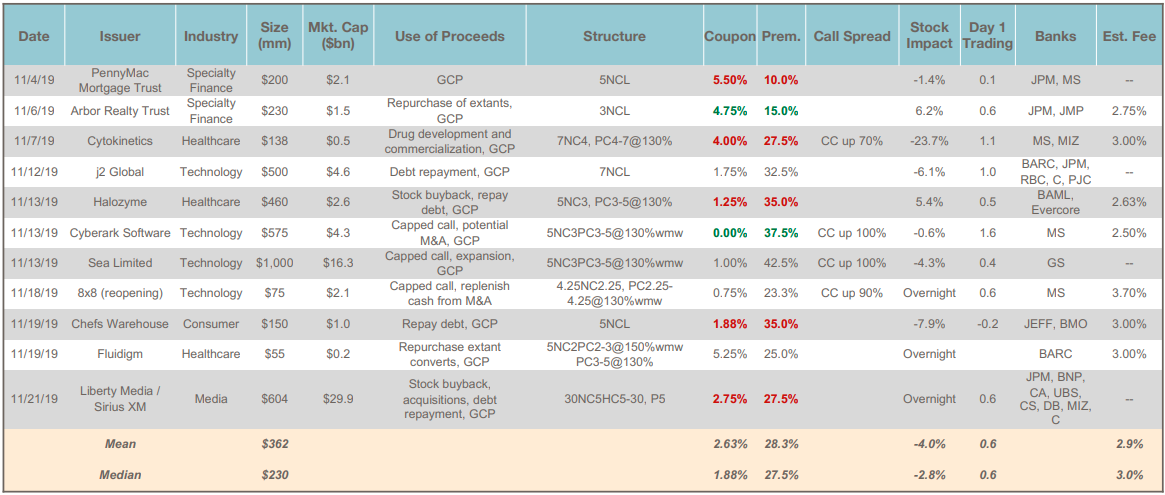

Total Issuance: November activity picked up after a quiet October, with 11 convertible debt deals pricing for a total of $4.0 billion. This brings the YTD total to $39.1 billion — on pace to surpass last year’s full year total of $41.0 billion.Flexibility: November’s new issuance showcased the ... >>>Read More

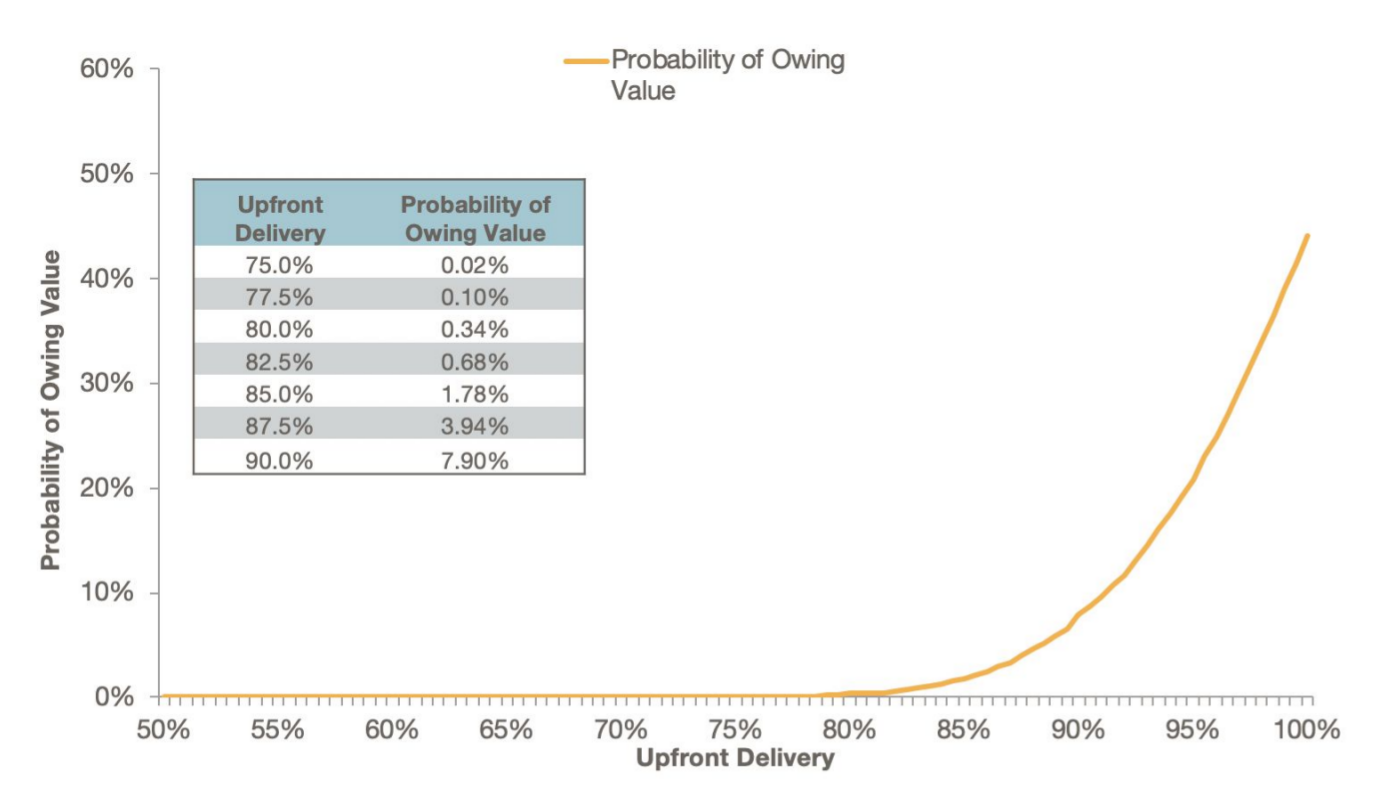

Should all ASRs have 80% Upfront Share Delivery?

An attractive feature of ASRs is the upfront share delivery. The immediate retirement of shares provides greater EPS improvement than an equivalent amount of open market share repurchases. The delivery also significantly reduces the credit exposure to the bank that is created by the ... >>>Read More

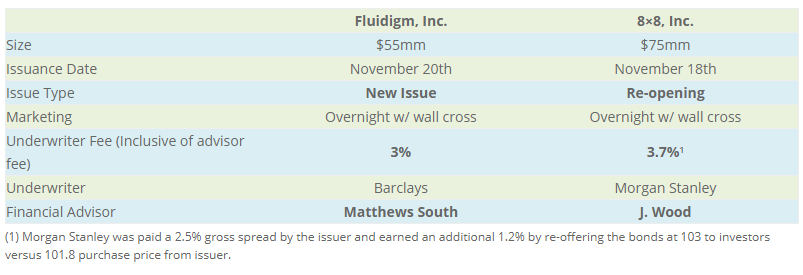

An appropriate fee for a convertible bond?

During the week before Thanksgiving, the coincidental execution of two convertible bond transactions provided a classic “A/B” comparison that highlights the variability in fees paid by issuers and the important role of the financial advisor in this regard. What is a typical fee for sub-$100mm ... >>>Read More

How does cloud computing help us advise clients?

The investment banks have made considerable investments in technology to support their capital markets businesses. As a result, when issuers interact with bankers they are at a considerable knowledge and informational disadvantage. A core mission of Matthews South is to eliminate this ... >>>Read More

“Low Cost” eOMR for Industrial Company

Matthews South advised a large cap industrial company on its first Enhanced Open Market Repurchase (“eOMR”). The eOMR is an open market program intended to maximize the discount to VWAP. The program does this by using an algorithm to determine the daily purchases. Our client had considered ... >>>Read More

- « Previous Page

- 1

- …

- 14

- 15

- 16

- 17

- 18

- 19

- Next Page »