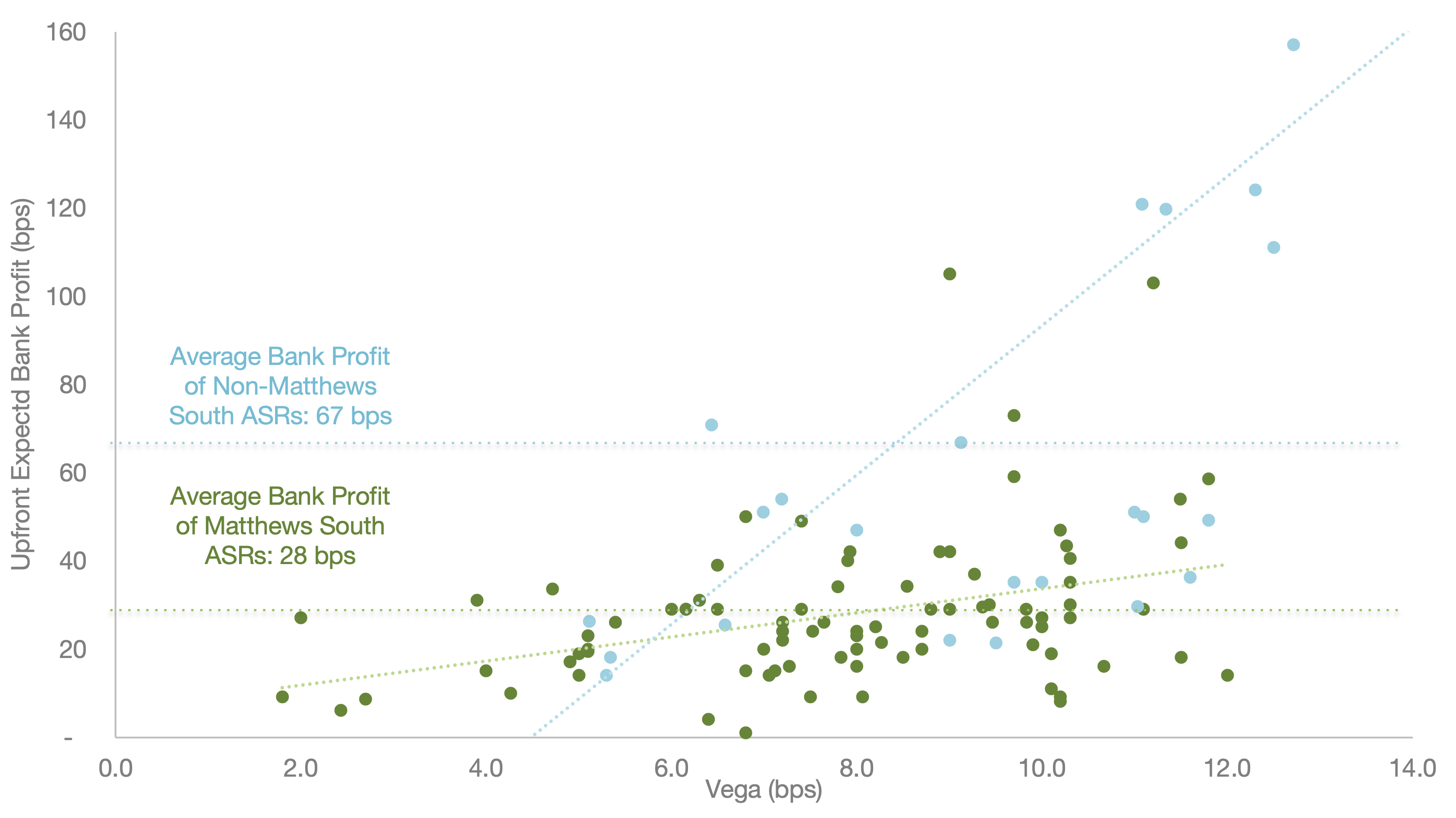

For the period from 2017 to now, we compare ASRs that we advised to ASRs that we did not advise and have enough information to calculate the counterparty’s expected profit. We use our software (which our clients can access) to calculate the bank’s upfront expected profit and volatility risk (vega) for each ASR. On the graph below, we plot initial bank expected profit as a function of the ASRs’ riskiness. Matthews South advised and non-advised ASRs are green and blue dots, respectively.

Source: Matthews South Internal Database

The data shows that on average, banks made 39 bps higher profit on transactions that Matthews South did not advise. There is a 1-for-1 relationship between upfront bank profit and VWAP discount for ASRs without collars or caps. This means that Matthews South clients achieved 39 bps higher VWAP discount on average.

We first shared this study in 2019 in which the savings was also ~40 bps. While the market has become more competitive with new, aggressive ASR counterparties, our clients continue to be successful in achieving better discounts.

Please reference our original blog post which details how we help our clients achieve better pricing.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.