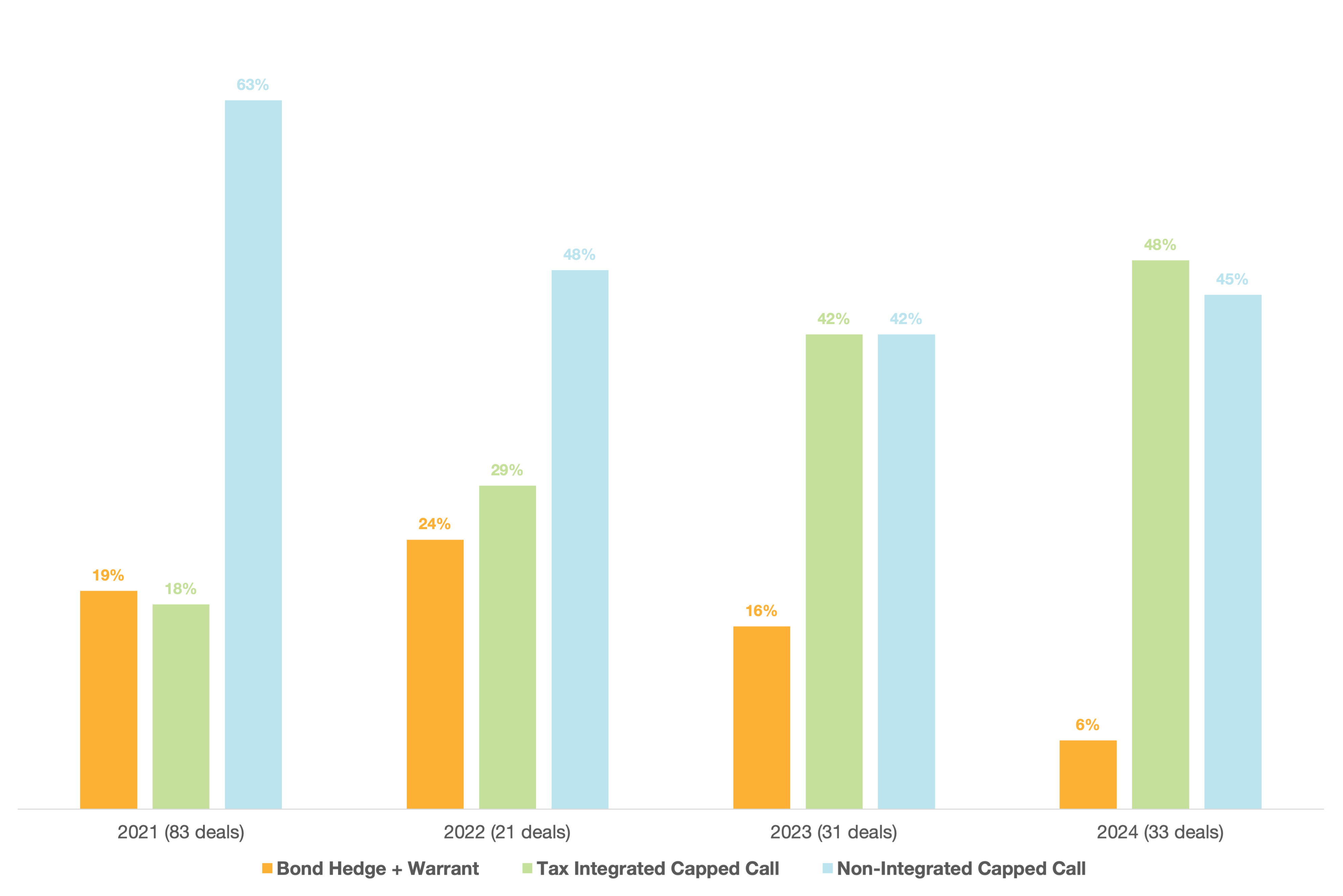

In the U.S. convertible market, about half of new deals are accompanied by call spreads, a transaction in which issuers purchase a derivative from banks that raises the effective conversion premium of the transaction to levels not typically available from the convertible market (e.g., 100% premium ... >>>Read More