Policy-driven macroeconomic volatility has triggered U.S. corporate commentary about business and financial uncertainty, especially since the “Liberation Day” tariff announcements on April 2. A number of companies, especially those in sectors with high tariff exposure (e.g., auto manufacturing) and ... >>>Read More

Strength Amid Choppiness: Q1 2025 Convertible Market Review

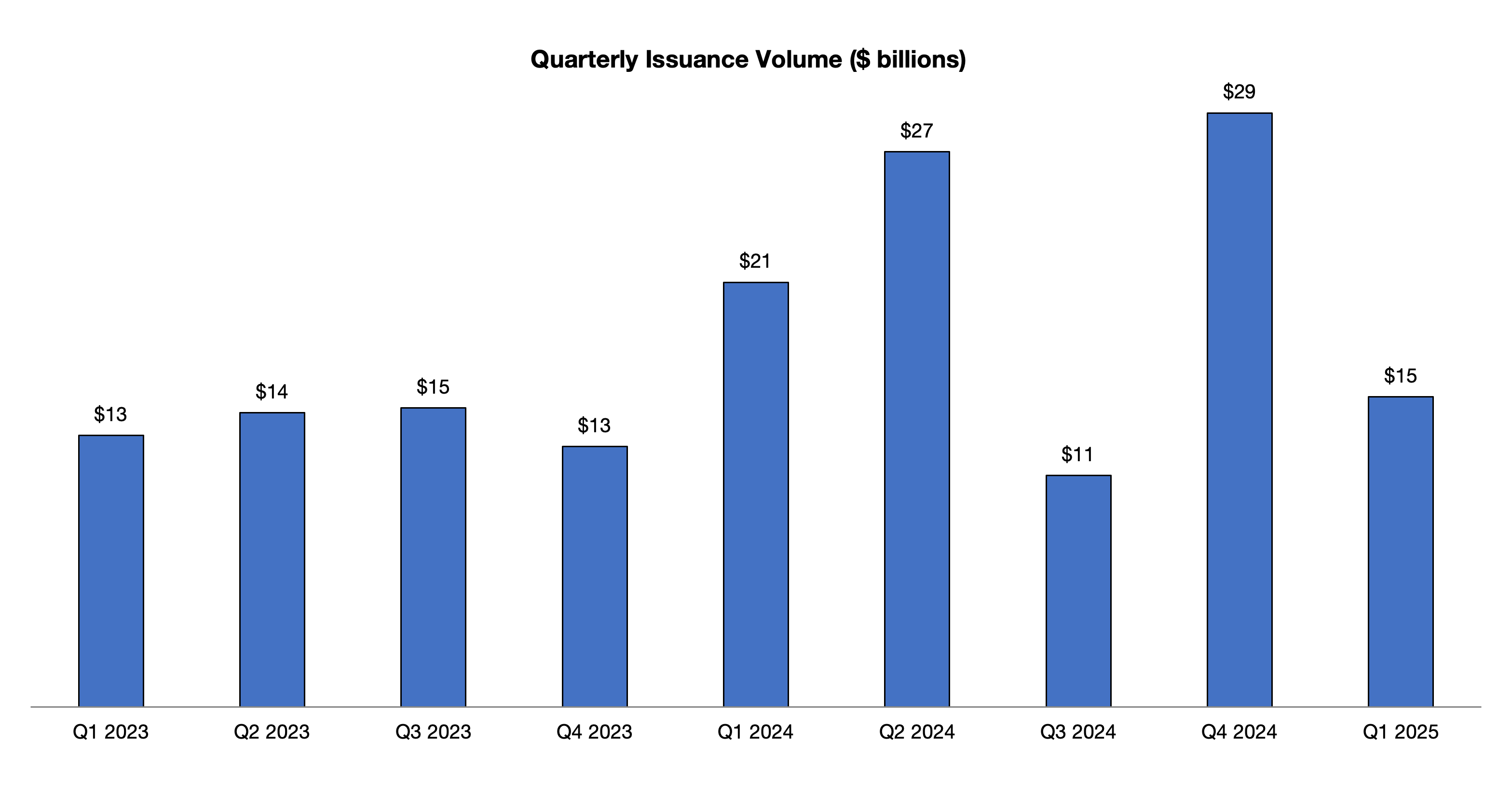

As part of our market update series, below are our key takeaways in the convertible market in the first quarter of 2025. New issue activity in Q1 totaled $15.1 billion, tracking 31% below 2024 issuance levels but in-line with historical averages. Potential issuers have remained on the sidelines to ... >>>Read More

2024 Year-End Convertible Market Review

As part of our market update series, below are our key takeaways in the convertible market in Q4 2024 and looking back on the year. New issue activity in the convertible market was significant with $29 billion volume in Q4, bringing total issuance for the year to $88 billion. Issuance volumes ... >>>Read More

Unscheduled Market Closure – Will ASRs Be Adjusted Fairly?

Background The New York Stock Exchange and Nasdaq announced today that Thursday, January 9, 2025 will be an exchange holiday as a day of mourning in recognition of President Jimmy Carter’s passing. The occurrence of an unscheduled exchange holiday has consequences for outstanding equity derivatives ... >>>Read More

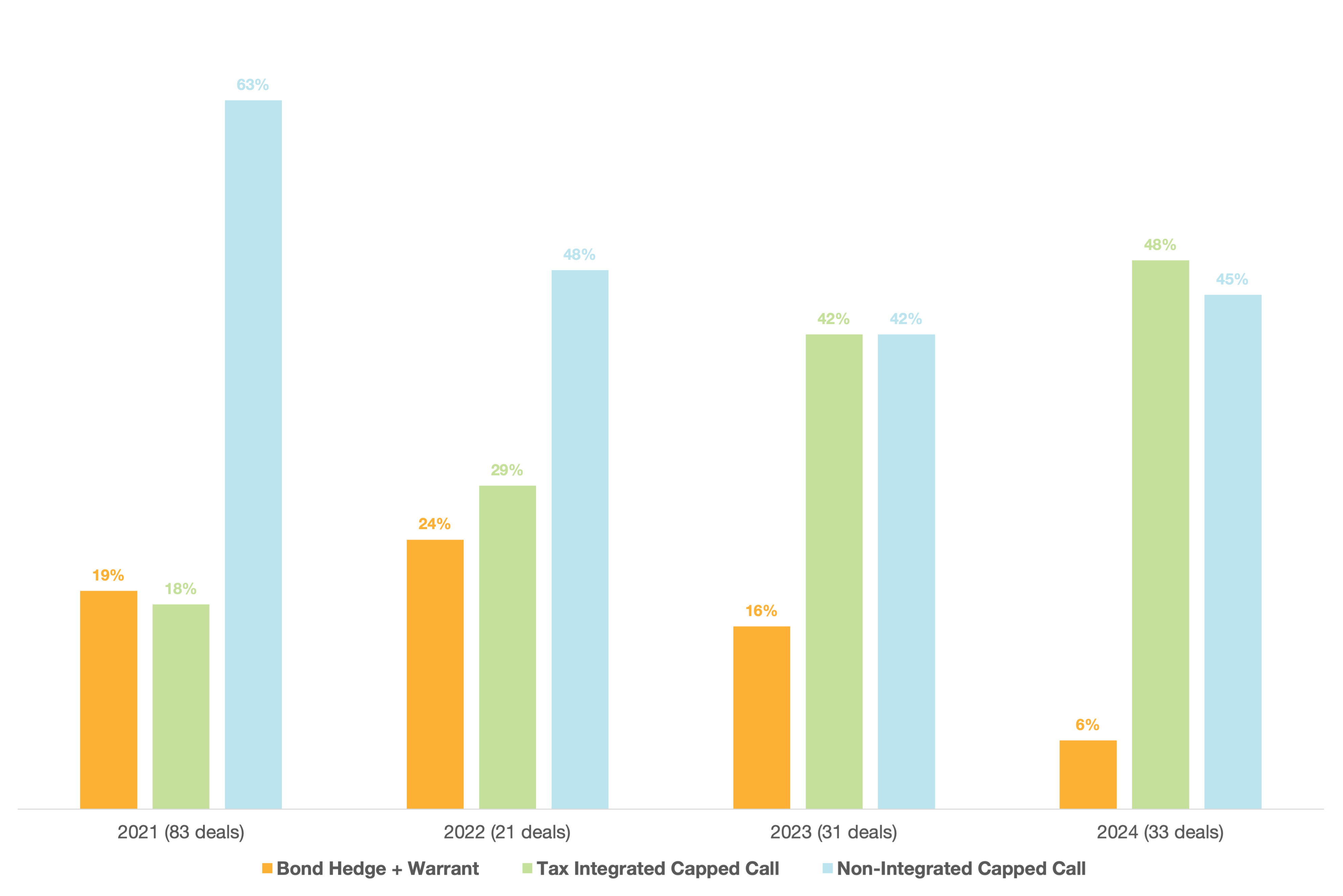

Trends in the Call Spread Market

In the U.S. convertible market, about half of new deals are accompanied by call spreads, a transaction in which issuers purchase a derivative from banks that raises the effective conversion premium of the transaction to levels not typically available from the convertible market (e.g., 100% premium ... >>>Read More

- 1

- 2

- 3

- …

- 19

- Next Page »