The new convertible accounting rules in ASU 2020-06 will take effect in 2022. However, companies may early adopt the rules starting in 2021. We summarize the new accounting rules below:

Summary of New Accounting Rules

- Bifurcating the bond into debt and equity components will no longer take place; the full principal amount will be booked as debt

- For bonds that can only be net share settled, the coupon will be the interest expense and share dilution calculations will remain unchanged (i.e. in-the-money share calculations)

- For bonds that can be flexibly settled (any combination of cash and stock), full share settlement is assumed; for EPS, the company will use the more dilutive of coupon through the income statement or the full underlying shares added to share count

- The new rules must be adopted for fiscal years starting after 15-Dec-21, although early adoption is permitted for any fiscal year starting after 15-Dec-20

Who is Early Adopting the Accounting Change?

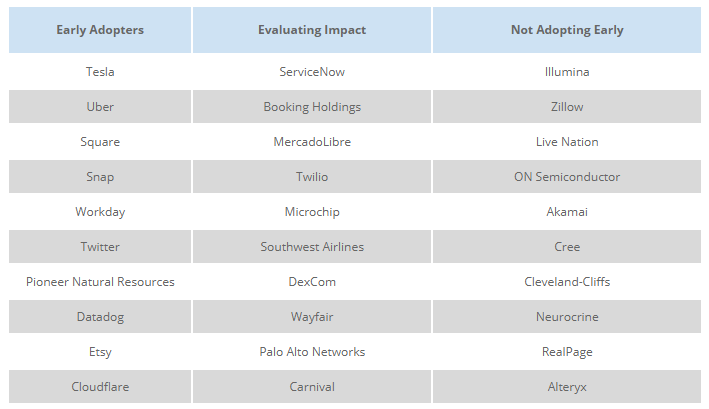

We searched EDGAR filings algorithmically for key words related to the accounting change for companies that have issued convertible bonds since 2017. We found 258 issuers with relevant disclosure, of which 77 companies (30%) explicitly say they are early adopting. 157 companies (61%) disclose that they are currently evaluating the impact of the rule changes and 24 (9%) state that they will not adopt early.

The table below is a list of the 10 largest companies (by market capitalization) for each category among companies with convertibles outstanding as of their most recent 10-K / 10-Q.

As of the time of this blog post, there have not yet been any filings related to financial reporting periods for which the new standard is applicable (even for early adopters). This likely explains the preponderance of issuers that are evaluating the impact of the change. We expect more companies will disclose early adoption in the coming months.

Disclosure Examples

The disclosure below by Square is an example of early adoption:

In August 2020, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2020-06, Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity, as part of its overall simplification initiative to reduce costs and complexity of applying accounting standards while maintaining or improving the usefulness of the information provided to users of financial statements. Among other changes, the new guidance removes from GAAP separation models for convertible debt that require the convertible debt to be separated into a debt and equity component, unless the conversion feature is required to be bifurcated and accounted for as a derivative or the debt is issued at a substantial premium. As a result, after adopting the guidance, entities will no longer separately present such embedded conversion features in equity, and will instead account for the convertible debt wholly as debt. The new guidance also requires use of the “if-converted” method when calculating the dilutive impact of convertible debt on earnings per share, which is consistent with the Company’s current accounting treatment under the current guidance. The guidance is effective for financial statements issued for fiscal years beginning after December 15, 2021, and interim periods within those fiscal years, with early adoption permitted, but only at the beginning of the fiscal year. The Company plans to early adopt the new guidance on January 1, 2021 using the modified retrospective approach and expects to record a cumulative effect of adoption of $103.5 million reduction to retained earnings. The Company expects the impact of adoption to result in a reduction to other paid in capital of $502.7 million related to amounts attributable to conversion options that had previously been recorded in equity. Additionally, the Company also expects to record an increase to its convertible notes balance by an aggregate amount of $399.2 million as a result of reversal of the separation of the convertible debt between debt and equity. There is no expected impact to the Company’s statements of operations or cash flows as the result of the adoption of this ASU.

In the next example, Lyft discloses that it is evaluating the impact of the new rules without indicating if they intend to early adopt:

In August 2020, the FASB issued ASU No. 2020-06, “Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging— Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity”, which simplifies the accounting for convertible instruments by eliminating the requirement to separate embedded conversion features from the host contract when the conversion features are not required to be accounted for as derivatives under Topic 815, Derivatives and Hedging, or that do not result in substantial premiums accounted for as paid-in capital. By removing the separation model, a convertible debt instrument will be reported as a single liability instrument with no separate accounting for embedded conversion features. This new standard also removes certain settlement conditions that are required for contracts to qualify for equity classification and simplifies the diluted earnings per share calculations by requiring that an entity use the if-converted method and that the effect of potential share settlement be included in diluted earnings per share calculations. This new standard will be effective for the Company for fiscal years beginning after December 15, 2021, including interim periods within those fiscal years. Early adoption is permitted, but no earlier than fiscal years beginning after December 15, 2020. The Company is currently assessing the impact of adopting this standard on the consolidated financial statements.

Our last example, by ON Semiconductor, explicitly states that it will not be early adopting:

In August 2020, the FASB issued ASU 2020-06, which simplifies the guidance on the issuer’s accounting for convertible debt instruments by removing the separation models for (1) convertible debt with a cash conversion feature and (2) convertible instruments with a beneficial conversion feature. As a result, entities will not separately present in equity an embedded conversion feature in such debt and will account for a convertible debt instrument wholly as debt, unless certain other conditions are met. The elimination of these models will reduce reported interest expense and increase reported net income for entities that have issued a convertible instrument that is within the scope of ASU 2020-06. Also, ASU 2020-06 requires the application of the if-converted method for calculating diluted earnings per share and the treasury stock method will be no longer available. ASU 2020-06 is applicable for fiscal years beginning after December 15, 2021, with early adoption permitted no earlier than fiscal years beginning after December 15, 2020. The Company does not intend to early adopt ASU 2020-06; however, based on the application of the new standard on the 1.625% Notes, there would be a decrease in interest expense and an increase in the dilutive effect of convertible notes included in diluted weighted average shares of common stock outstanding for calculating earnings per share.

Personal Views: The views expressed in this report reflect our personal views. This blog post is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. The large majority of reports by us are published at irregular intervals as appropriate in our judgment and ability to produce, so updates may not be made or available even when circumstances may have changed.

No Offer: This analysis is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances. You should not construe any of the material contained herein as business, financial, investment, hedging, trading, legal, regulatory, tax, or accounting advice. The price and value of investments referred to in this analysis and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.