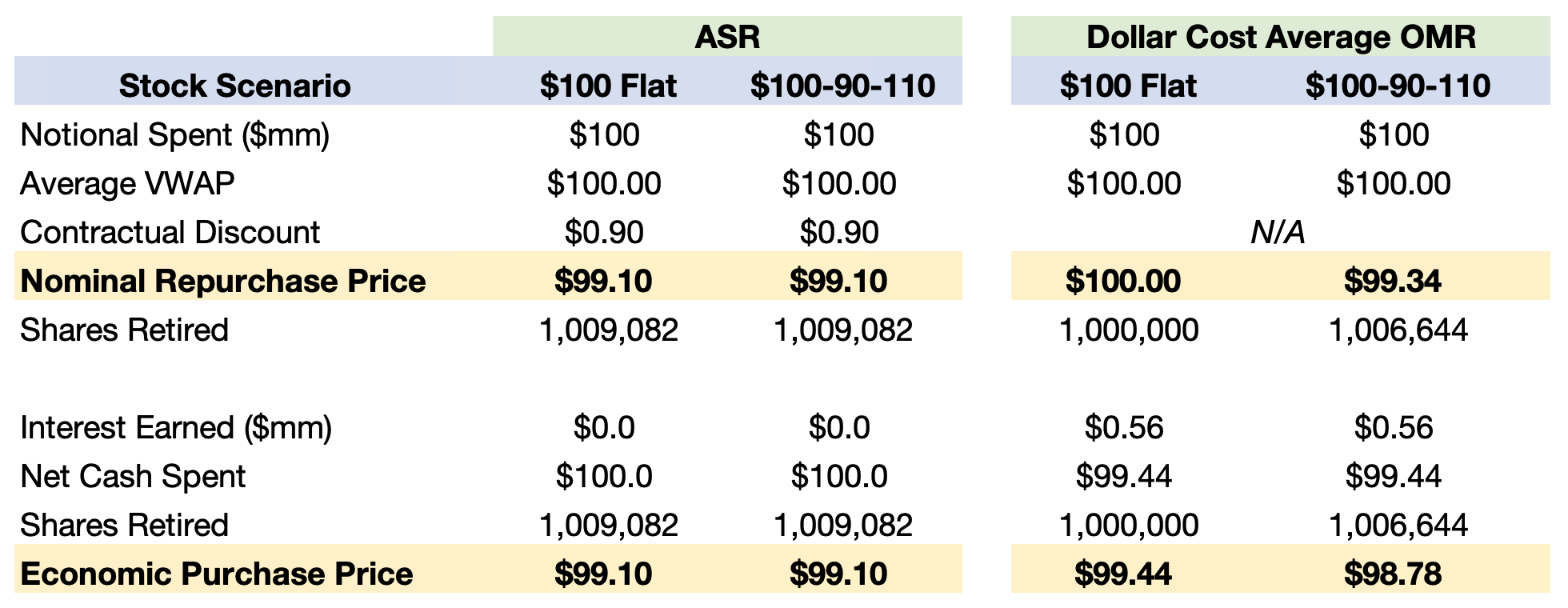

It is easy to compute a number for repurchase price per share: cash spent on buybacks divided by number of shares retired. For better informed decision-making, a more complete economic analysis of share repurchase programs that take place over time should reflect both (1) interest income, which has ... >>>Read More

Five Common Questions about eOMRs, an Essential Share Repurchase Tool

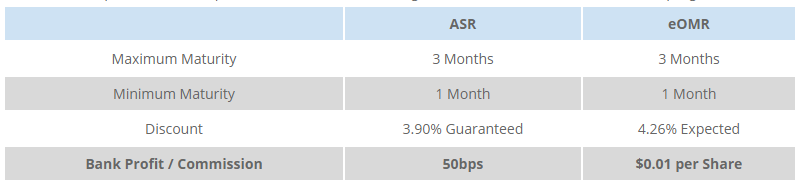

At Matthews South, we continue to see a meaningful increase in Enhanced Open Market Repurchase (eOMR) interest and usage from our clients. Open Market Repurchase (OMR) users are progressively considering eOMR because of the large expected discount beat that eOMR provides. Additionally, it is an ... >>>Read More

Matthews South Advises on $200mm “Low Cost” eOMR for Technology Company

Matthews South advised a large-cap technology company on its first Enhanced Open Market Repurchase (“eOMR”). The eOMR is an open market program intended to maximize the discount to VWAP. The program does this by using an algorithm to determine the daily purchases. Matthews ... >>>Read More

Share Repurchase Strategies for Volatile Markets

Over the past three weeks, the VIX index (a measure of expected volatility of the US market over a 30-day forward looking period) has steadily increased from the mid teens to a maximum of 82.7% on 16-Mar-2020. To put this in perspective, the VIX index peaked at 80.9% during the 2008 financial ... >>>Read More

“Low Cost” eOMR for Industrial Company

Matthews South advised a large cap industrial company on its first Enhanced Open Market Repurchase (“eOMR”). The eOMR is an open market program intended to maximize the discount to VWAP. The program does this by using an algorithm to determine the daily purchases. Our client had considered ... >>>Read More