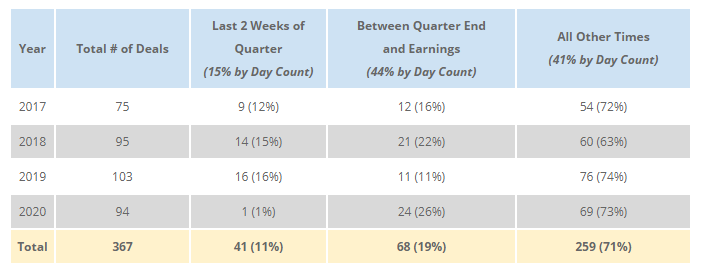

An issuer must be free of any material non-public information (“MNPI”) at the time of a securities offering. In the ordinary course, the most likely source of MPNI is information about business performance since the last earnings announcement. As an issuer gets later into the quarter or ... >>>Read More

A Costly Convertible Private Placement

Almost all new issue convertibles are sold through Rule 144A or registered offerings. So, our interest was piqued on May 8th, when Luminex Corporation (Ticker: LMNX) issued a $260mm convertible through a 4(a)(2) private placement. J. Wood Capital Advisors was the sole placement ... >>>Read More

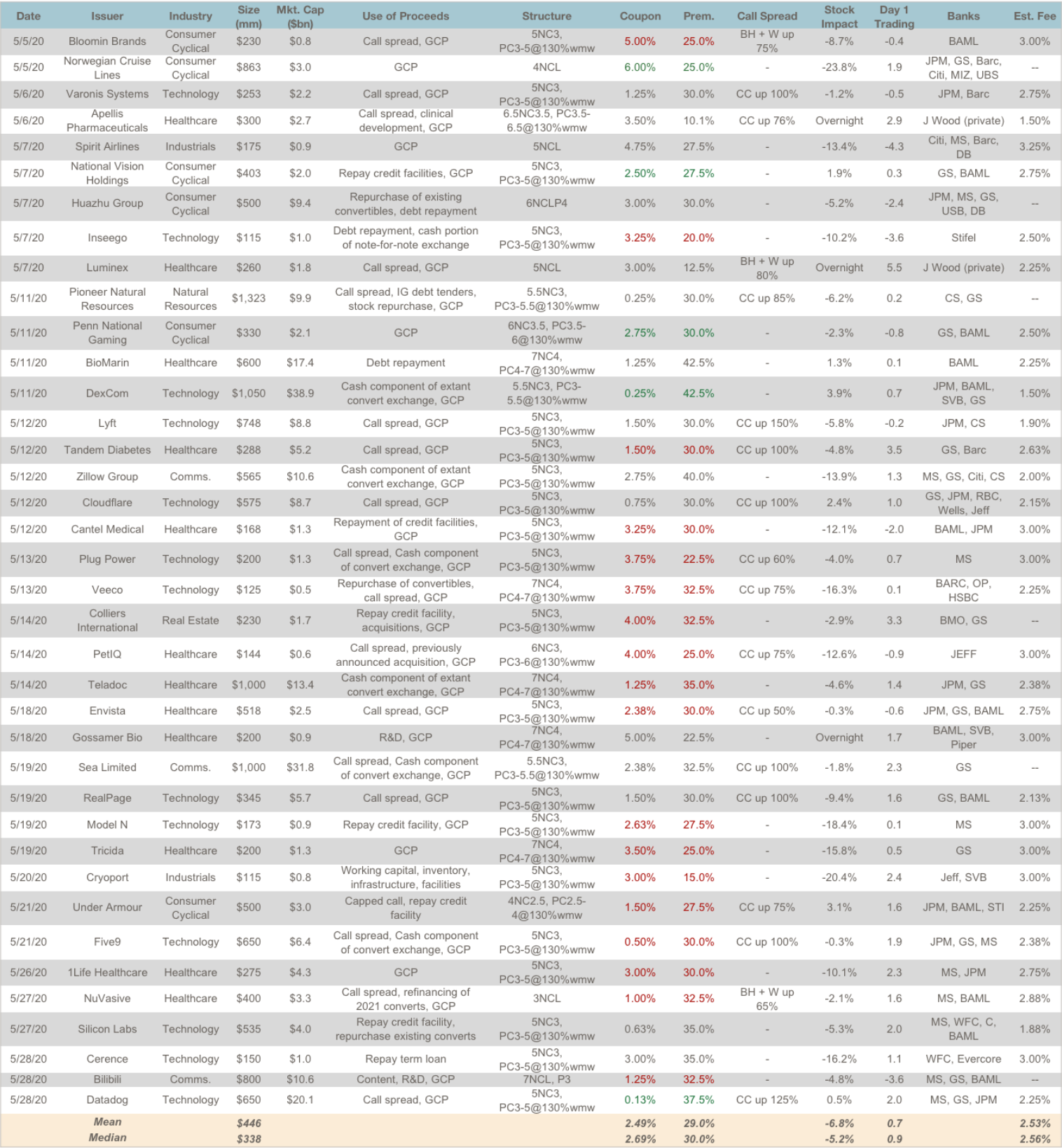

May Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in May. Additional details on all the deals are in the attached. Related Articles ... >>>Read More

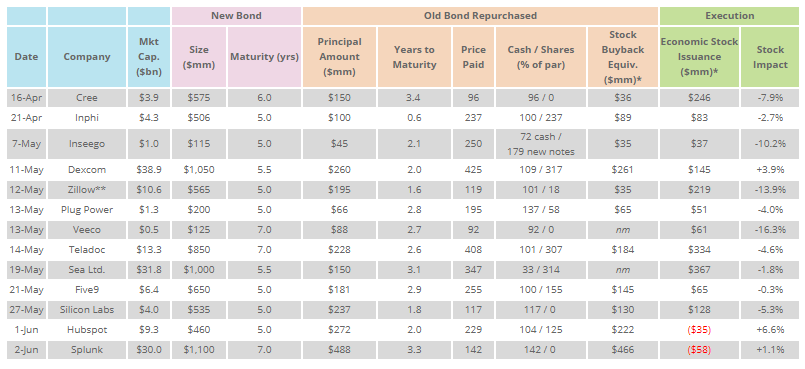

Convertible Offerings with Concurrent Bond Buybacks

Since April, the U.S. market saw a total of $33 billion of convertible debt issued in the U.S. primary market across 65 deals, almost as much as the full-year totals for both 2018 and 2019 ($41 and $42 billion, respectively). During this period, 13 issuers repurchased existing convertible ... >>>Read More

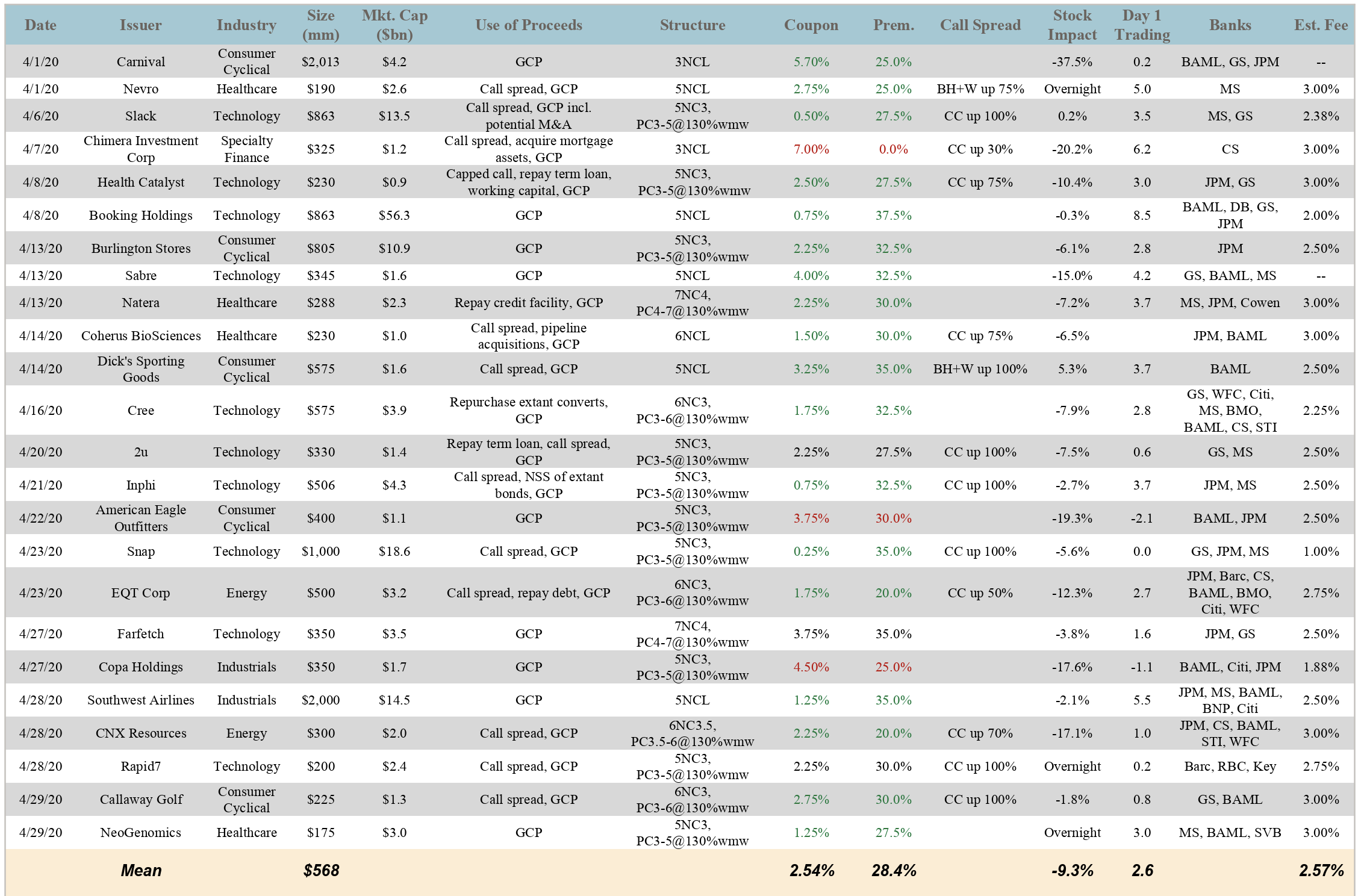

April Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in April. Additional details on all the deals are in the attached. Related Articles May Convertible Market ReviewJune Convertible Market ReviewJuly-August ... >>>Read More

- « Previous Page

- 1

- …

- 6

- 7

- 8

- 9

- 10

- …

- 14

- Next Page »