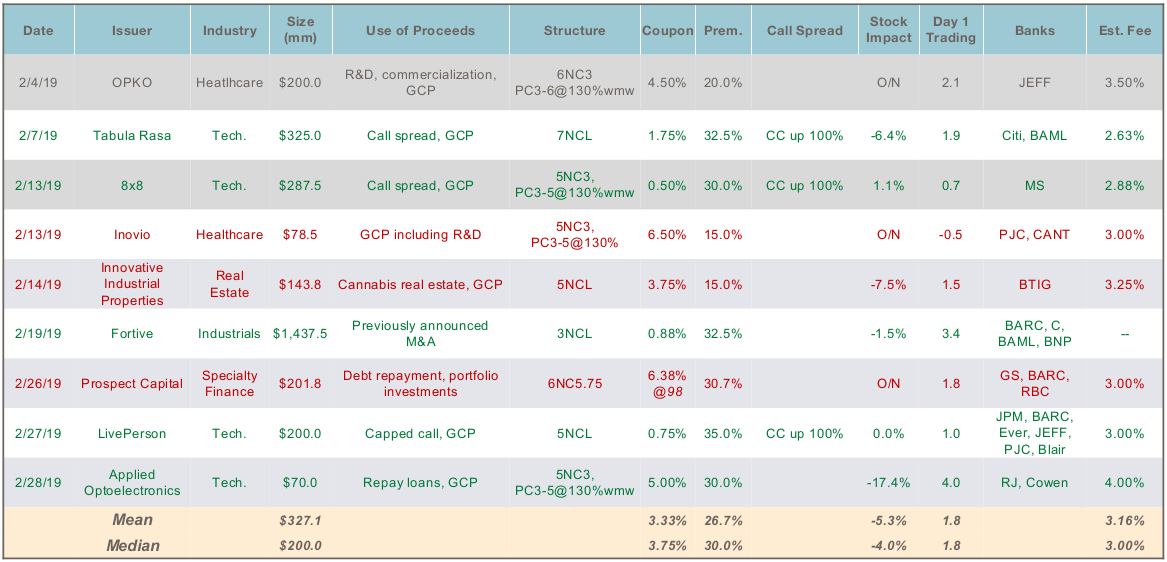

Total Issuance: February new issue activity recovered from December and January, with 9 deals for a total of $2.9 billion, of which half was the $1.4375 bn Fortive deal. The YTD total now stands at $3.9 billion (11 deals), compared to $4.2 billion (15 deals) through February of last year.Investment ... >>>Read More

January Convertible Market Review

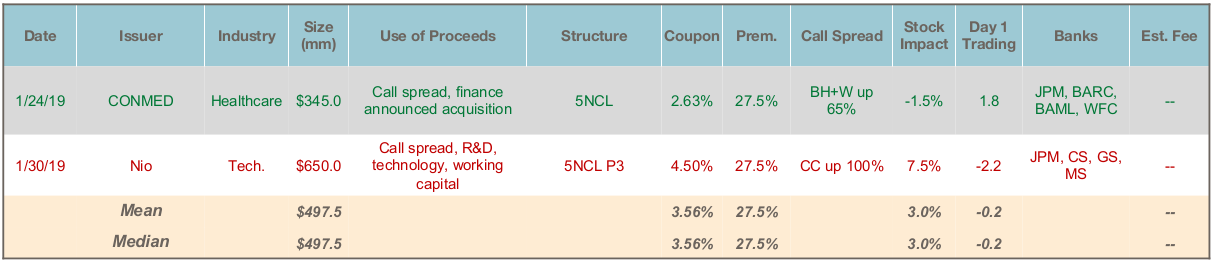

Total Issuance: With the continued market choppiness from the holiday period, January was quiet in the primary market, even accounting for the fact that most companies are in blackout for the first few weeks. There were 2 convertible debt deals totalling $1 billion — CONMED and for China-based Nio ... >>>Read More

November-December Convertible Market Review

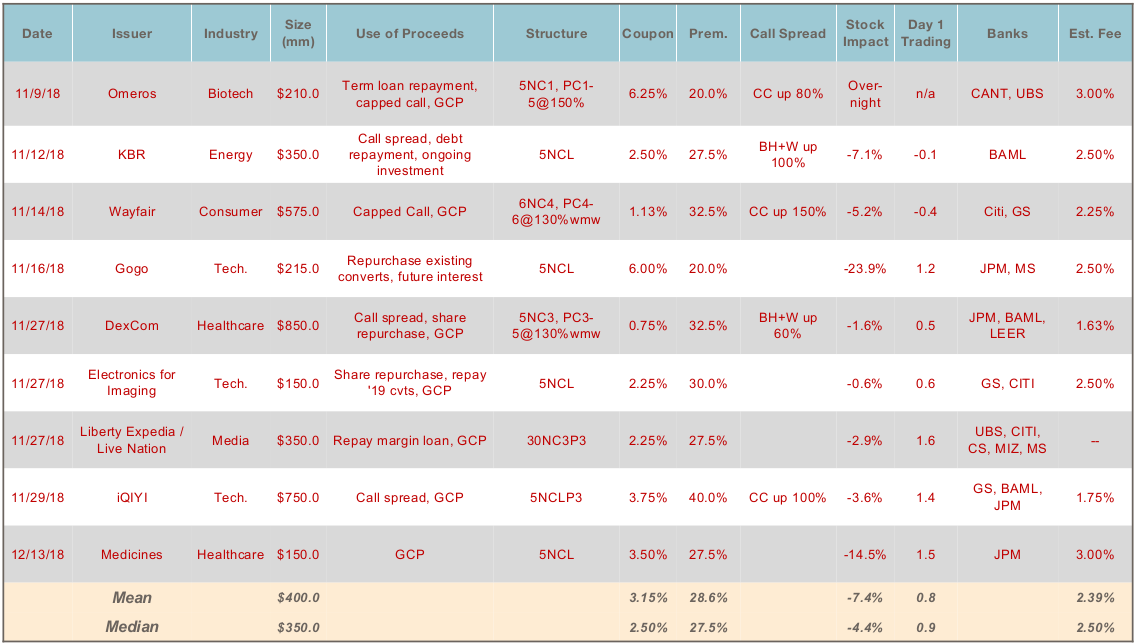

Total Issuance: Despite the uptick in market choppiness starting in late October, the convertible primary market priced a healthy amount of new issue paper since the start of November: $3.6 billion across 9 deals (plus another $200mm currently on offer by Benefitfocus set to price this afternoon). ... >>>Read More

October/November Convertible Market Review

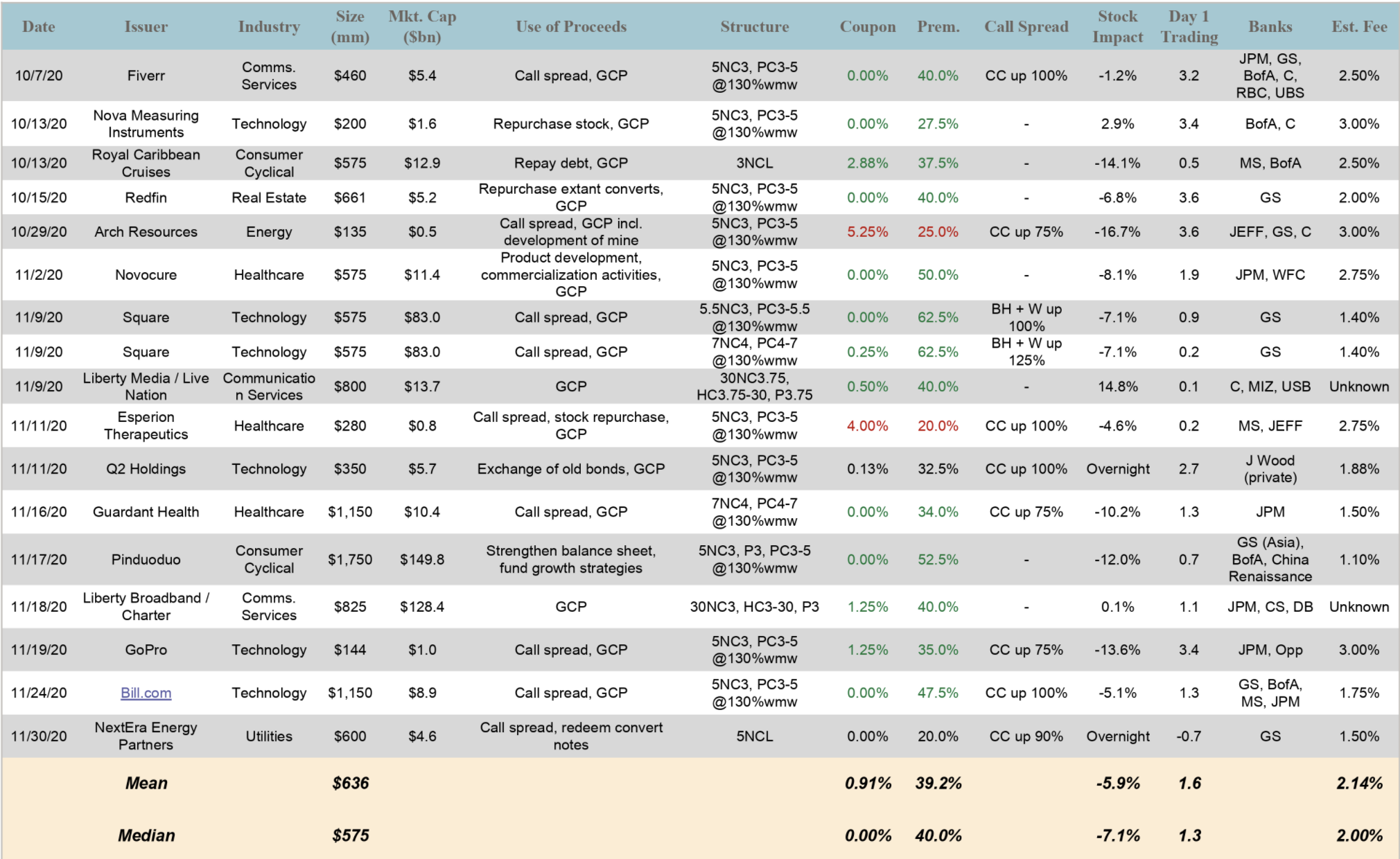

As part of our market update series, please see the summary below of what we saw in the convertible market in October and November 2020. Sector2019 Full YearQ1 2020Q2 2020Q3 2020Oct.-Nov. 2020All Deals Avg. 2.20% / 30%1.25% / 37%2.53% / 29%2.10% / 34%0.91% / 39%Tech Sector ... >>>Read More

- « Previous Page

- 1

- …

- 17

- 18

- 19