Highlight: The convertible market has continued to weaken since March 13. By our calculations, expected new issue coupons are now 3% higher than in mid-February and 1.5% higher than on March 13. In a previous post, we examined the impact of the current volatile market conditions on ... >>>Read More

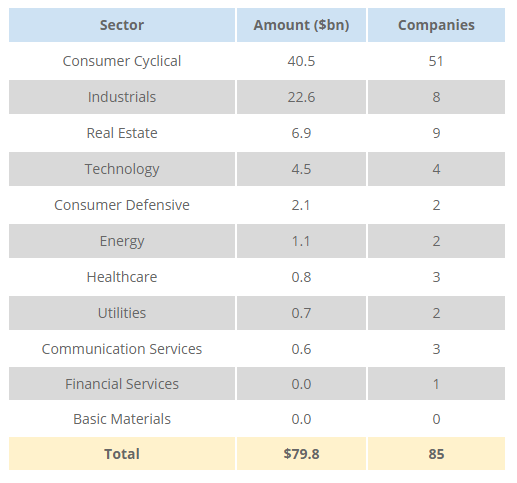

Measuring COVID-19 Credit Facilities Drawdowns

Updated on 3/31/2020 for additional data from algorithm refinement As social distancing and business closures have taken hold in the last several weeks in response to the developing Covid-19 pandemic, a number of companies are bracing for a downturn by improving their liquidity ... >>>Read More

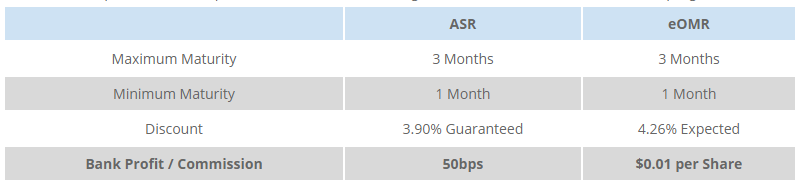

Share Repurchase Strategies for Volatile Markets

Over the past three weeks, the VIX index (a measure of expected volatility of the US market over a 30-day forward looking period) has steadily increased from the mid teens to a maximum of 82.7% on 16-Mar-2020. To put this in perspective, the VIX index peaked at 80.9% during the 2008 financial ... >>>Read More

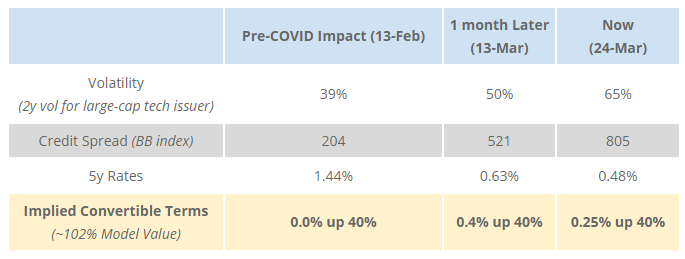

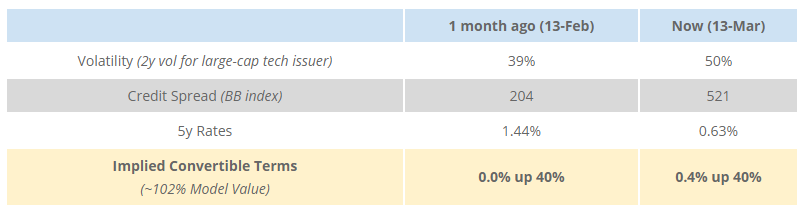

Measuring COVID-19’s Impact to the Convertible Market

Over the past three weeks, prospective issuers have heard versions of the following banker simplification of the convertible market: “Convertible pricing is very attractive because rates are at historic lows and the benefit from the increased volatility offsets widening credit spreads.” While ... >>>Read More

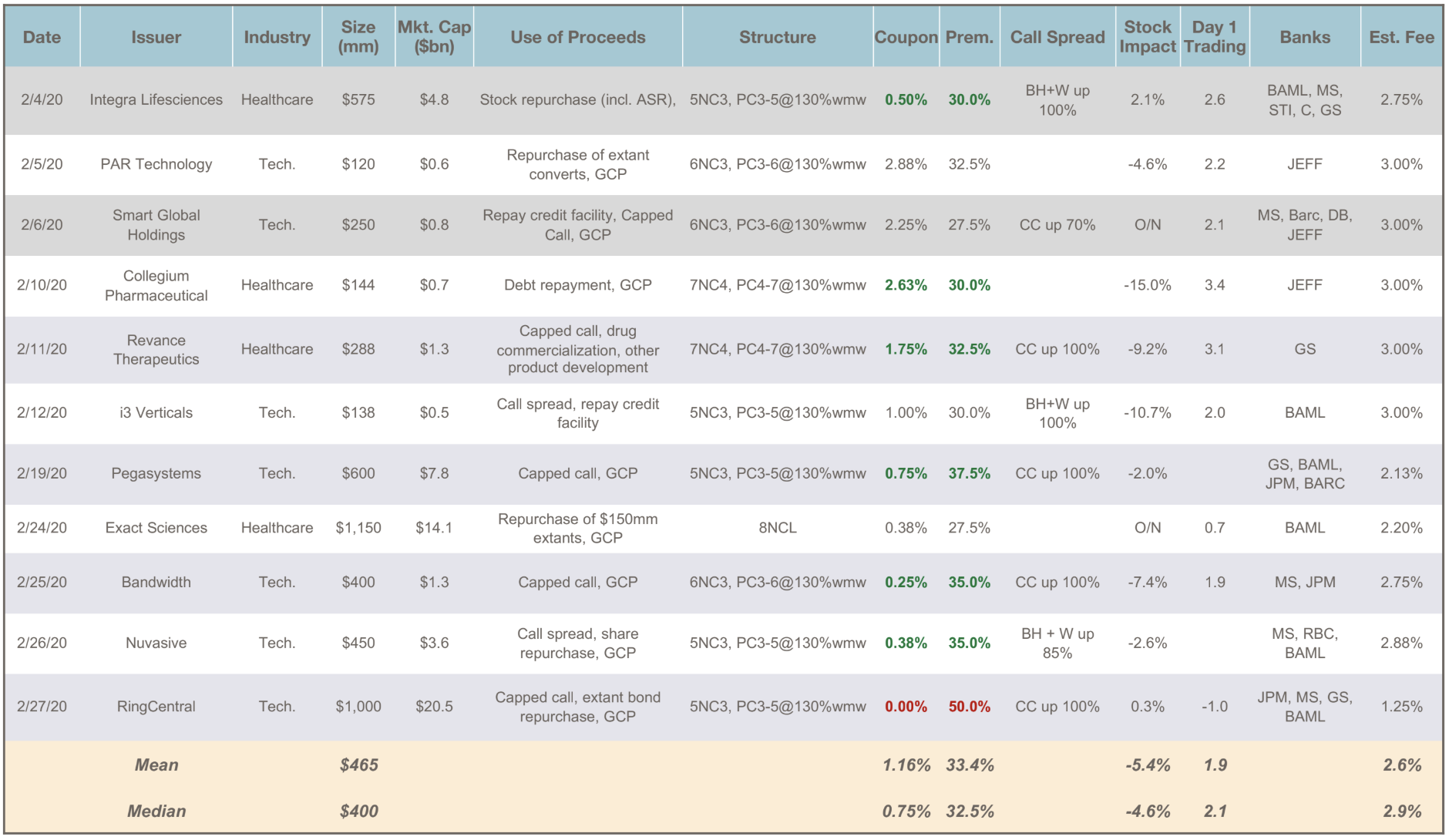

February Convertible Market Review

Total Issuance: Despite the sharp market sell-off, February was a very busy month in the convertible market. A total of $5.1 billion priced over 11 deals – a higher dollar volume than every month of 2019 except for August and September. Activity was in fact concentrated (4 deals for ... >>>Read More

- « Previous Page

- 1

- …

- 12

- 13

- 14

- 15

- 16

- …

- 19

- Next Page »