Companies in the S&P 500 alone spent $770 billion in the past four quarters on share repurchase. The majority of this buyback was executed through open market repurchases (“OMR”), including 10b5-1 plans. In OMR programs, the broker, as an agent of the company, executes the ... >>>Read More

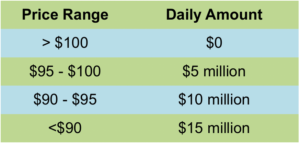

January Convertible Market Review

Trends: January’s MongoDB deal continued the trend of convertible issuers from the last 2 years conducting new offerings to refinance and extend the maturity of their balance sheets, while taking advantage (especially in tech) of meaningfully higher equity valuations and convertible market ... >>>Read More

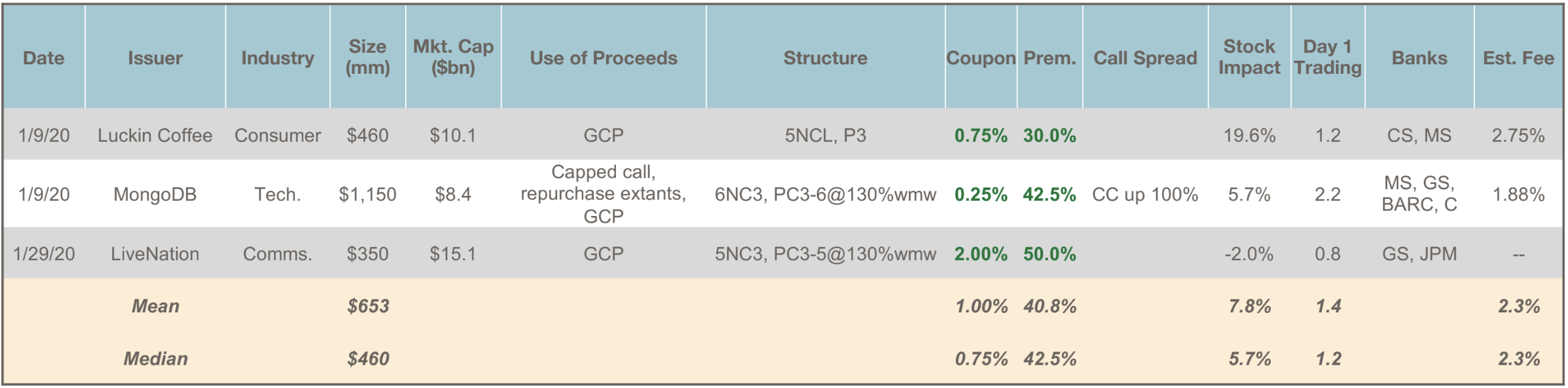

Should ASRs have the “Lookback” Termination Feature?

In a variable maturity ASR, the bank has the right to terminate the ASR on any date that occurs between the specified first acceleration and final termination dates. In return for having this valuable optionality, the bank agrees to provide the issuer with a guaranteed discount to VWAP. Most ... >>>Read More

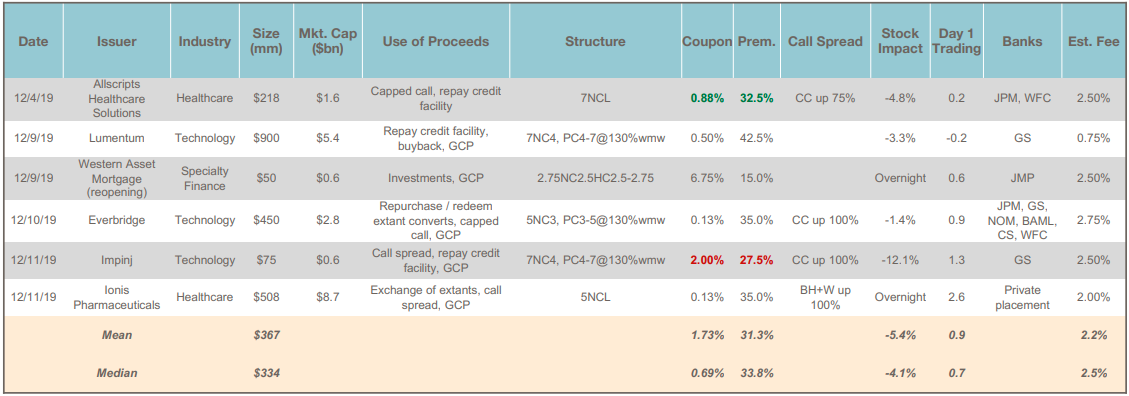

A Costly Convertible Exchange

Convertible issuers frequently refinance upcoming maturities with the issuance of new convertible bonds. As most convertible bonds are non-callable, issuers must decide whether to leave the bonds outstanding or repurchase them concurrently with the issuance of the new bonds. If they are ... >>>Read More

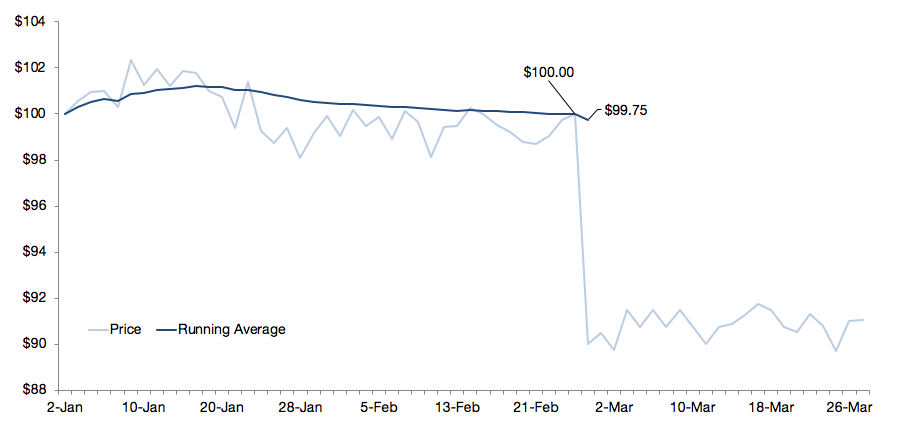

December Convertible Market Review

Total Issuance: December saw 6 convertible debt deals for a total of $2.2 billion. This brings the 2019 total to $41.5 billion of convertible debt issuance over 101 deals. By comparison, 2018 saw $41.0 billion of issuance over 103 deals (2017: $28.2 billion / 80 deals). ... >>>Read More

- « Previous Page

- 1

- …

- 13

- 14

- 15

- 16

- 17

- …

- 19

- Next Page »