The Inflation Reduction Act of 2022 implemented an excise tax on corporations equal to 1% of the fair market value of stock repurchased during each taxable year, netted against the value of shares issued (including for stock-based compensation). The IRS followed up with more detailed guidance. The tax went into effect for repurchases on or after January 1, 2023, making calendar Q1 2023 the first full quarter where share repurchases were subject to the tax.

Share repurchase activity reported in recent 10-Q filings for calendar-quarter companies shows no meaningful change in repurchase activity compared to the last several quarters.

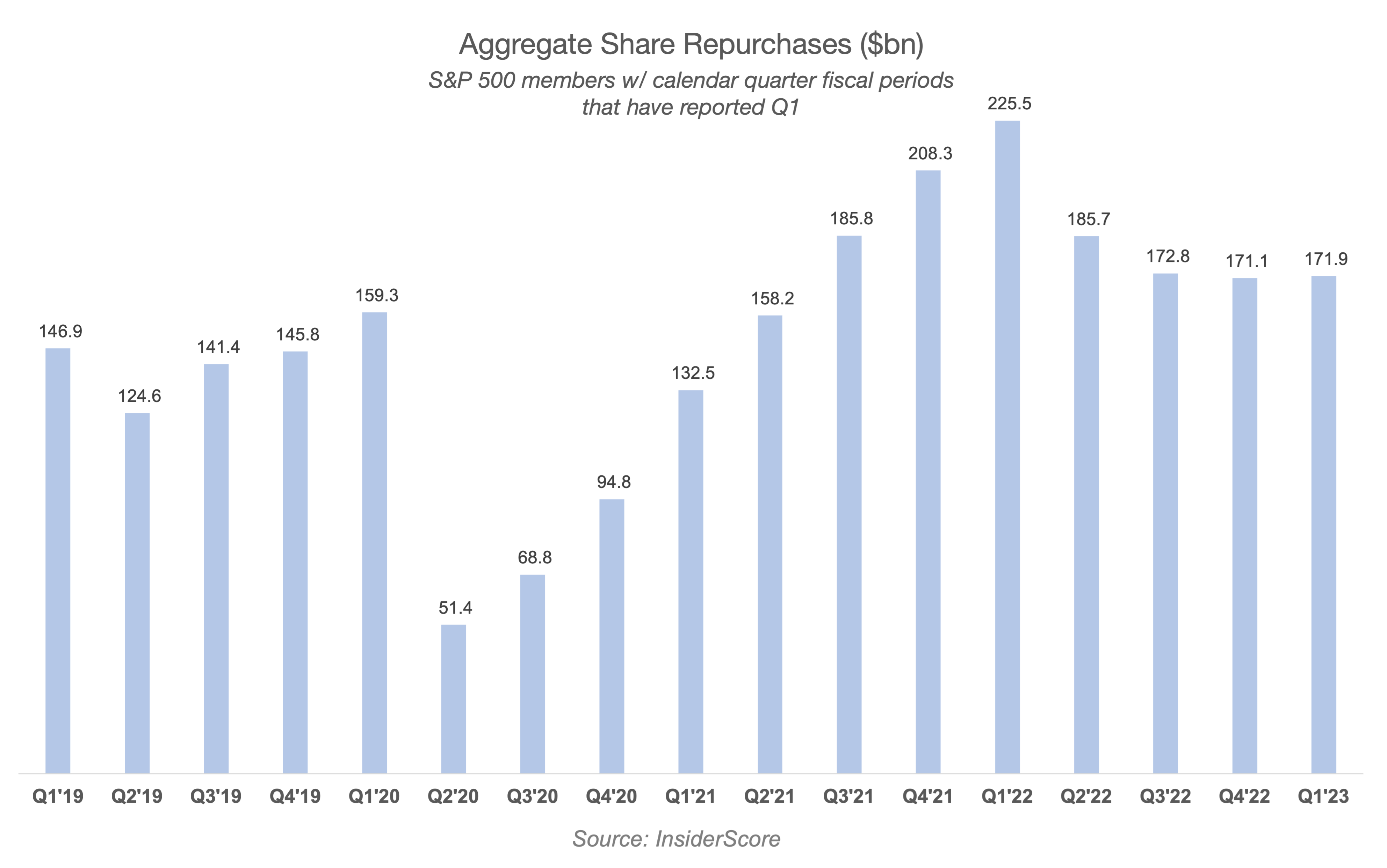

We examined repurchase activity for a subset of S&P 500 companies that have most recent fiscal quarter end dates on or around March 31, 2023 and that have bought any stock back in the last 2 years (344 companies total, typically representing about 85% of the S&P 500’s buybacks). This universe executed a total of $171.9 billion of stock buybacks in Q1, compared to $171.1 billion in Q4 2022.

This year’s Q1 total is relatively low compared to Q1 2022’s total of $225.5 billion, but examining the data over the last several years suggests late 2021 / early 2022 was a catch-up period after many companies suspended or reduced capital return during the early COVID period. Q1 2023 repurchases, moreover, remain elevated compared to the pre-COVID run rate of $140 – $160 billion of quarterly buybacks.

While the limited data we have shows no material impact on the level of share repurchases from the 1% excise tax, we will continue to monitor corporate behavior as 2023 progresses.

Please reach out to the Matthews South team to discuss capital structure and market execution considerations for your share repurchase programs.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.