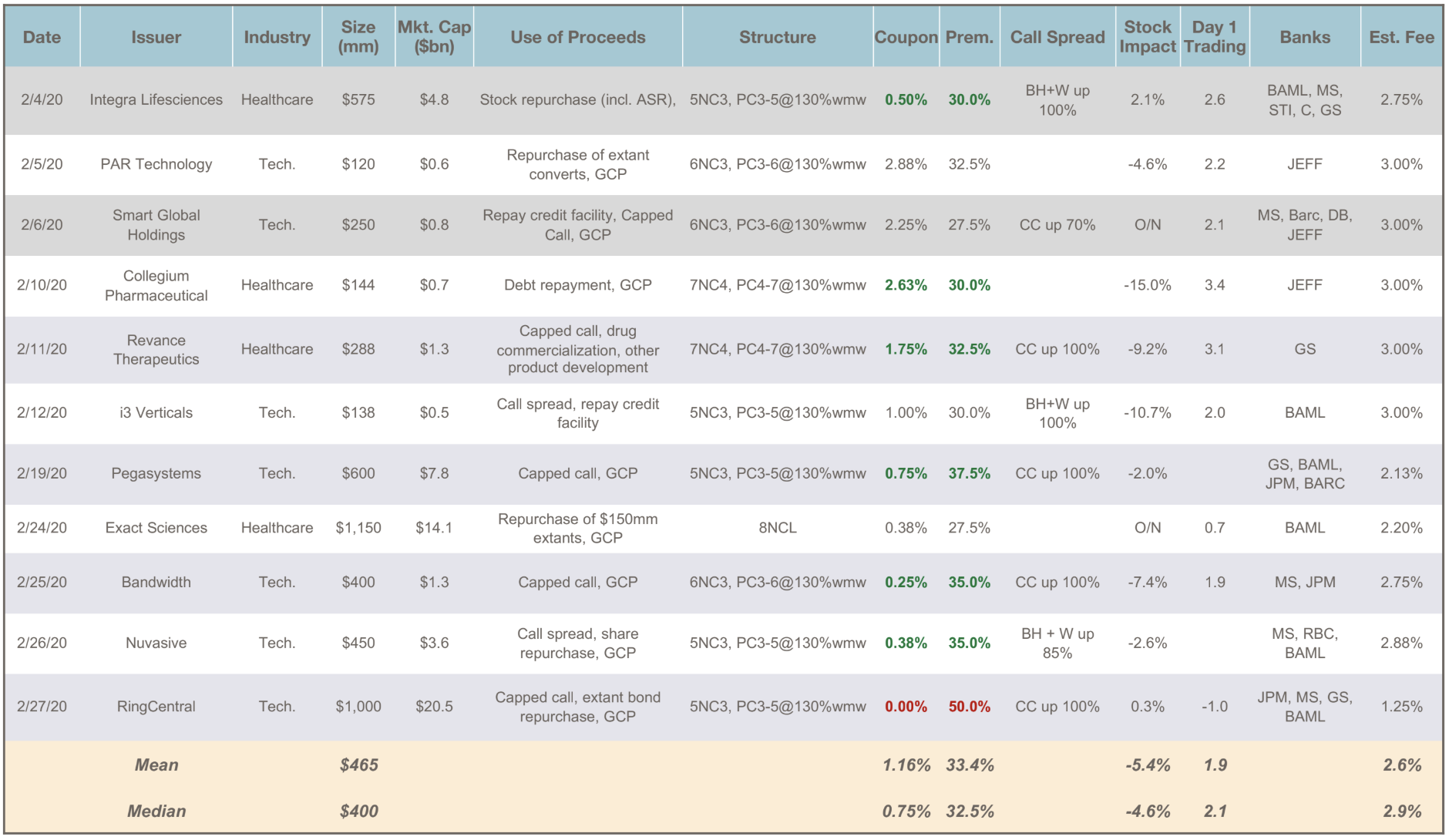

Total Issuance: Despite the sharp market sell-off, February was a very busy month in the convertible market. A total of $5.1 billion priced over 11 deals – a higher dollar volume than every month of 2019 except for August and September. Activity was in fact concentrated (4 deals for ... >>>Read More

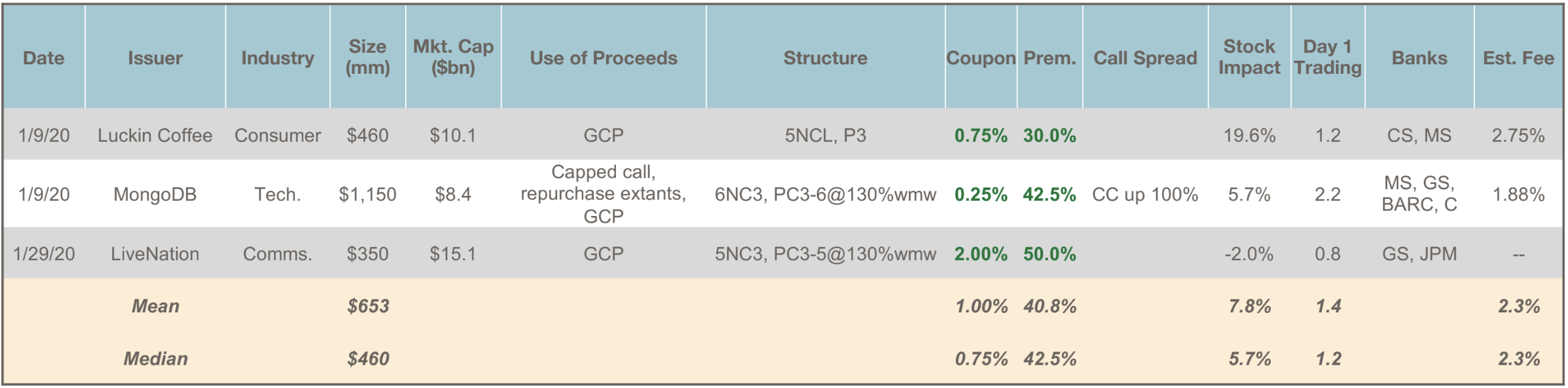

January Convertible Market Review

Trends: January’s MongoDB deal continued the trend of convertible issuers from the last 2 years conducting new offerings to refinance and extend the maturity of their balance sheets, while taking advantage (especially in tech) of meaningfully higher equity valuations and convertible market ... >>>Read More

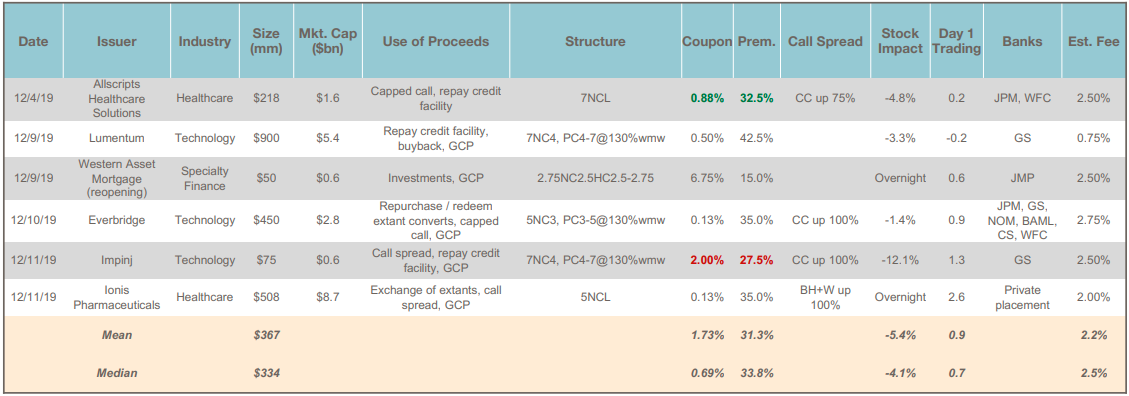

December Convertible Market Review

Total Issuance: December saw 6 convertible debt deals for a total of $2.2 billion. This brings the 2019 total to $41.5 billion of convertible debt issuance over 101 deals. By comparison, 2018 saw $41.0 billion of issuance over 103 deals (2017: $28.2 billion / 80 deals). ... >>>Read More

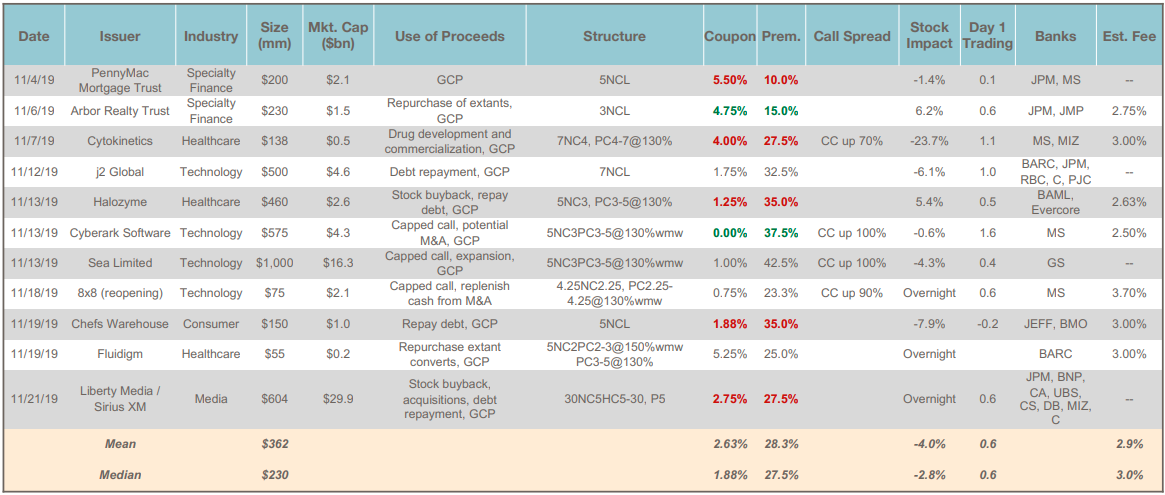

November Convertible Market Review

Total Issuance: November activity picked up after a quiet October, with 11 convertible debt deals pricing for a total of $4.0 billion. This brings the YTD total to $39.1 billion — on pace to surpass last year’s full year total of $41.0 billion.Flexibility: November’s new issuance showcased the ... >>>Read More

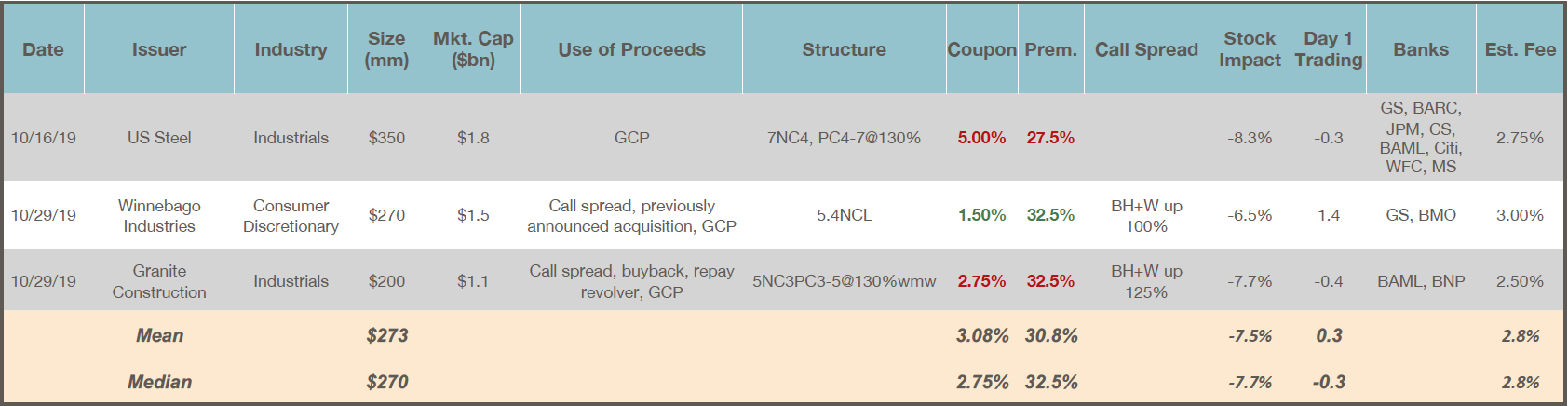

October Convertible Market Review

Total Issuance: October was typically quiet, with the majority of issuers in blackout for the bulk of the month pending Q3 earnings releases. $820mm of convertible debt priced in 3 transactions, bringing the YTD total to $35.1 billion (vs. $37.0 billion for the same period in 2018). ... >>>Read More

- « Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- 9

- 10

- Next Page »