As part of our market update series, please see the summary below of what we saw in the convertible market in Q1 2023 along with some key takeaways. Q1 volume of $13.2 billion was the highest in a quarter since Q4 2021 Technology issuers regained dominance, accounting for 38% of the deal count and ... >>>Read More

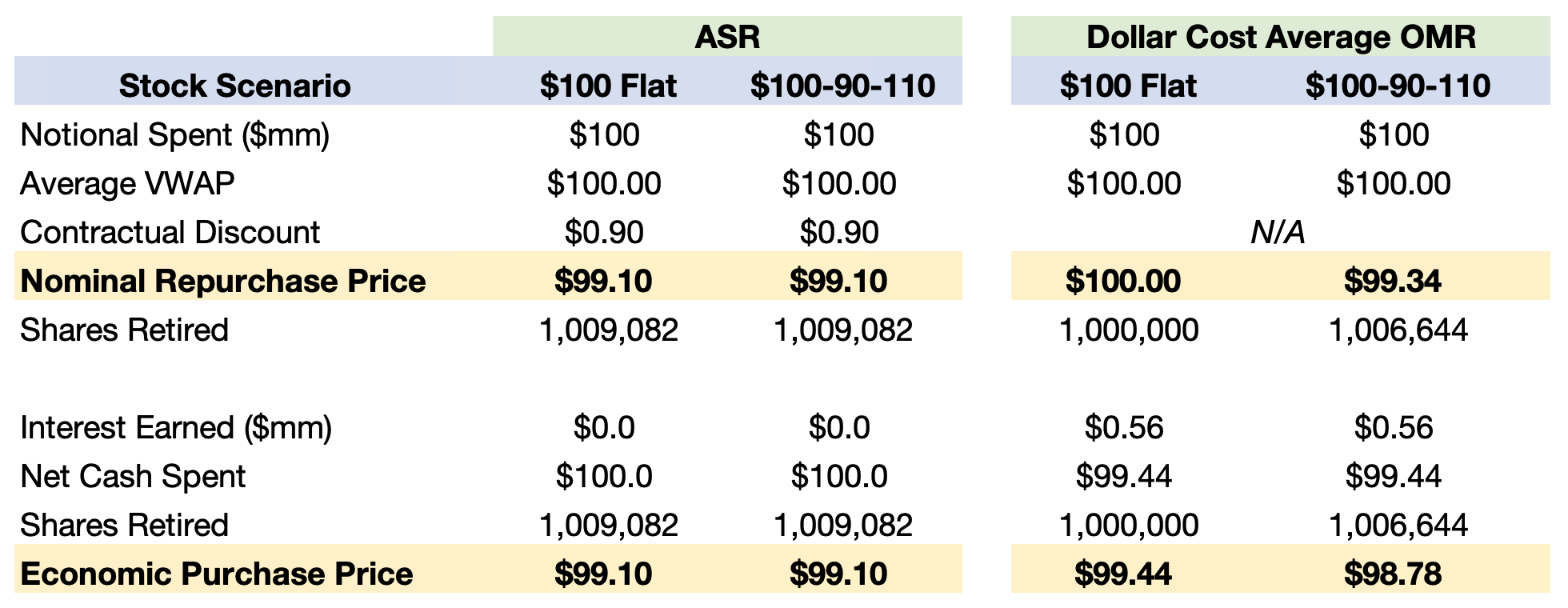

Apples and Oranges: Calculating and Comparing Repurchase Prices Is More Interesting than You Think

It is easy to compute a number for repurchase price per share: cash spent on buybacks divided by number of shares retired. For better informed decision-making, a more complete economic analysis of share repurchase programs that take place over time should reflect both (1) interest income, which has ... >>>Read More

Q4 2022 and Year End Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q4 2022 along with some year-end takeaways. Although Q3 and Q4 were relatively active (with ~$10 billion of issuance each quarter), 2022 total volume (~$29 billion) was the lowest over the ... >>>Read More

Breaking News: No mandatory cooling-off period required for issuer 10b5-1 repurchases

The U.S. Securities and Exchange Commission (SEC) today adopted amendments to its Rule 10b5-1 under the Securities Exchange Act of 1934 (Rule 10b5-1). Though the SEC had proposed a “cooling off” period for issuers when the amendments were initially proposed last year, the final ... >>>Read More

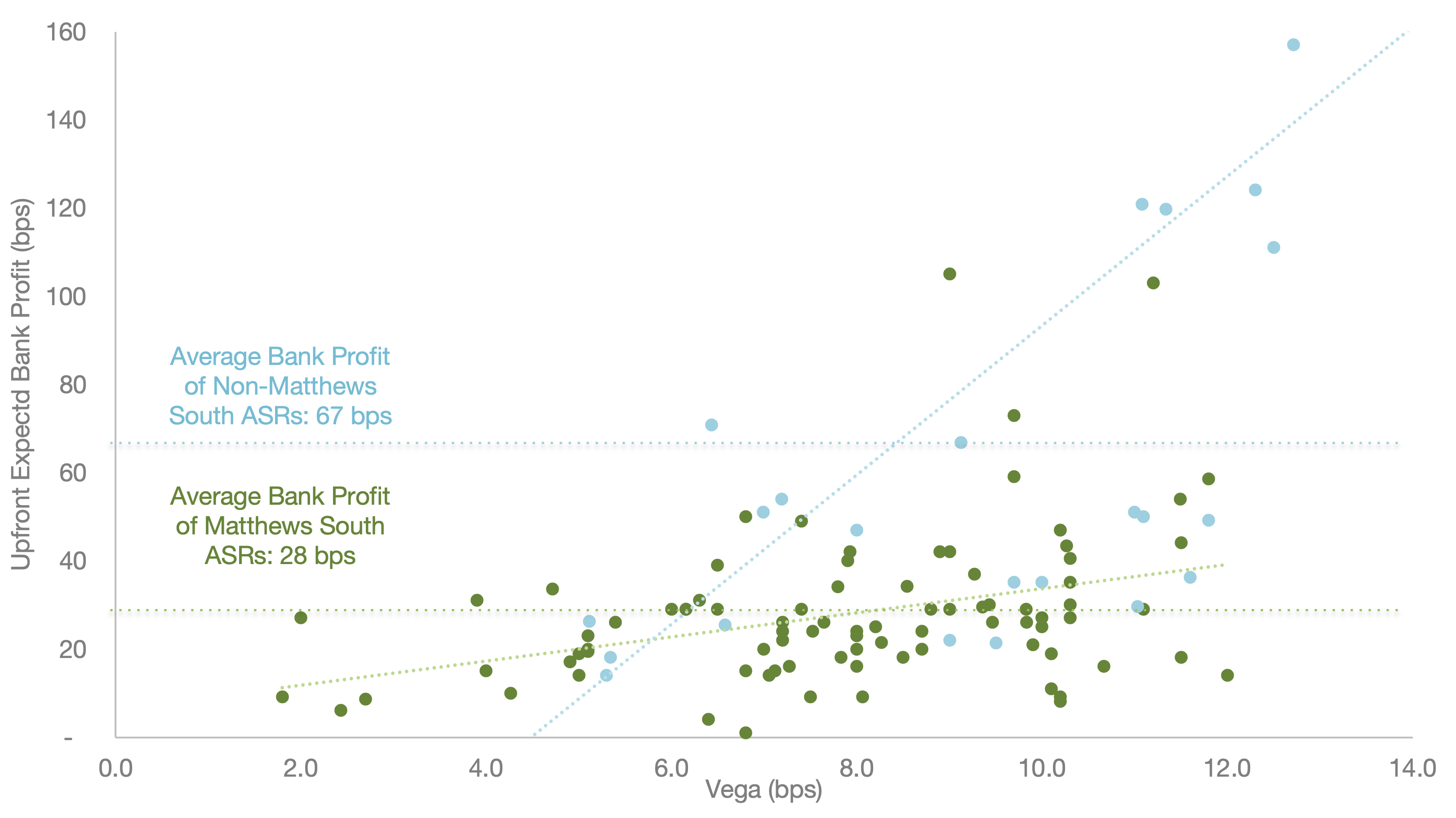

ASR VWAP Discount: Are You Receiving The Best Price?

Matthews South has advised clients on $80bn of share repurchase to date and ~30% of ASRs in 2022. This experience, coupled with our proprietary software, gives us an unrivaled ability to help our clients achieve the best ASR pricing. In this blog, we present updated statistics on the pricing of ... >>>Read More

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 19

- Next Page »