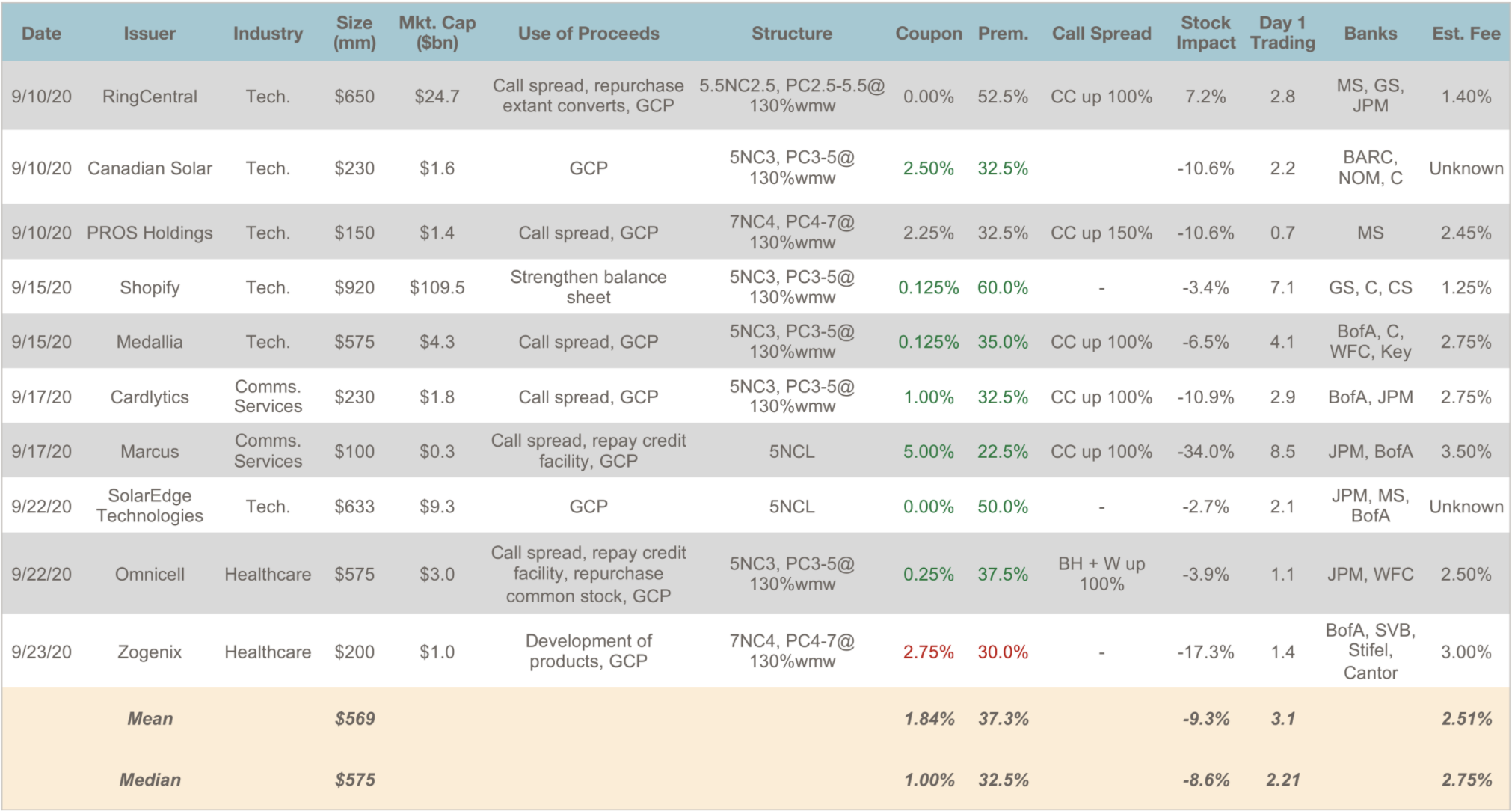

As part of our market update series, please see the summary below of what we saw in the convertible market in September 2020. Additional details on all the deals are in the attached. Related Articles April Convertible Market Review May Convertible Market Review June ... >>>Read More

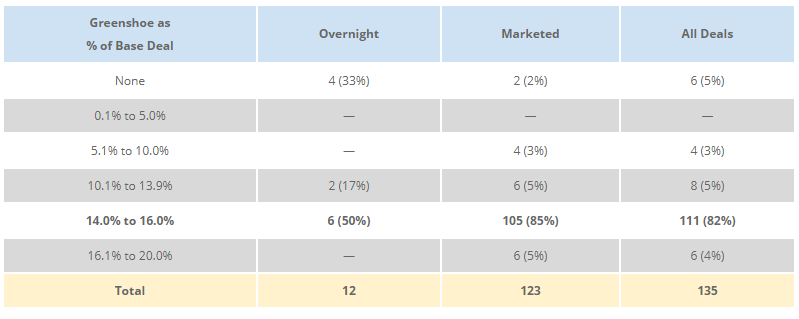

How Do Greenshoes Work in the Real World?

A 15% greenshoe is considered market standard in the U.S. convertible bond market. The greenshoe feature derives from the equity market, where it is also standard. Debt markets — high yield bonds, investment grade bonds, term loans — do not use it. We provide data to help issuers ... >>>Read More

Convertible Trivia: So You Think You are a “Convert Guru”?

We all had a long summer and an “unusual” 2020 so far. So for our last post of summer, we wanted to create something fun.If you think you are well-versed in converts, take part in our convertible trivia and see if you are a “Convert Guru.” As a bonus, our detailed answers should allow you learn more ... >>>Read More

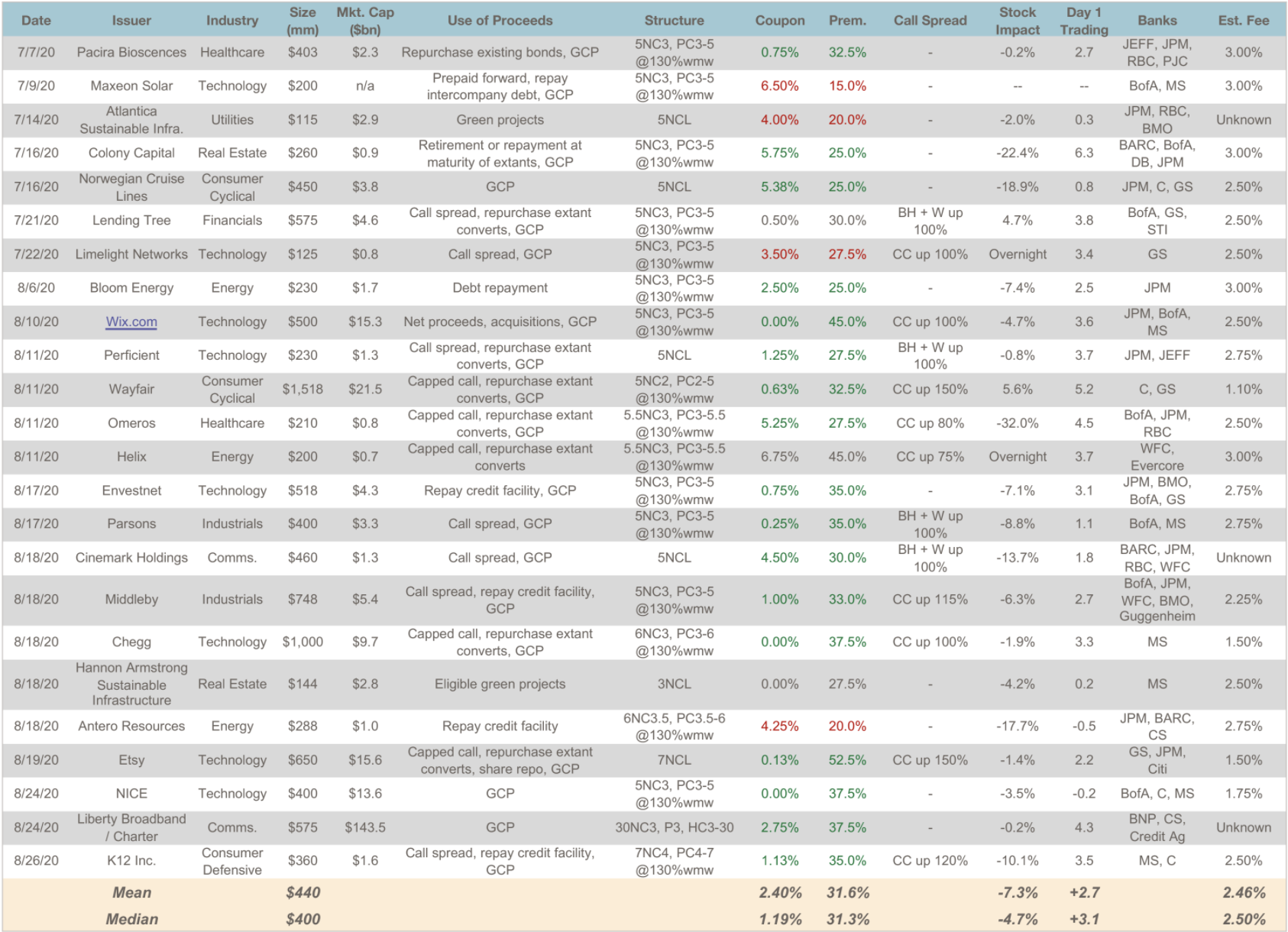

July-August Convertible Market Review

As part of our market update series, please see the summary below of what we saw in the convertible market in July and August 2020. Additional details on all the deals are in the attached. Related Articles April Convertible Market Review May Convertible Market ... >>>Read More

Convertible Debt Accounting Update

In this post, we wanted to summarize the recently finalized convertible bond accounting change put out by FASB. Current AccountingUnder the current accounting framework, any bond issued where the company intends to settle the principal amount in cash and any in-the-money amount in net shares ... >>>Read More

- « Previous Page

- 1

- …

- 8

- 9

- 10

- 11

- 12

- …

- 19

- Next Page »