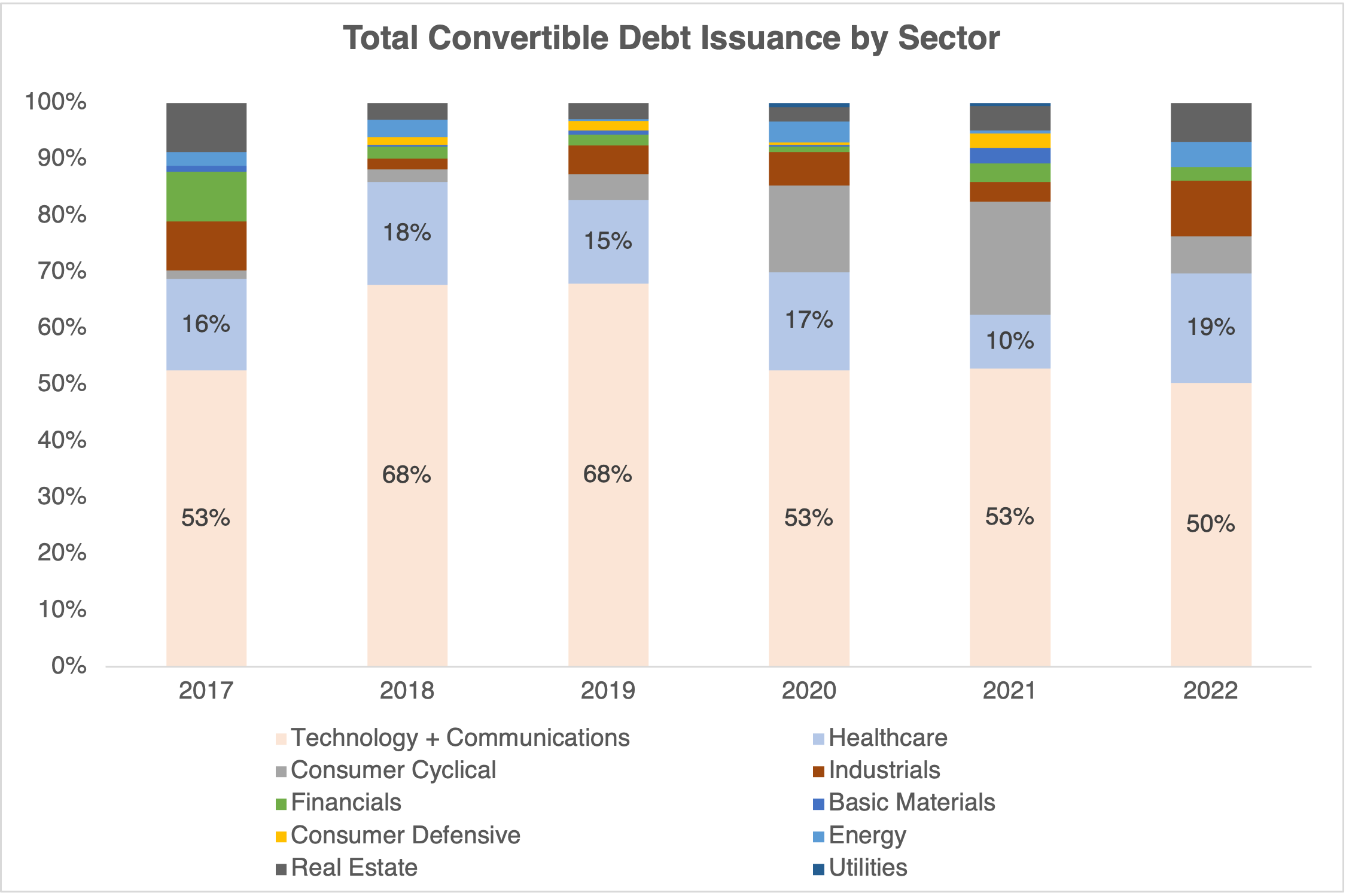

As part of our market update series, please see the summary below of what we saw in the convertible market in Q2 2022. New Issuance. The convertible market continues to see a slow down in new issue paper with 10 deals in Q2 (all debt) worth $3.4bn. This level of issuance is the lowest in the past ... >>>Read More

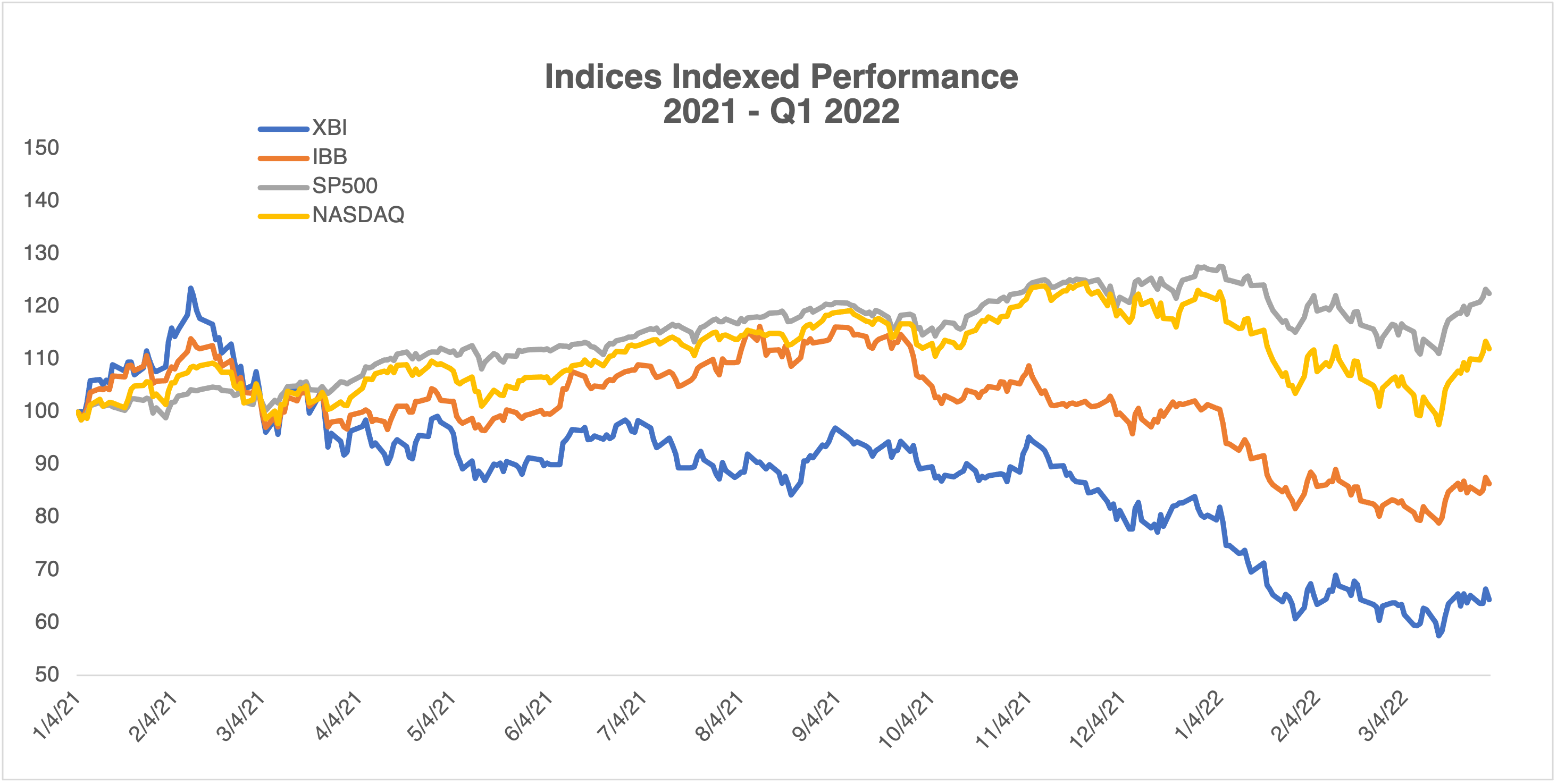

Convertible Issuance in Life Sciences: How, When and Why

In the first installment of our three-part series on the financing landscape for life sciences issuers, we covered the evolution of the typical life sciences IPO. In the second installment, we covered post-IPO financing dynamics and the importance of laying the foundation for successful capital ... >>>Read More

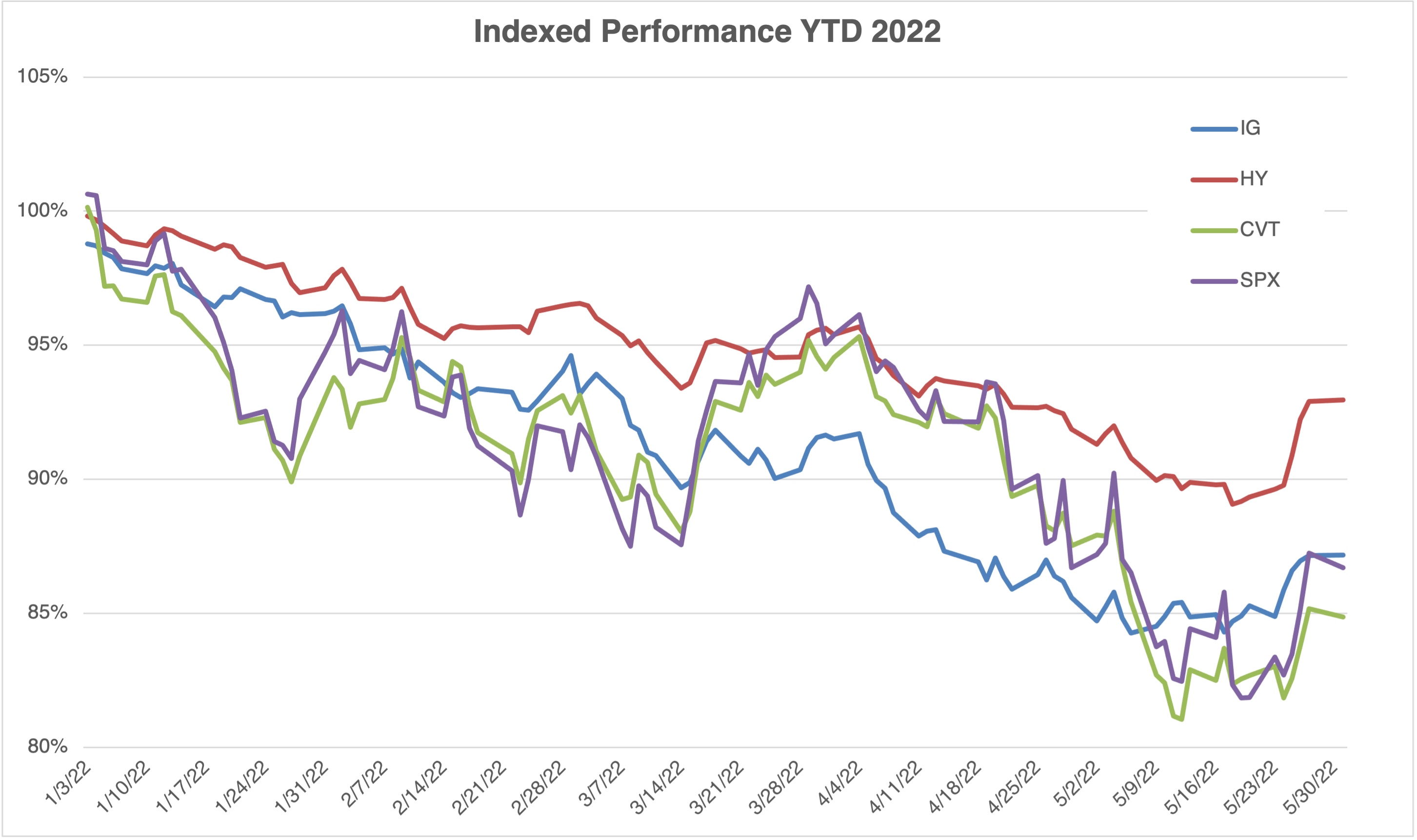

Are the Financing Markets Really Open? – An Examination of the US Equity, Convertible, High Yield, and Investment Grade Markets in Spring 2022

With Federal Reserve tightening and geopolitical uncertainty rising in the last few months, we have seen gains accumulated during COVID dissipate since the start of the year. Consequently, US secondary markets have caused drastic shifts in primary issuance behavior in each of the major financing ... >>>Read More

Share Buyback 101 for Beginners

As a service for those who may not have prior experience with stock repurchase strategies, we provide background information on some general questions. Why do companies do share buybacks? A share buyback is a method of capital return to shareholders. Companies may choose to repurchase ... >>>Read More

Post-IPO Financing Dynamics: How to Lay the Foundation for Successful Capital Raises

In the first installment of our three-part series on the financing landscape for life sciences issuers, we covered the evolution of the typical life sciences IPO. In this second installment, we will cover post-IPO financing dynamics and the importance of laying the foundation for successful capital ... >>>Read More

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- …

- 19

- Next Page »