This is the third of a series of posts examining the redemption features of warrants in post-SPAC public companies. In the first post, we described typical redemption features in warrants. The second post discussed how issuers might economically analyze whether and when to redeem the warrants. ... >>>Read More

Q3 2021 Convertible Market Review

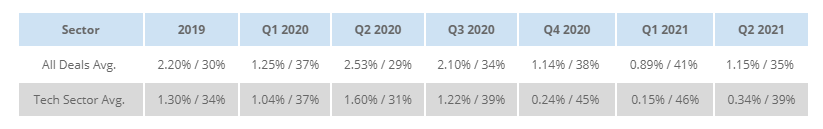

As part of our market update series, please see the summary below of what we saw in the convertible market in Q3 2021. New Issuance. Q3 2021 saw 23 new issue convertible deals (22 debt & 1 mandatory) with dollar volumes of $15.0bn, compared to $17.0bn across 30 deals from Q2 2021 and $19.9bn ... >>>Read More

Post-SPAC Warrant Redemption Features (Part 2)

This is the second of a three-part series of posts examining the redemption features of warrants in post-SPAC public companies. In the first post, we described typical redemption features in warrants. Here we introduce economic frameworks for how issuers can approach the decision whether and when ... >>>Read More

Post-SPAC Warrant Redemption Features (Part 1)

This is the first of a three-part series of posts examining the redemption features of SPAC warrants: here, we describe the typical redemption features found in SPAC warrants. In subsequent posts we will examine (1) how to approach the decision whether and when to redeem warrants and (2) what ... >>>Read More

Q2 2021 Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in Q2 2021. Related Articles Q1 2021 Convertible Market Review Q3 2021 Convertible Market Review Q4 2021 Convertible Market Review ... >>>Read More

- « Previous Page

- 1

- …

- 6

- 7

- 8

- 9

- 10

- …

- 19

- Next Page »