Companies in the S&P 500 alone spent $770 billion in the past four quarters on share repurchase. The majority of this buyback was executed through open market repurchases (“OMR”), including 10b5-1 plans. In OMR programs, the broker, as an agent of the company, executes the ... >>>Read More

Should ASRs have the “Lookback” Termination Feature?

In a variable maturity ASR, the bank has the right to terminate the ASR on any date that occurs between the specified first acceleration and final termination dates. In return for having this valuable optionality, the bank agrees to provide the issuer with a guaranteed discount to VWAP. Most ... >>>Read More

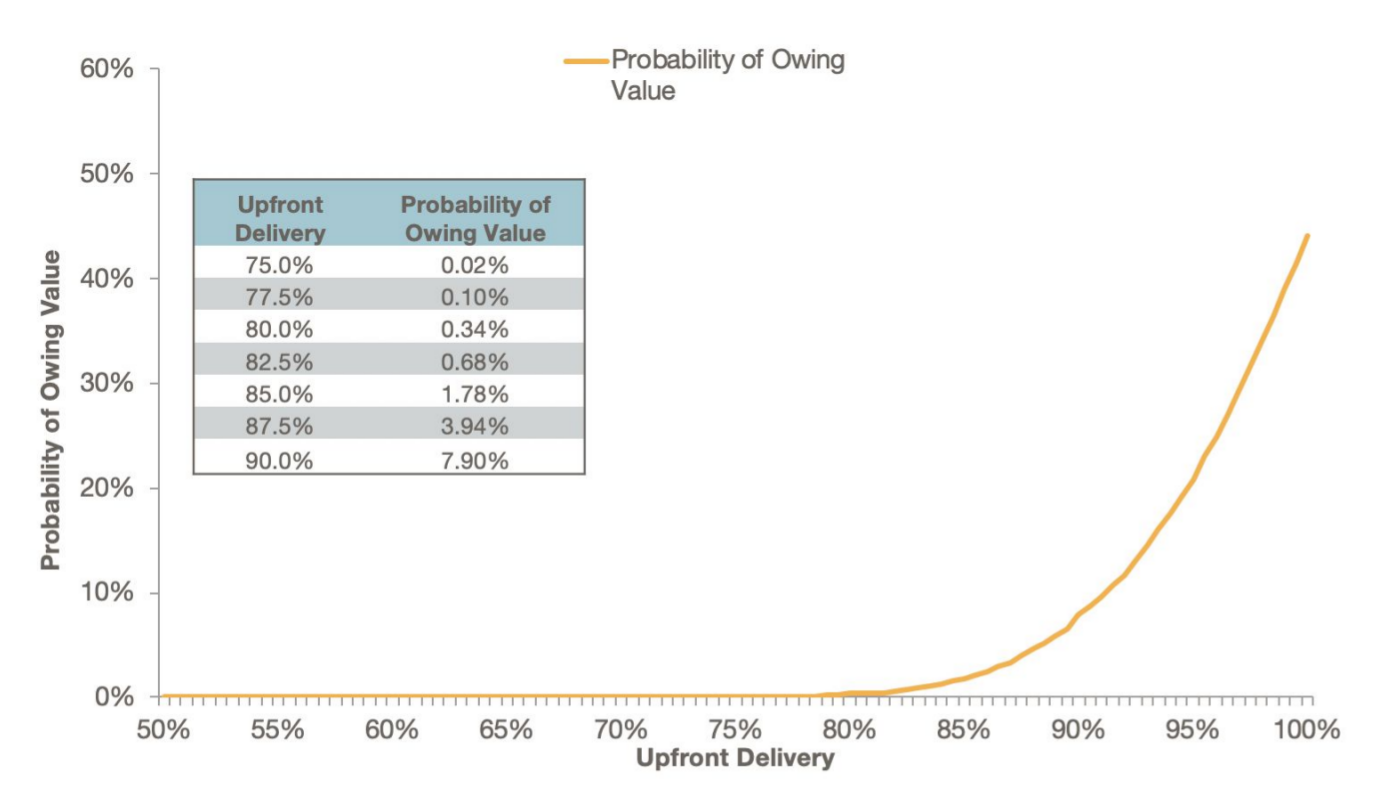

Should all ASRs have 80% Upfront Share Delivery?

An attractive feature of ASRs is the upfront share delivery. The immediate retirement of shares provides greater EPS improvement than an equivalent amount of open market share repurchases. The delivery also significantly reduces the credit exposure to the bank that is created by the ... >>>Read More

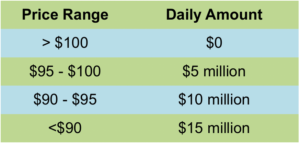

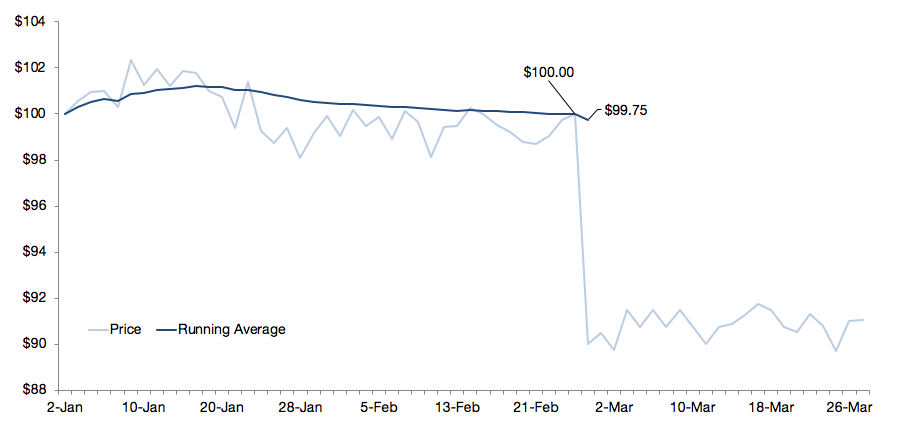

“Low Cost” eOMR for Industrial Company

Matthews South advised a large cap industrial company on its first Enhanced Open Market Repurchase (“eOMR”). The eOMR is an open market program intended to maximize the discount to VWAP. The program does this by using an algorithm to determine the daily purchases. Our client had considered ... >>>Read More

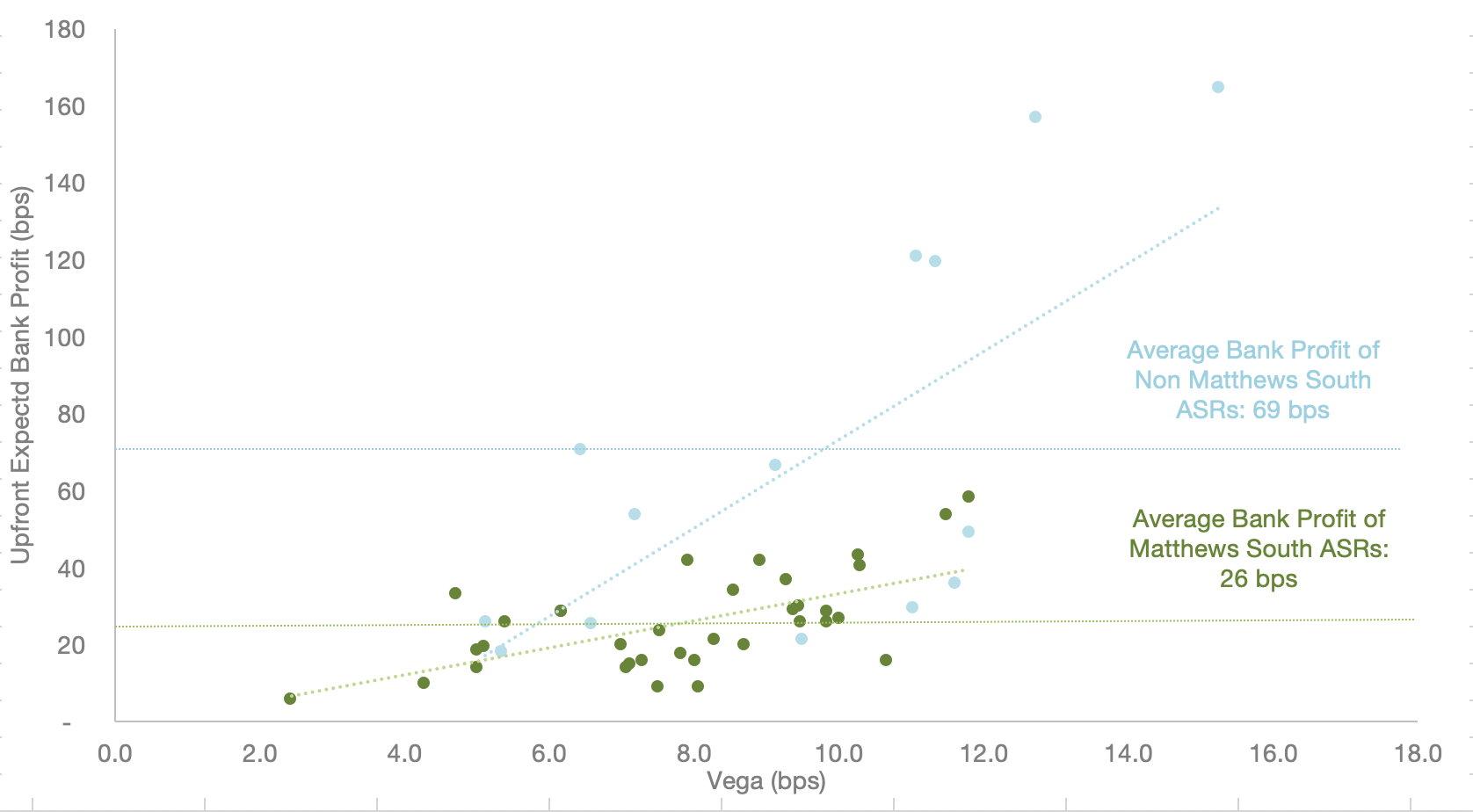

Are You Getting the Best ASR Pricing?

Over the past five years, Matthews South has advised clients on over $30 billion of ASR transactions. As a result, we have collected a large amount of data on achieving the best pricing for ASRs. In this write-up, we “open source” our findings so that all ASR issuers may benefit from what we have ... >>>Read More