As part of our market update series, please see the summary below of what we saw in the convertible market in Q3 2022. Notably, Q3 volumes were the highest of the year totaling $10.5bn - accounts for over 50% of the YTD volumes Healthcare issuance continues to be the largest driver of volumes with ... >>>Read More

Are the Financing Markets Still Open? – An Update as We Head into Fall

As part of our ongoing market update series, we wanted to take a look at the current state of the convertible markets as we approach the end of summer. In this blog post, we review the recent trading and issuance dynamics of the convertible market and what that means for issuers contemplating ... >>>Read More

Q2 2022 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q2 2022. New Issuance. The convertible market continues to see a slow down in new issue paper with 10 deals in Q2 (all debt) worth $3.4bn. This level of issuance is the lowest in the past ... >>>Read More

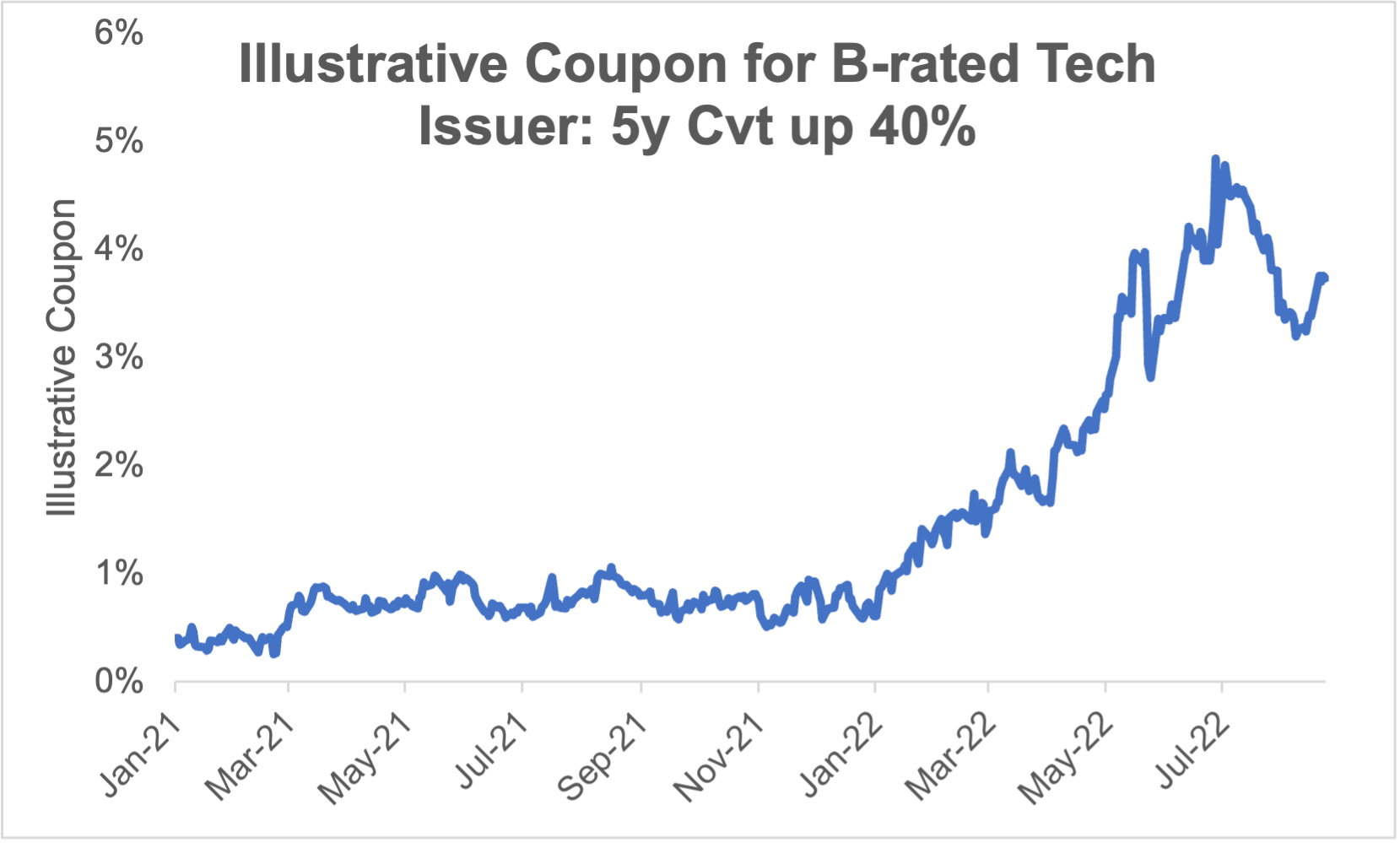

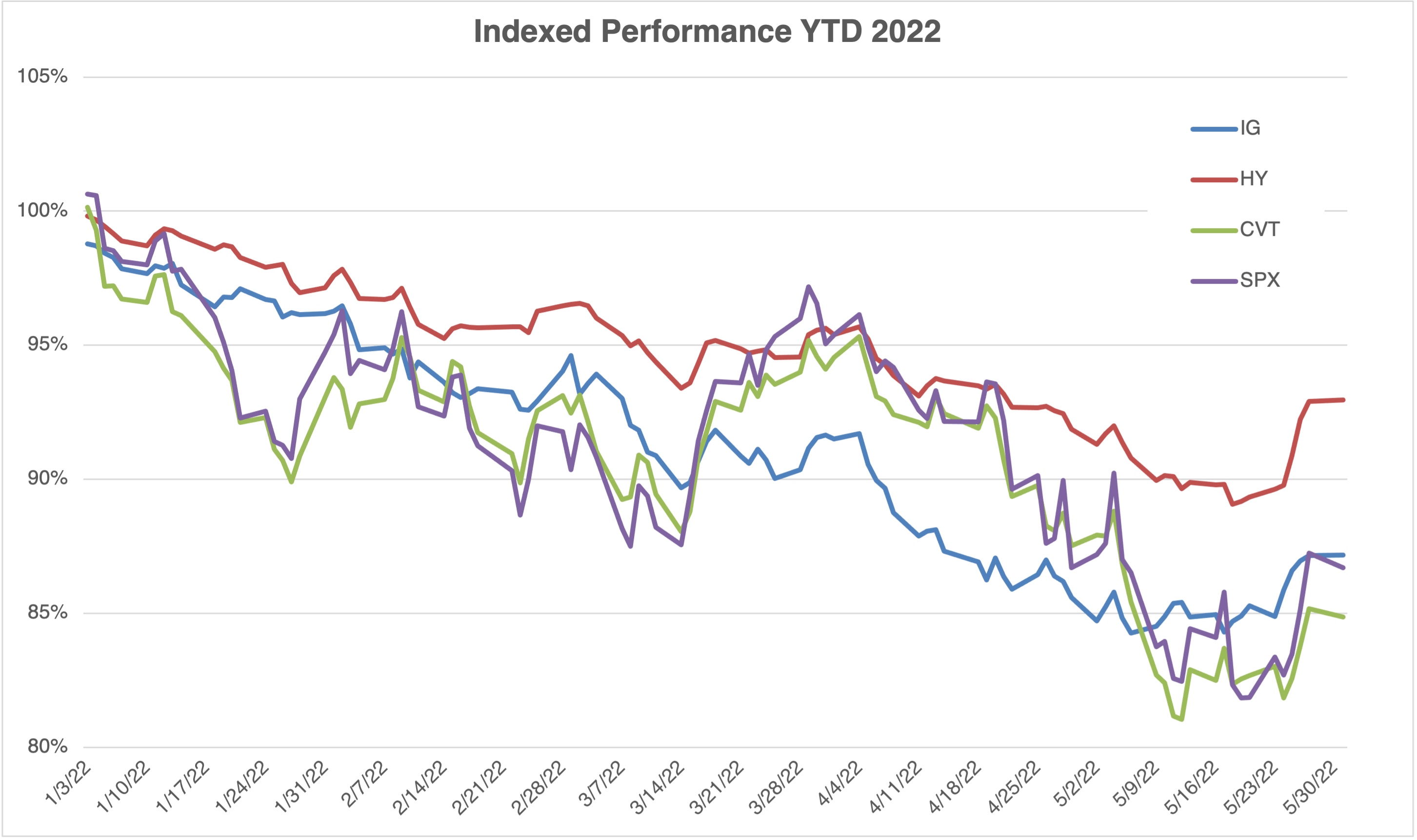

Are the Financing Markets Really Open? – An Examination of the US Equity, Convertible, High Yield, and Investment Grade Markets in Spring 2022

With Federal Reserve tightening and geopolitical uncertainty rising in the last few months, we have seen gains accumulated during COVID dissipate since the start of the year. Consequently, US secondary markets have caused drastic shifts in primary issuance behavior in each of the major financing ... >>>Read More

Q1 2022 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2022. New Issuance. Q1 2022 saw 11 new issue convertible deals (all debt) with a total volume of $6.1bn, which marks the lowest level of issuance since Q4 2018 ($5.3bn across 16 ... >>>Read More

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 10

- Next Page »