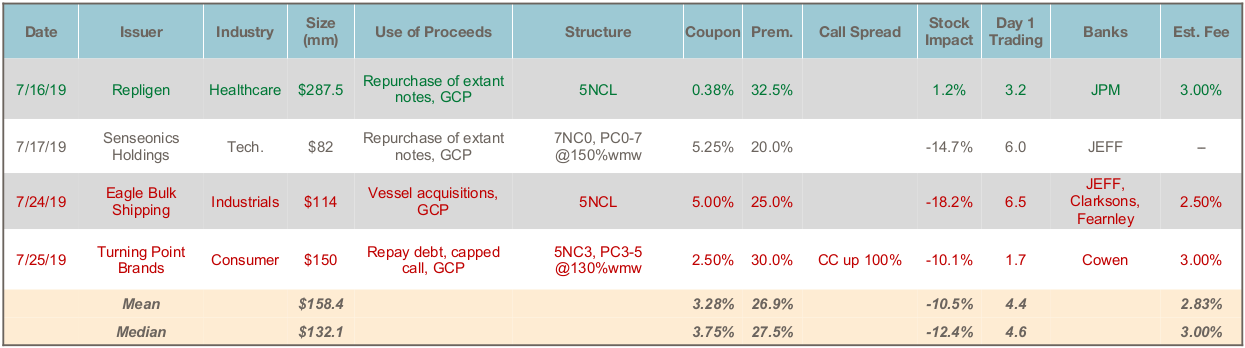

Total Issuance: July is typically quiet with many companies in blackout for much of the month, and last month was especially so – with only 4 small convertible debt deals pricing for a total of $634mm. By comparison, July 2018 saw 5 deals for a total of $2.4 billion. Total issuance YTD is $19.6 ... >>>Read More

June Convertible Market Review

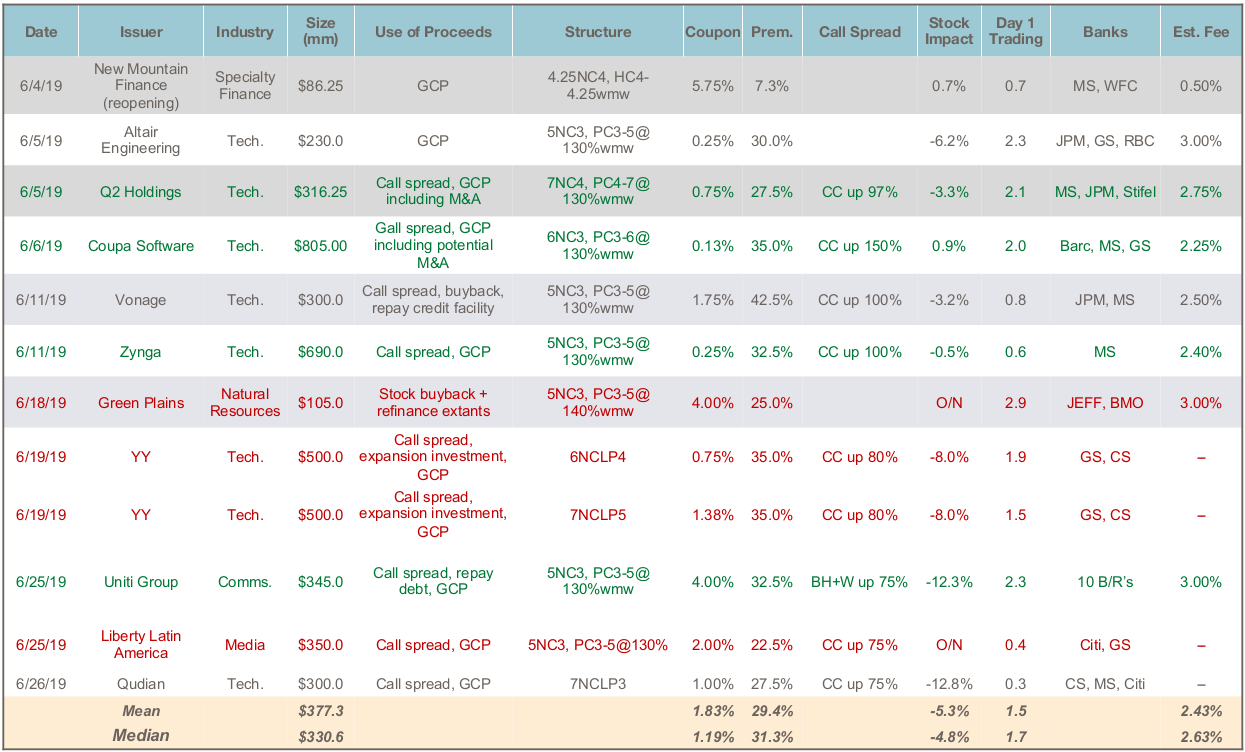

Total Issuance: Activity remained robust in June, with $4.5 billion of new convertible bond issuance over 11 transactions (notwithstanding that many issuers entered blackout in the second half of the month). Year to date there is now $19.8 billion total issuance, less than 2018 1H’s total of $26.6 ... >>>Read More

May Convertible Market Review

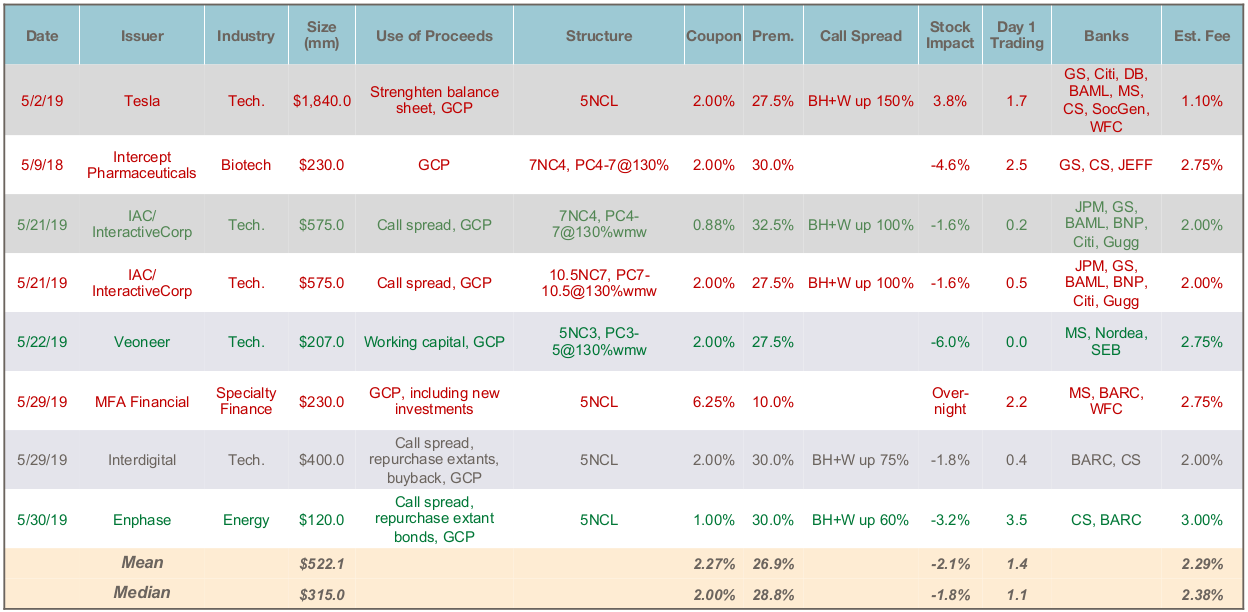

Total Issuance: Activity picked up from April to May, with $4.3 billion of new convertible bond issuance over 8 transactions. Year-to-date there has now been $14.4 billion of total issuance in 31 deals. This is behind last year’s pace of $19.2 billion over 51 deals over the first five months of the ... >>>Read More

April Convertible Market Review

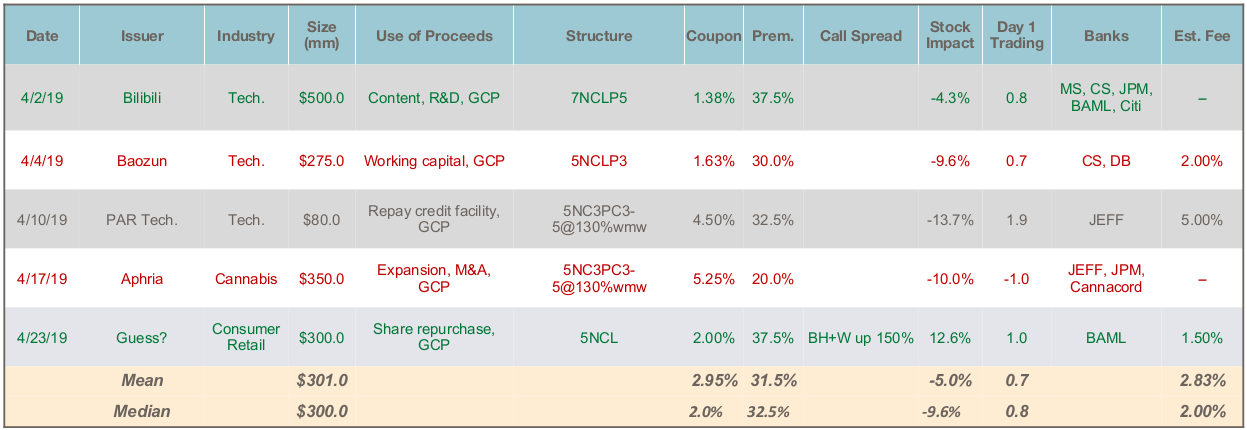

Total Issuance: April was typically quiet, with most U.S. issuers in blackout for several weeks. There were 5 convertible bond deals for a total of $1.5 billion. Bilibili and Baozun continued the trend in the past year of Chinese-based tech companies accessing the market. Year-to-date total ... >>>Read More

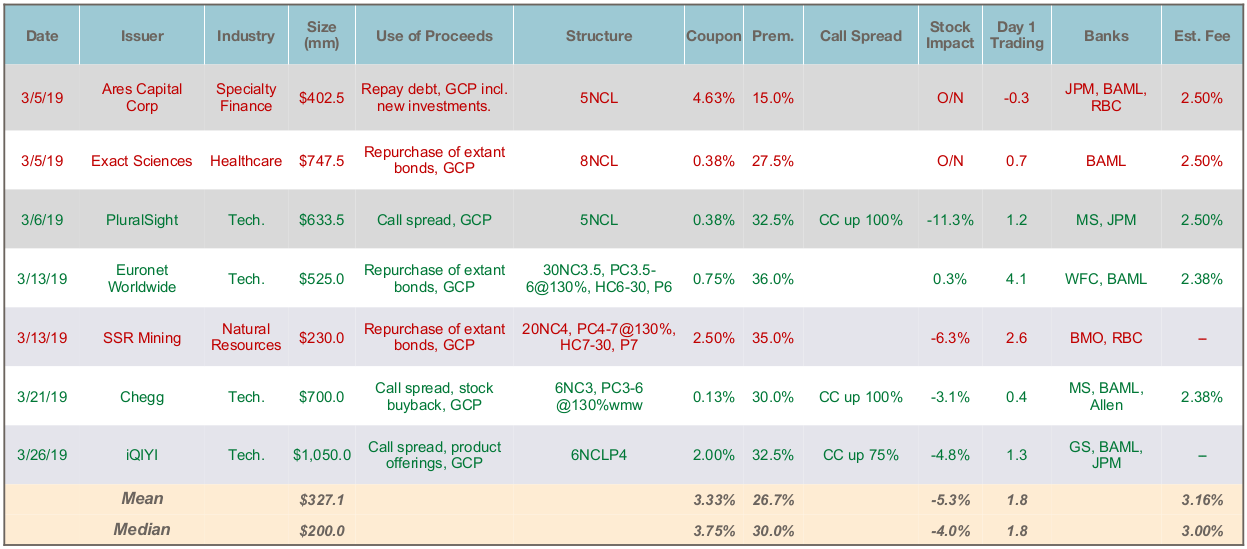

March Convertible Market Review

Total Issuance: March continued the healthy primary market activity in February (allowing for many companies being in blackout at the end of the month), with 7 deals for $4.3 billion last month. The YTD total now stands at $8.4 billion across 18 deals, compared to $9.6 billion in 28 deals in Q1 ... >>>Read More