In the first installment of our three-part series on the financing landscape for life sciences issuers, we covered the evolution of the typical life sciences IPO. In this second installment, we will cover post-IPO financing dynamics and the importance of laying the foundation for successful capital raises in this sector. Our final installment will cover the path to issuing convertible debt for life sciences companies as one form of later stage financing.

Equity Financing Market Background

The financing market in life sciences is dynamic and investor appetite is often heavily linked to independent factors: binary data events, FDA behavior (inclusive of unexpected change in its policies), and political rhetoric around drug pricing.

Biotech struggled to perform in 2021 and in 2022 YTD, driven by:

- A broader risk-off environment in growth sectors,

- Lack of M&A,

- Generalist investors rotating toward stability,

- Muted performance on the back of data readouts, and

- Lackluster deal performance both for IPOs and for secondary offerings.

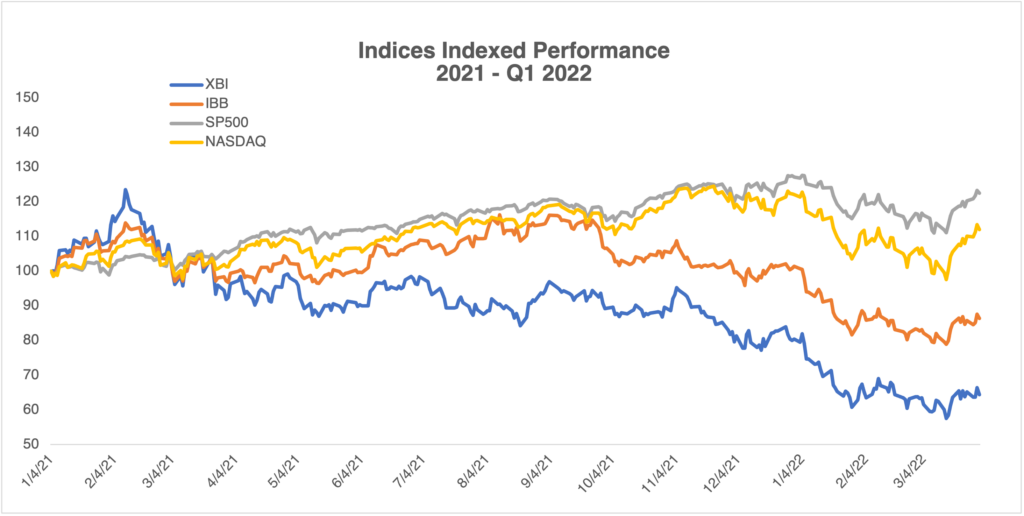

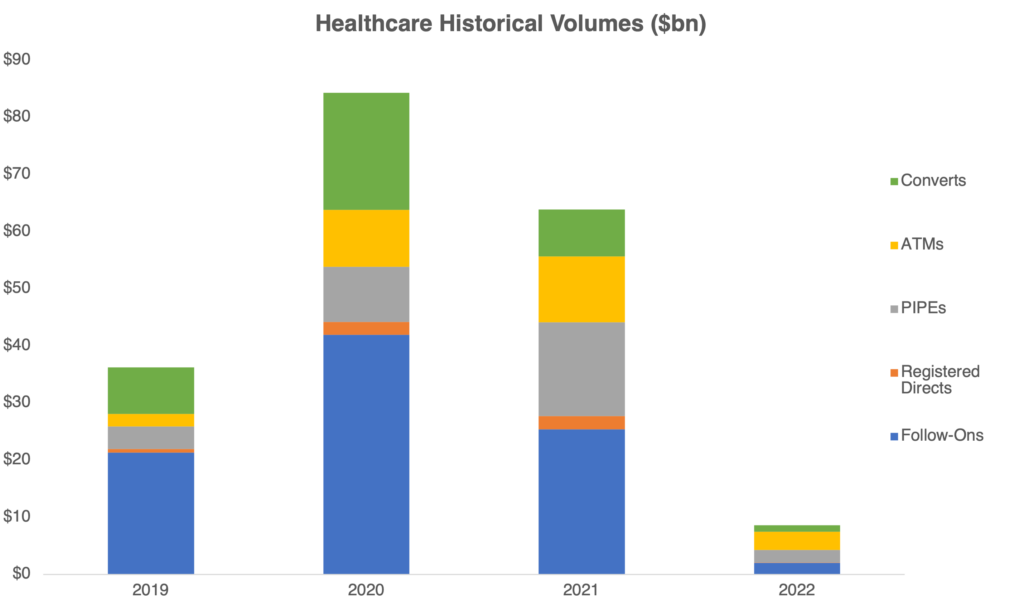

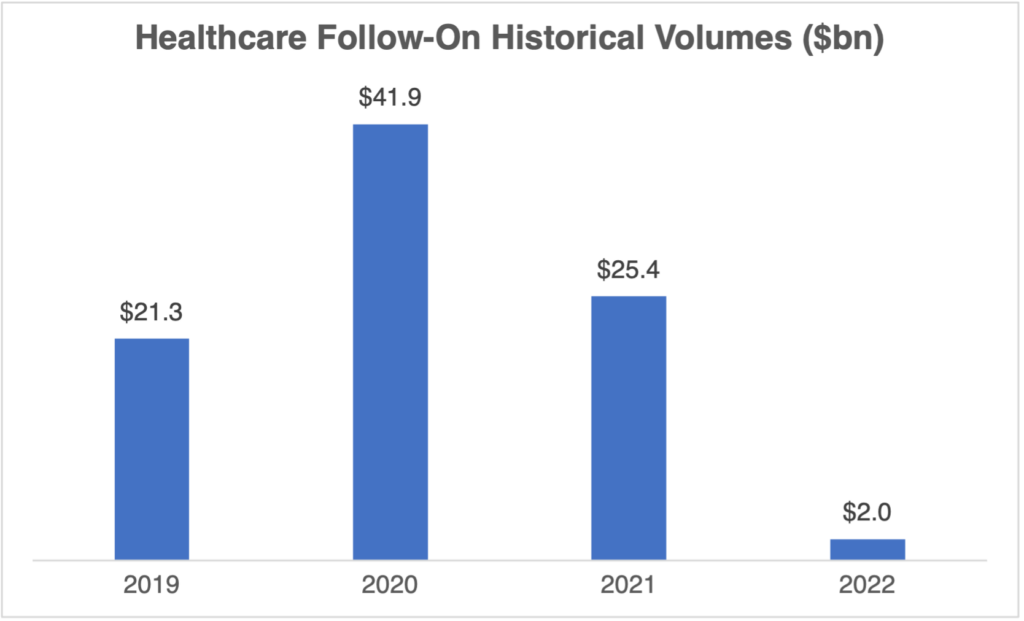

In 2021, the S&P Biotechnology Select Industry Index as reflected by the XBI ETF (small and mid-cap biotechs) was down 20.5%, while the iShares Biotechnology ETF (IBB) (large-cap biotechs) was slightly up at 0.99% versus the S&P 500 which was up 26.9% and Nasdaq up 21.4%. In 2022, performance has been impacted by inflation concerns, interest rate hikes, the economic implications of COVID variants, and the Russia-Ukraine conflict. As a result, in the first quarter of 2022 we have seen the XBI drop 19.6% and the IBB lose 14.6%, while the S&P 500 was down 4.9% and Nasdaq was down 9.1%.

We anticipate that the financing market for life sciences companies will continue to function in 2022, though, for private companies, the path to the public market could be extended. Further, financings in the public market post-IPO may skew towards more structured offerings. The ultimate execution format should be carefully considered and can be driven by a variety of factors including the level of investor dialogue and appetite, reverse inquiry, trading dynamics, existing shareholder base, presence or absence of a catalyst, willingness to take on dilution, and issuer price sensitivity.

We cover below the following four types of post-IPO equity financing strategies:

- Underwritten Equity Follow-on Offering (FO)

- Registered Direct Offering (RDO)

- Private Investment in Public Equity (PIPE)

- At-The-Market Offering (ATM)

Most life science companies will access at least one of these strategies, and often more than one of these depending on where they are in financing life cycle and current market conditions.

In addition to these equity financings, most life sciences companies should consider accessing the convertible debt market for financing. This is generally an event that should be considered later in the company’s financing life cycle when the profile of the company is more de-risked and there is a true line of sight to revenue. However, there are also some companies who have de-risked profiles earlier on and can access this alternative immediately after an IPO. Given the number of considerations around this type of financing option, convertible debt for life science companies will be discussed in Part 3 of our blog series.

A trusted, independent advisor can help issuers navigate the myriad considerations across these financing alternatives and choose the right strategy. In addition to the factors described below, an advisor can help improve execution in both pricing and marketing considerations.

Post-IPO Equity Financing Strategies

Underwritten Equity Follow-On Offering

An underwritten equity follow-on offering (“FO”) is a resale of securities pursuant to an effective registration statement by one or more underwriters after they have agreed to purchase such securities at a fixed price. As a result, in a firm commitment, the issuer will know the amount of funds it will receive from an offering at the time it executes the underwriting agreement.

Given this is a registered offering, there are no restrictions on who can purchase securities from the underwriters. If there is no marketing before the execution of the underwriting agreement, this is generally known as a “block trade,” as the underwriters commit without having any feedback on investor appetite. For this reason, underwriters are typically willing to execute block trades only for high quality, seasoned issuers whose shares have good daily trading liquidity. More commonly, there is a one to two day marketing period to assess market interest before pricing.

If the offering takes place within one year from the IPO, the offering is done under an S-1 registration statement and generally will be executed after one to two days of public marketing. With recent changes in regulation (Rule 163B under the Securities Act of 1933), issuers can “Test the Waters” (TTW) in advance of the public filing of an S-1 registration statement to gauge investor appetite for the offering. However, it bears noting that this should be done carefully and with oversight of legal counsel given Securities Act considerations.

If the issuer is past its one year IPO anniversary, they can file an S-3 shelf registration and market securities off of that registration statement. This enables the issuer to take advantage of other execution techniques and offers more flexibility.

Many life sciences issuers choose to finance on the back of a data event. In doing so, a company can consider a few approaches:

- Publicly market the transaction and price the deal after the decided marketing window (usually one to two days),

- Wall-cross investors (either in advance or post-data release) to build demand for a transaction, then launch the transaction publicly and price the deal overnight, or

- A hybrid approach of wall-crossing followed by public marketing.

Many issuers prefer to limit “market risk.” In its simplest definition, “market risk” is the window of public marketing where stock price impact can be observed. While publicly marketing a transaction (thus having exposure to “market risk”) was the most common execution technique pre-JOBS Act, the comfort of TTW brought a more confidential approach to follow-on execution, leading to a shift to a wall-cross strategy in most transactions.

A traditional wall-cross execution is one to two days of confidential marketing orchestrated by the underwriting group. There are a few approaches an issuer can consider, inclusive of bringing investors over the wall before data is made public to the market. Execution strategy is critical. Depending on the circumstances, a publicly marketed transaction (versus overnight execution after the wall cross) could very well be the best way to bolster a shareholder base in an execution.

In addition to high-level strategy, the number and style of investors that are wall-crossed in a transaction should be reflective of the situation at hand. We find that this is typically a key decision impacting the success of a transaction. Investor relations dialogue in the lead-up to execution is paramount and should be factored into the ultimate strategy.

There are many decisions to be made regarding execution strategy when evaluating an underwritten follow-on offering. Each issuer should carefully evaluate their circumstances, but the market backdrop and recent executions should also be factored into any execution.

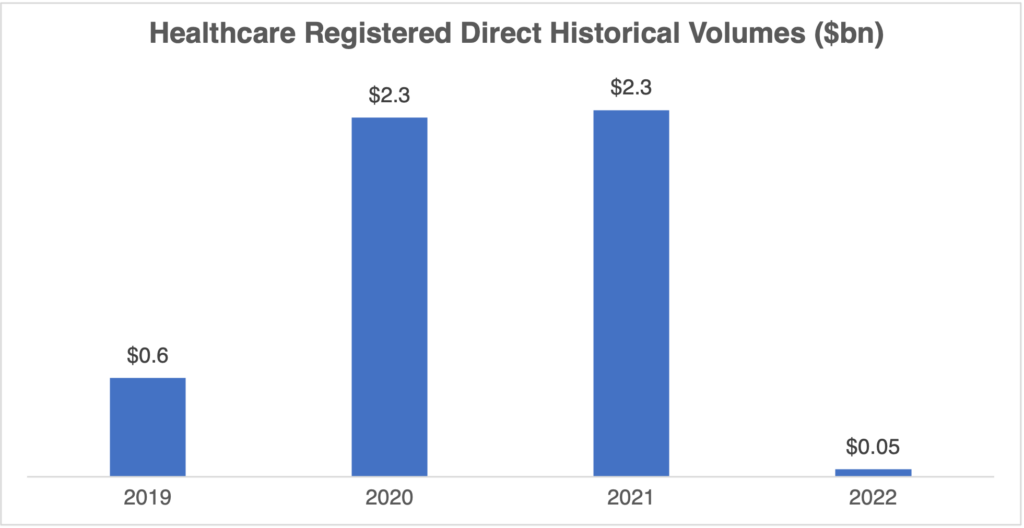

Registered Direct Offering

A Registered Direct Offering (“RDO”) is a public securities offering that is marketed on a “best efforts” basis to a select group of investors who agree to keep the transaction confidential during negotiations. RDOs are generally done through a placement agent. This means that investors purchase securities directly from the issuer and there is more execution uncertainty than in a firm commitment underwriting. The placement agent can only undertake passive market making activities and cannot engage in market stabilizing transactions in an RDO.

An RDO allows for flexibility on size and can be structured as “any-or-all” (where transaction will close regardless of how much the company raised), with min-max size thresholds (where transaction closing is subject to reaching certain size thresholds), or as “all-or-none” (where all securities must be sold). All of these give issuers a fair amount of optionality.

Since RDOs are marketed to a smaller group of investors, there is a general perception that it is easier to preserve confidentiality before pricing and so it may be easier to avoid pre-pricing stock price erosion. This execution strategy is subject to the same stringent SEC requirements as a marketed follow-on offering. This is because investors can resell their securities to anyone after pricing.

RDOs are often utilized by smaller-cap issuers, vs. mid-to large cap companies. The “clubby” nature of the execution can limit price discovery and ability to broaden the shareholder base compared to a wall-cross to overnight exercise or a more broadly publicly marketed deal. Depending on the company’s objectives, stage in financing life cycle, and overall maturity surrounding their investor base, a Registered Direct Offering could be a logical execution tactic for capital raising, but should be evaluated closely alongside other alternatives.

Private Investment into Public Equity (PIPE)

A PIPE has been a relatively common execution technique in life sciences over the last decade. A PIPE offering is a private placement of securities in a public company that is issued to “accredited” investors. The securities are later registered through a resale shelf in order to provide liquidity to those investors. Considering the illiquidity they face out of the gate, PIPEs often come at a cost to the issuer. In addition to a bigger discount to the trading price for the issuer’s securities, this cost can also include warrants or other “sweeteners” to make the investment attractive to investors.

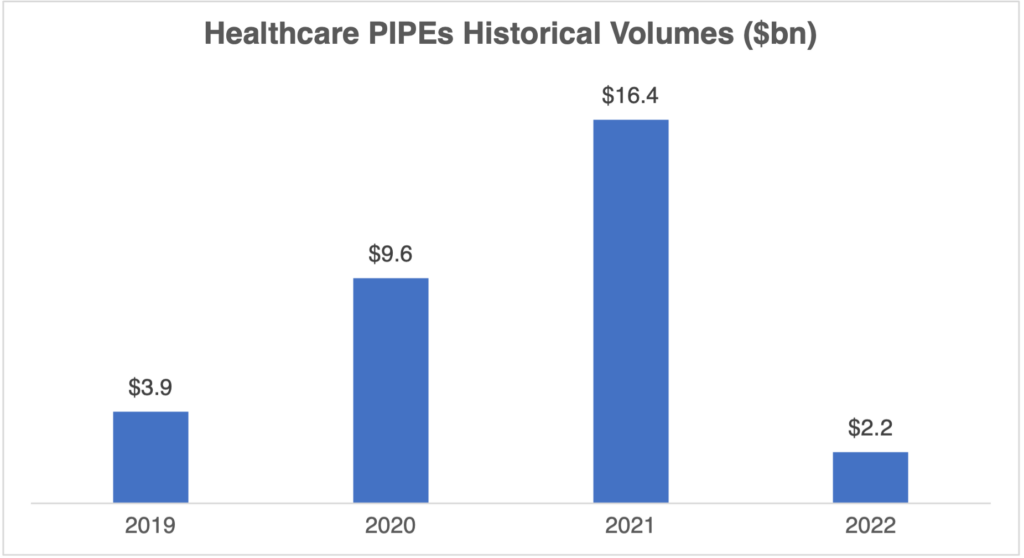

In a more challenging market (both broader indices and deal performance), we can expect a shift towards PIPE execution as investors with high conviction can participate in a meaningful way to support a company. However, these often come with more investor-friendly terms compared to what would be achievable in a marketed follow-on or in a registered direct offering.

Because PIPE execution is often a more dilutive option for an issuer, it should be carefully evaluated relative to other alternatives and advisory capability is important. The type of investor leading the financing and the terms and conditions of the PIPE may also impact aftermarket performance.

At-The-Market Offering (ATM)

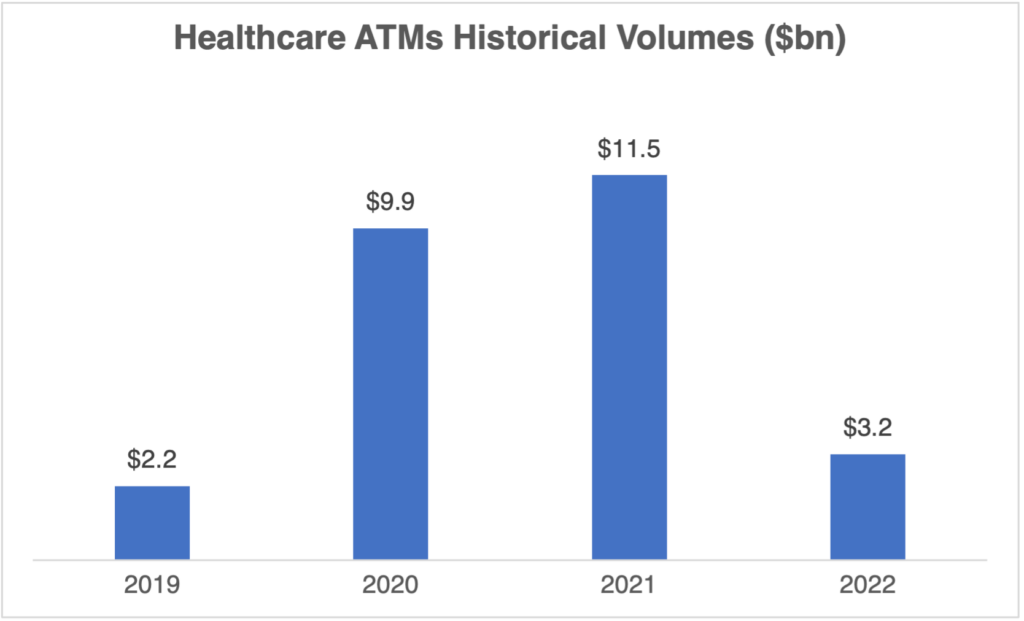

ATM offerings have become an integral piece of the capital formation process over the last decade. In an ATM offering, publicly listed companies can sell registered securities on a periodic basis with a broker-dealer either purchasing as principal or selling into the market.

A broker-dealer in an ATM generally has the option to elect not to participate, and the issuer has discretion over pricing parameters and execution of trades (in communication with the broker-dealer executing the ATM). An ATM facility and the size of the transaction is generally limited by the company’s liquidity, so careful consideration should be given to size and signaling to the market. It is also important to note that the issuer will have to be in an open window when the sales take place.

Prior to this most recent extended “bull market” in life sciences, an ATM offering was often viewed as a capital-raising technique for a struggling company. This dynamic has changed and an ATM is now viewed as a “good housekeeping” strategy. After a year from IPO, when an issuer becomes S-3 eligible, they can file an ATM registration statement on Form S-3 in order to put this option into place. This has become more of a standard practice than an exception in recent years.

Issuers have levers they can pull when it comes to ATM arrangement and execution. As a method to create cost savings and increase efficiency, an issuer can run a competitive process in order to select brokers. In addition, issuers can be more efficient with respect to staging the timing of an ATM filing and the coinciding draw-down. In all of these situations, issuers may consider engaging an advisor to work independently of the managing broker-dealers to create efficiency and execution transparency.

During ATM execution, issuers also often receive inbound interest through their broker-dealer, but may lack clarity on where the demand is coming from or what the implications of engaging may be. Additionally, there are strategies that can be employed to utilize an ATM as a source for minimally discounted capital raising to dovetail into a marketed follow on offering – a nuanced execution that requires considerable planning and careful execution. An advisor may be helpful in this situation to help issuers ascertain the best next steps quickly and efficiently.

Conclusion

Issuers should carefully plan and execute their capital formation journey with an eye on fortifying the balance sheet to weather a storm, whether it be company-specific or externally driven. The perception of a financing overhang can take place long before a company is starved for cash, leading to a depressed stock price in anticipation of a financing. An advisor can be helpful in choosing the right strategy, as well as facilitating better pricing and execution once a strategy is determined.

For detailed analysis and advice regarding your specific situation, please reach out to the Matthews South team.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.