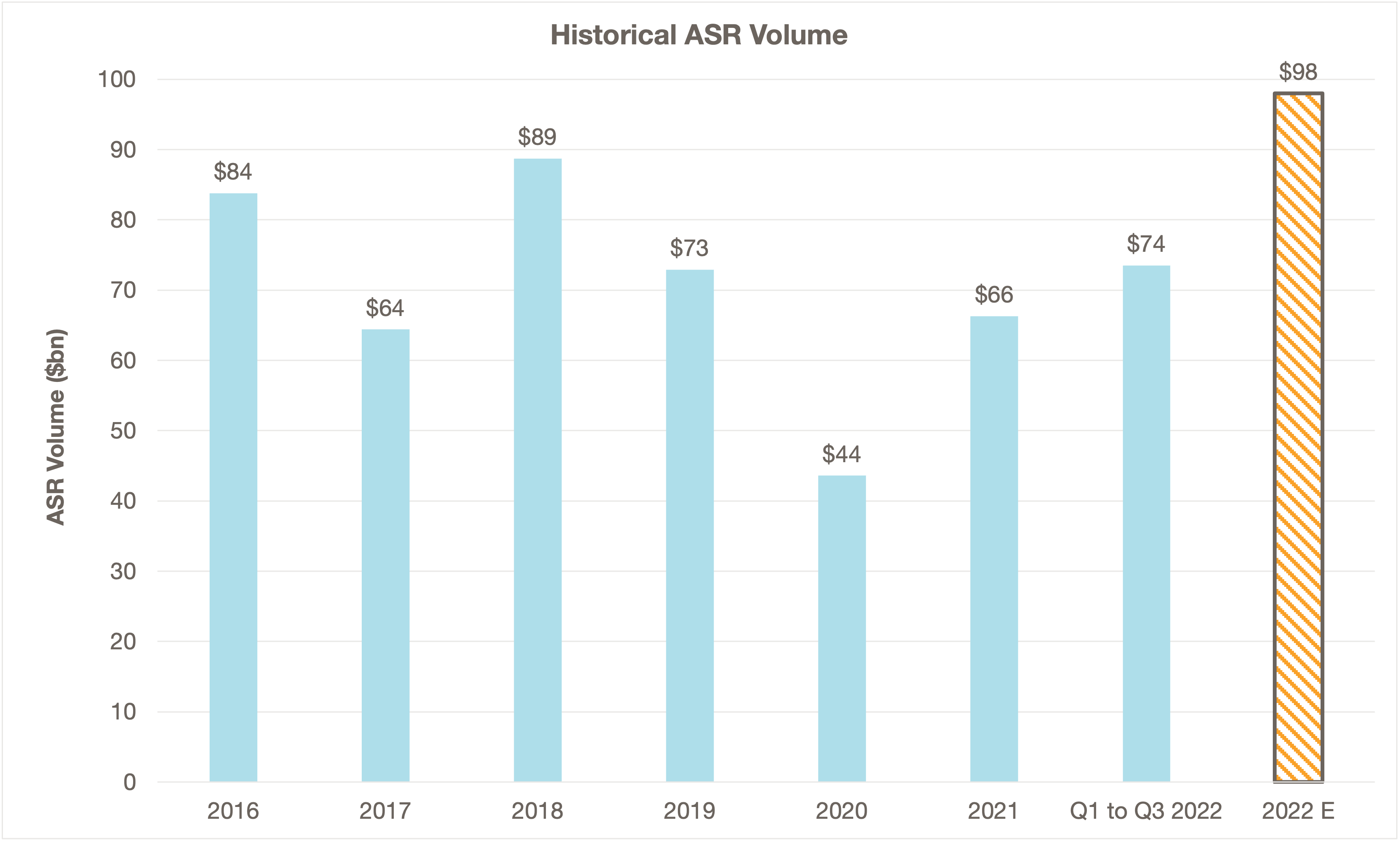

2022 has been a banner year for ASRs with greater volume through the first three quarters than the corresponding period in any year in recent history. There have been 77 ASRs for a total of $73.5bn during this period. ASR terms for companies have never been better given high volatility and rising ... >>>Read More

Q3 2022 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q3 2022. Notably, Q3 volumes were the highest of the year totaling $10.5bn - accounts for over 50% of the YTD volumes Healthcare issuance continues to be the largest driver of volumes with ... >>>Read More

Five Common Questions about eOMRs, an Essential Share Repurchase Tool

At Matthews South, we continue to see a meaningful increase in Enhanced Open Market Repurchase (eOMR) interest and usage from our clients. Open Market Repurchase (OMR) users are progressively considering eOMR because of the large expected discount beat that eOMR provides. Additionally, it is an ... >>>Read More

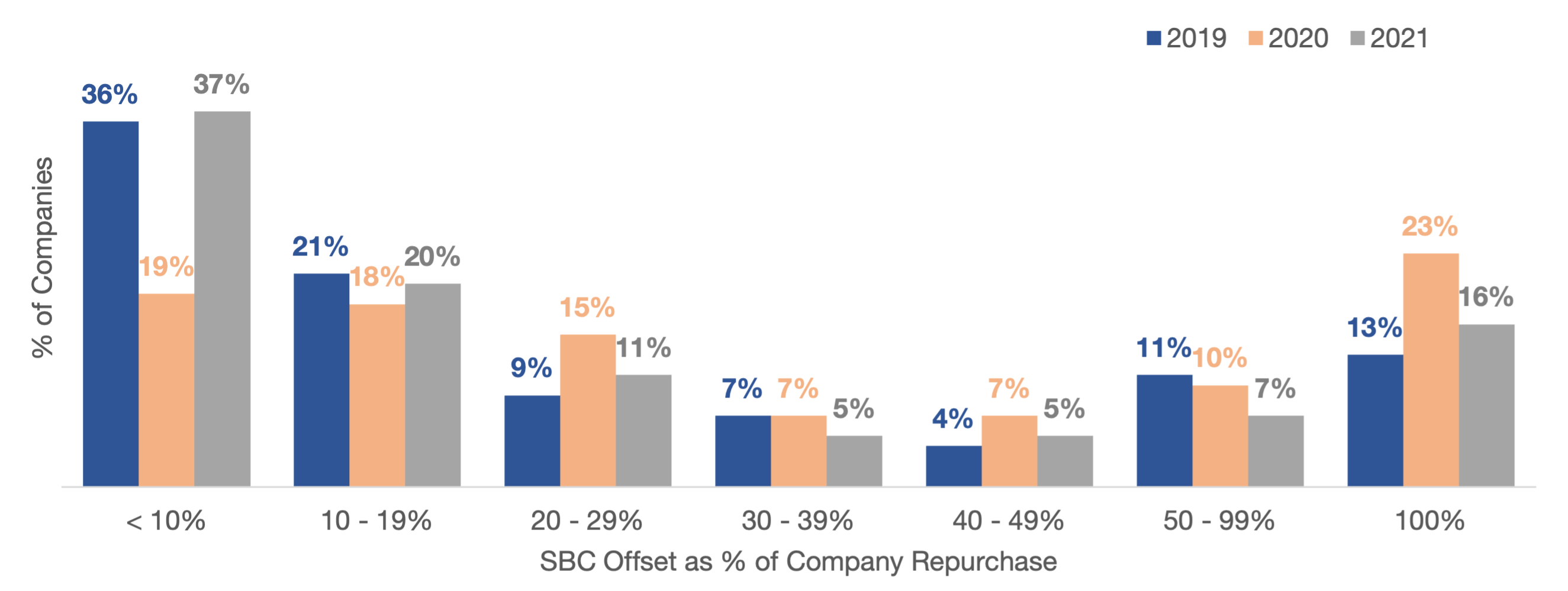

Impact of Stock Based Compensation on the 1% Buyback Tax

On August 16, the Inflation Reduction Act of 2022 was signed into law, including a tax on corporations equal to 1% of “the fair market value of any stock of the corporation which is repurchased by such corporation during the taxable year.” Details (including the treatment of Accelerated Share ... >>>Read More

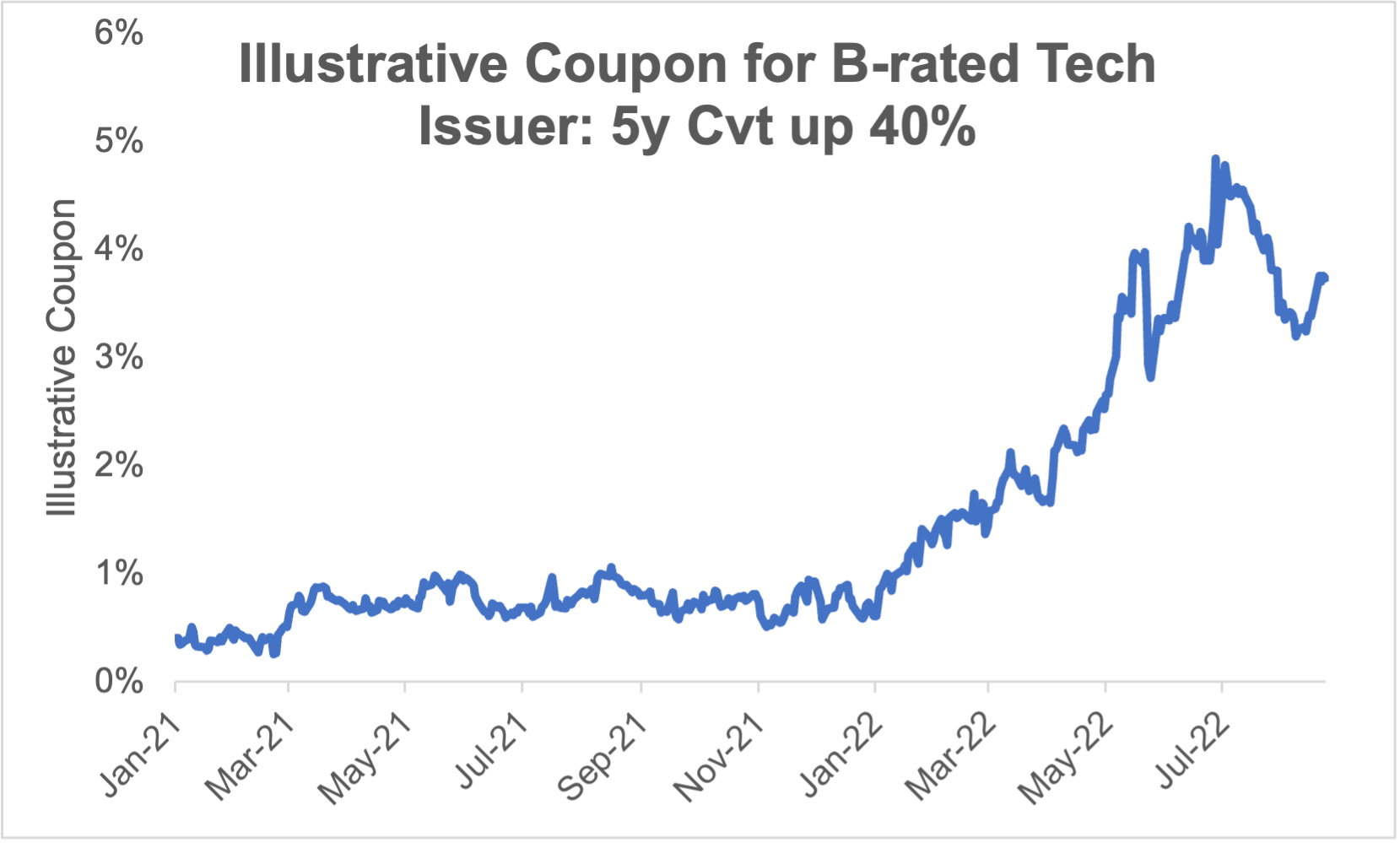

Are the Financing Markets Still Open? – An Update as We Head into Fall

As part of our ongoing market update series, we wanted to take a look at the current state of the convertible markets as we approach the end of summer. In this blog post, we review the recent trading and issuance dynamics of the convertible market and what that means for issuers contemplating ... >>>Read More

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 19

- Next Page »