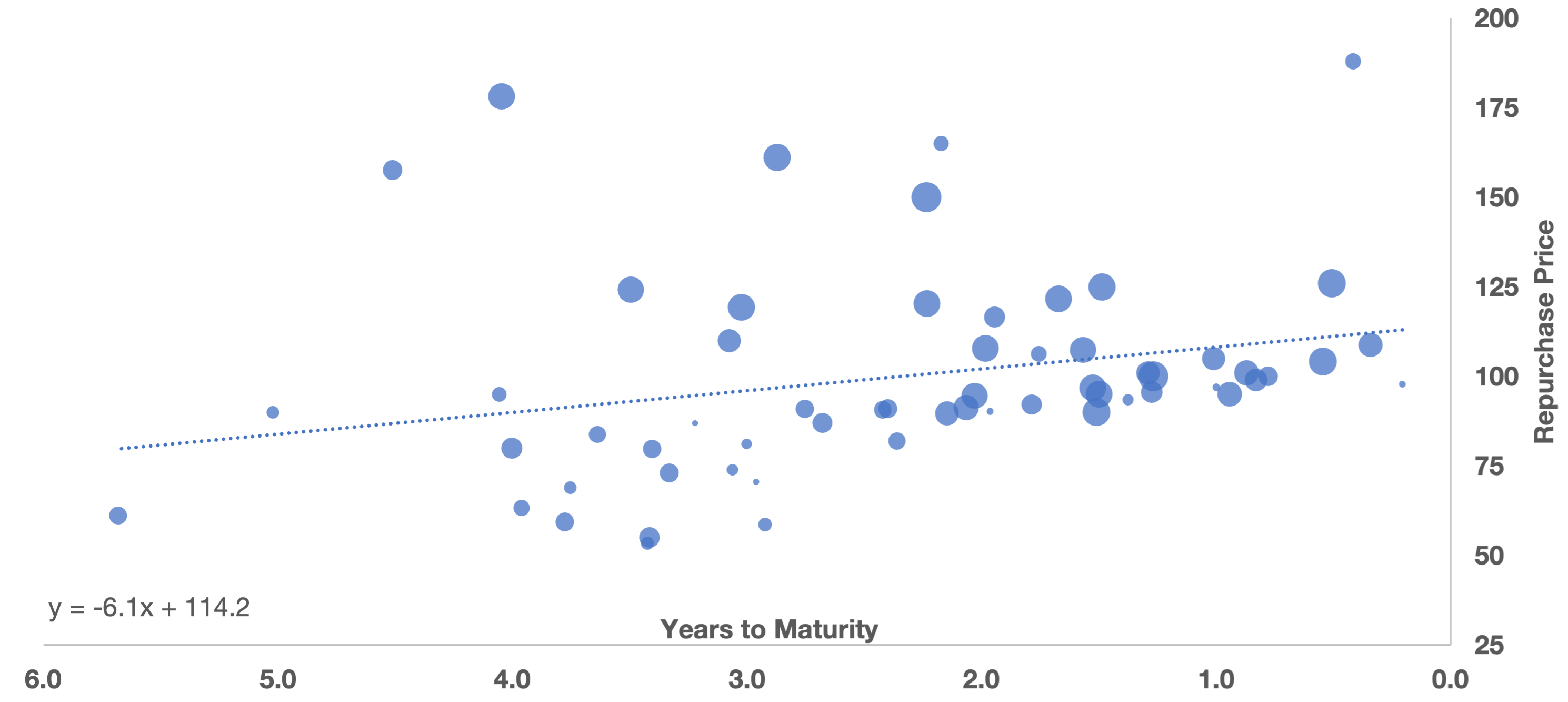

We have previously discussed the economic rationale for repurchasing convertible bonds in times of market turbulence. Today we look at actual data regarding recent liability management transactions, and find:Over the past year, issuers have addressed upcoming convertible maturities on average 2.35 ... >>>Read More

Managing Debt in an Uncertain Environment – Assessing a Cash Repurchase

Macro market volatility along with a rise in interest rates has had a material impact to all asset classes in US capital markets. As a result, many debt securities (including convertible debt) are trading below par. In this blog post, we review why a potential repurchase of convertible bonds ... >>>Read More

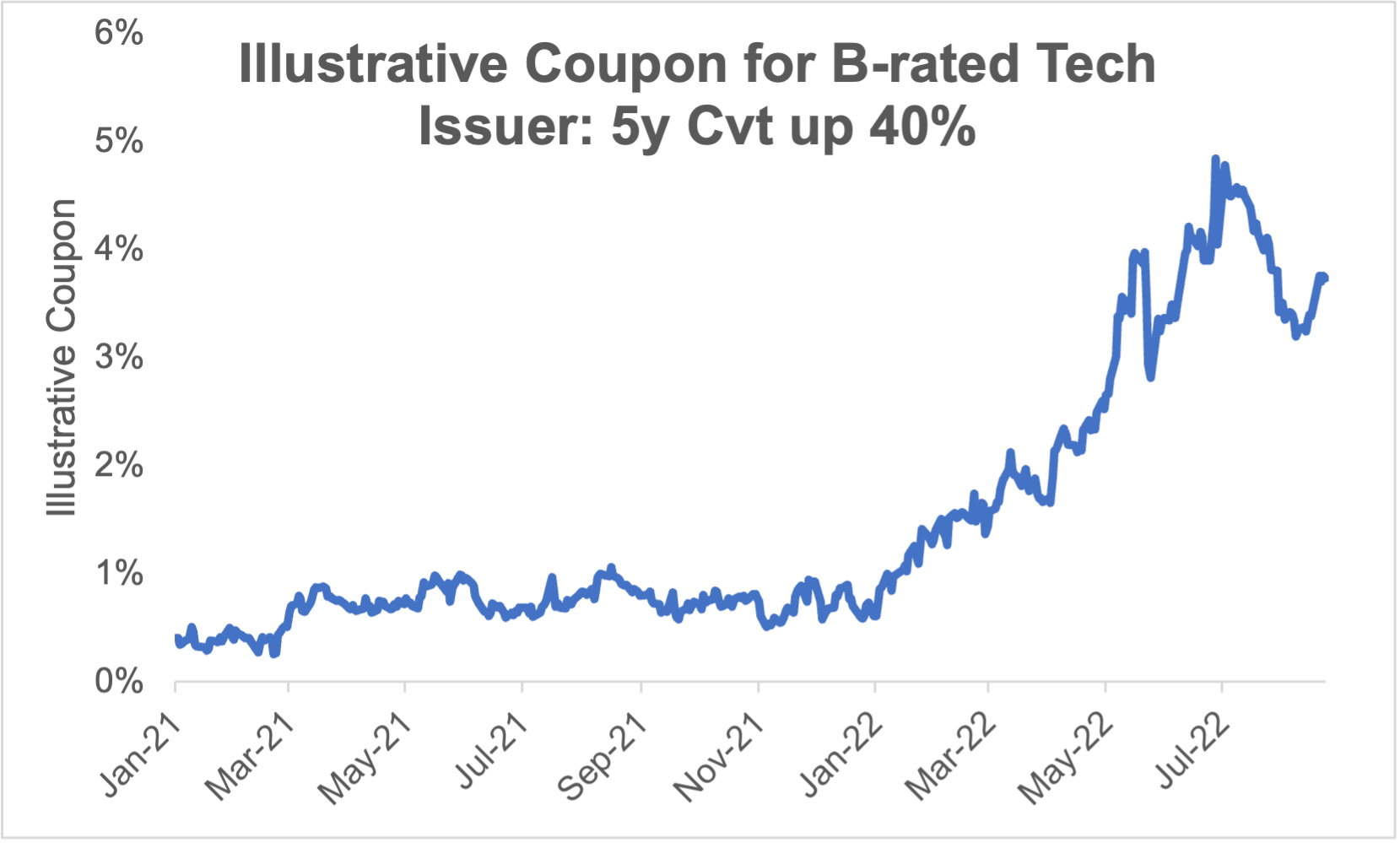

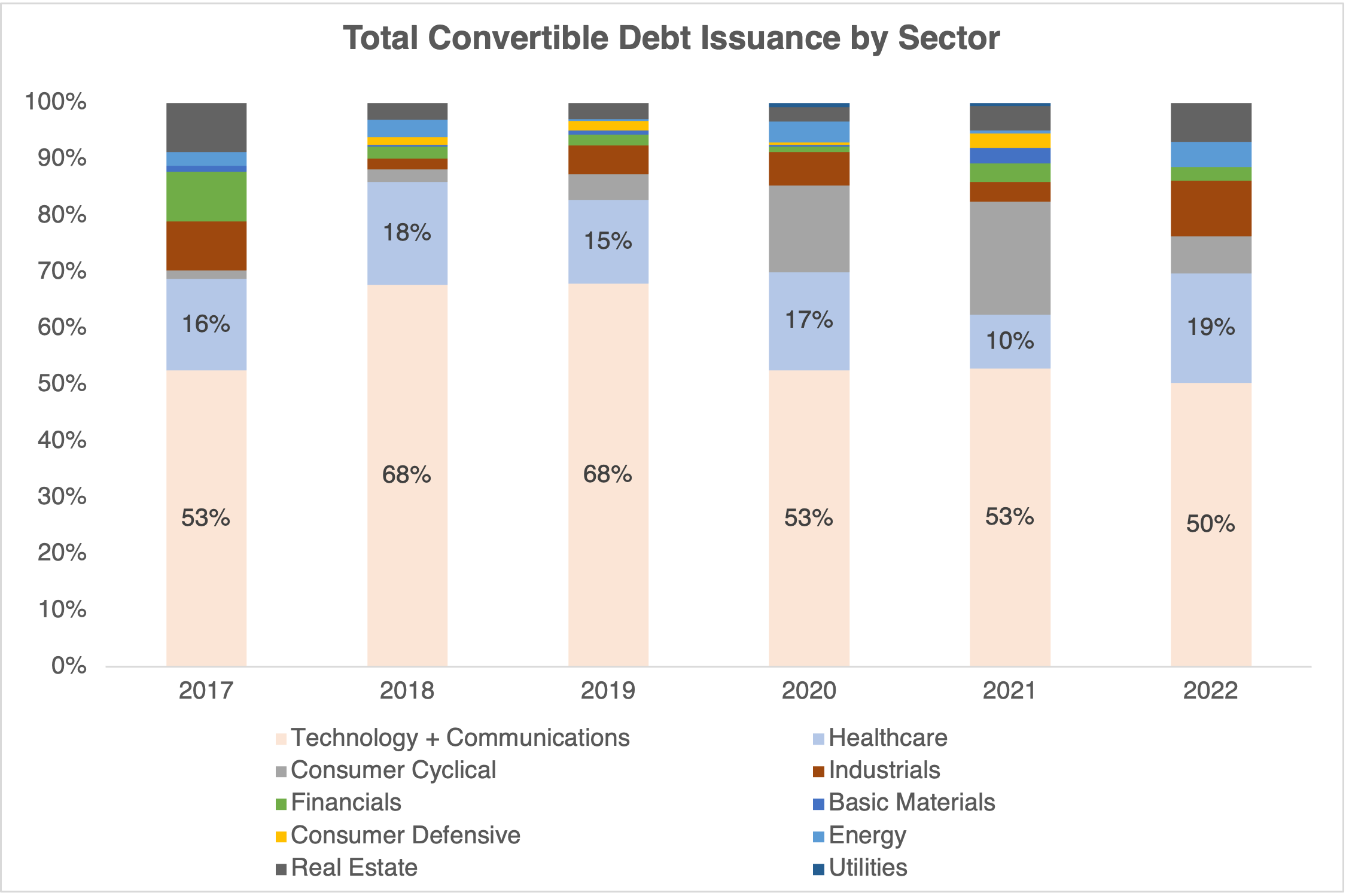

Are the Financing Markets Still Open? – An Update as We Head into Fall

As part of our ongoing market update series, we wanted to take a look at the current state of the convertible markets as we approach the end of summer. In this blog post, we review the recent trading and issuance dynamics of the convertible market and what that means for issuers contemplating ... >>>Read More

Convertible Issuance in Life Sciences: How, When and Why

In the first installment of our three-part series on the financing landscape for life sciences issuers, we covered the evolution of the typical life sciences IPO. In the second installment, we covered post-IPO financing dynamics and the importance of laying the foundation for successful capital ... >>>Read More

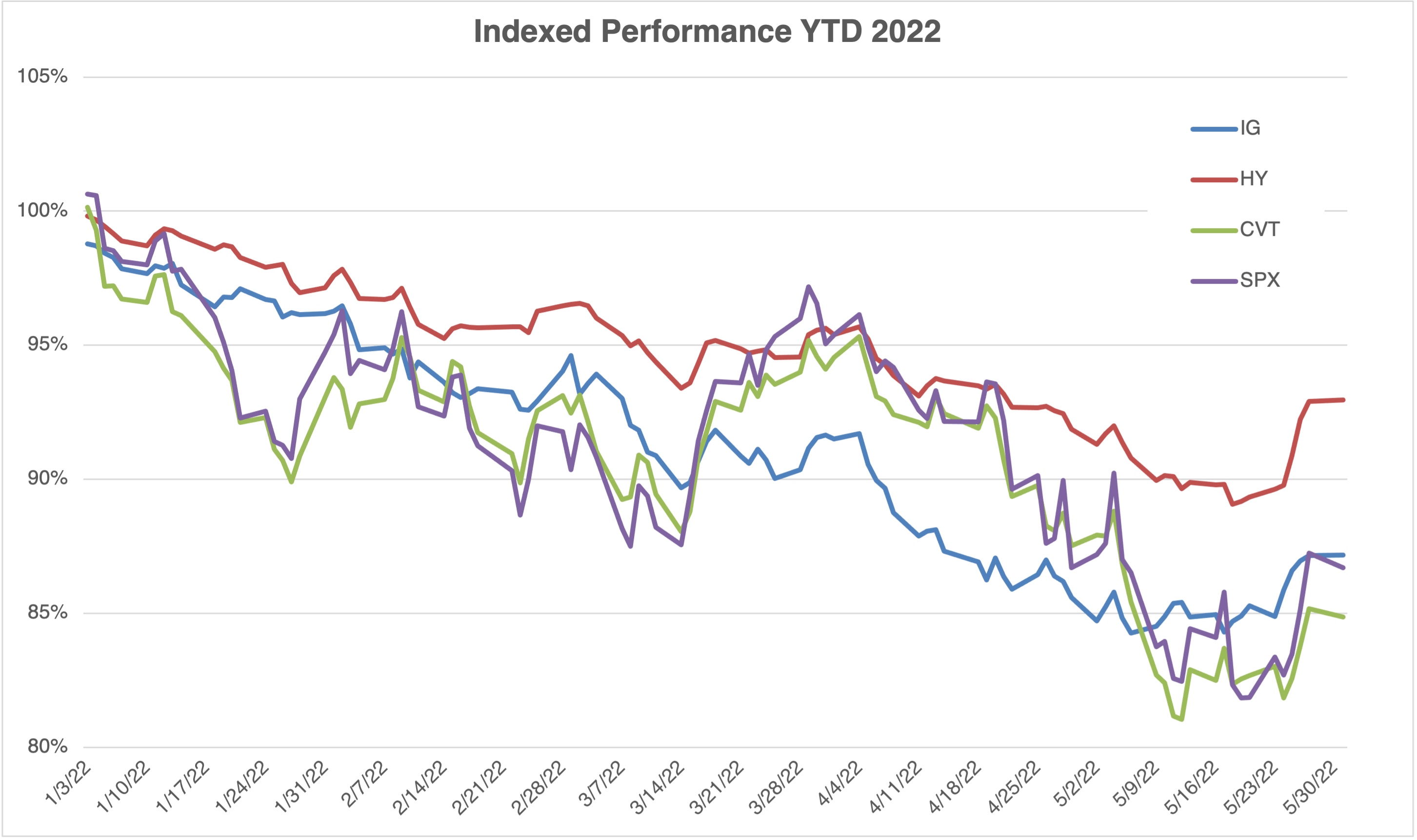

Are the Financing Markets Really Open? – An Examination of the US Equity, Convertible, High Yield, and Investment Grade Markets in Spring 2022

With Federal Reserve tightening and geopolitical uncertainty rising in the last few months, we have seen gains accumulated during COVID dissipate since the start of the year. Consequently, US secondary markets have caused drastic shifts in primary issuance behavior in each of the major financing ... >>>Read More