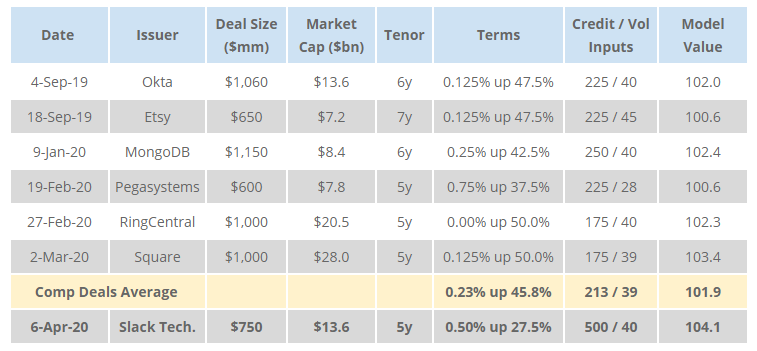

The new issue convertible market got a notable data point with the offering for Slack Technologies, which priced a $750 million 5-year offering after the close Monday. The deal priced with a 0.5% coupon and 27.5% conversion premium. The transaction was marketed with a L + 500 ... >>>Read More

Matthews South Advises on $200mm “Low Cost” eOMR for Technology Company

Matthews South advised a large-cap technology company on its first Enhanced Open Market Repurchase (“eOMR”). The eOMR is an open market program intended to maximize the discount to VWAP. The program does this by using an algorithm to determine the daily purchases. Matthews ... >>>Read More

Convertible New Issue Market Reopens

For the first time since March 4, the convertible market saw new issuance this Wednesday (April 1), with the pricing of two deals. Both were part of larger capital raises, and both priced with model values in the 104 – 105 range in addition to credit spread assumptions meaningfully wider than ... >>>Read More

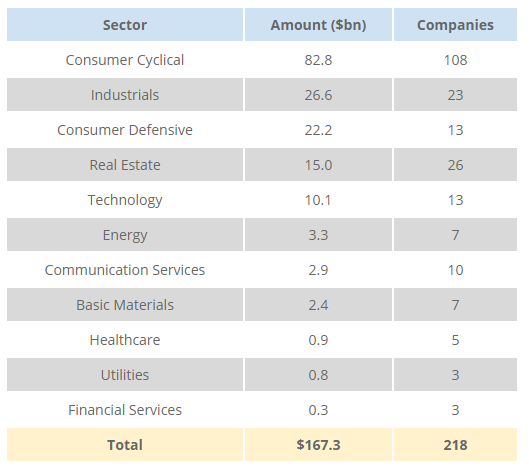

Update: COVID-19 Credit Facility Drawdowns

As detailed in our previous post on the topic, in response to COVID-19, companies have been drawing on their revolving credit facilities. We have updated our algorithmic search of SEC 8-K filings to cover the period from March 1st – 27th. Our update reveals a ... >>>Read More

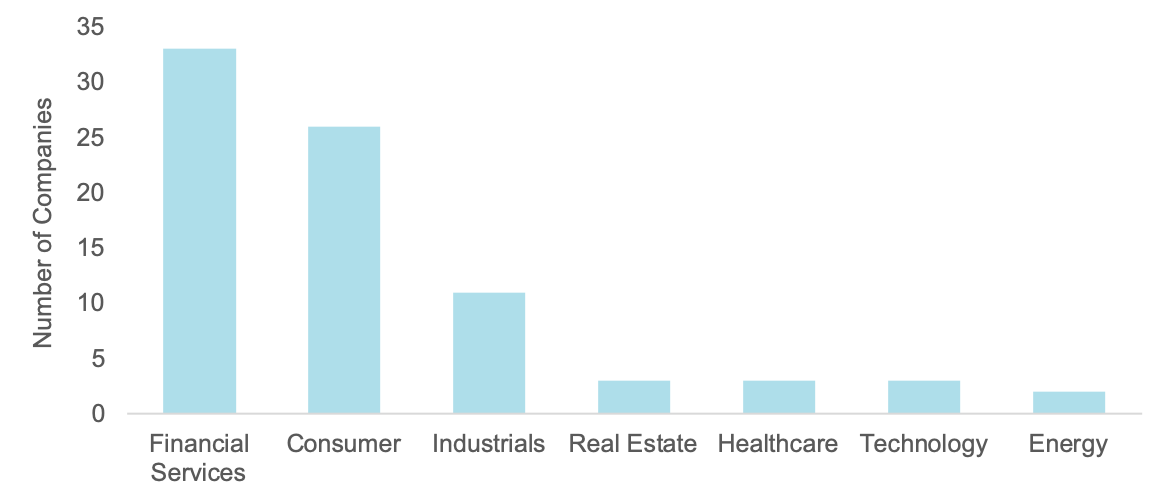

COVID-19 and Share Repurchase Suspensions

In a previous post, we analyzed the trend of drawing down on credit facilities to enhance liquidity during the COVID-19 crisis. In a similar theme, many companies are also reconsidering their capital return programs. We quantified the number of companies that have announced the ... >>>Read More

- « Previous Page

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 19

- Next Page »