Macro market volatility along with a rise in interest rates has had a material impact to all asset classes in US capital markets. As a result, many debt securities (including convertible debt) are trading below par. In this blog post, we review why a potential repurchase of convertible bonds ... >>>Read More

Q1 2023 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2023 along with some key takeaways. Q1 volume of $13.2 billion was the highest in a quarter since Q4 2021 Technology issuers regained dominance, accounting for 38% of the deal count and ... >>>Read More

Q4 2022 and Year End Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q4 2022 along with some year-end takeaways. Although Q3 and Q4 were relatively active (with ~$10 billion of issuance each quarter), 2022 total volume (~$29 billion) was the lowest over the ... >>>Read More

Q3 2022 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q3 2022. Notably, Q3 volumes were the highest of the year totaling $10.5bn - accounts for over 50% of the YTD volumes Healthcare issuance continues to be the largest driver of volumes with ... >>>Read More

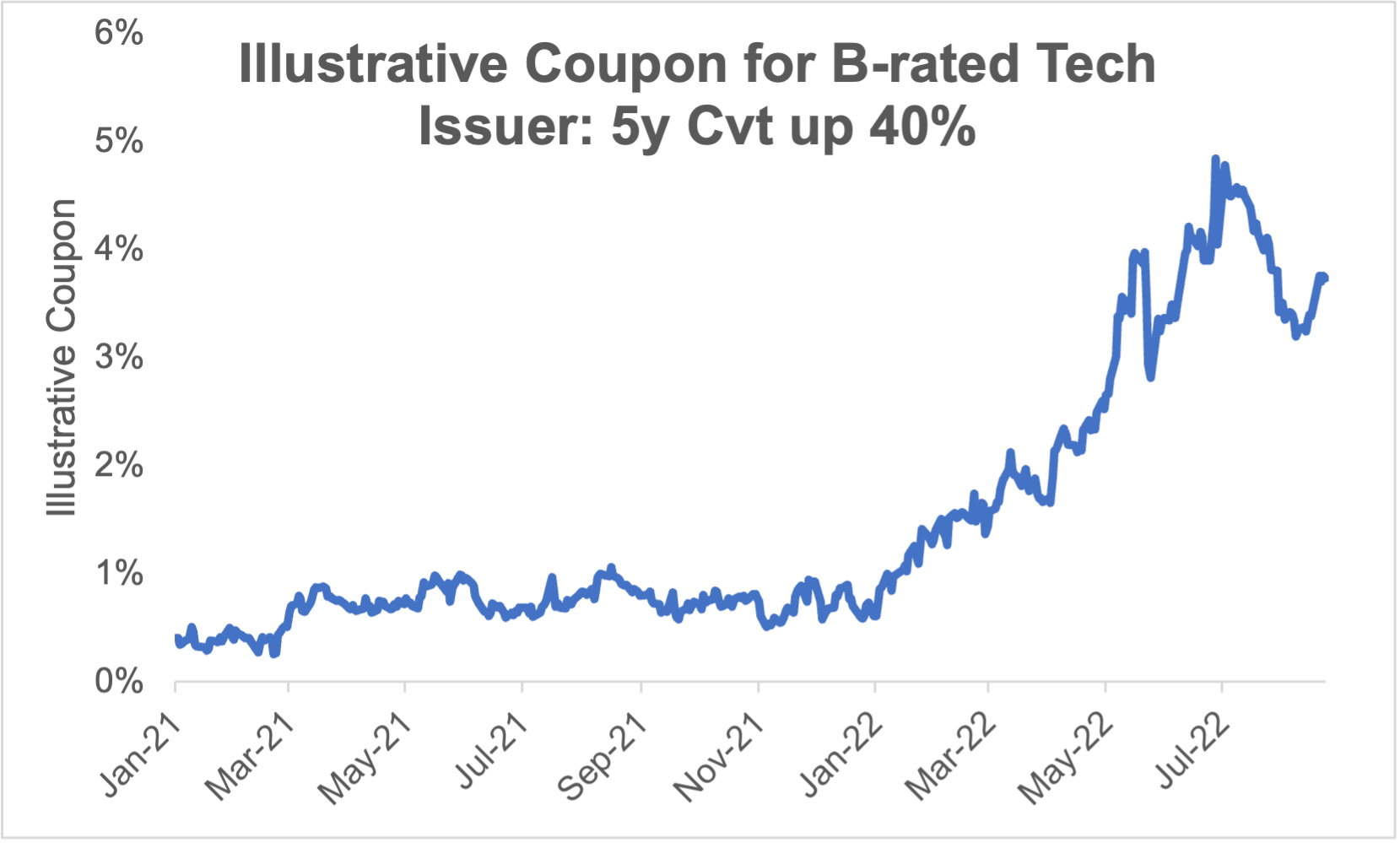

Are the Financing Markets Still Open? – An Update as We Head into Fall

As part of our ongoing market update series, we wanted to take a look at the current state of the convertible markets as we approach the end of summer. In this blog post, we review the recent trading and issuance dynamics of the convertible market and what that means for issuers contemplating ... >>>Read More

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 14

- Next Page »