As a service for those who may not have prior experience with stock repurchase strategies, we provide background information on some general questions. Why do companies do share buybacks? A share buyback is a method of capital return to shareholders. Companies may choose to repurchase ... >>>Read More

Share Repurchase Strategy: Are Pre-paid Puts Attractive in the Current Market?

CAESARS. Dragons. ZcallS. YEPS. Give derivative marketers a simple product and they will come up with a million names and a lot of dressing up. This blog post explores a simple put option sale (a.k.a. CAESARs, Dragons, ZcallS, and YEPS) and its role in a corporate share buyback plan, especially ... >>>Read More

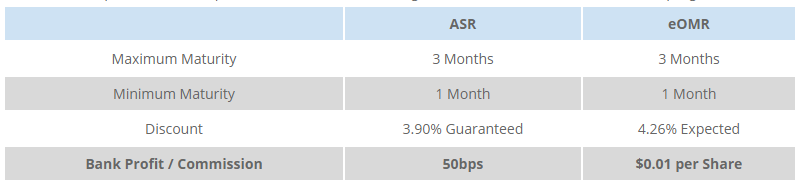

Matthews South Advises on $200mm “Low Cost” eOMR for Technology Company

Matthews South advised a large-cap technology company on its first Enhanced Open Market Repurchase (“eOMR”). The eOMR is an open market program intended to maximize the discount to VWAP. The program does this by using an algorithm to determine the daily purchases. Matthews ... >>>Read More

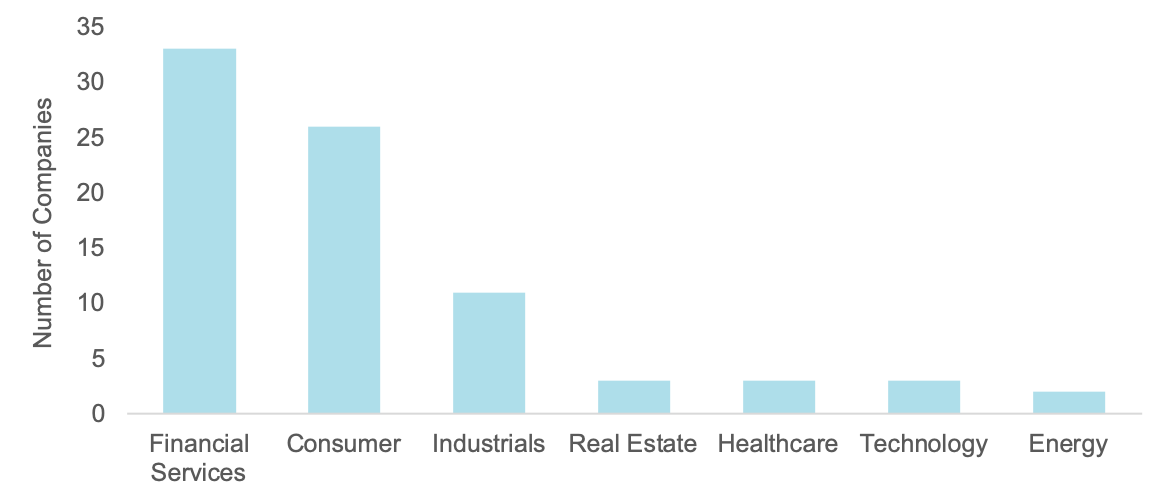

COVID-19 and Share Repurchase Suspensions

In a previous post, we analyzed the trend of drawing down on credit facilities to enhance liquidity during the COVID-19 crisis. In a similar theme, many companies are also reconsidering their capital return programs. We quantified the number of companies that have announced the ... >>>Read More

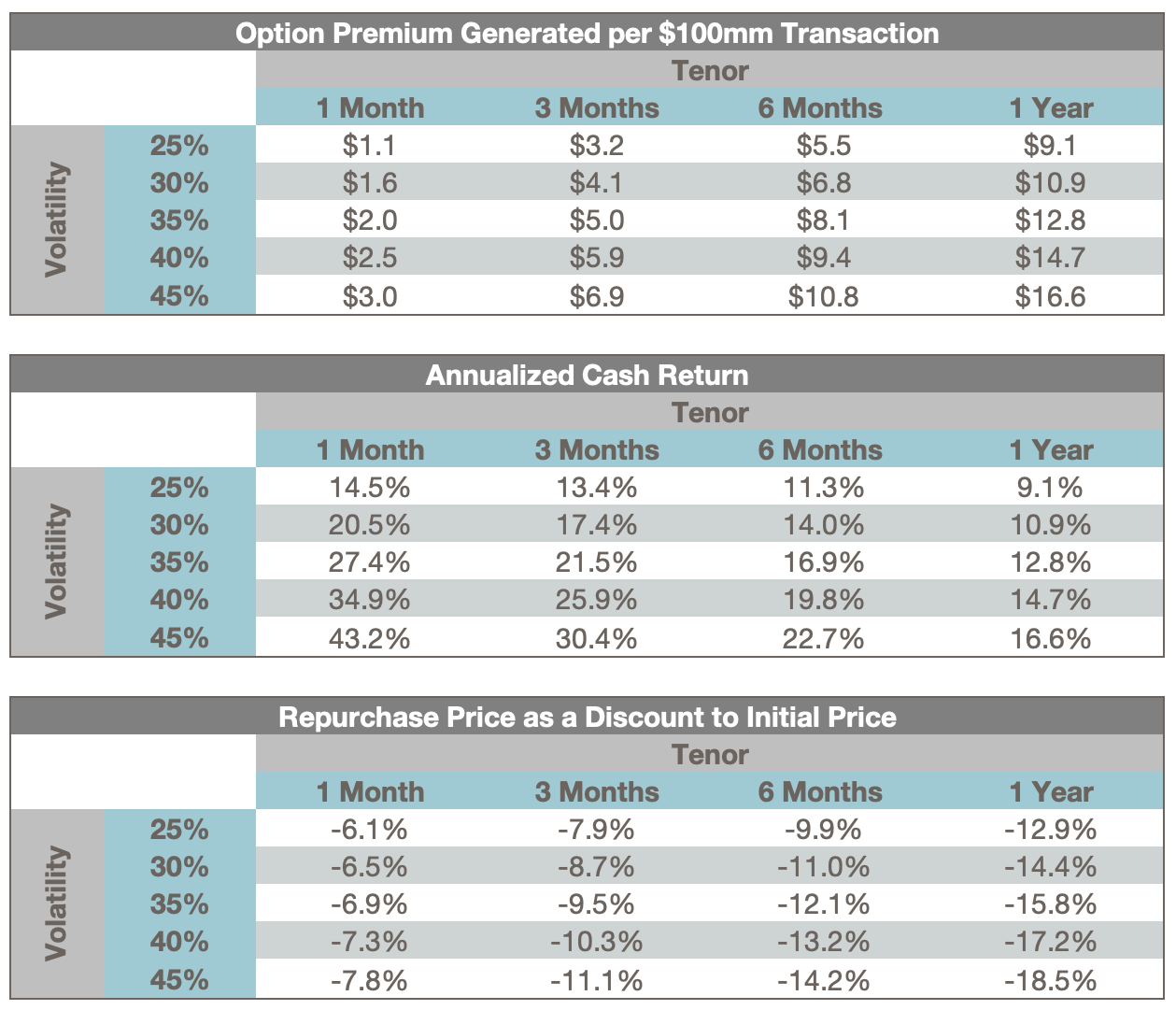

Share Repurchase Strategies for Volatile Markets

Over the past three weeks, the VIX index (a measure of expected volatility of the US market over a 30-day forward looking period) has steadily increased from the mid teens to a maximum of 82.7% on 16-Mar-2020. To put this in perspective, the VIX index peaked at 80.9% during the 2008 financial ... >>>Read More