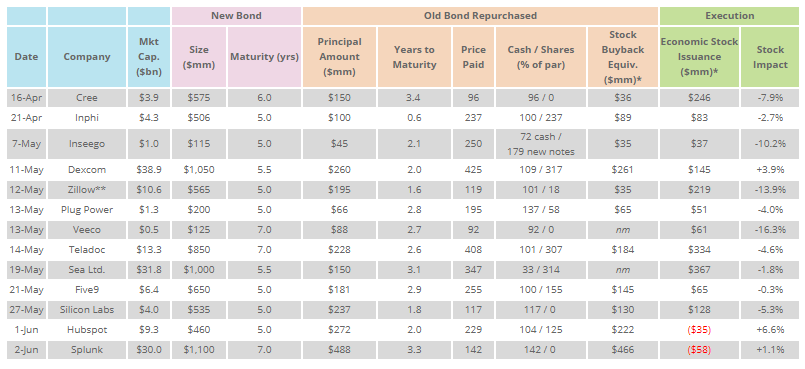

Since April, the U.S. market saw a total of $33 billion of convertible debt issued in the U.S. primary market across 65 deals, almost as much as the full-year totals for both 2018 and 2019 ($41 and $42 billion, respectively). During this period, 13 issuers repurchased existing convertible ... >>>Read More

April Convertible Market Review

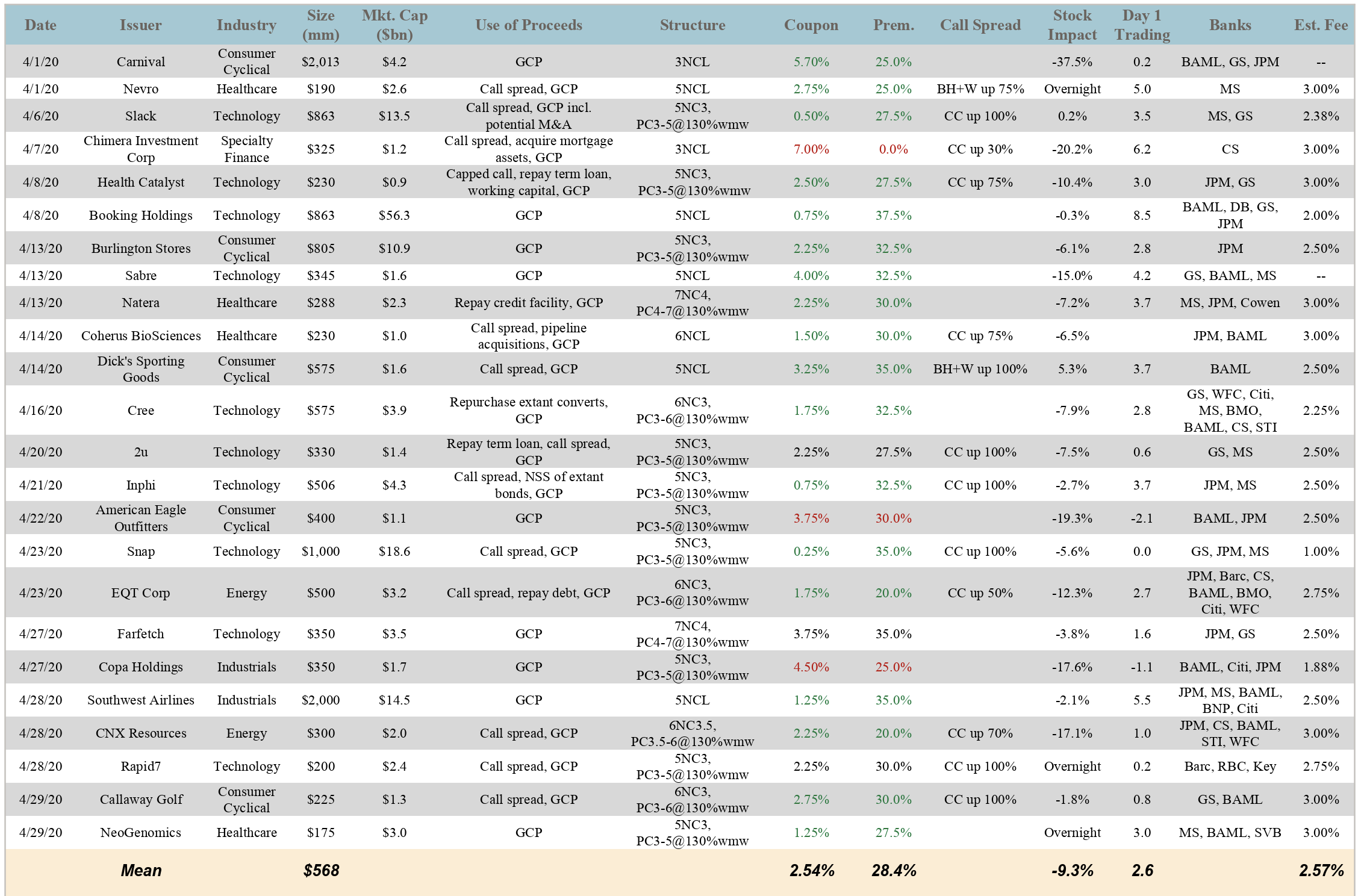

As part of our market update series, please see the summary below of what we saw in the convertible market in April. Additional details on all the deals are in the attached. Related Articles May Convertible Market ReviewJune Convertible Market ReviewJuly-August ... >>>Read More

Is the PIPE Alternative Worth Considering?

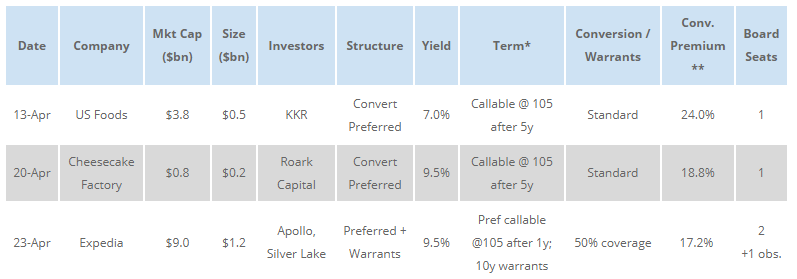

In the last several weeks, we have seen companies in the sectors most directly affected by Covid-19 (consumer/retail, travel) access the private markets through PIPE investments (Private Investment in Public Equity), as well as the public equity and equity-linked markets. The table below ... >>>Read More

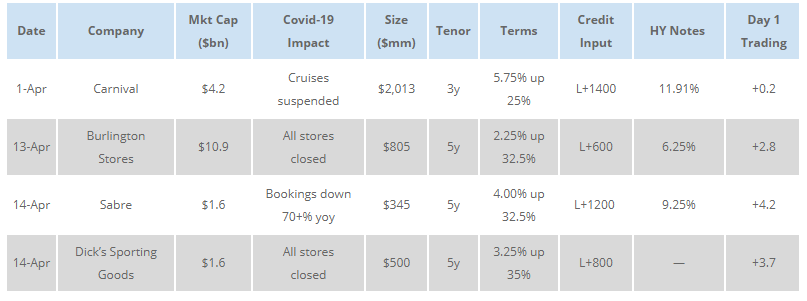

Convertible Market Access for Covid-19 Impacted Sectors

Last week, the convertible market was very active with 6 new issue transactions totalling $2.6 billion in issuance. Three of the issuers were from sectors that have been deeply impacted by the Covid-19 pandemic: two in retail (Burlington Stores and Dick’s Sporting Goods) and one in travel ... >>>Read More

COVID-19 and Dividend Suspensions

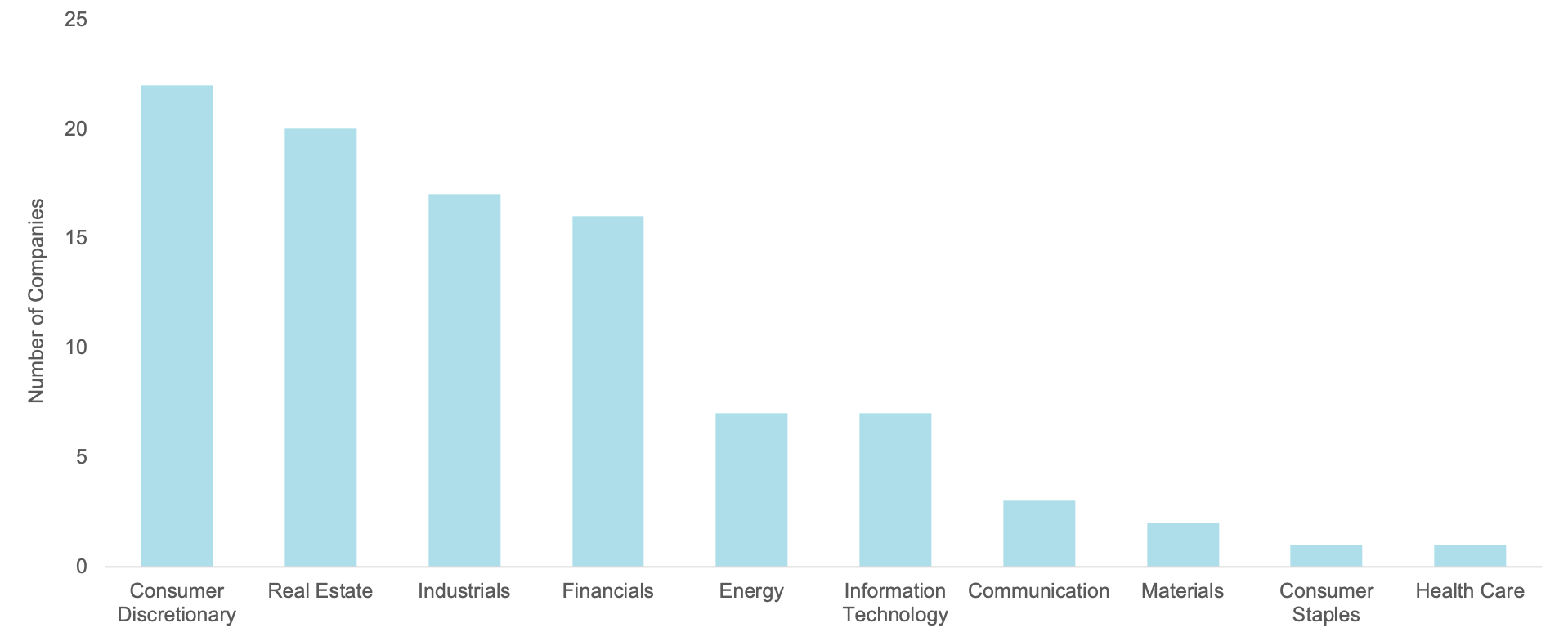

In a previous post, we analyzed the trend of suspending share repurchases to preserve liquidity during the COVID-19 crisis. In a similar theme, many companies are also now reconsidering their dividend programs. We quantified the number of companies that have announced the reduction or ... >>>Read More

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 19

- Next Page »