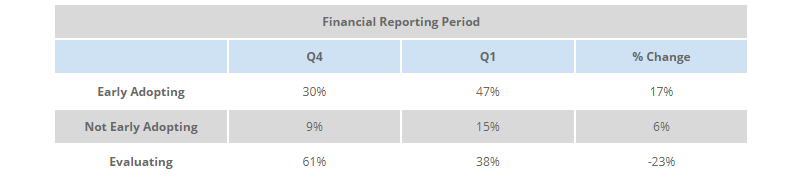

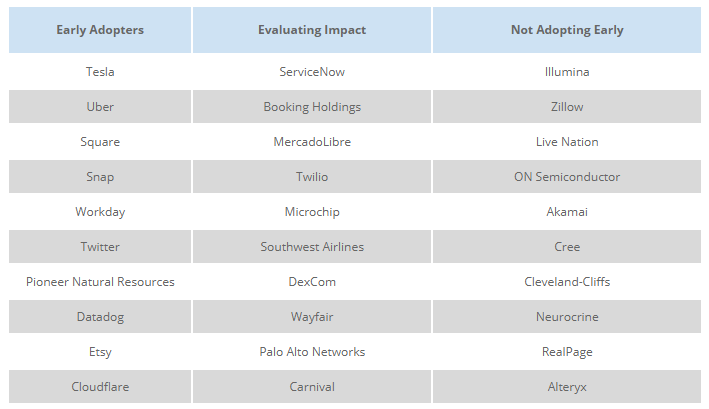

As discussed in a prior blog, the new convertible accounting rules in ASU 2020-06 will take effect in 2022. However, companies may early adopt the rules starting in 2021. We summarize the new accounting rules below: Summary of New Accounting Rules How Many Companies are Early ... >>>Read More

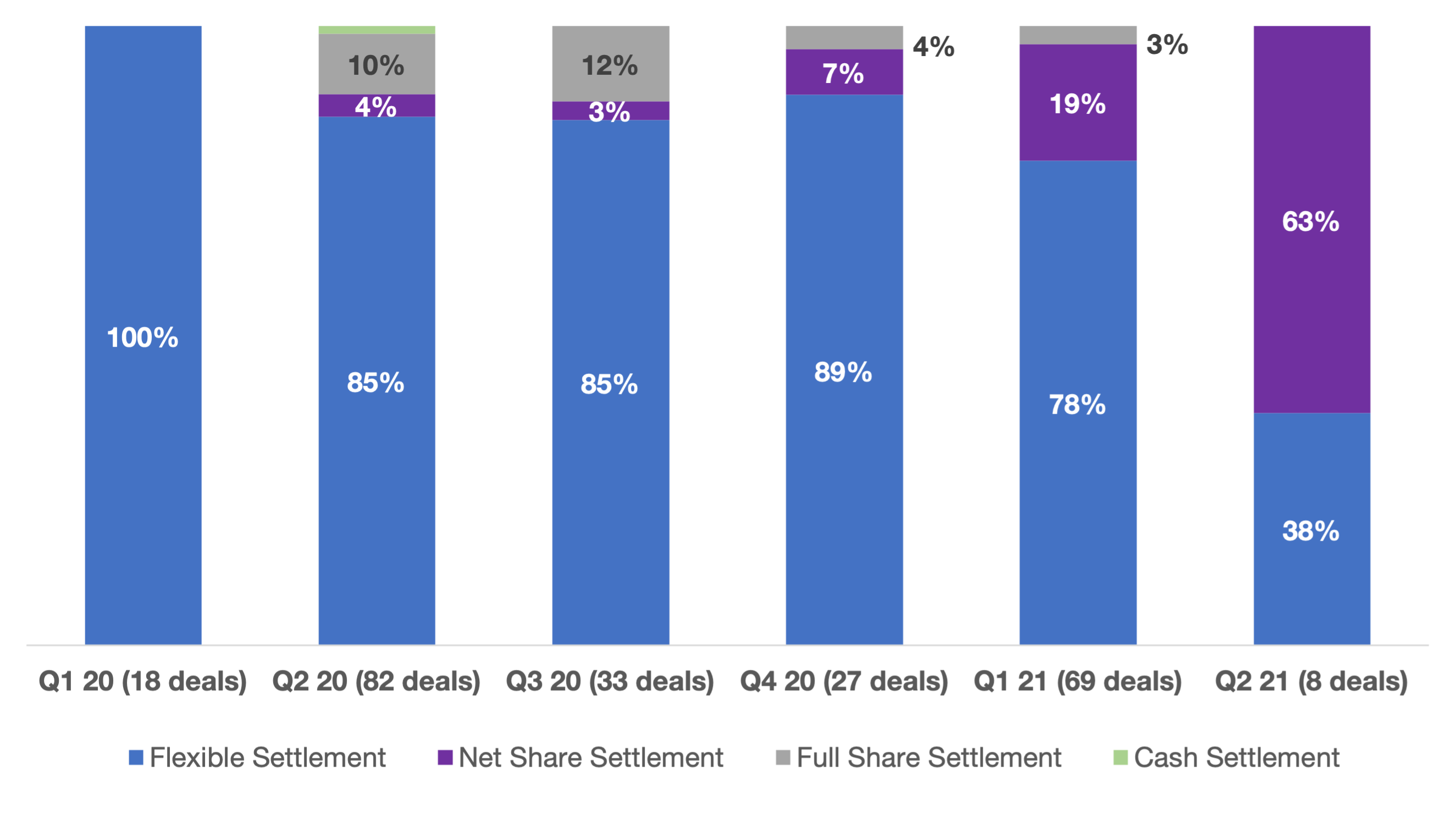

Convertible Settlement Changes in Response to ASU 2020-06

As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2021. We have previously discussed the new accounting standards from FASB governing convertible bonds and reviewed company disclosure around early adoption of those ... >>>Read More

Q1 2021 Convertible Market Review

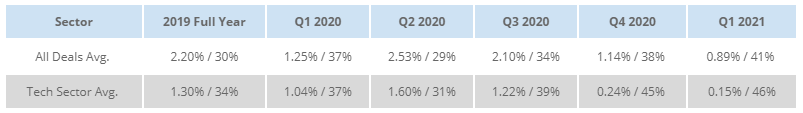

As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2021. Pricing Results: Theoretical Value. The first graph below shows trends in theoretical model valuation throughout the quarter — i.e., showing how much the typical ... >>>Read More

Early Adoption and Disclosure Trends for ASU 2020-06

The new convertible accounting rules in ASU 2020-06 will take effect in 2022. However, companies may early adopt the rules starting in 2021. We summarize the new accounting rules below: Summary of New Accounting Rules Bifurcating the bond into debt and equity components will no longer ... >>>Read More

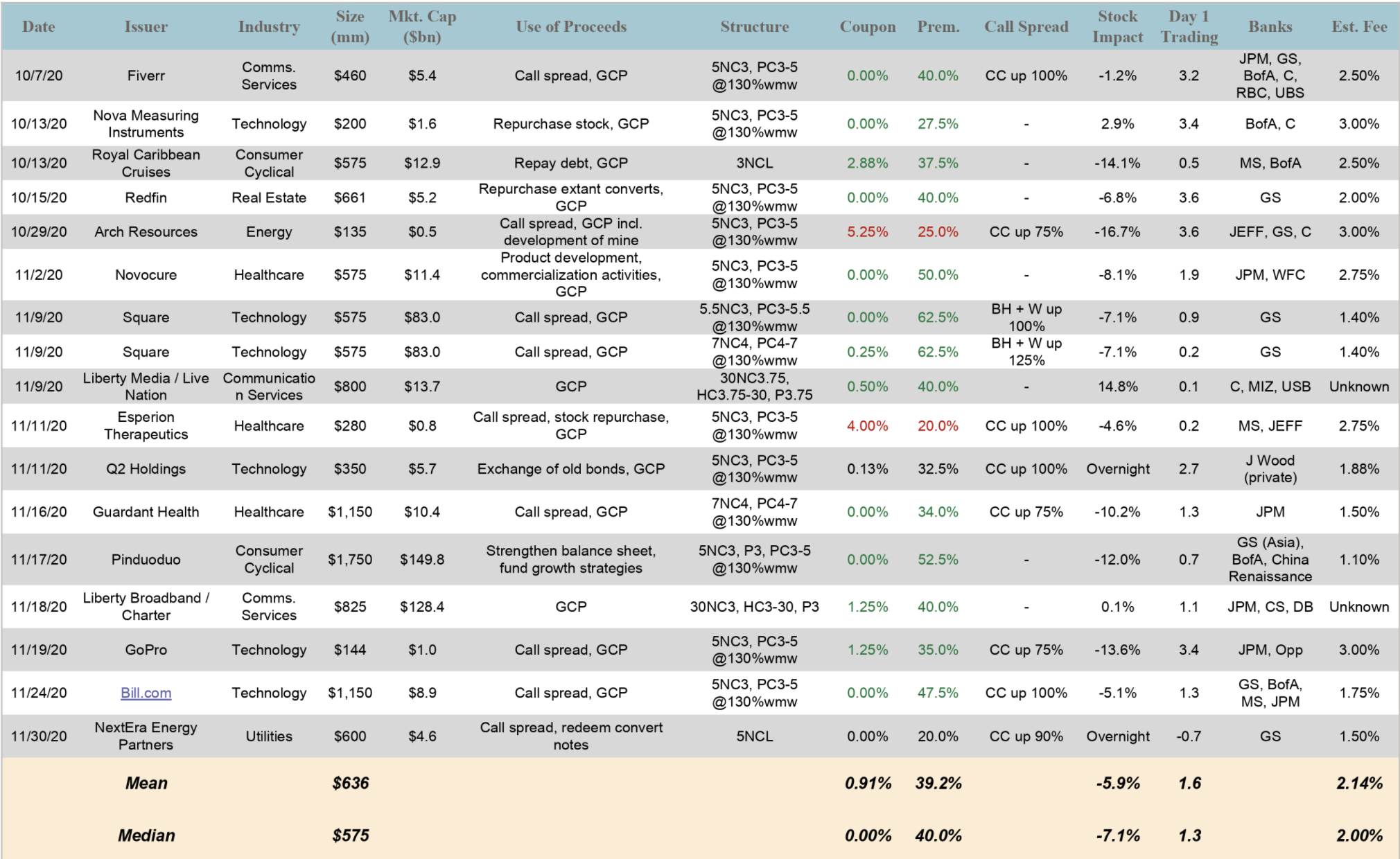

October/November Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in October and November 2020. New Issuance. October and November 2020 saw 5 and 12 new issue convertible deals, with dollar volumes of $2.0 billion and $8.7 billion, respectively. The ... >>>Read More

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 19

- Next Page »