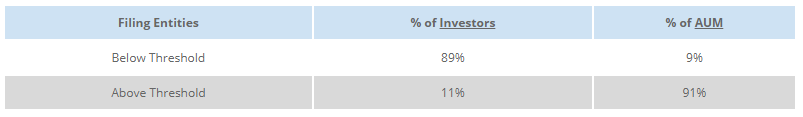

In 1975, the Congress passed The Securities Act Amendments of 1975. As a part of the amendments, Section 13(f) of the Securities Exchange Act of 1934 requires an institutional investment manager to file quarterly ownership reports with the SEC on File 13F within 45 days after the end of each ... >>>Read More

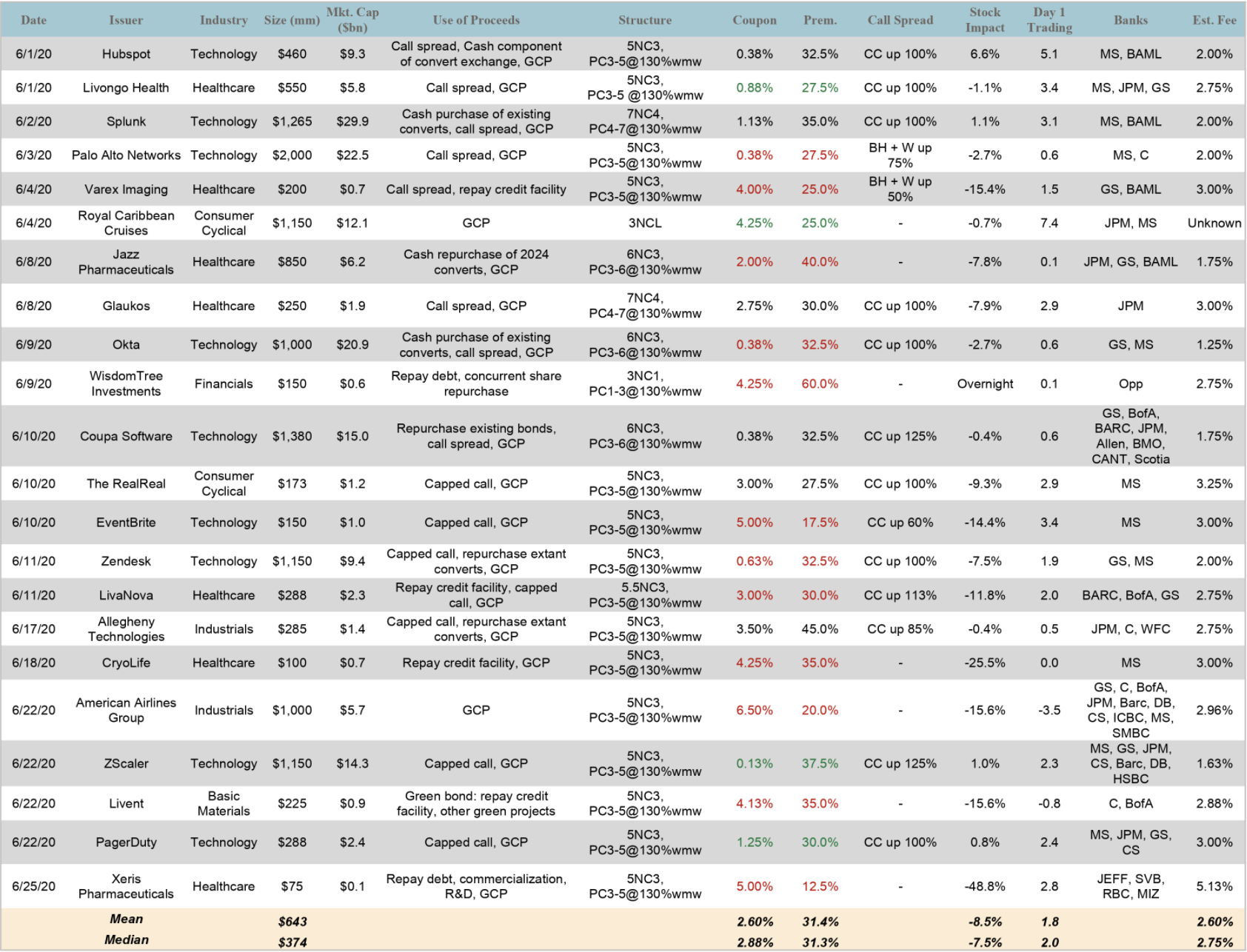

June Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in June. Additional details on all the deals are in the attached. Related Articles April Convertible Market Review May Convertible Market Review July-August Convertible ... >>>Read More

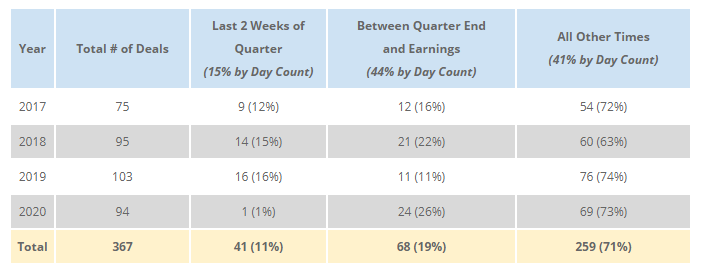

Convertible Issuance in Blackout Periods

An issuer must be free of any material non-public information (“MNPI”) at the time of a securities offering. In the ordinary course, the most likely source of MPNI is information about business performance since the last earnings announcement. As an issuer gets later into the quarter or ... >>>Read More

A Costly Convertible Private Placement

Almost all new issue convertibles are sold through Rule 144A or registered offerings. So, our interest was piqued on May 8th, when Luminex Corporation (Ticker: LMNX) issued a $260mm convertible through a 4(a)(2) private placement. J. Wood Capital Advisors was the sole placement ... >>>Read More

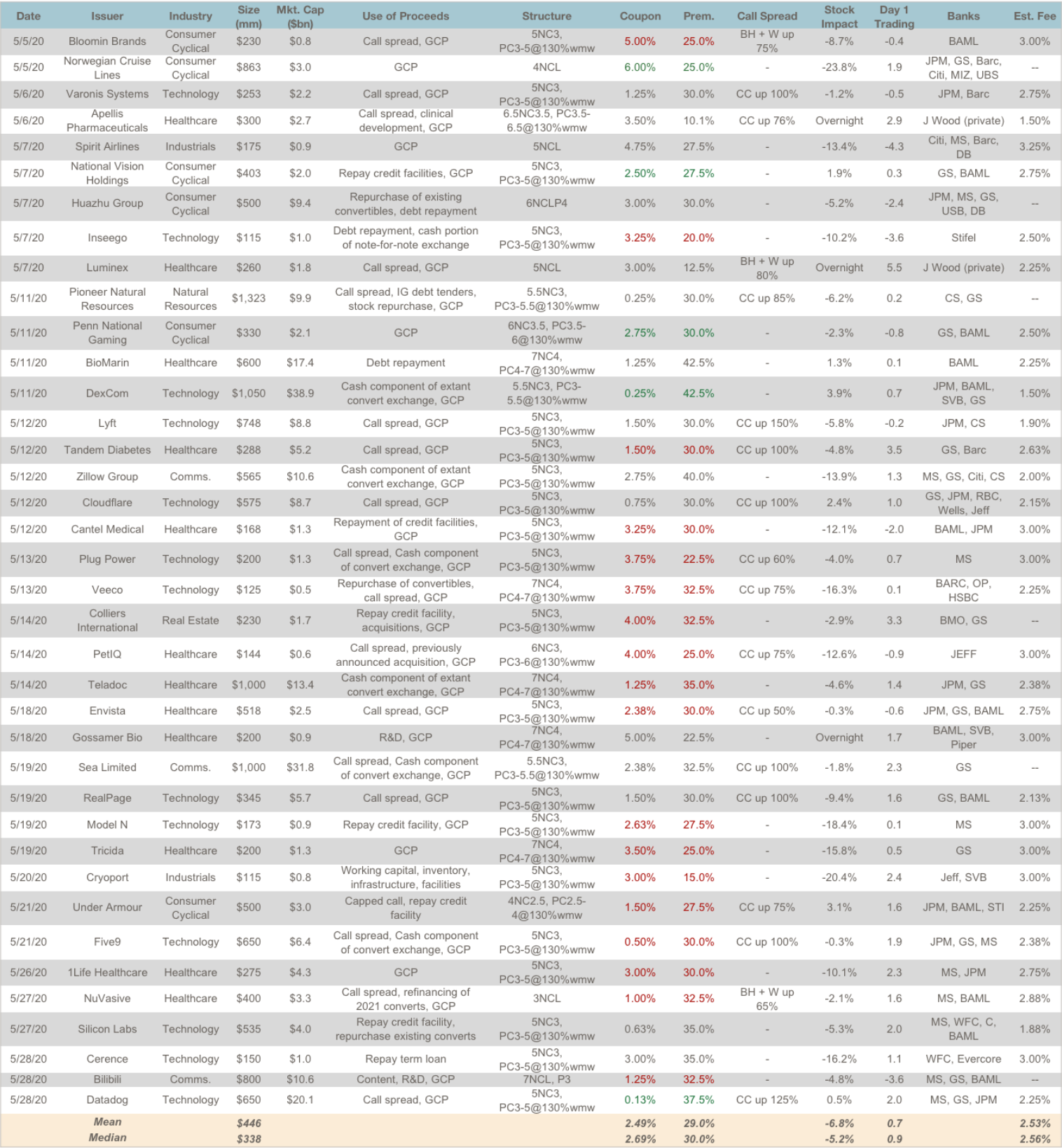

May Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in May. Additional details on all the deals are in the attached. Related Articles ... >>>Read More

- « Previous Page

- 1

- …

- 9

- 10

- 11

- 12

- 13

- …

- 19

- Next Page »