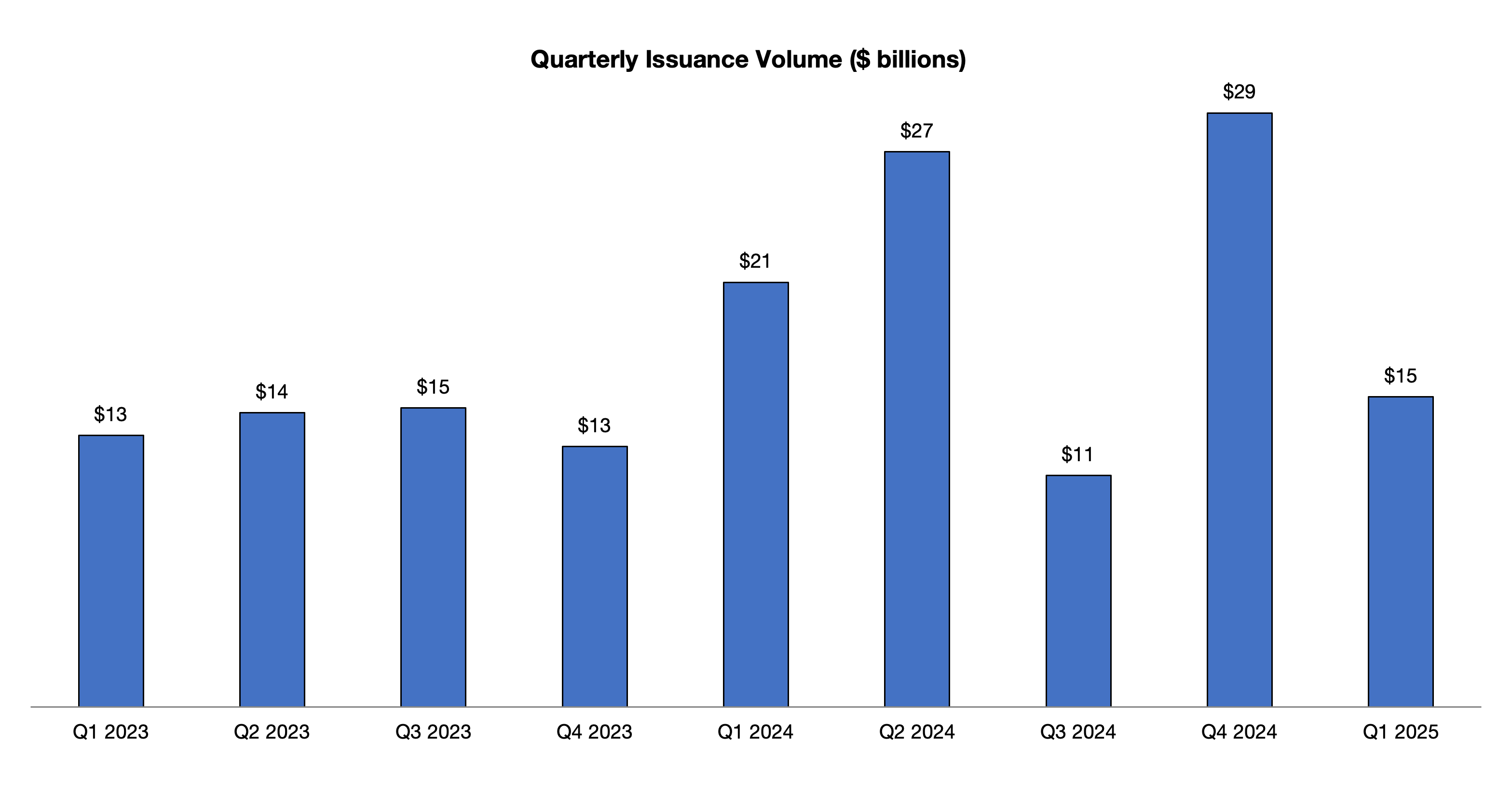

As part of our market update series, below are our key takeaways in the convertible market in the first quarter of 2025. New issue activity in Q1 totaled $15.1 billion, tracking 31% below 2024 issuance levels but in-line with historical averages. Potential issuers have remained on the sidelines to ... >>>Read More

2024 Year-End Convertible Market Review

As part of our market update series, below are our key takeaways in the convertible market in Q4 2024 and looking back on the year. New issue activity in the convertible market was significant with $29 billion volume in Q4, bringing total issuance for the year to $88 billion. Issuance volumes ... >>>Read More

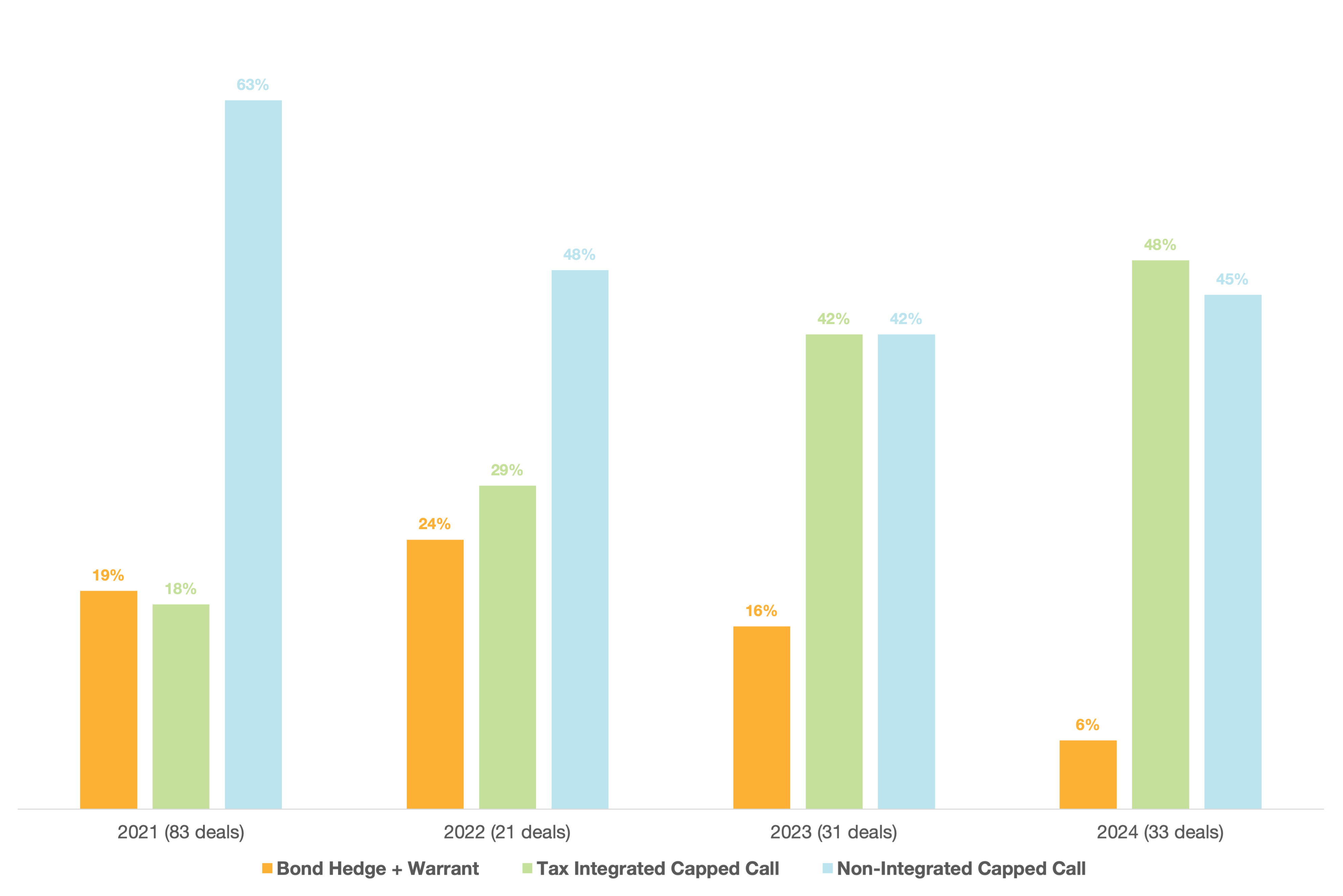

Trends in the Call Spread Market

In the U.S. convertible market, about half of new deals are accompanied by call spreads, a transaction in which issuers purchase a derivative from banks that raises the effective conversion premium of the transaction to levels not typically available from the convertible market (e.g., 100% premium ... >>>Read More

Q2 2024 Convertible Market Review

As part of our market update series, here are our key takeaways from the convertible market in the second quarter of 2024.There was $27 billion of new issuance in the quarter, putting 2024 on pace for ~$97 billion of total volume. The second quarter was the most active in the convertible market ... >>>Read More

Q1 2024 Convertible Market Review

As part of our market update series, here are our key takeaways from the convertible market in the first quarter of 2024. The convertible market started 2024 with a very active quarter yielding ~$20 billion of new issuance. The past quarter was the busiest quarter since the “covid wave” in Q1 ... >>>Read More

- 1

- 2

- 3

- …

- 14

- Next Page »