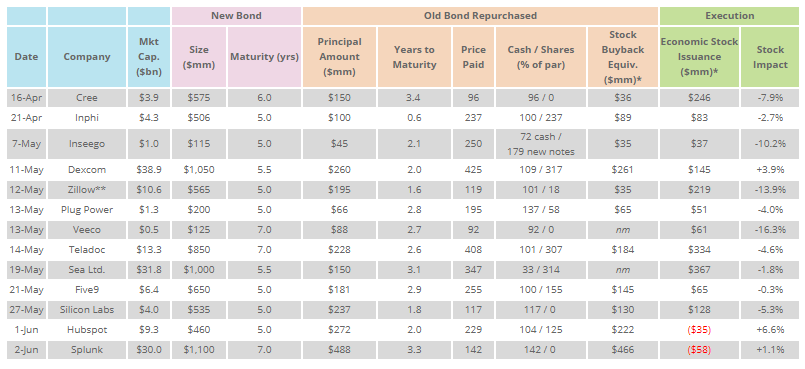

Since April, the U.S. market saw a total of $33 billion of convertible debt issued in the U.S. primary market across 65 deals, almost as much as the full-year totals for both 2018 and 2019 ($41 and $42 billion, respectively). During this period, 13 issuers repurchased existing convertible ... >>>Read More

April Convertible Market Review

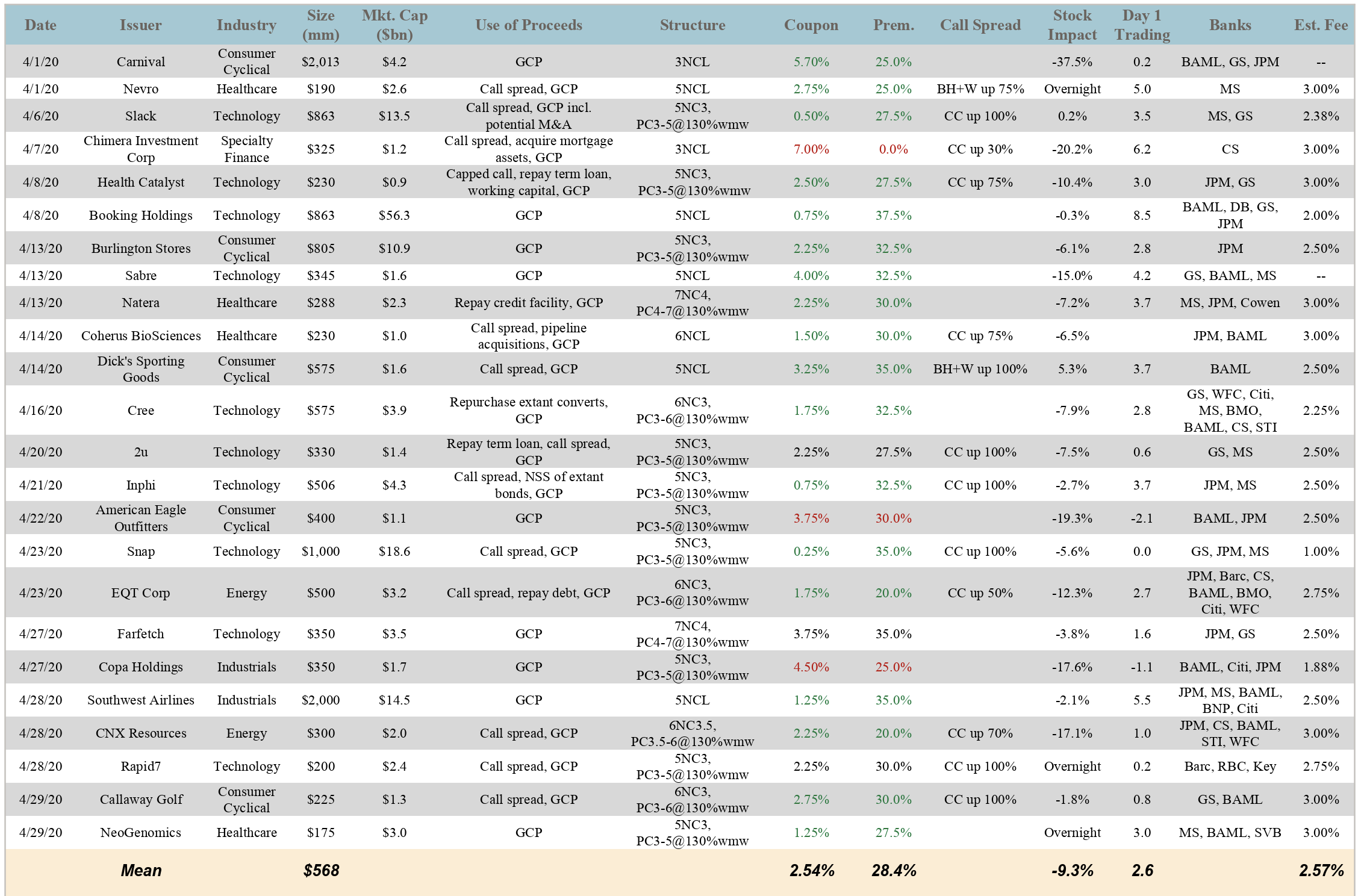

As part of our market update series, please see the summary below of what we saw in the convertible market in April. Additional details on all the deals are in the attached. Related Articles May Convertible Market ReviewJune Convertible Market ReviewJuly-August ... >>>Read More

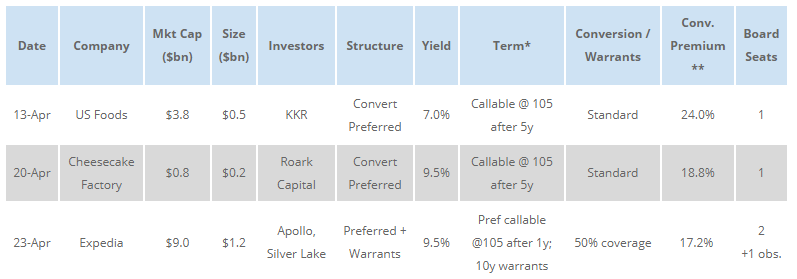

Is the PIPE Alternative Worth Considering?

In the last several weeks, we have seen companies in the sectors most directly affected by Covid-19 (consumer/retail, travel) access the private markets through PIPE investments (Private Investment in Public Equity), as well as the public equity and equity-linked markets. The table below ... >>>Read More

Convertible New Issue Market Reopens

For the first time since March 4, the convertible market saw new issuance this Wednesday (April 1), with the pricing of two deals. Both were part of larger capital raises, and both priced with model values in the 104 – 105 range in addition to credit spread assumptions meaningfully wider than ... >>>Read More

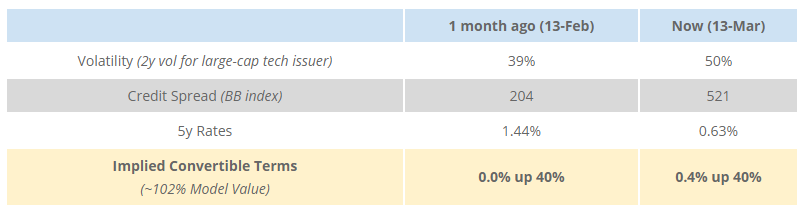

Measuring COVID-19’s Impact to the Convertible Market

Over the past three weeks, prospective issuers have heard versions of the following banker simplification of the convertible market: “Convertible pricing is very attractive because rates are at historic lows and the benefit from the increased volatility offsets widening credit spreads.” While ... >>>Read More

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 10

- Next Page »