As part of our market update series, here are our takeaways in the convertible market in Q4 2023 and looking across the year. Convertible market ended 2023 with another active quarter with ~$13 billion of new issuance activity. 2023 new issuance volume finished at ~$55 billion, which is a strong ... >>>Read More

Q3 2023 Convertible Market Review

Sector Deal Count Deal Count % Volume ($bn) Volume % Technology 7 30.4% 6.1 41.5% Industrials 5 21.7% 2.4 16.3% Healthcare 3 13.0% 1.6 10.9% Consumer 3 13.0% 1.3 8.8% Real Estate 2 8.7% 0.7 4.8% Financials 1 4.3% 1.4 9.5% Utilities 1 4.3% 1.0 6.8% Basic ... >>>Read More

Q2 2023 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in the second quarter of 2023 along with some key takeaways. Q2 volume of $14.3 billion slightly surpassed Q1 volume of $13.2 billion, and now puts 2023 on pace for ~$55 billion of ... >>>Read More

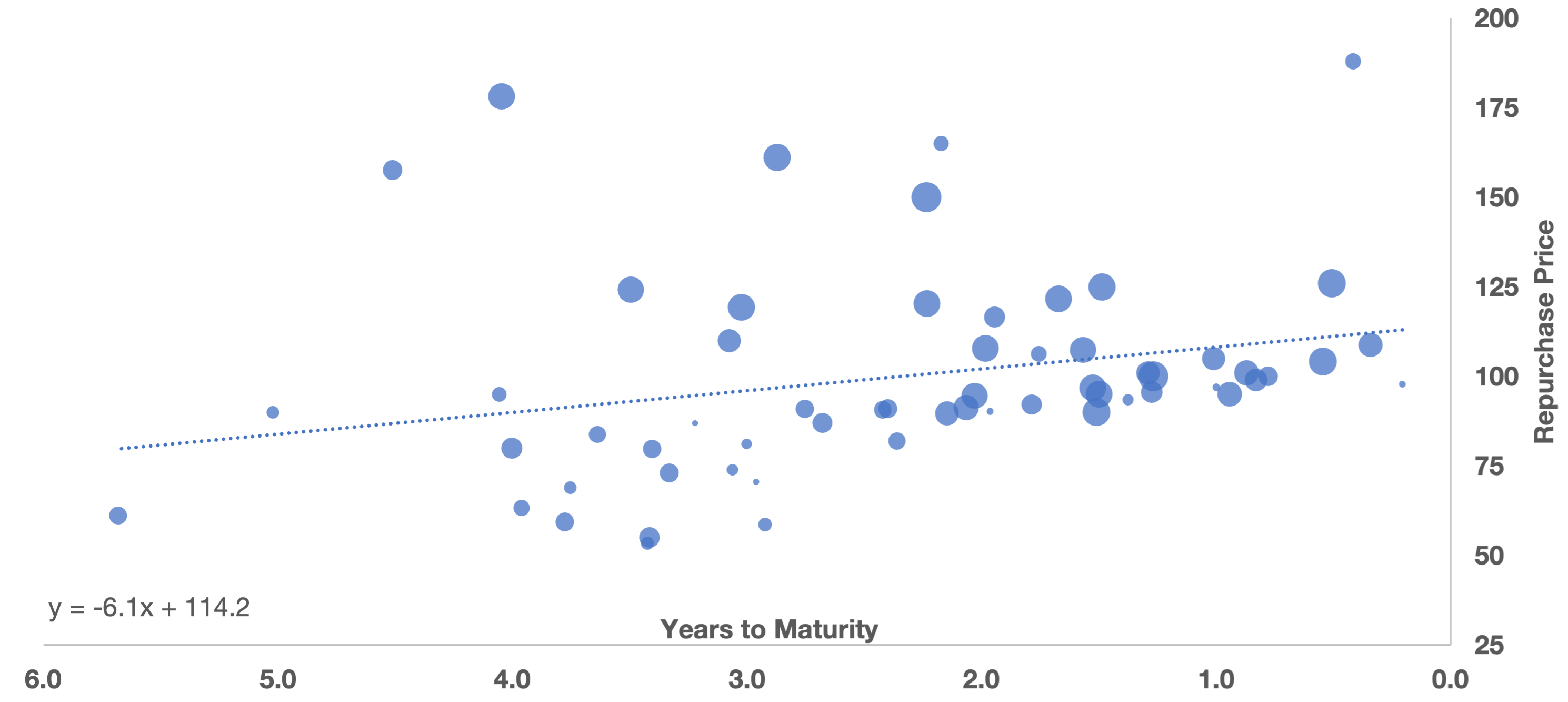

Convertible Liability Management: Earlier and More Outside of Convert-for-Convert Refinancings

We have previously discussed the economic rationale for repurchasing convertible bonds in times of market turbulence. Today we look at actual data regarding recent liability management transactions, and find:Over the past year, issuers have addressed upcoming convertible maturities on average 2.35 ... >>>Read More

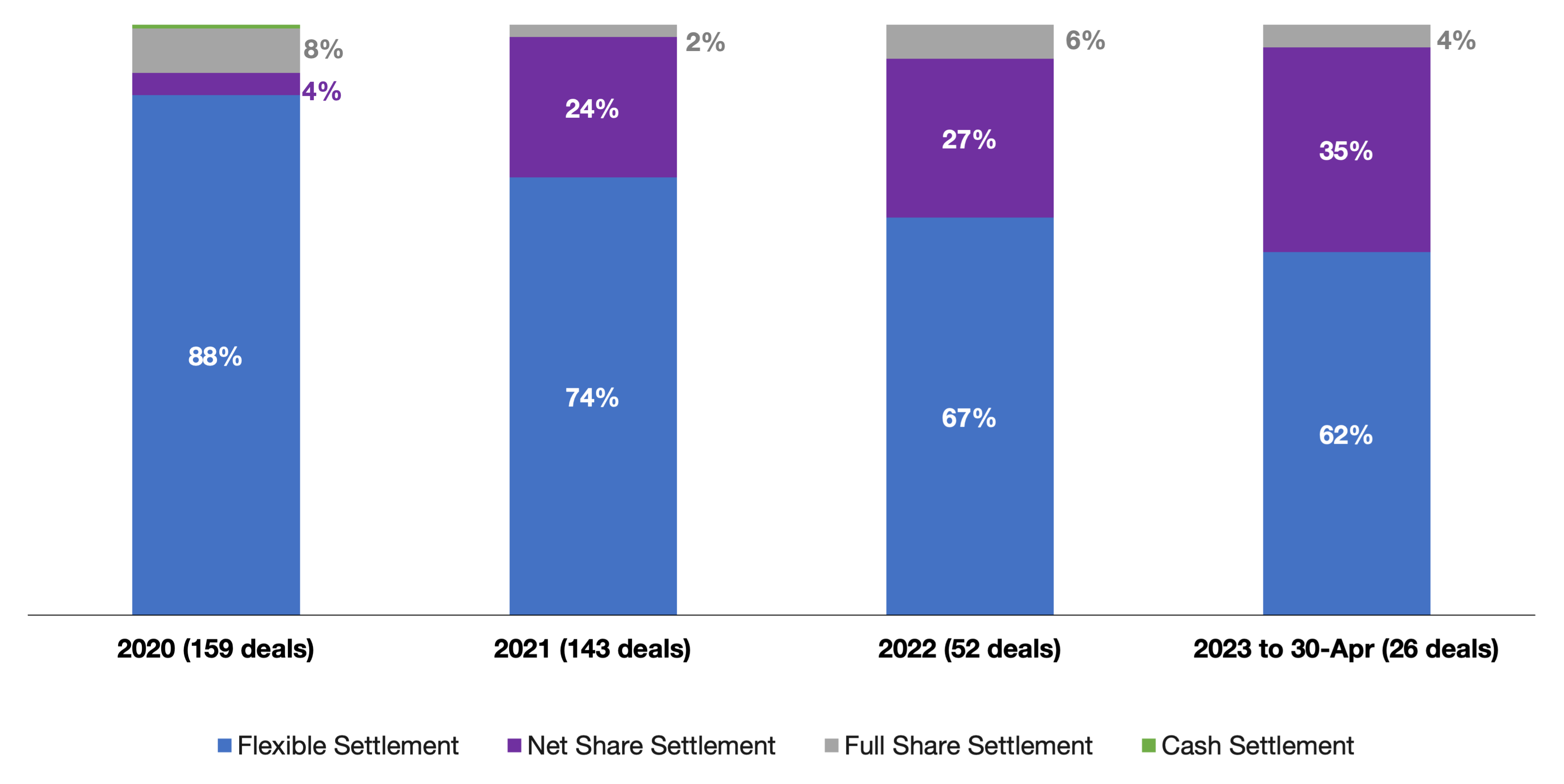

Update: Convertible Settlement Method Structuring after New Accounting Standards

In a prior post we examined the nascent shift from convertible bonds being structured predominantly as “Flexible Settlement” towards being structured as “Net Share Settled”. This migration began in 2021 as issuers began to early-adopt the new accounting standards under FASB’s Accounting Standards ... >>>Read More

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 14

- Next Page »