As part of our market update series, please see the summary below of what we saw in the convertible market in the second quarter of 2023 along with some key takeaways. Q2 volume of $14.3 billion slightly surpassed Q1 volume of $13.2 billion, and now puts 2023 on pace for ~$55 billion of ... >>>Read More

Convertible Liability Management: Earlier and More Outside of Convert-for-Convert Refinancings

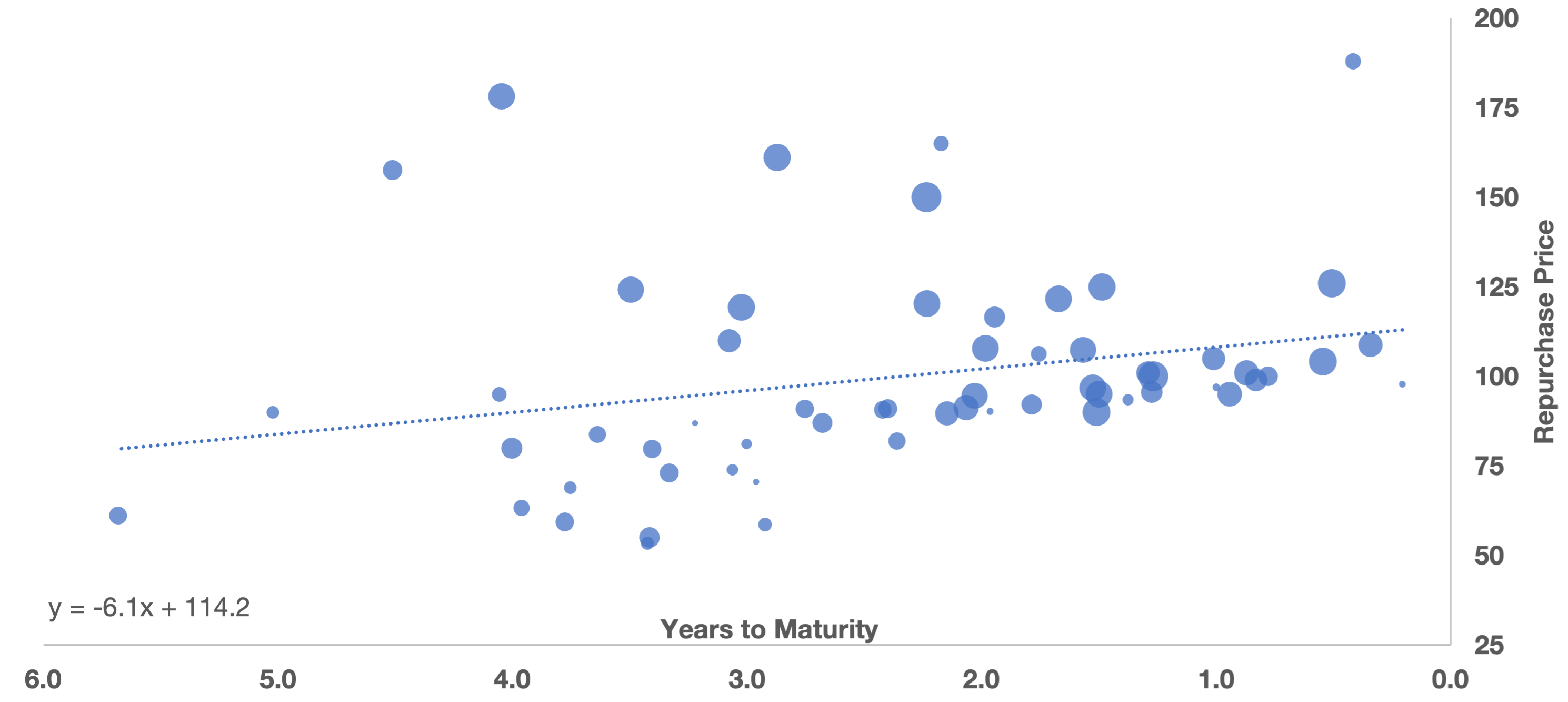

We have previously discussed the economic rationale for repurchasing convertible bonds in times of market turbulence. Today we look at actual data regarding recent liability management transactions, and find:Over the past year, issuers have addressed upcoming convertible maturities on average 2.35 ... >>>Read More

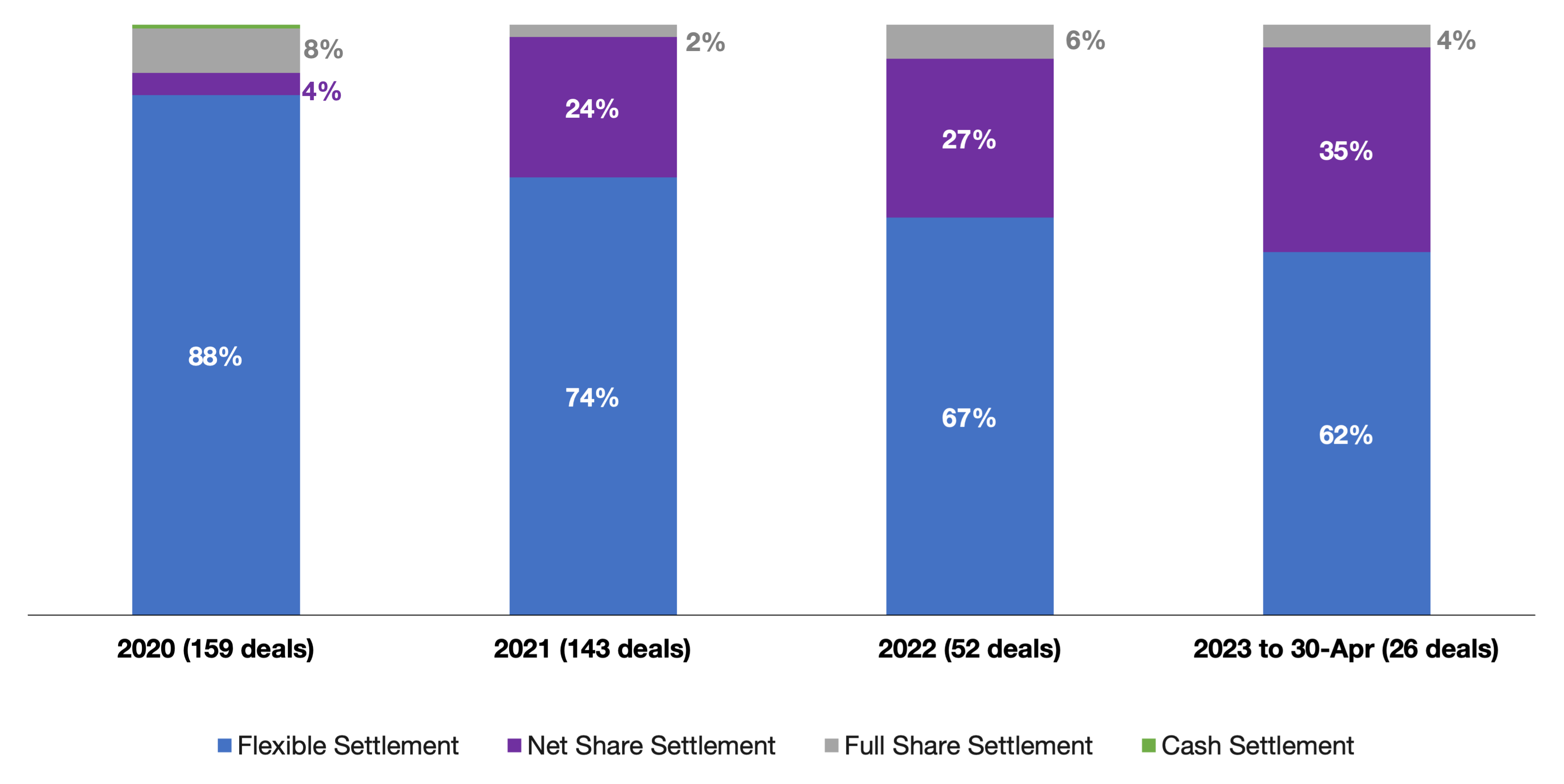

Update: Convertible Settlement Method Structuring after New Accounting Standards

In a prior post we examined the nascent shift from convertible bonds being structured predominantly as “Flexible Settlement” towards being structured as “Net Share Settled”. This migration began in 2021 as issuers began to early-adopt the new accounting standards under FASB’s Accounting Standards ... >>>Read More

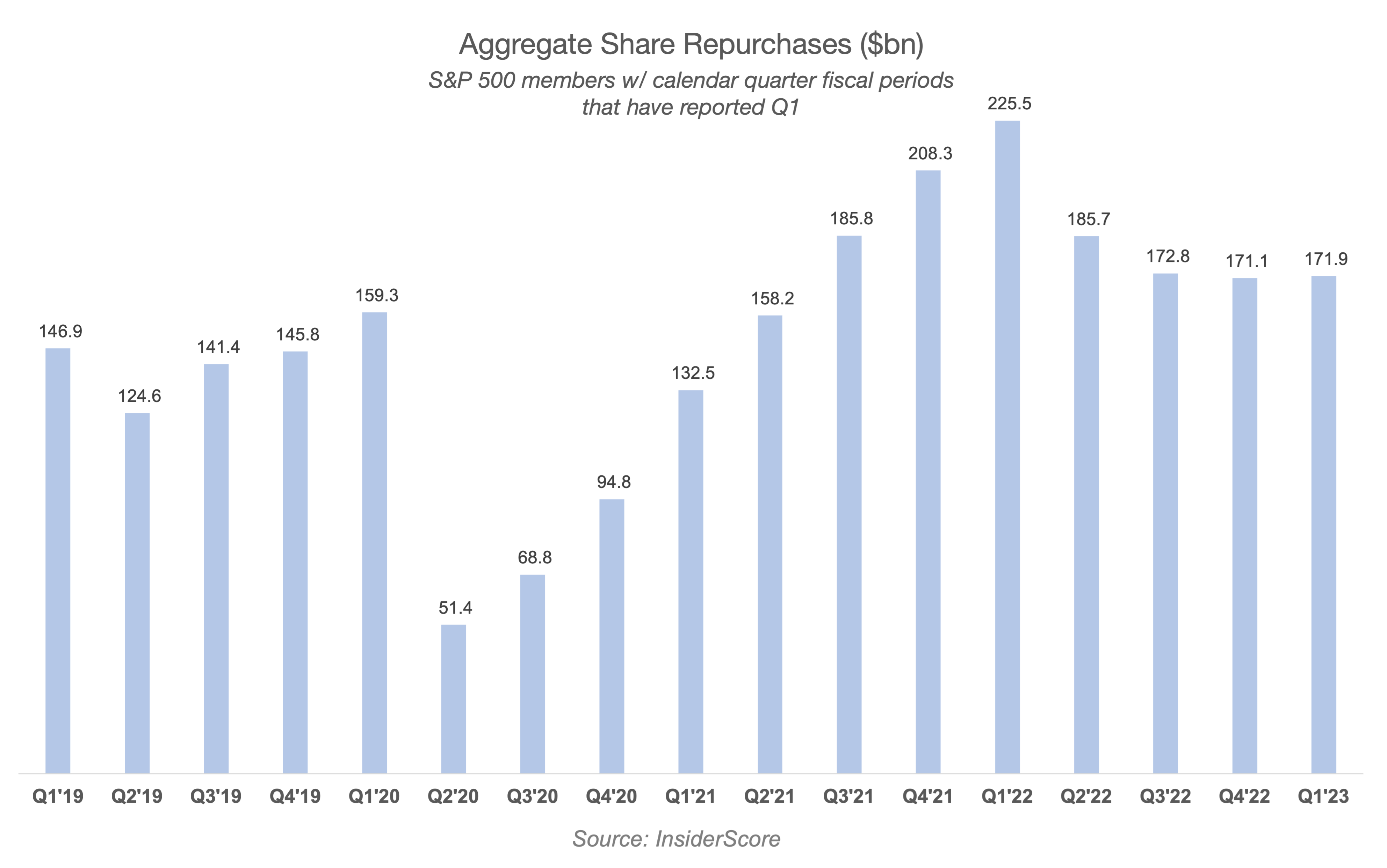

Early Read: No Meaningful Impact in Q1 from 1% Tax on Stock Buybacks

The Inflation Reduction Act of 2022 implemented an excise tax on corporations equal to 1% of the fair market value of stock repurchased during each taxable year, netted against the value of shares issued (including for stock-based compensation). The IRS followed up with more detailed guidance. The ... >>>Read More

Managing Debt in an Uncertain Environment – Assessing a Cash Repurchase

Macro market volatility along with a rise in interest rates has had a material impact to all asset classes in US capital markets. As a result, many debt securities (including convertible debt) are trading below par. In this blog post, we review why a potential repurchase of convertible bonds ... >>>Read More

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 19

- Next Page »