As part of our market update series, please see the summary below of what we saw in the convertible market in April. Additional details on all the deals are in the attached.

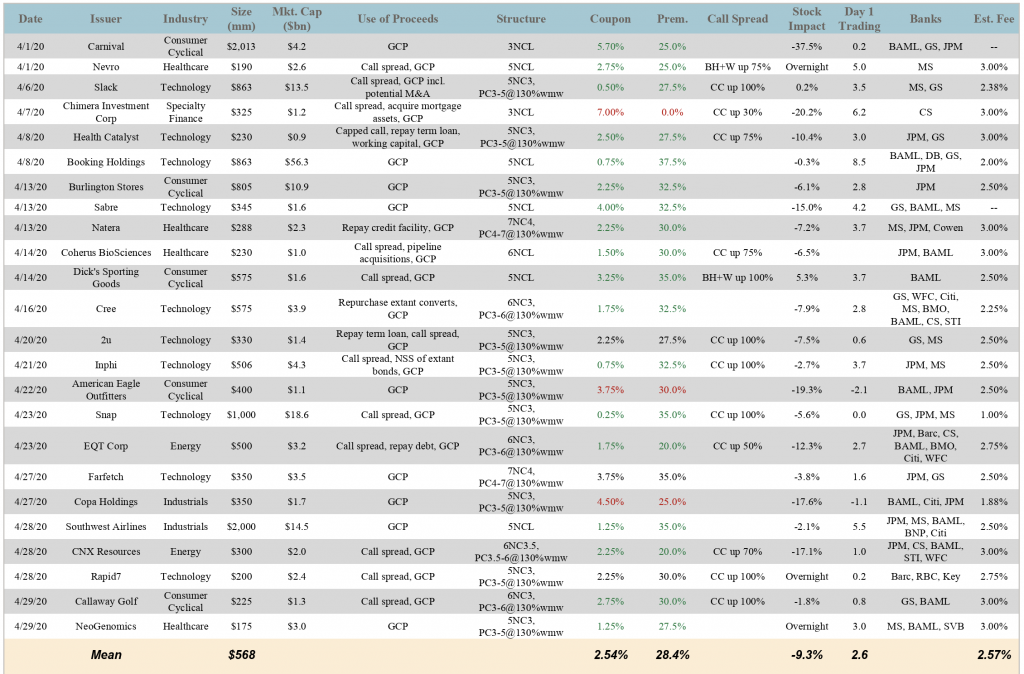

- New Issuance: After a very quiet March (with no deals after March 4), April was extremely busy as markets recovered from the bottom of the Covid-19 reaction: there were 24 deals for $13.6 billion total issuance, the busiest month in the convertible market in many years. In addition to 10 tech sector issuers, there were also 4 healthcare deals, 5 consumer issuers, 2 airlines, 2 energy companies, and 1 mortgage REIT.

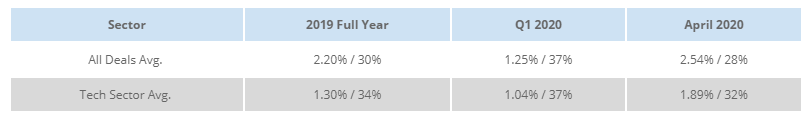

- Terms. In the table below, we compare terms for April deals to Q1 2020 and 2019; terms were meaningfully wider given the market stresses.

- Day 1 Trading. Bonds traded up on average ~2.6 points on a stock-price adjusted basis in April, compared to 1.7 points in Q1 2020 and 1.3 points in 2019. While markets are weaker than they had been (see secondary market data below), the higher day-1 trading impact does reflect additional money “left on the table.”

This could have been driven by more conservatism than is necessary from banks in price talk, which can be “sticky” even with a strong order book. Banks have marketed deals with higher credit spreads (L + 780 average in April vs. 439 in Q1 2020 and 477 in 2019) as well as higher model values using those inputs (most bonds are modeling to ~103-105 as opposed to the more typical 101-102). - Call Spreads. 54% of deals (13/24) used call spreads in April, down slightly from 63% in Q1 and 55% during 2019, which may reflect a slight shift in mentality towards balance sheet repair / maximizing proceeds during the Covid-19 period. Call spread pricing was slightly less efficient, with typical volatility skew in the 4.0 – 4.5% area vs. 3.0 – 3.5% pre-Covid-19. This translates into a ~0.75% cost increment for an up 30% to up 100% call spread, although we do expect this trend to reverse if the market continues to stabilize.

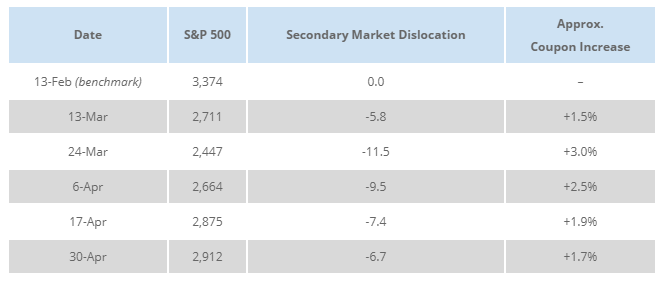

- Secondary Market. Finally, we are updating our data series tracking the dislocation in the convertible secondary trading market for a fixed universe of bonds since February. After a severe dislocation in the last week of March / first week of April, trading levels have been relatively stable in the last several weeks, settling at levels that imply around a ~1.7% coupon increase in new issuance (for an equivalent conversion premium), approximately in line with what we have seen (i.e., a smaller coupon increase but coupled with somewhat lower conversion premiums).

Related Articles

May Convertible Market Review

June Convertible Market Review

July-August Convertible Market Review

September Convertible Market Review

October/November Convertible Market Review