As part of our market update series, please see the summary below of what we saw in the convertible market in September 2020. Additional details on all the deals are in the attached.

- New Issuance. Compared to a rapid-paced year, September saw a bit of a slow down, with $4.3 billion pricing in 10 convertible debt deals (plus an additional $2 billion overnight mandatory convertible for NextEra Energy). This brings the full-year total to $70.7 billion in 137 deals, compared to full year totals in 2018 / 2019 of $41 and $42 billion.

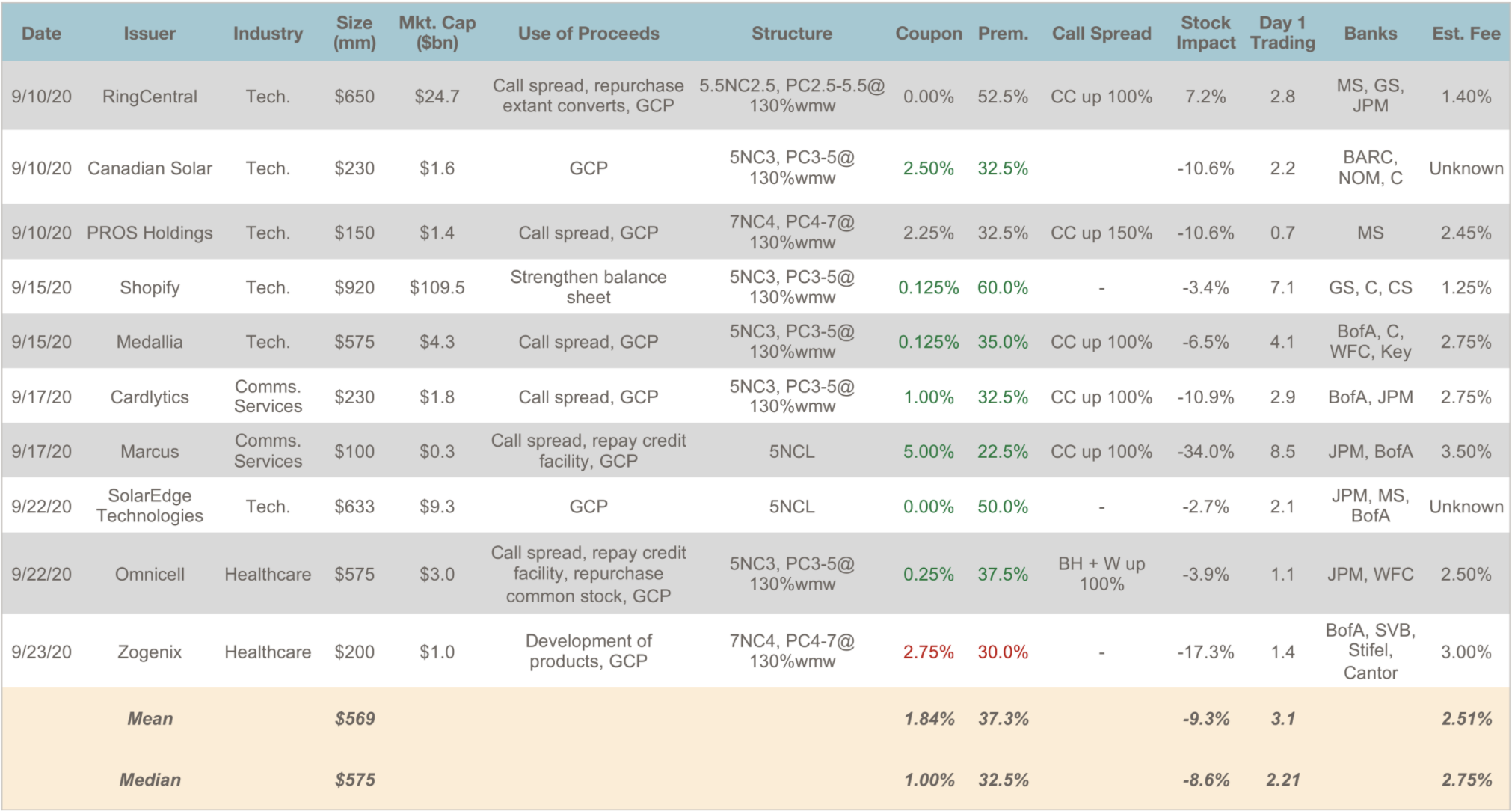

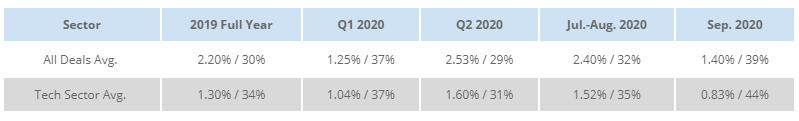

Activity was dominated last month by the Tech / Communications sectors, representing 8 of the 10 deals (plus 2 healthcare deals). - Terms. In the table below, we compare terms for September to previous periods both before and after the Covid-19 pandemic. The statistics for September were attractive, although some of that is driven by a greater than typical skew towards technology deals (which have had attractive terms). Notable among these deals was Shopify, which priced a $920 million deal for 0.125% coupon with a 60% conversion premium, making clear that the market is willing to accept higher-than-standard premiums in current market conditions (similarly both RingCentral and Etsy have priced up 52.5% convertibles recently).

Similarly, the model value of terms was, based on marketing credit / volatility assumptions, 102.4% of par, approaching the more typical ~102 longer-run norm.

- Day 1 Trading. Deals on average traded up on a stock-price adjusted basis more than usual in September, +3.3 points, compared to a +1.5 longer-run average, despite 7 of the 10 deals pricing at better than the midpoint of price talk. Among individual deals, Marcus (+8.5 points) and Shopify (+7.1 points) were notable, despite issuer-friendly pricing terms (Shopify priced outside initial price talk to the Issuer’s benefit).

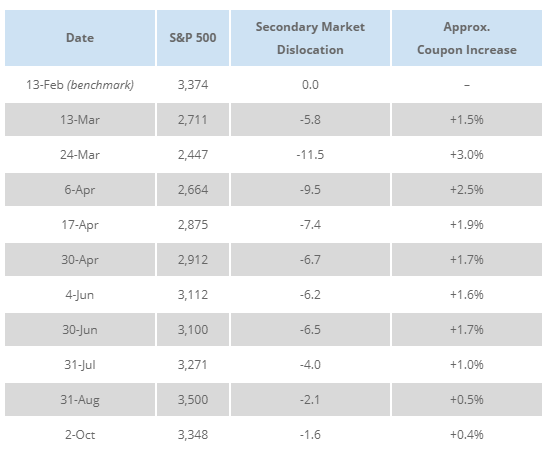

This type of trading outcome (the difference between 3.3 points and 1.5 points equates to about 3/8ths of coupon) serves as a reminder that issuer-friendly pricing relative to price talk does not prove that pricing has been optimized from a market perspective, and that one must continue to be vigilant of banks’ pricing recommendations. - Secondary Market. Finally, we are updating our data tracking that we launched earlier in the year tracking the dislocation in the convertible secondary trading market for a fixed universe of bonds since pre-Covid-19 in February.Implied terms continue to improve. They remain slightly wider than pre-Covid-19 (by about 0.4% of coupon), but have recovered most of the dislocation that was seen in March/April, once again similar to what we have seen in the primary market.

Related Articles

April Convertible Market Review

June Convertible Market Review