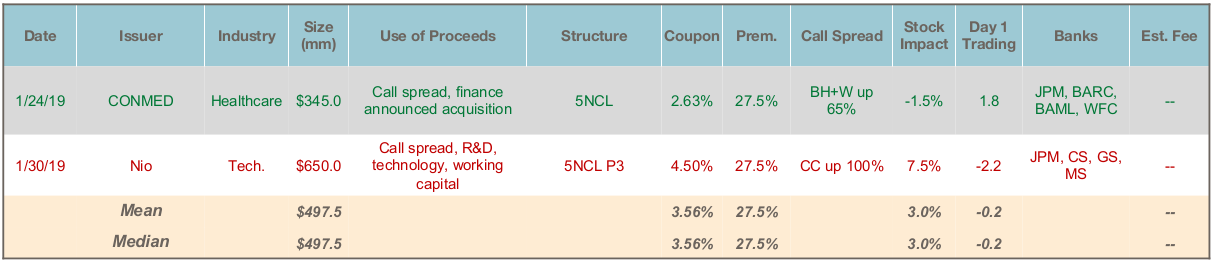

- Total Issuance: With the continued market choppiness from the holiday period, January was quiet in the primary market, even accounting for the fact that most companies are in blackout for the first few weeks. There were 2 convertible debt deals totalling $1 billion — CONMED and for China-based Nio Inc. — compared to the year-ago period which saw 10 deals for a total of $4 billion. In a related market segment, there were two mandatory convertible offerings (~$600mm total) earlier in the month as well (one with a capped call, which is very unusual in that space).

- Pricing: Suggesting a higher degree of uncertainty around market receptivity, both deals priced outside the initial marketing range. CNMD priced at better terms (lower coupon) than the range and traded up. Likely driven by the need for a borrow facility, NIO priced at worse terms (higher coupon) than the range, and traded down.

- Market Inputs: Along with equity valuations, credit spreads are somewhat wider than where they were in Q2-Q3 of last year: BB corporate spreads are 25-50 bps higher than last summer, which appears to have been reflected in CNMD pricing assumptions. However, inputs have recovered meaningfully since December (BB spreads are ~85bps lower than year-end).