On September 3rd, Insulet issued $800mm (including greenshoe) of new 7-year convertible bonds, and bought back $225mm principal amount of its old convertibles due 2021. Matthews South was not involved in the transaction. JWood was the independent advisor to the company. The Insulet ... >>>Read More

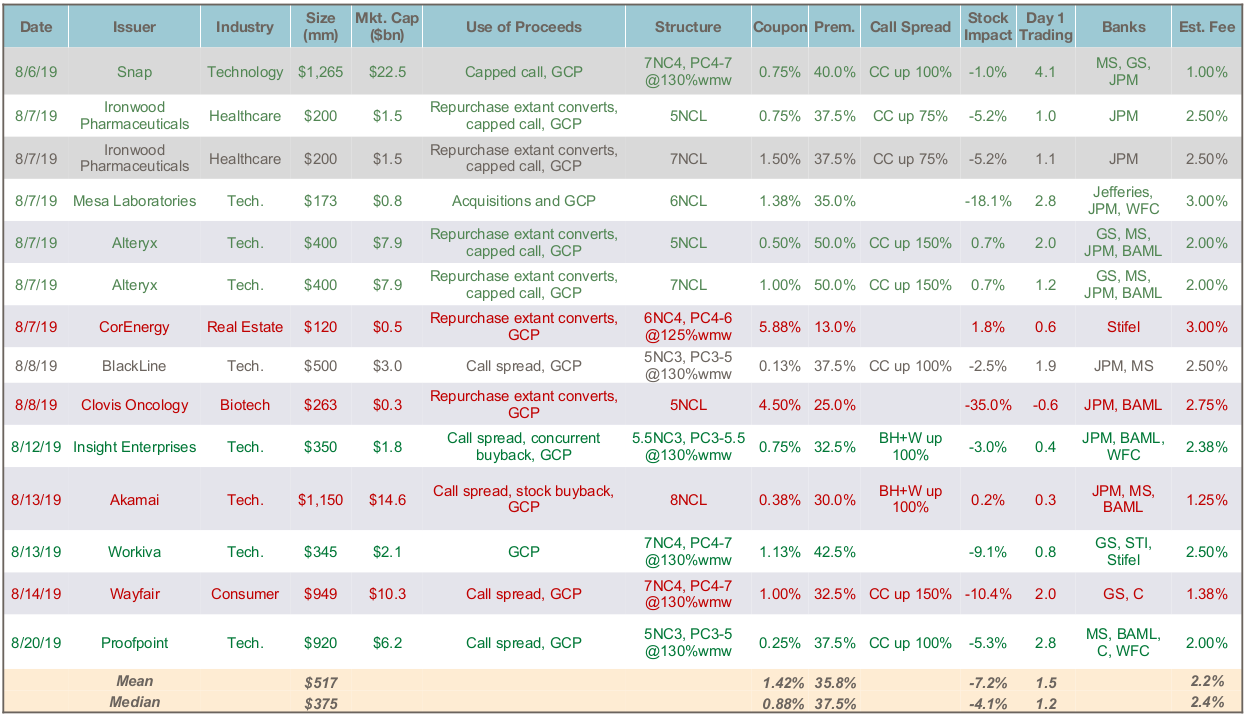

August Convertible Market Review

Total Issuance: Activity picked up significantly in August, with $7.2 billion of convertible bond issuance over 12 transactions. This makes August the busiest month of 2019, and brings the YTD total issuance to $26.9 billion, versus $32.1 billion in 2018 through August.Market Dynamics: August did ... >>>Read More

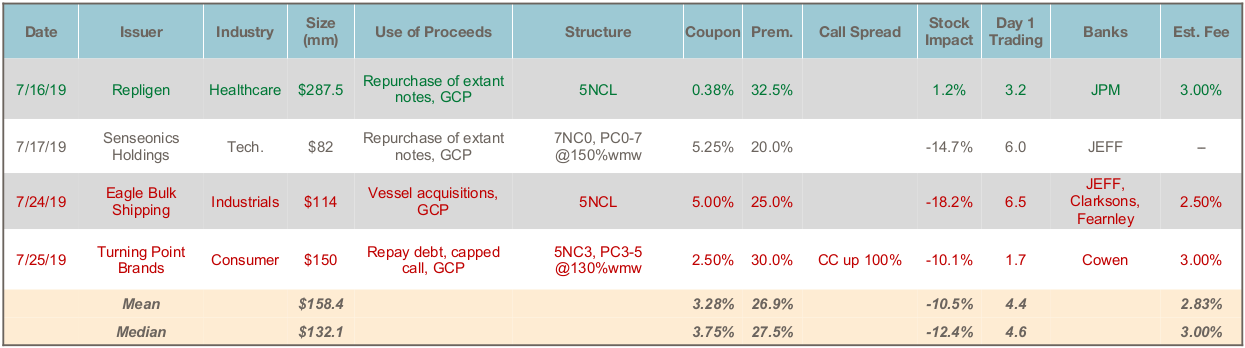

July Convertible Market Review

Total Issuance: July is typically quiet with many companies in blackout for much of the month, and last month was especially so – with only 4 small convertible debt deals pricing for a total of $634mm. By comparison, July 2018 saw 5 deals for a total of $2.4 billion. Total issuance YTD is $19.6 ... >>>Read More

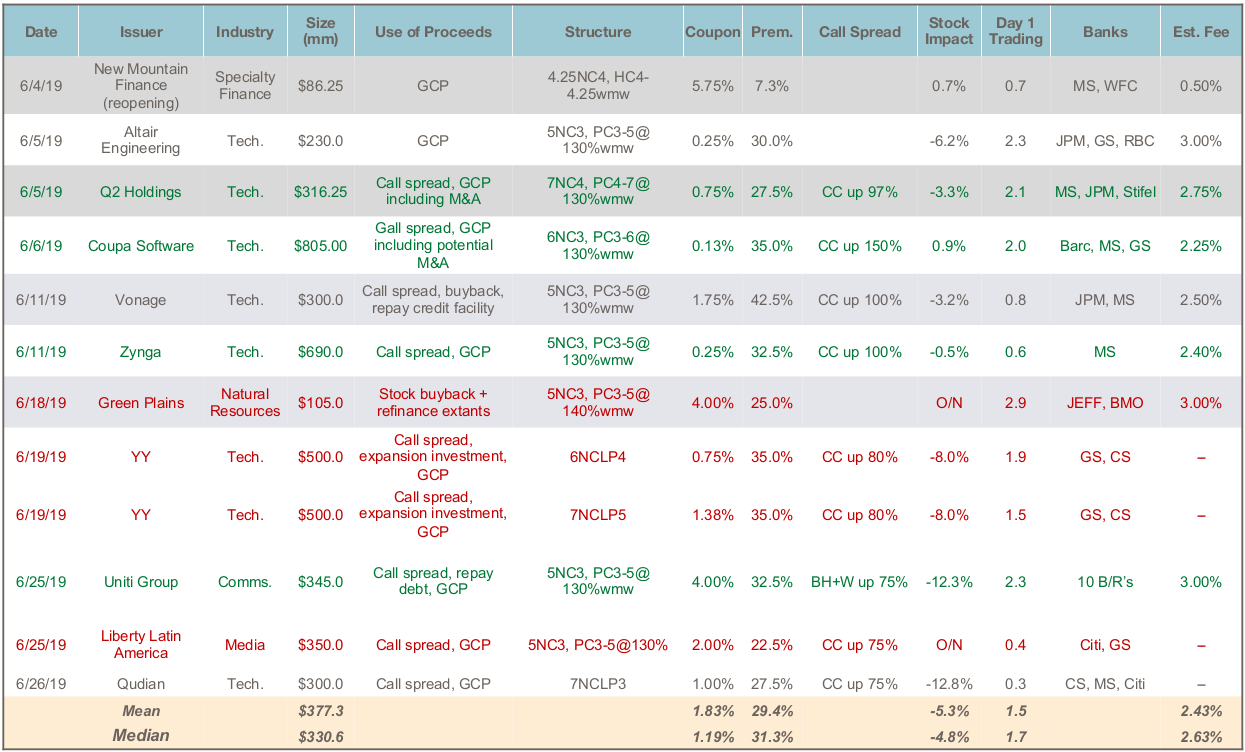

June Convertible Market Review

Total Issuance: Activity remained robust in June, with $4.5 billion of new convertible bond issuance over 11 transactions (notwithstanding that many issuers entered blackout in the second half of the month). Year to date there is now $19.8 billion total issuance, less than 2018 1H’s total of $26.6 ... >>>Read More

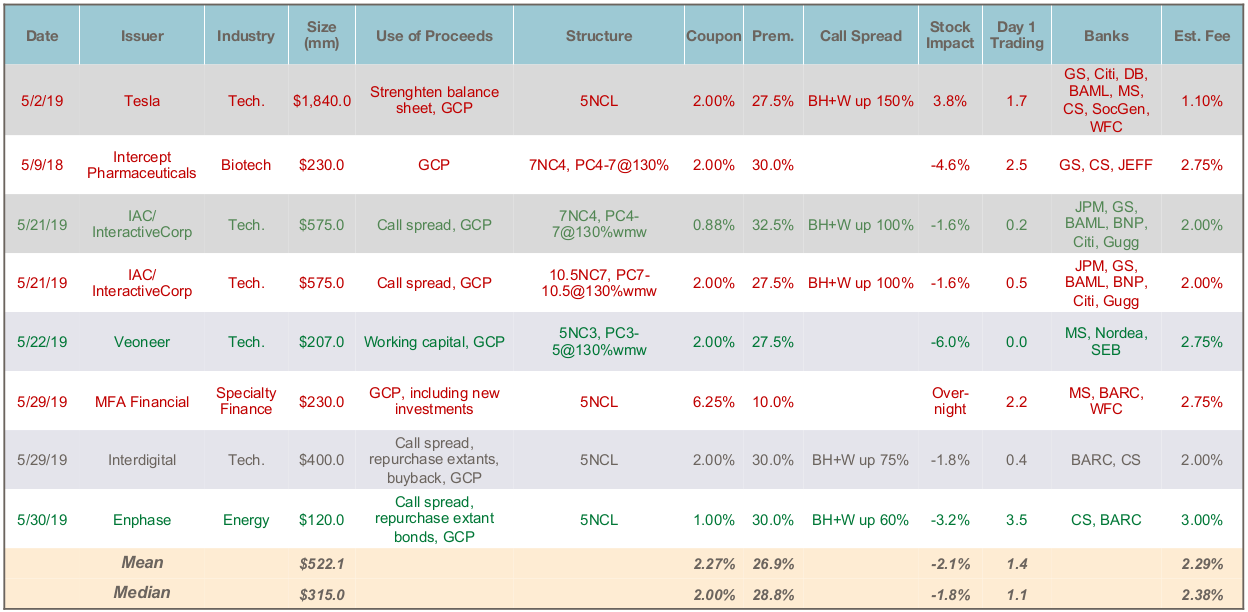

May Convertible Market Review

Total Issuance: Activity picked up from April to May, with $4.3 billion of new convertible bond issuance over 8 transactions. Year-to-date there has now been $14.4 billion of total issuance in 31 deals. This is behind last year’s pace of $19.2 billion over 51 deals over the first five months of the ... >>>Read More