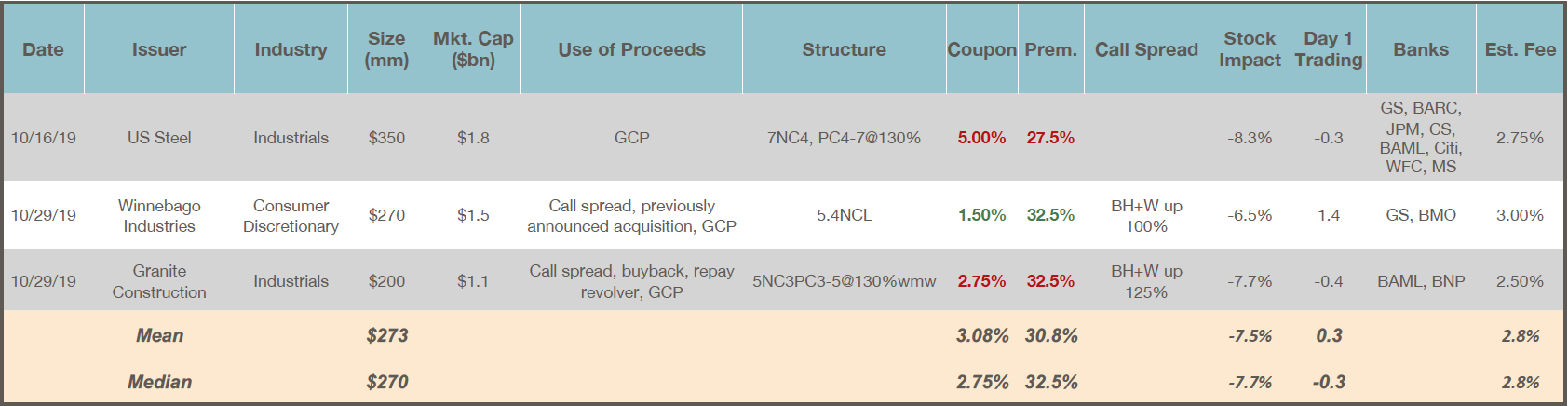

Total Issuance: October was typically quiet, with the majority of issuers in blackout for the bulk of the month pending Q3 earnings releases. $820mm of convertible debt priced in 3 transactions, bringing the YTD total to $35.1 billion (vs. $37.0 billion for the same period in 2018). ... >>>Read More

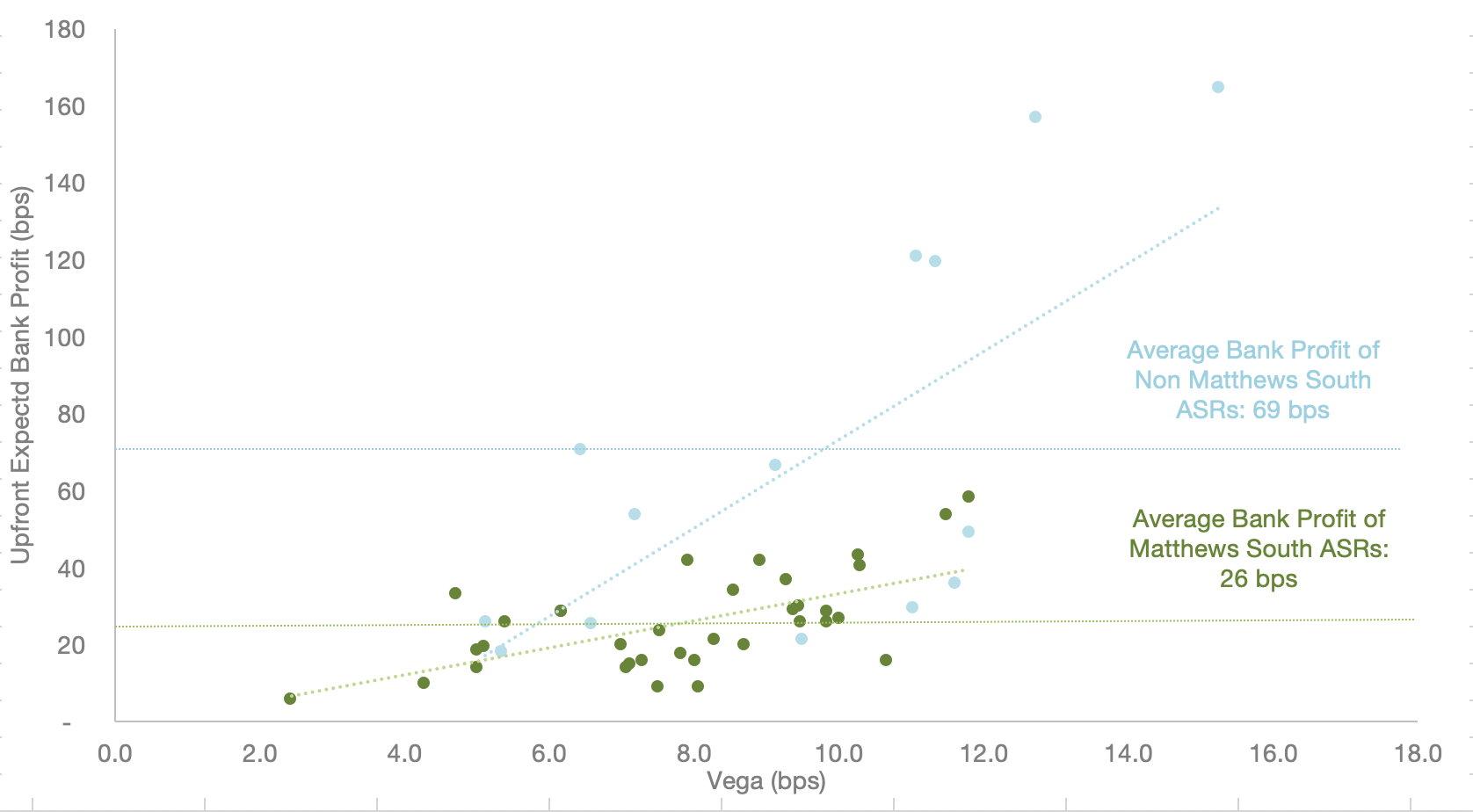

Are You Getting the Best ASR Pricing?

Over the past five years, Matthews South has advised clients on over $30 billion of ASR transactions. As a result, we have collected a large amount of data on achieving the best pricing for ASRs. In this write-up, we “open source” our findings so that all ASR issuers may benefit from what we have ... >>>Read More

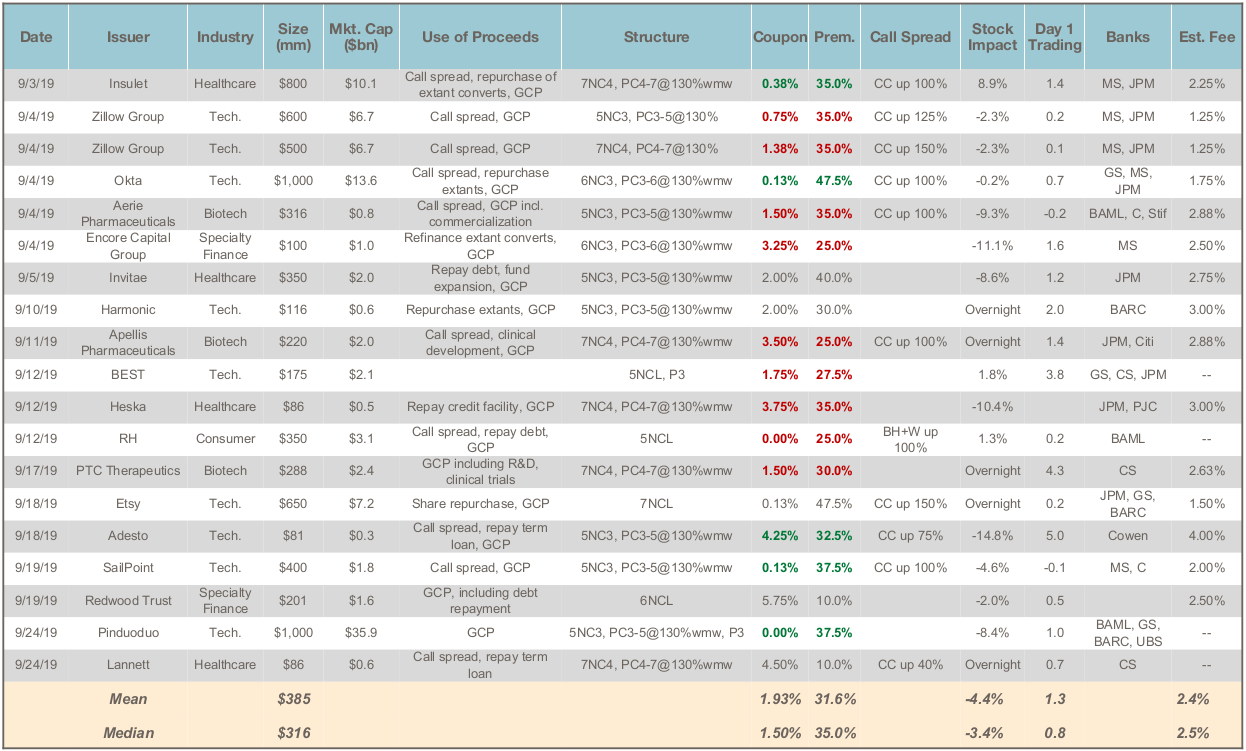

September Convertible Market Review

Total Issuance: September was the busiest month of the year, surpassing August. There was $7.3 billion of convertible bond issuance over 18 transactions, bringing the 2019 total to $34.2 billion (vs. $35.7 billion for the same period in 2018). There was also $4.75 of mandatory convertibles issued by ... >>>Read More

Cautionary Tale of Insulet’s $800mm Convertible Transaction

On September 3rd, Insulet issued $800mm (including greenshoe) of new 7-year convertible bonds, and bought back $225mm principal amount of its old convertibles due 2021. Matthews South was not involved in the transaction. JWood was the independent advisor to the company. The Insulet ... >>>Read More

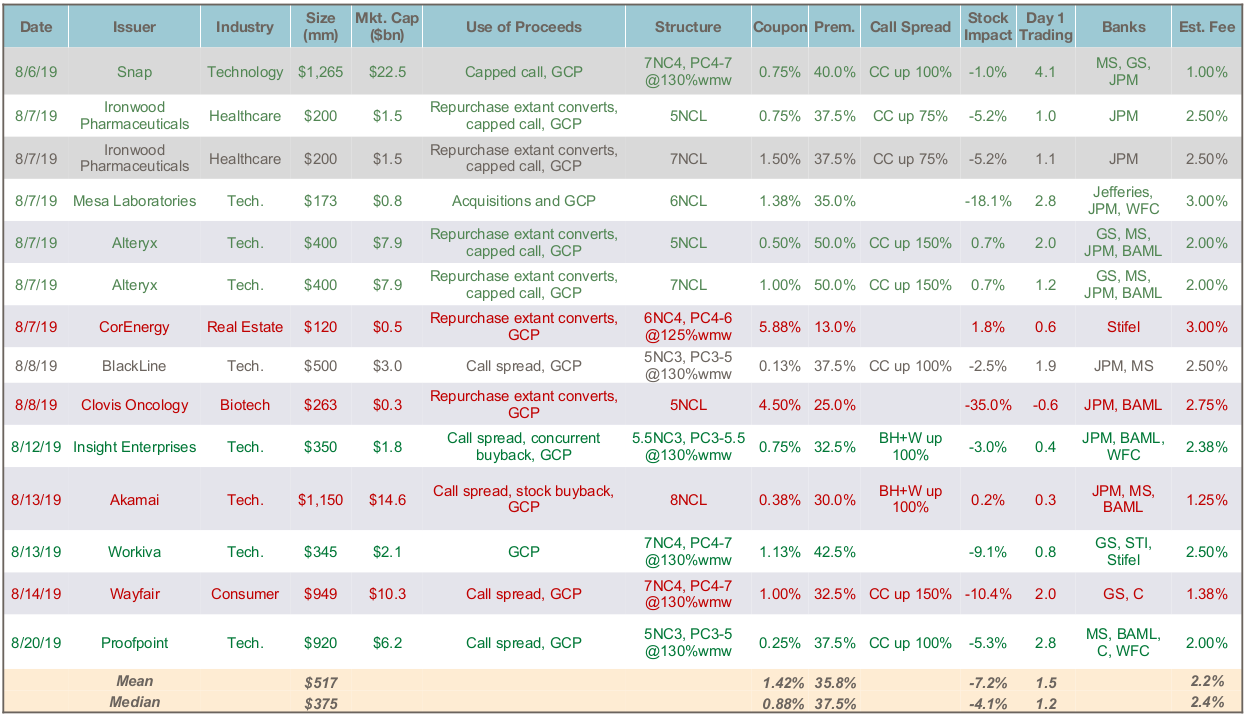

August Convertible Market Review

Total Issuance: Activity picked up significantly in August, with $7.2 billion of convertible bond issuance over 12 transactions. This makes August the busiest month of 2019, and brings the YTD total issuance to $26.9 billion, versus $32.1 billion in 2018 through August.Market Dynamics: August did ... >>>Read More