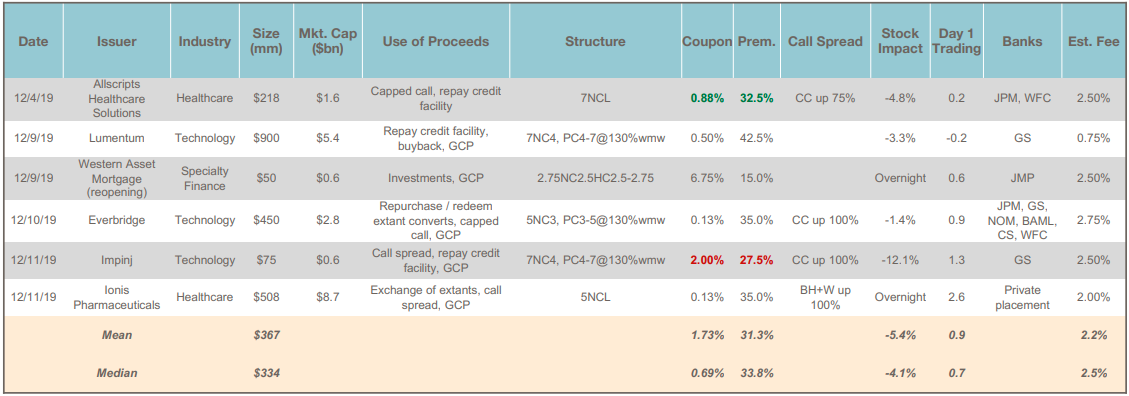

Total Issuance: December saw 6 convertible debt deals for a total of $2.2 billion. This brings the 2019 total to $41.5 billion of convertible debt issuance over 101 deals. By comparison, 2018 saw $41.0 billion of issuance over 103 deals (2017: $28.2 billion / 80 deals). ... >>>Read More

November Convertible Market Review

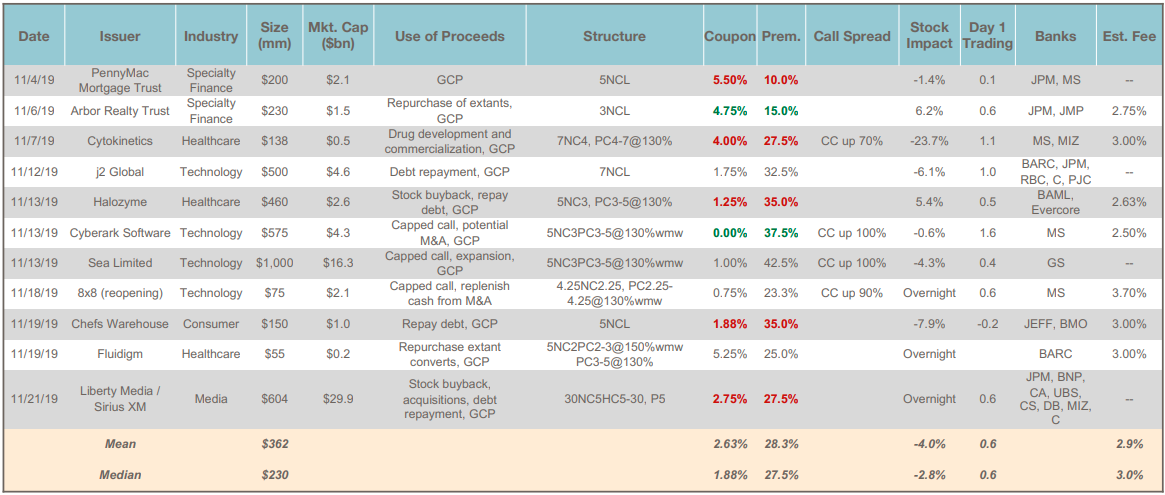

Total Issuance: November activity picked up after a quiet October, with 11 convertible debt deals pricing for a total of $4.0 billion. This brings the YTD total to $39.1 billion — on pace to surpass last year’s full year total of $41.0 billion.Flexibility: November’s new issuance showcased the ... >>>Read More

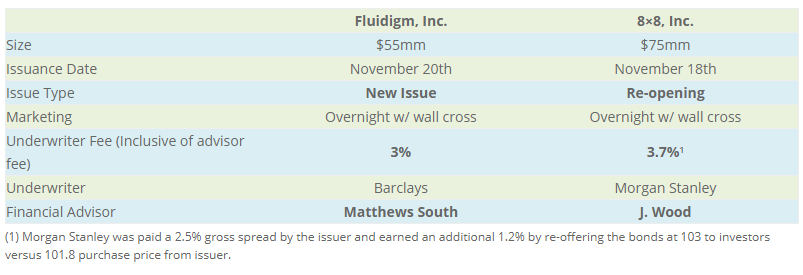

An appropriate fee for a convertible bond?

During the week before Thanksgiving, the coincidental execution of two convertible bond transactions provided a classic “A/B” comparison that highlights the variability in fees paid by issuers and the important role of the financial advisor in this regard. What is a typical fee for sub-$100mm ... >>>Read More

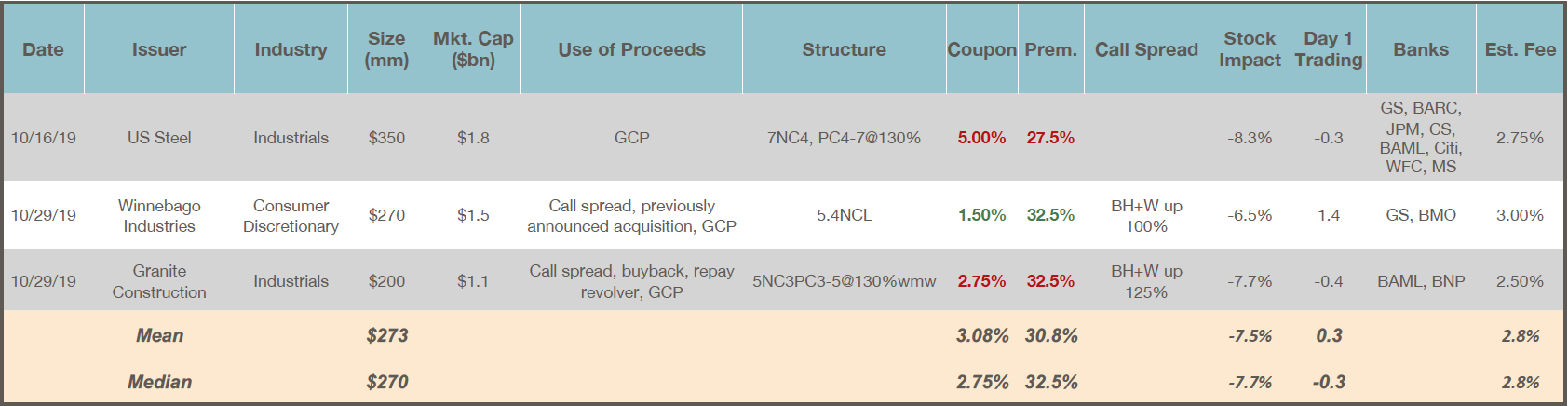

October Convertible Market Review

Total Issuance: October was typically quiet, with the majority of issuers in blackout for the bulk of the month pending Q3 earnings releases. $820mm of convertible debt priced in 3 transactions, bringing the YTD total to $35.1 billion (vs. $37.0 billion for the same period in 2018). ... >>>Read More

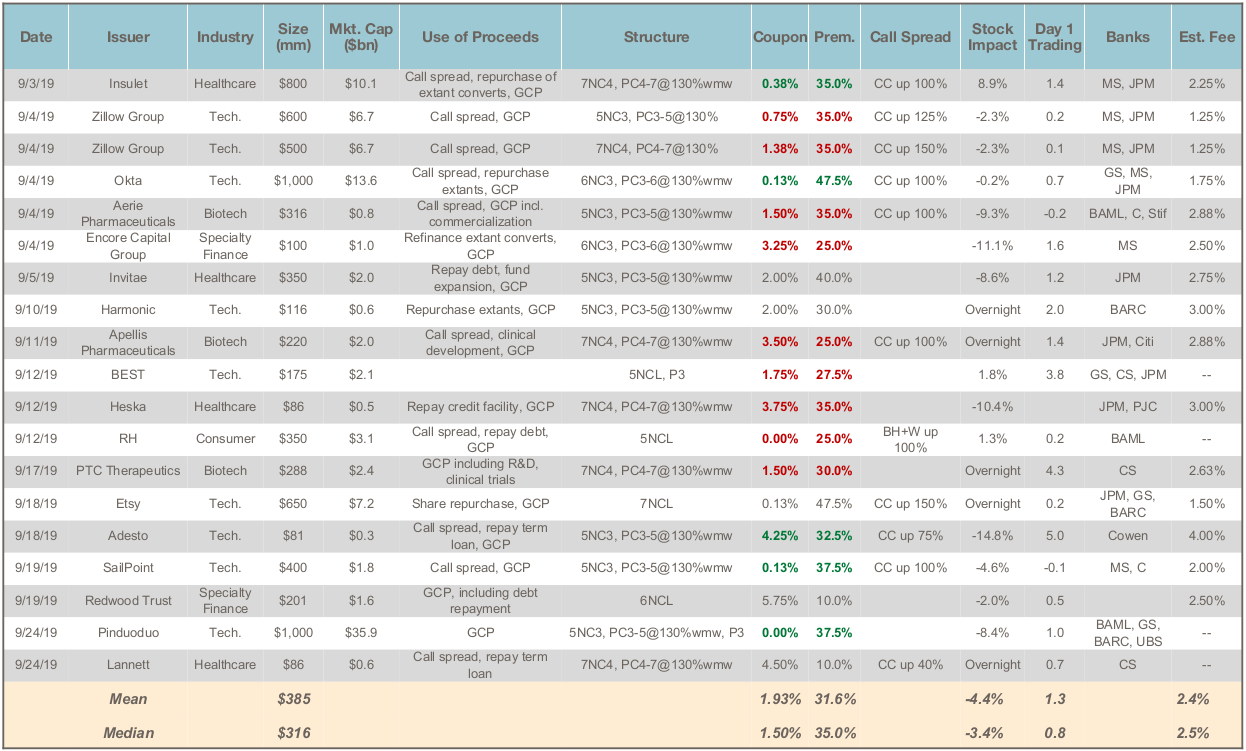

September Convertible Market Review

Total Issuance: September was the busiest month of the year, surpassing August. There was $7.3 billion of convertible bond issuance over 18 transactions, bringing the 2019 total to $34.2 billion (vs. $35.7 billion for the same period in 2018). There was also $4.75 of mandatory convertibles issued by ... >>>Read More

- « Previous Page

- 1

- …

- 9

- 10

- 11

- 12

- 13

- 14

- Next Page »