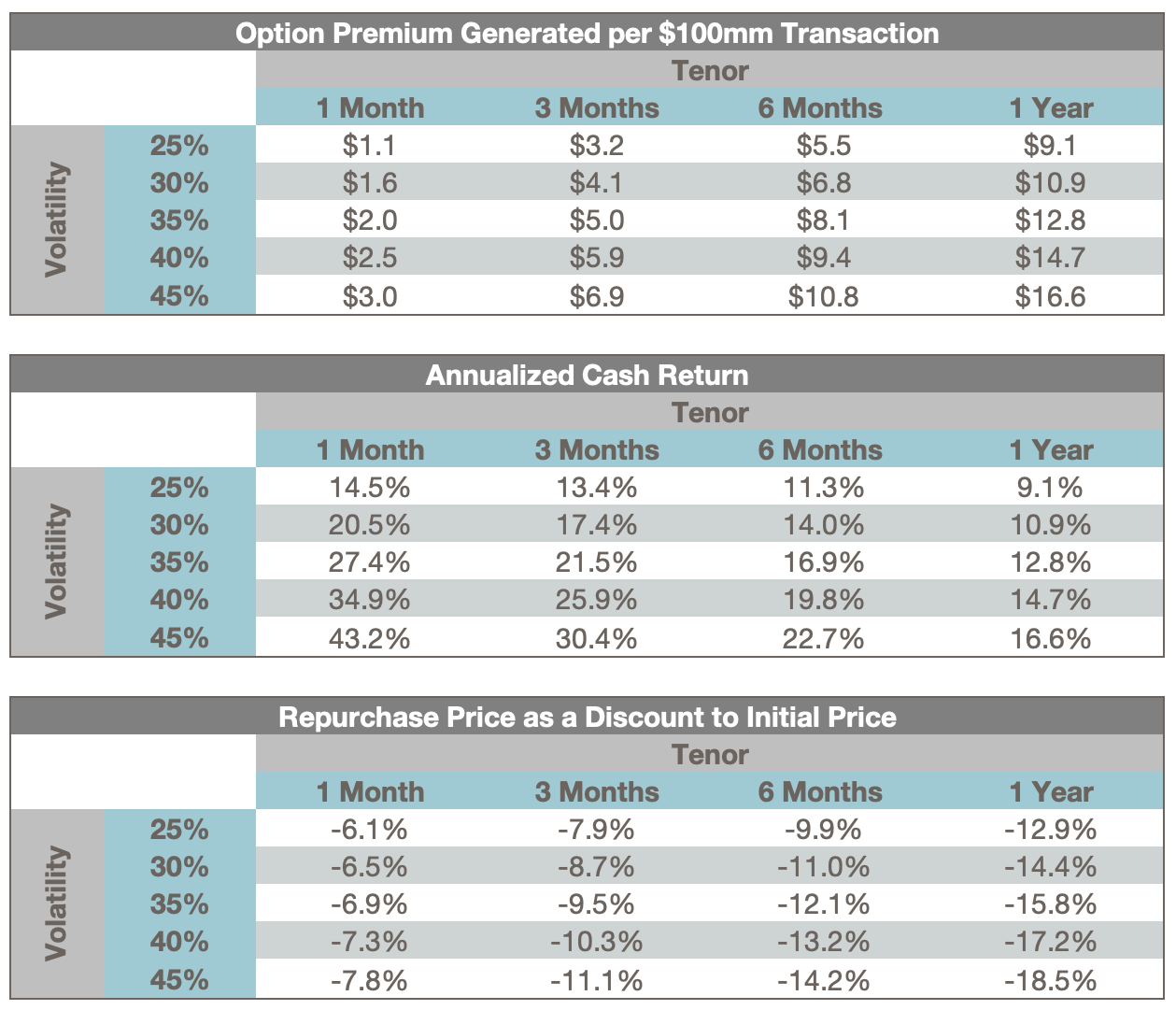

CAESARS. Dragons. ZcallS. YEPS. Give derivative marketers a simple product and they will come up with a million names and a lot of dressing up. This blog post explores a simple put option sale (a.k.a. CAESARs, Dragons, ZcallS, and YEPS) and its role in a corporate share buyback plan, especially ... >>>Read More

Convertible 101 for Beginners

As a courtesy for those who may not have prior experience with convertible bonds, we provide some background information on some general questions. What are convertible offerings? Convertible offerings are sales of securities convertible into equity (generally common stock) of public ... >>>Read More

Q1 2022 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2022. New Issuance. Q1 2022 saw 11 new issue convertible deals (all debt) with a total volume of $6.1bn, which marks the lowest level of issuance since Q4 2018 ($5.3bn across 16 ... >>>Read More

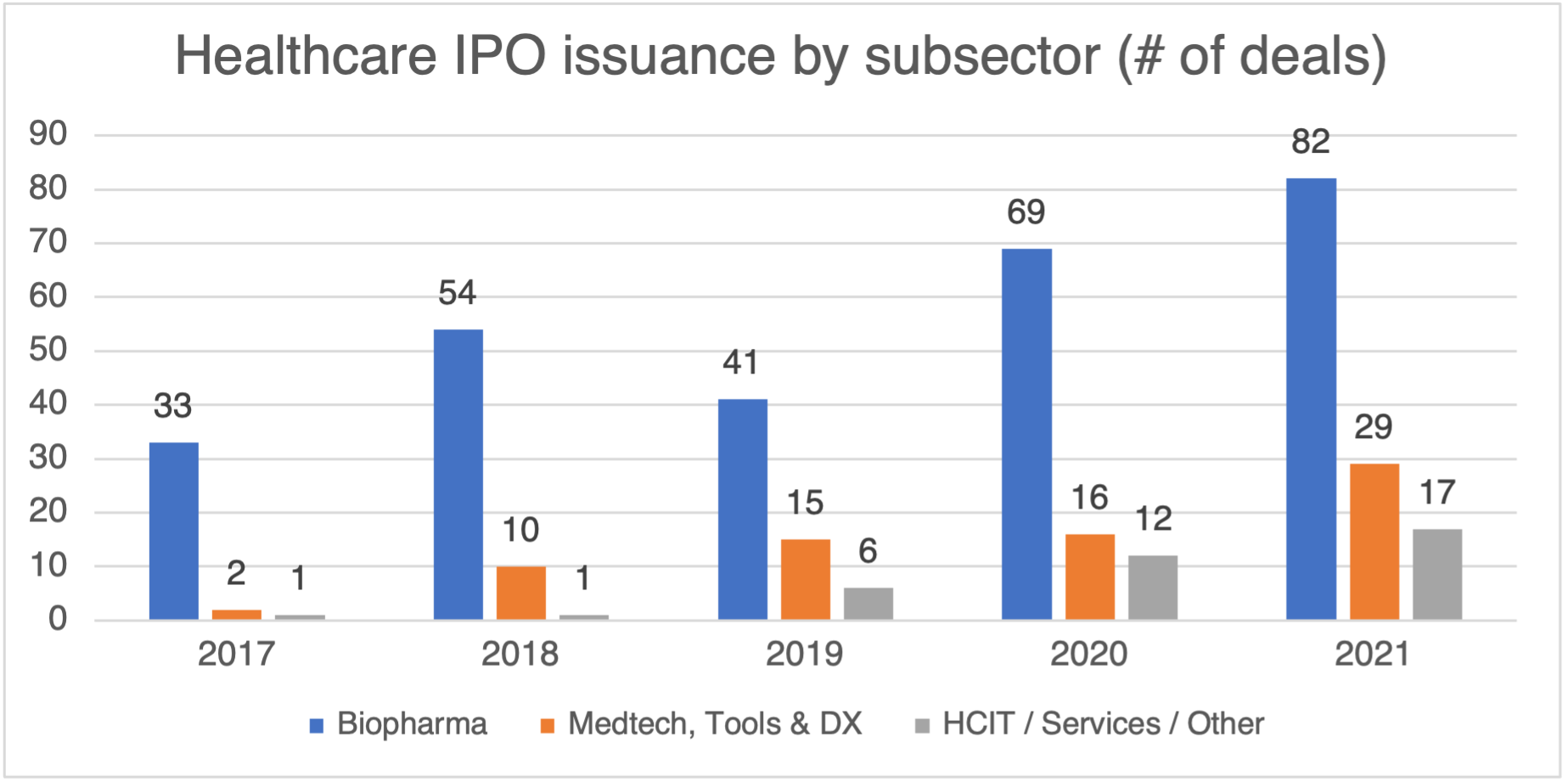

What You Need to Know as You Navigate the Market and an Ever-Evolving Life Sciences Financing Landscape

The financing landscape for life sciences issuers has transformed over the last 5 years. In this three-part series, we will cover 1) the evolution of the typical life sciences IPO, 2) post-IPO financing dynamics and the importance of laying the foundation for successful capital raises, and 3) later ... >>>Read More

Q4 2021 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q4 2021. New Issuance. Q4 2021 saw 27 new issue convertible deals (all debt) with a total volume of $18.1bn, which brought total 2021 issuance to $92.8bn across 155 deals. 2021 was the ... >>>Read More

- « Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- 9

- …

- 19

- Next Page »