Over the past three weeks, the VIX index (a measure of expected volatility of the US market over a 30-day forward looking period) has steadily increased from the mid teens to a maximum of 82.7% on 16-Mar-2020. To put this in perspective, the VIX index peaked at 80.9% during the 2008 financial crisis. This period of unprecedented volatility creates opportunities for companies looking to execute share buybacks.

In this blog post, we explore how companies can take advantage of the current market environment by analyzing two repurchase strategies: ASR and eOMR.

Overview of Alternatives

An Accelerated Share Repurchase (“ASR”) is a committed strategy in which the company pays the notional amount to a bank and receives a large portion of the shares upfront. The final settlement is based on the average of the daily VWAPs over the program’s duration. The completion date of the program is determined by the bank, between a contractually specified minimum and maximum maturity. This option to determine the maturity has quantifiable value and allows the bank to offer the company a guaranteed discount to the average daily VWAP over the program period.

An enhanced Open Market Program (“eOMR”) is a “non committed” strategy in which the company instructs a broker to purchase shares on an agency basis pursuant to an ASR algorithm. Like an ASR, the company specifies the notional amount and minimum / maximum maturity. The algorithm calculates a daily price-volume grid that mimics what a bank would have purchased to hedge an ASR with the same parameters. The grid is calculated and sent to the broker pre-open, each morning and changes daily based on the spot price, trailing average VWAP and volatility. The eOMR is, essentially, an open market program with ASR-like economics.

There are two important differences between an ASR and eOMR: 1) the eOMR can be cancelled by the company at any time (including when in possession of MNPI) while the ASR cannot and 2) the ASR VWAP discount is fixed upfront whereas the eOMR discount is variable.

Volatility Expectation and Strategy Selection

The bank generally determines the guaranteed discount in an ASR by using the market’s expectation of volatility of the stock over the ASR period (as observed in the listed options market) and applying a haircut for its expected profit (discount to fair value). The bank’s actual profit will depend on the volatility realized by the stock, during the ASR life, as compared to the initial expectation. The company’s VWAP discount, however, is fixed regardless of the volatility outcome. Therefore, by virtue of the ASR’s fixed discount, the company is economically selling volatility at market’s current expectation. If the volatility realized by the stock is lower than expected, the company benefits from having received a larger fixed discount than it should have, and vice versa.

The eOMR program does not have a fixed discount, but the algorithm is intended to generate a discount over the duration of the program. The magnitude of the discount will be a function of the volatility of the stock over the life of the program. A more volatile period will result in a higher discount than a less volatile period. Interestingly, since the algorithm mimics an ASR, the eOMR’s expected discount on day-1 should be similar to the ASR’s fixed discount. By not fixing the discount upfront, the company implicitly monetizes the volatility that the stock exhibits over the life of the program.

The ASR locks-in today’s volatility with a fixed discount whereas the eOMR’s discount will be based on actual volatility of the stock. Economically, the company should choose an eOMR if it believes that realized volatility will be equal to or higher than current market expectation. The ASR is a better choice, if the company believes realized volatility will be lower than current expectation.

Quantifying Impact of Volatility on Outperformance

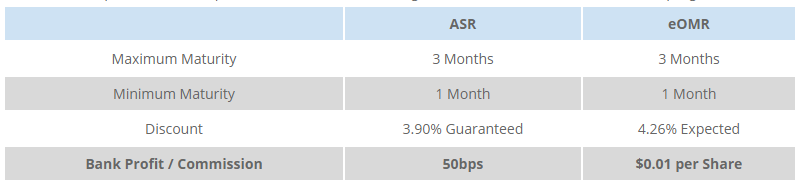

In order to compare the relative performance of the two strategies, we modelled similar 1 to 3 month programs¹:

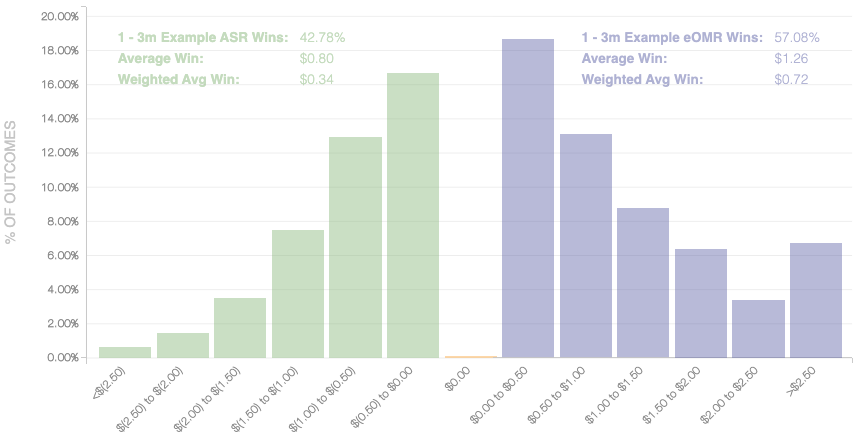

The histogram below is the output of a 5000 path, Monte Carlo simulation from our software platform. For each path in the Monte Carlo analysis, the software 1) simulates the ASR and eOMR, 2) calculates the average repurchase price for each, and 3) subtracts them. This difference in repurchase price is a measure of outperformance on each path. The histogram below graphs the 5000 values of difference between ASR and eOMR repurchase prices. The x-axis is the difference in repurchase price presented in $0.50 intervals and the y-axis is the frequency of each interval. The green bars are the cases in which the ASR does better and the blue bars are the cases in which the eOMR does better.

At a 50% volatility assumption, the eOMR performs better ~57% of the times with a weighted average win of $0.72. Conversely, the ASR wins less often (~43% of the time) with a weighted average win of $0.34. The majority of this difference is explained by the eOMR’s lower transaction cost than the ASR. If the company believed that 50% volatility was a reasonable (or low) expectation of volatility over the next three months, it should choose the eOMR.

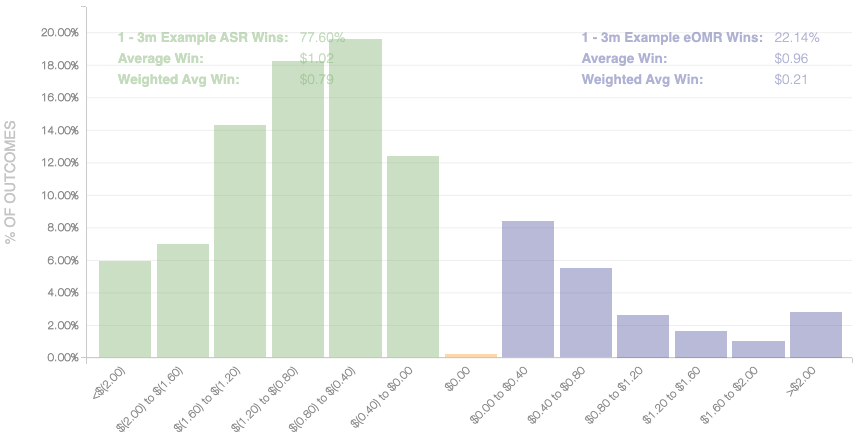

Let’s now consider the case where the company believes that volatility over the next three months will be lower (e.g. 40%) than the current 50% expectation. The histogram below shows the outperformance data with the simulation run at a 40% volatility.

If the stock price only exhibits a 40% volatility over the life of the program, the ASR will tend to perform better as a result of locking in the discount at a higher volatility level (i.e., 50%). This leads to the ASR program outperforming ~78% of the time.

Conclusion

Both the ASR and eOMR provide companies with an actionable way to benefit from the high volatility in the market. The discounts to VWAP currently achievable through these programs are unprecedented. We have presented an economic framework, based on expectations of volatility, for companies that are repurchasing shares to choose between the two.

It should be noted that there are non-economic considerations that are also relevant. Principally, the flexibility provided by the eOMR, to terminate the program at any time and incorporate price limits, can be important features in these uncertain markets.

¹ Assumes a $100 share price, 50% volatility, 5-point volatility discount for ASR PnL assumption

Related Articles

Accelerated Share Repurchase (ASR)

how many hours is part time

Share Repurchase Strategies for Volatile Markets – Matthews South