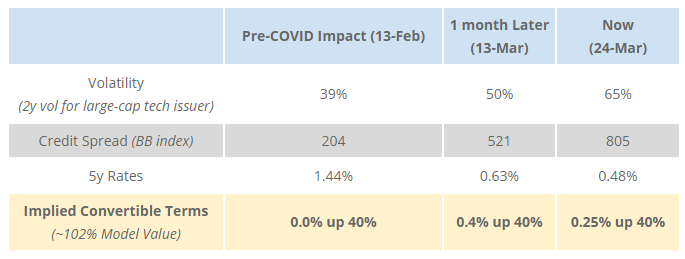

Highlight: The convertible market has continued to weaken since March 13. By our calculations, expected new issue coupons are now 3% higher than in mid-February and 1.5% higher than on March 13. In a previous post, we examined the impact of the current volatile market conditions on ... >>>Read More

Measuring COVID-19’s Impact to the Convertible Market

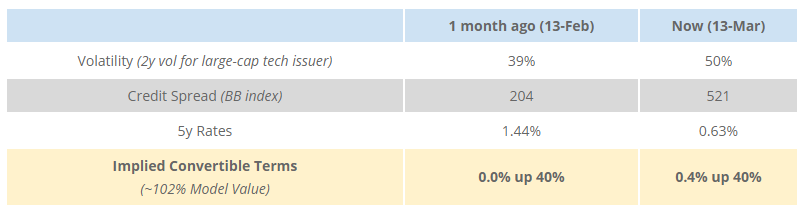

Over the past three weeks, prospective issuers have heard versions of the following banker simplification of the convertible market: “Convertible pricing is very attractive because rates are at historic lows and the benefit from the increased volatility offsets widening credit spreads.” While ... >>>Read More

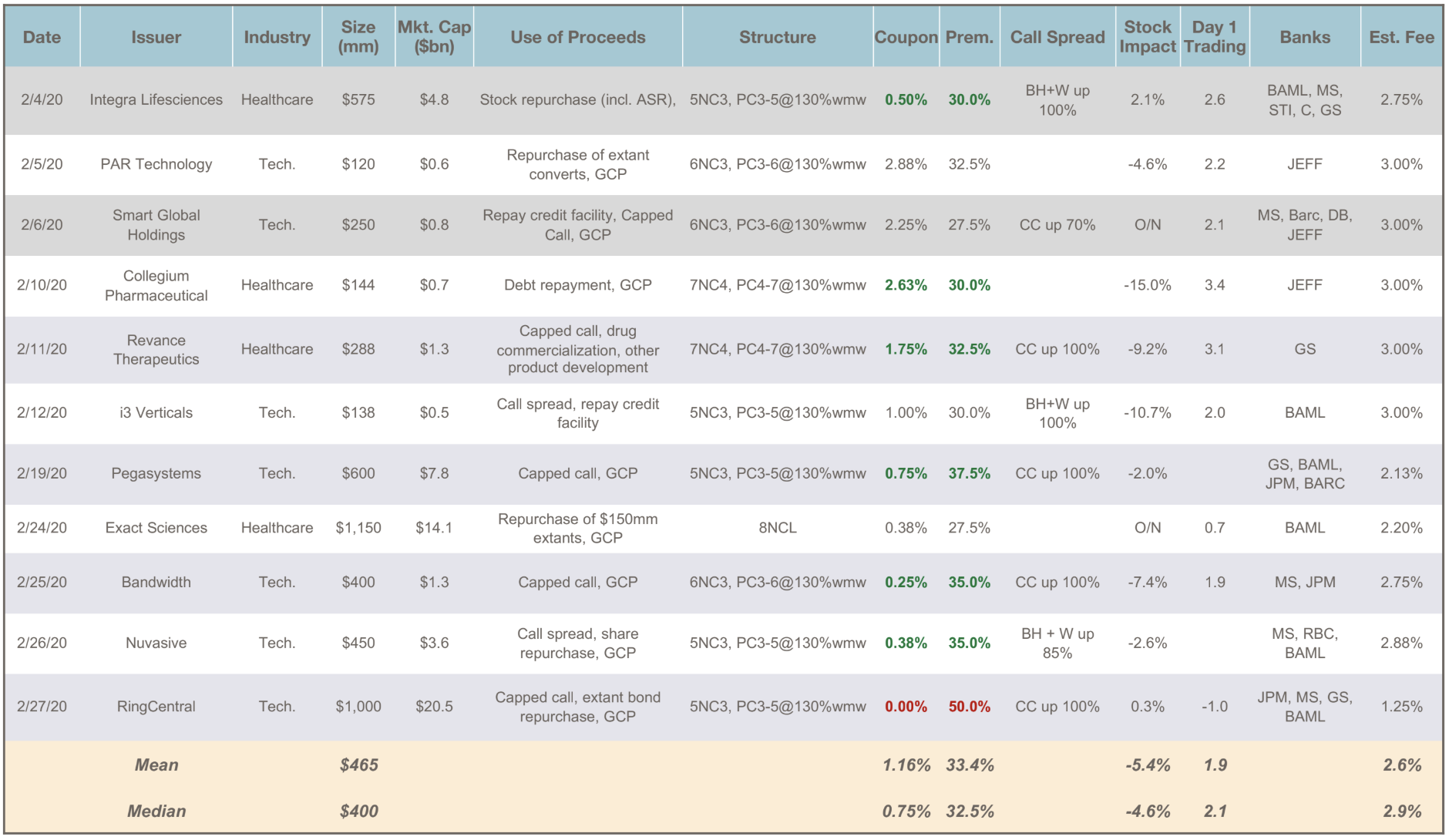

February Convertible Market Review

Total Issuance: Despite the sharp market sell-off, February was a very busy month in the convertible market. A total of $5.1 billion priced over 11 deals – a higher dollar volume than every month of 2019 except for August and September. Activity was in fact concentrated (4 deals for ... >>>Read More

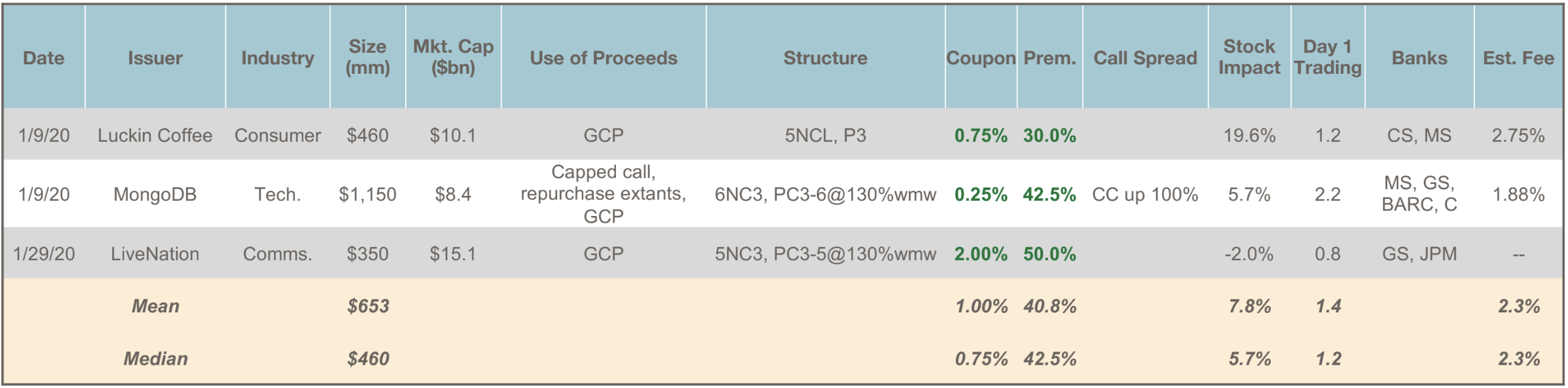

January Convertible Market Review

Trends: January’s MongoDB deal continued the trend of convertible issuers from the last 2 years conducting new offerings to refinance and extend the maturity of their balance sheets, while taking advantage (especially in tech) of meaningfully higher equity valuations and convertible market ... >>>Read More

A Costly Convertible Exchange

Convertible issuers frequently refinance upcoming maturities with the issuance of new convertible bonds. As most convertible bonds are non-callable, issuers must decide whether to leave the bonds outstanding or repurchase them concurrently with the issuance of the new bonds. If they are ... >>>Read More

- « Previous Page

- 1

- …

- 8

- 9

- 10

- 11

- 12

- …

- 14

- Next Page »