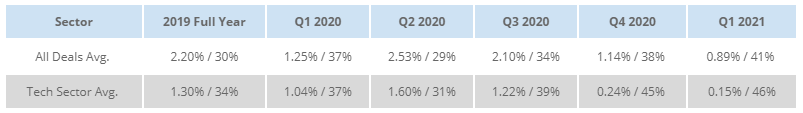

As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2021. Pricing Results: Theoretical Value. The first graph below shows trends in theoretical model valuation throughout the quarter — i.e., showing how much the typical ... >>>Read More

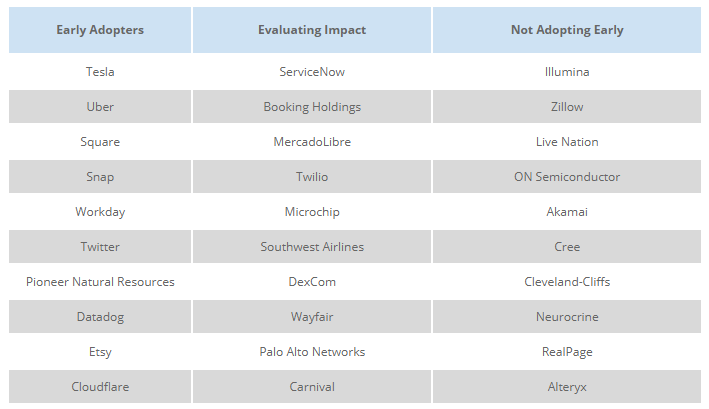

Early Adoption and Disclosure Trends for ASU 2020-06

The new convertible accounting rules in ASU 2020-06 will take effect in 2022. However, companies may early adopt the rules starting in 2021. We summarize the new accounting rules below: Summary of New Accounting Rules Bifurcating the bond into debt and equity components will no longer ... >>>Read More

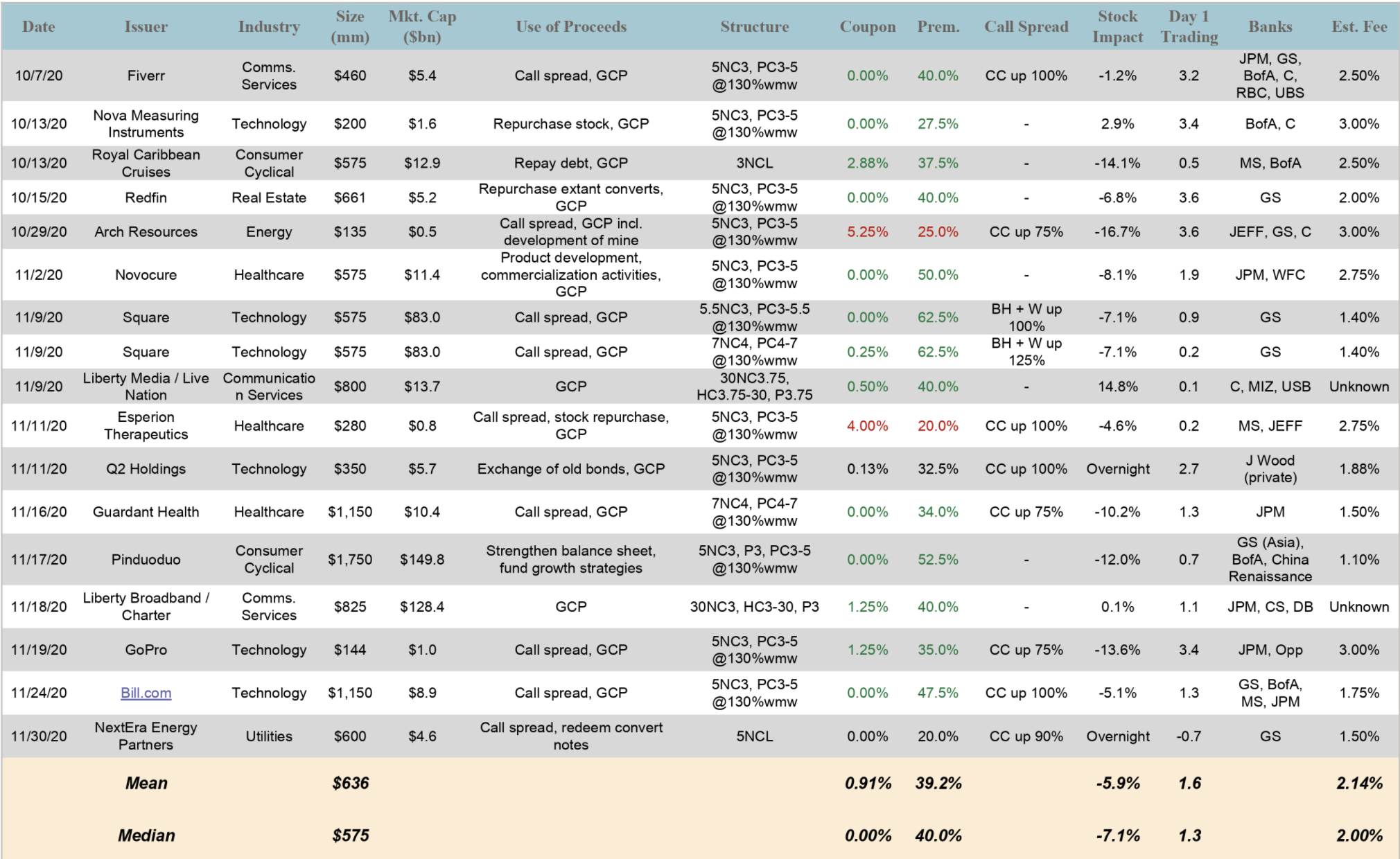

October/November Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in October and November 2020. New Issuance. October and November 2020 saw 5 and 12 new issue convertible deals, with dollar volumes of $2.0 billion and $8.7 billion, respectively. The ... >>>Read More

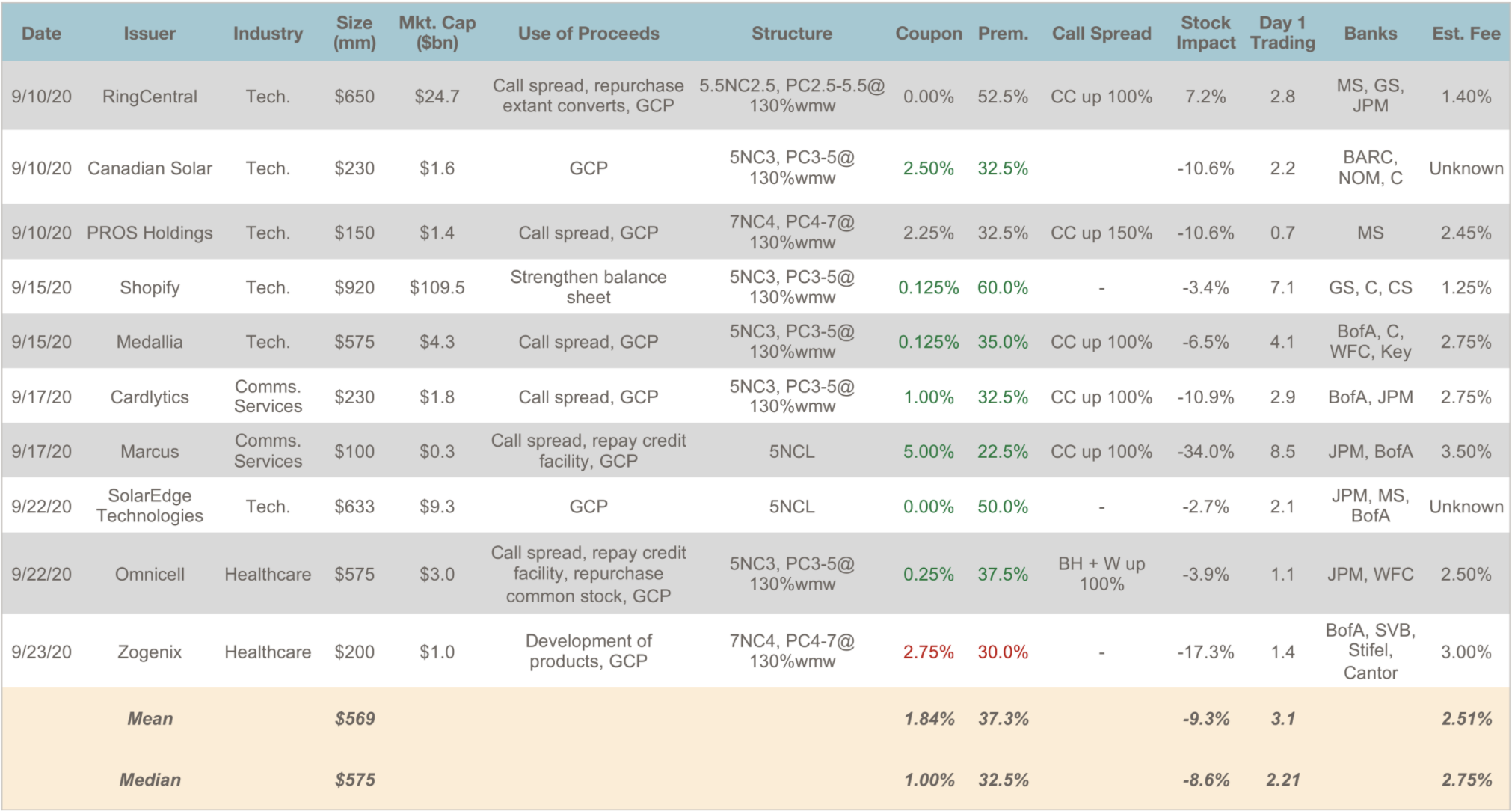

September Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in September 2020. Additional details on all the deals are in the attached. Related Articles April Convertible Market Review May Convertible Market Review June ... >>>Read More

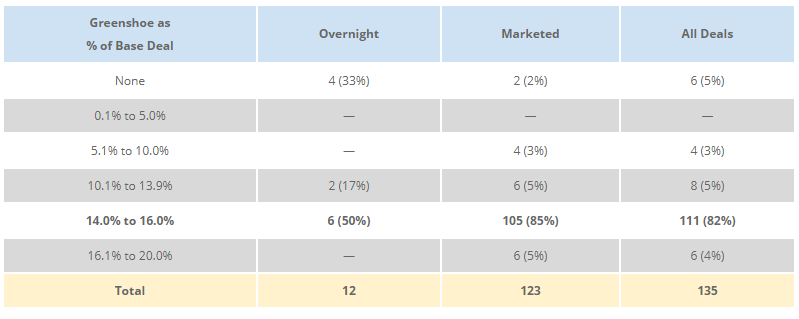

How Do Greenshoes Work in the Real World?

A 15% greenshoe is considered market standard in the U.S. convertible bond market. The greenshoe feature derives from the equity market, where it is also standard. Debt markets — high yield bonds, investment grade bonds, term loans — do not use it. We provide data to help issuers ... >>>Read More

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 14

- Next Page »